November 2025

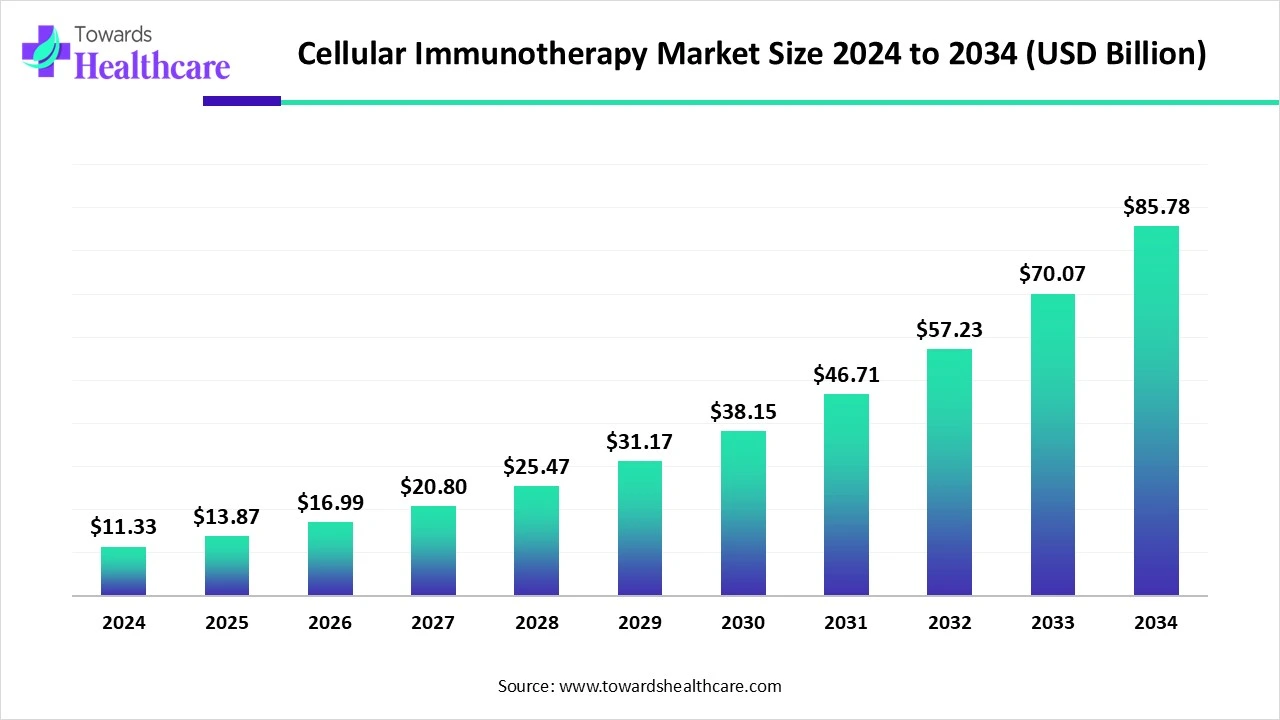

The global cellular immunotherapy market size recorded US$ 11.33 billion in 2024, set to grow to US$ 13.87 billion in 2025 and projected to hit nearly US$ 85.78 billion by 2034, with a CAGR of 22.45% throughout the forecast timeline.

