February 2026

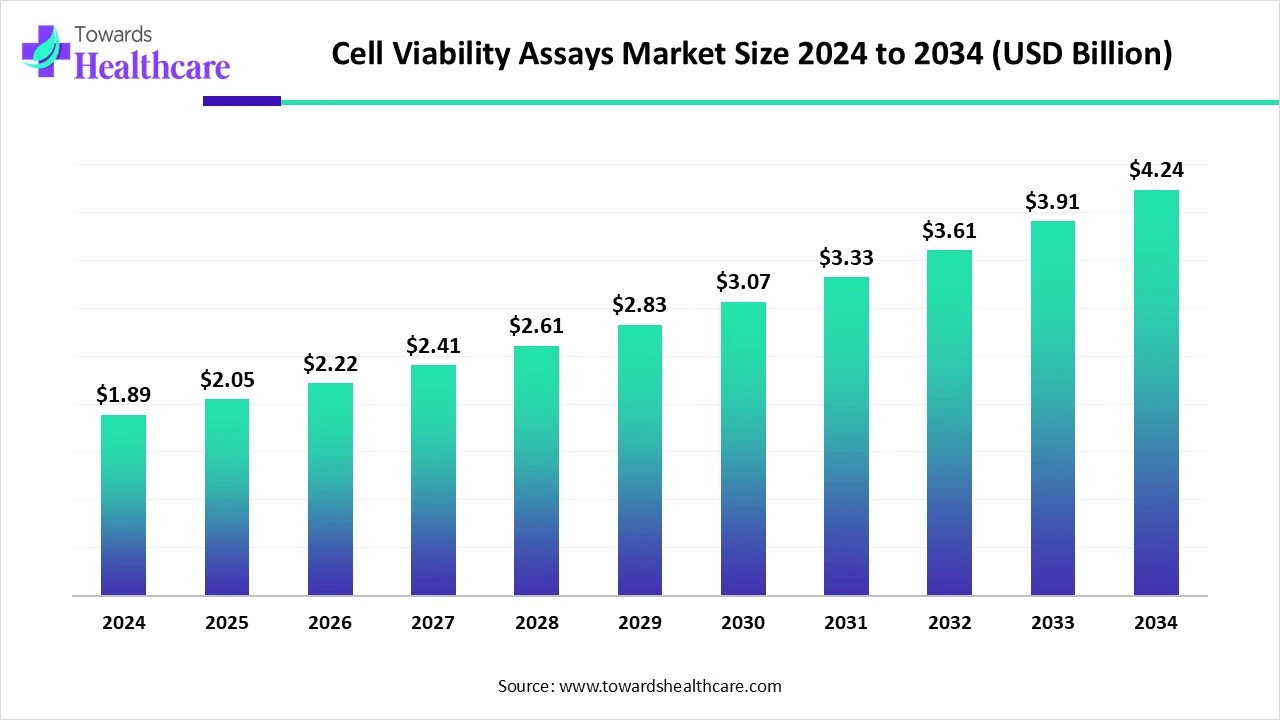

The global cell viability assays market size is calculated at USD 1.89 billion in 2024, grew to USD 2.05 billion in 2025, and is projected to reach around USD 4.24 billion by 2034. The market is expanding at a CAGR of 8.54% between 2025 and 2034.

The cell viability assays market is primarily driven by the growing research and development activities and increasing R&D investments. Several regulatory agencies mandate cytotoxicity tests to assess the toxicity profile of drug products. The rising prevalence of cancer, metabolic disorders, and other disorders facilitates market growth. The future looks promising, driven by automation in cell viability assays and the growing demand for personalized medicines.