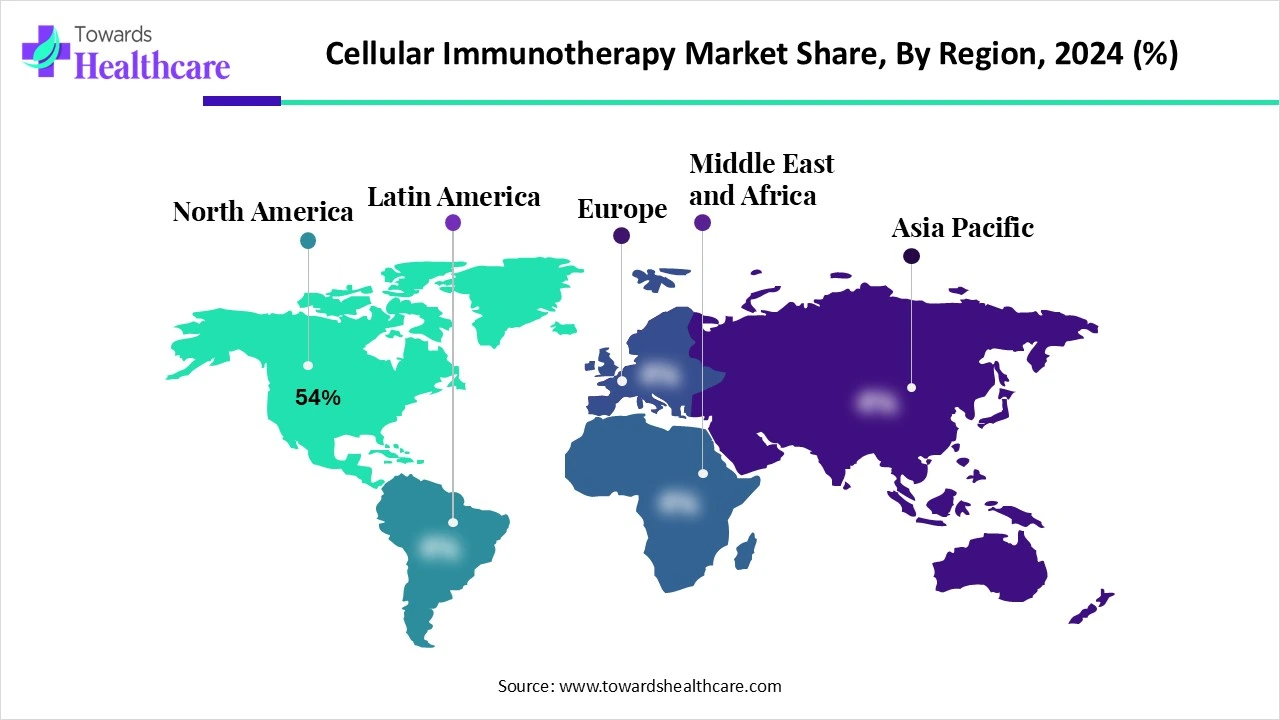

Cellular immunotherapy aligns with the rising trend towards personalized medicine, which enables the development of treatments tailored according to the individual patient profiles. The market is also expanding rapidly, driven by groundbreaking clinical outcomes, FDA/EMA approvals, and ongoing research into allogeneic (off-the-shelf) and in vivo cellular therapies that overcome the scalability and cost limitations of autologous products. In this global market, North America dominated the market, followed by Asia Pacific, fueled by the rising cancer burden, surge in government funding, and increasing presence of biotech hubs in China, Japan, and South Korea.

| Metric | Details |

| Market Size in 2025 | USD 13.87 Billion |

| Projected Market Size in 2034 | USD 85.78 Billion |

| CAGR (2025 - 2034) | 22.45% |

| Leading Region | North America Share 54% |

| Market Segmentation | By Therapy Type, By Indication, By Cell Source, By Manufacturing Modality, By End User / Application Setting, By Region |

| Top Key Players | Gilead Sciences (Kite Pharma), Novartis AG, Bristol Myers Squibb (BMS), Allogene Therapeutics, Adaptimmune Therapeutics, Sana Biotechnology, CRISPR Therapeutics, Fate Therapeutics, Autolus Therapeutics, Precision BioSciences, Poseida Therapeutics, Nkarta, Inc., Celyad Oncology, Caribou Biosciences, Immatics N.V., Bluebird Bio, Tessa Therapeutics, Beigene Ltd., Legend Biotech |

The cellular immunotherapy market encompasses the development, manufacturing, and commercialization of therapeutic approaches that utilize living cells to stimulate or restore the body’s immune response against diseases, primarily cancer, but also infectious and autoimmune conditions. This includes T-cell therapies (CAR-T, TCR-T), Natural Killer (NK) cell therapies, Dendritic Cell (DC) therapies, and emerging macrophage-based therapies.

The worldwide growing investments in AI technologies by many pharmaceutical companies to boost drug development and reach a market position are mainly impacting the widespread adoption of AI tools. Eventually, AI-powered measures give minimal expenses and time linked with drug discovery and development in both the chemical and biological sectors, with enhanced success rates in various clinical trial designs. In clinical trial optimization, AI has a crucial role in accelerating and improving trial design, patient recruitment, and monitoring. Whereas, in quality control, AI algorithms assist in automated data entry, analysis of vast datasets to resolve possible quality concerns, and estimate failures, with progressed product safety.