| Metric | Details |

| Market Size in 2025 | USD 2.05 Billion |

| Projected Market Size in 2034 | USD 4.24 Billion |

| CAGR (2025 - 2034) | 8.54% |

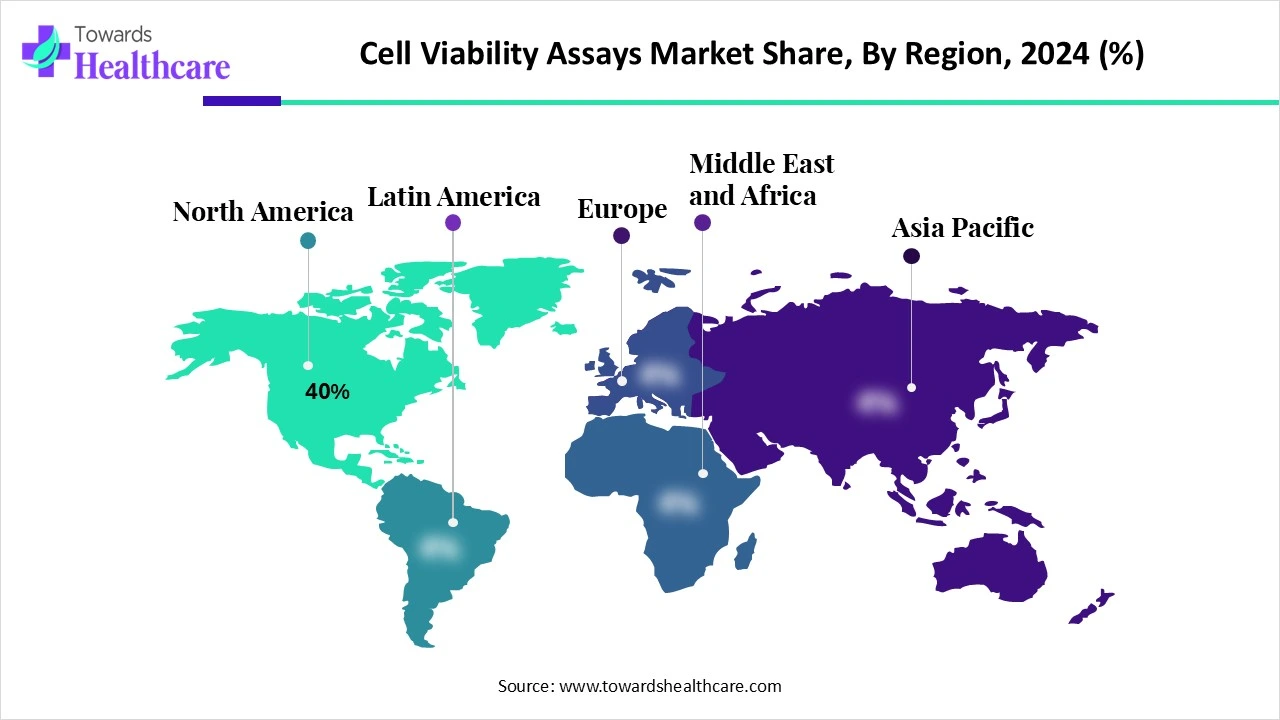

| Leading Region | North America Share by 40% |

| Market Segmentation | By Product Type, By Assay Type, By Application, By End-Use, By Technology, By Region |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, PerkinElmer Inc., Promega Corporation, Lonza Group AG, Abcam plc, BD Biosciences, Agilent Technologies, Roche Diagnostics, Takara Bio Inc., GE Healthcare Life Sciences, Enzo Life Sciences, Qiagen N.V., Corning Incorporated, Sigma-Aldrich (part of Merck), Sartorius AG, Tecan Group Ltd., Luminex Corporation, Cellular Technology Limited (CTL) |

The cell viability assays market refers to the global market for analytical techniques and reagents used to assess the health, proliferation, and survival of cells in biological and pharmaceutical research. These assays measure the number of living cells in a sample and are crucial for drug discovery, toxicology studies, cancer research, and other biomedical applications. They provide insights into cellular metabolic activity, membrane integrity, and enzyme function, helping researchers understand cytotoxicity, proliferation, and cellular responses to treatments.

Numerous factors influence market growth, including the rising prevalence of chronic disorders and cancer, as well as growing research and development activities. The burgeoning pharmaceutical and biotechnology sectors contribute to market growth. Stringent regulatory policies regarding cytotoxicity test results for new drug compounds are expected to favor market growth. Technological advancements drive the latest innovations in cell viability assays by introducing automation.

Artificial intelligence (AI) plays a vital role in cell viability assays by introducing automation and improving accuracy. It provides real-time monitoring of assays, enabling researchers to make proactive decisions. Live-cell assays generate multiple data points from a single well over time. AI can enhance the efficiency, accuracy, and reproducibility of viability assays, allowing researchers to focus on result interpretation over conducting laborious manual tasks. Additionally, it can assist researchers in data interpretation, avoiding complex calculations. Thus, AI can overcome the significant challenges of conventional assay procedures.

Growing Cancer Research

The major growth factor for the cell viability assays market is the growing field of cancer research. The rising prevalence of cancer and its severity lead to increased cancer research activities. The World Health Organization (WHO) estimates that about 1 in 5 people develop cancer in their lifetime, and approximately 1 in 9 men and 1 in 12 women die from cancer. (Source - WHO) Researchers identify novel targets and biomarkers that are involved in disease progression. This enables them to design novel drugs and test those drugs for their cytotoxicity profile.

Lack of Qualitative Data

Cell viability assays provide only quantitative data. They are unable to distinguish between different forms of cell death or derive the mechanism of cell death. This leads to insufficient data about cell viability, restricting market growth.

What is the Future of the Cell Viability Assays Market?

The market future is promising, driven by the increasing demand for personalized medicines. Personalized medicines are developed to address rapidly changing demographics and deliver targeted treatment. Advancements in genomics also support the development of personalized medicines. Stem cells, gene therapy, monoclonal antibodies, and recombinant proteins are the most common examples of personalized medicines. Cell viability assays are essential for stem cell research to assess their cell health and proliferation, especially when evaluating treatments or culture conditions. These assays help quantify the number of live cells, providing insights into cell survival, metabolic activity, and potential cytotoxicity.

By product type, the reagents and kits segment held a dominant presence in the market in 2024. This segment dominated due to the continuous requirements of reagents and kits for assays. Several companies provide kits and reagents at affordable rates, enabling researchers to meet their research requirements. They are more cost-effective than instruments and do not require specialized infrastructure. They enable researchers to develop accurate and reproducible results.

By product type, the instruments & systems segment is expected to grow at the fastest CAGR in the market during the forecast period. Instruments provide advanced services and results, and are integral parts of cell viability assays. Technological advancements drive the latest innovations in instruments to derive accurate results. Instruments, such as microplate readers, fluorescence microscopes, flow cytometers, and cell imaging systems, aid in data analysis and interpretation.

By assay type, the metabolic activity-based assays segment held the largest revenue share of the market in 2024. This is due to the ease of measuring cell metabolites and the simple procedure. Metabolites are directly linked to cellular energy, the generation of cellular building blocks, and signaling pathways. Metabolic activity-based assays help researchers to measure glucose uptake, lactate, glutamine, oxidative stress, and dinucleotide detection assays. These tests assess enzymatic activity as a marker for cell viability. An increase in enzyme activity is an indication of enhanced cell proliferation.

By application, the pharmaceutical & biotech research segment contributed the biggest revenue share of the market in 2024. This segment dominated due to the growing research and development activities in the pharma and biotech sectors. New drug discovery and stem cell research necessitate cell-based assays to assess cell cytotoxicity. Cell viability assays are used to evaluate drug safety and efficacy, optimize culture conditions, and screen drug candidates. This enables researchers to identify potential drug candidates before testing on animals. The increasing emphasis of several government organizations on reducing animal testing potentiates the demand for cell viability assays.

By application, the clinical diagnostics segment is expected to grow with the highest CAGR in the market during the studied years. The rising prevalence of chronic disorders and the increasing demand for early disease diagnosis augment the segment’s growth. Cell viability assays are used to determine the health and metabolic state of cells. The growing need for point-of-care diagnostics promotes the use of cell viability assays. These assays offer high specificity and sensitivity in diagnosing several chronic disorders.

By end-use, the pharmaceutical & biotech companies segment led the global market in 2024. The segmental growth is attributed to favorable infrastructure and suitable capital investments, enabling pharma & biotech companies to perform cell viability assays within their facilities. This also saves cost for indigenously performing assays. These companies mainly focus on developing novel drug candidates to expand their pipeline, necessitating the use of cell viability assays.