Rising Number of Cancers and Expanding Regulatory Approvals

The number of cancers and expanding regulatory approvals are expected to boost the growth of the cellular immunotherapy market during the forecast period. Cancer is one of the leading causes of death globally. In 2022, nearly 20 million new cancer cases were reported, and 9.7 million people died from the disease around the world. The surge in the incidence of cancer spurs the demand for cellular immunotherapy as an effective treatment approach. In addition, authorized regulatory bodies such as the U.S Food and Drug Administration (FDA) are expediting approvals for innovative cell-based therapies, bolstering the market’s expansion. Therefore, the rising number of product approvals and increasing prevalence of cancer has significantly adoption of these therapies.

High Cost

The high cost associated with the cellular immunotherapy product manufacturing is anticipated to hamper the market's growth. The manufacturing process is complicated and requires high capital investment, which often creates a barrier for small-scale industries and results in slow adoption in several low and middle-income countries. Such factors may hinder the growth of the global cellular immunotherapy market during the forecast period.

How are the Increasing Investments in Research and Development Impacting the Market Expansion?

The increasing focus on sustainability and eco-friendly products is projected to offer lucrative growth opportunities to the dispenser pump market in the coming years. The market has witnessed a surge in heavy investment in research and development by robust pharmaceutical and biotechnology companies to expand novel cellular-based treatment approaches. Significant funding from both the private and government sectors is supporting cancer treatment through research grants and initiatives, further encouraging the development and adoption of cellular immunotherapies.

In 2024, the autologous (patient-derived cells) segment registered dominance. Autologous cell therapies are being widely explored for cancer. These therapies, which utilize a patient's cells and are highly preferred for their reduced risk of rejection as compared to the allogeneic approach. Moreover, several regulatory bodies, like the EMA and FDA, are increasingly recognizing the significance of these advanced therapies and streamlining approval processes.

On the other hand, the allogeneic (donor-derived cells) segment is expected to witness the fastest growth in the market over the forecast period, owing to the rising incidence of cancer. Allogeneic therapies are readily available, "off-the-shelf" products and are less expensive than autologous therapies, potentially reducing cancer treatment delays and costs.

The ex vivo cell expansion segment was dominant, with the biggest share of the global cellular immunotherapy market in 2024. In ex vivo cell expansion, patients' immune cells are isolated, activated, and multiplied in a lab setting before being reinfused into the patient’s body. Ex vivo cell expansion is a crucial part of cellular immunotherapy, fuelling the production of effective and persistent immune cell therapies to fight against cancer.

On the other hand, the in vivo engineering (via LNP, viral vectors, mRNA) segment is expected to register the fastest growth, owing to the increasing need for treating various diseases, including cancer. In vivo engineering is the process of modifying immune cells directly within the body rather than outside the body in a lab. In vivo engineering is a cost-effective, accessible, and significantly safer cellular immunotherapy.

The CAR-T Cell Therapy segment led the cellular immunotherapy market in 2024. CAR T-cell therapy is a prominent type of cancer immunotherapy that uses a patient's own genetically modified immune cells to destroy cancer. CAR-T therapies have significantly revolutionized the treatment of cancers. Currently, there are several CAR T-cell therapy trials underway for various cancers. The growth of the segment is driven by the rising prevalence of cancer, a surge in clinical trial success rates, rising regulatory approvals, increasing investments by biotechnology companies, and growing demand for personalized medicine.

On the other hand, the Natural Killer (NK) Cell Therapy segment is anticipated to register rapid expansion in the predicted timeframe. The growth of the segment is fuelled by the growing need for effective cancer treatments, rising investments in research and development, and rapid technological advancements in cell engineering, particularly with techniques like CRISPR-Cas9. Natural killer (NK) cell therapeutics leverage the body’s immune system to fight cancer without prior sensitization. NK cells can recognize and destroy abnormal cells in the body. These cell therapies can use allogeneic (donor-derived) NK cells. NK cell therapies offer a promising and transformative treatment option for a wider range of cancer patients.