By end-use, the contract research organizations (CROs) segment is expected to expand rapidly in the market in the coming years. Numerous large and small-scale pharma companies prefer outsourcing their research activities to CROs due to the presence of skilled professionals and specialized equipment. CROs provide customized solutions to research problems. The increasing collaboration with CROs enables companies to focus primarily on product sales and marketing.

By technology, the colorimetric segment held a major revenue share of the market in 2024. The colorimetric method is most widely preferred as it can quantify viable cells easily using a formazan dye. This method accounts for visual changes in assay procedures and cell proliferation. It eliminates the need for using specialized equipment to measure cell viability. It involves the use of a variety of tetrazolium reagents, including XTT, MTT, CCK-8/WST-8, etc. The color intensity of the reagents is analyzed using a UV spectrophotometer.

By technology, the luminescent segment is expected to witness the fastest growth in the market over the forecast period. Luminescence-based assays quantify ATP that signals the presence of metabolically active cells. The amount of ATP present is directly proportional to the number of cells present. This assay is based on the luciferase reaction, which has a half-life of more than five hours. This eliminates the need for constant reagent injectors, providing greater flexibility for reagent procedures.

North America dominated the global market share by 40% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major growth factors of the market in North America. Government organizations provide funding to conduct pharma & biotech research. Research institutions and companies in North America have skilled professionals to perform assays.

Key players, such as Thermo Fisher Scientific, Sigma Aldrich, and Promega Corporation, are the major contributors to the cell viability assays market in the U.S. There are currently 542 research institutions in the U.S. The National Institute of Health (NIH) provides funding for various research activities and is made up of 27 Institutes and Centers, focusing on particular diseases. NIH invests around $48 billion annually.

The Ontario Institute for Cancer Research (OICR) launched the “Drug Discovery Program”, which is one of the largest programs of its kind in Canada. The OICR’s Cancer Therapeutics Innovation Pipeline (CTIP) awards funded $300,000 over 2 years to help advance promising drug discovery research for the development of new cancer drugs.

Asia-Pacific is expected to grow at the fastest CAGR in the cell viability assays market during the forecast period. The burgeoning pharmaceutical and biotech sectors and growing research activities bolster market growth. Increasing R&D investments and collaborations among key players facilitate access to advanced technology. Numerous private and public research institutions conduct seminars and workshops at national and international levels to educate and train researchers and students about cell viability assays.

China is emerging as a global leader in clinical and pharmaceutical research. China led in the total number of drug approvals from 2019 to 2023, with 256 new drug approvals. The Chinese government also provides funding for the development of new drugs and encourages innovation in domestic pharmaceutical companies.

The Indian government has launched the Rs 5,000 crore Scheme for Promotion of Research and Innovation in Pharma MedTech Sector (PRIP). The government aims to invest approximately Rs 17,000 crore in pharma R&D by FY28, focusing on cancer research, lifestyle disease prevention, medical technology, and niche segments like orphan drugs.

Europe is expected to grow at a notable CAGR in the cell viability assays market in the foreseeable future. Research institutions in European nations have favorable infrastructure to conduct cell viability assays. The funding cut in research by the U.S. government opens doors for American scientists to conduct their experiments in Europe. Favorable government support by the European government and the rising adoption of advanced technologies promote market growth.

Germany hosts around 700 pharmaceutical companies, employing a total of 133,000 people. The German government recently launched the National Pharma Strategy to secure the supply of pharmaceuticals, accelerating access to innovations and boosting Germany’s competitiveness in the pharma industry. (Source - Deutschland)

The Association of the British Pharmaceutical Industry (ABPI) reported that the industry contributed to almost 5,000 research papers from 2019 to 2023, supporting 283 patent applications. 11% of such papers were in the top 1% of the most referenced scientific papers. The UK government announced ten-year funding for pharmaceutical R&D.

James Atwood, General Manager of Opentrons Robotics, commented that the company’s newly launched automation marketplace serves as a one-stop shop, providing convenient access to products and services. The company aims to expand its marketplace offerings through strategic partnerships, especially in genomics, proteomics, and cell-based assays, ensuring customers can effortlessly address all their needs in one centralized location. (Source - Businesswire)

By Product Type

By Assay Type

By Application

By End-Use

By Technology

By Region

February 2026

January 2026

January 2026

January 2026