The hospitals & cancer centers segment accounted for a maximum revenue share of 62% in the market in 2024. The increasing incidence of cancer has substantially increased the total number of hospitalizations globally in hospital settings. Cancer institutes are increasingly offering advanced treatment and care to a high number of cancer patients. Additionally, hospitals & cancer centers are equipped with the necessary infrastructure and highly skilled healthcare professionals to deliver advanced cancer treatments, including cellular immunotherapy.

On the other hand, the Contract Development & Manufacturing Organizations (CDMOs) segment is expected to expand rapidly in the market in the coming years. Biotechnology and pharmaceutical companies are increasingly relying on CDMOs to handle various aspects of cellular-based therapy development and manufacturing, which allows them to focus on core activities. The potential of cellular immunotherapy to offer personalized and curative treatments in oncology creates significant opportunities for CDMOs to provide specialized manufacturing services.

A major revenue share captured by North America in the cellular immunotherapy market share by 54% in 2024. This region holds a strong position in the cellular immunotherapy market, with the presence of a thriving biotechnology sector, accelerating emphasis on healthcare spending, surging R&D investments by key players, and increasing regulatory approvals. The rising prevalence of cancer, along with the development of advanced cell-based therapies, is expected to boost the market’s revenue during the forecast period.

The country has a well-established healthcare infrastructure, a robust presence of key biotechnology companies, increasing availability of advanced therapies, and high per capita healthcare expenditure. The key players are actively involved in research & development and manufacturing of cellular immunotherapies, including CAR-T cells, NK cells, and other immune cell types. The increasing prevalence of cancer has significantly contributed to the dominance of the market in the region.

Regulatory bodies such as the FDA are expediting approvals for advanced cell-based therapies, driving the segment’s growth. The FDA is offering rapid approval pathways with rigorous safety evaluations, which facilitate the introduction of novel treatments. Moreover, the ongoing clinical trials and research efforts are substantially expanding the applications of cellular immunotherapies in the country.

In this country, the rise in healthcare expenditure, coupled with an increasing number of cancers, has significantly contributed to the dominance of the market in the region. Several key participants in the country are expanding capacity to meet the demand for advanced cancer therapy. The rise in clinical trials, surging investment in R&D activities, rising advancement in cell engineering techniques, and growing demand for personalized (allogeneic, off-the-shelf) treatments, propelling the growth of the cellular immunotherapy market in the country.

During 2025-2034 in the cellular immunotherapy market, the Asia Pacific market is expanding steadily, attributed to the high incidences of cancer, rapid advancements in cell engineering, increasing funding for cell-based research, favorable reimbursement policies, expanding regulatory approval, and a growing focus on precision medicine. Moreover, the greater R&D spending by major players and the increasing number of clinical studies are likely to boost the expansion of the cellular immunotherapy market in the region. The rising progress in technology and the need for cell-based approaches in cancer therapy, driving the market’s growth. Several key players in the market are strategically adopting initiatives such as mergers & acquisitions and product launches to strengthen their market presence.

The country has a rapidly developing healthcare infrastructure, surging investment in the development of availability of advanced cancer therapies, and the availability of specialized healthcare professionals. Governments in the country are increasingly prioritizing the biotechnology sector and supporting the development of cellular immunotherapy through various initiatives. Key players in the market continue to offer advanced cellular immunotherapy to meet the rising need for cancer treatment.

The country has a sophisticated healthcare infrastructure and high per capita healthcare expenditure. The country has the presence of a strong research infrastructure, along with a large number of clinical studies being conducted by cell therapy manufacturers, which has significantly contributed to the growth of the market. Government support through research grants and initiatives significantly encourages the development and adoption of cellular immunotherapies in the country.

In December 2024, Tampa General Hospital (TGH) announced the opening of a new outpatient Cellular-Immunotherapy Transplant Unit (CTU) at the TGH Cancer Institute to offer alternative cell therapy treatment to patients with aggressive blood cancers such as leukemias, lymphomas, multiple myeloma, and other cancers. The program allows adult patients undergoing Chimeric Antigen Receptor (CAR) T-cell therapy and Bone Marrow Transplant (BMT) to receive daily treatment at the new unit as an outpatient while living at home with a 24/7 caregiver to monitor the patient, take vitals, and communicate regularly with TGH clinicians on the patient's behalf.

By Therapy Type

By Indication

By Cell Source

By Manufacturing Modality

By End User / Application Setting

By Region

November 2025

November 2025

February 2026

November 2025