January 2026

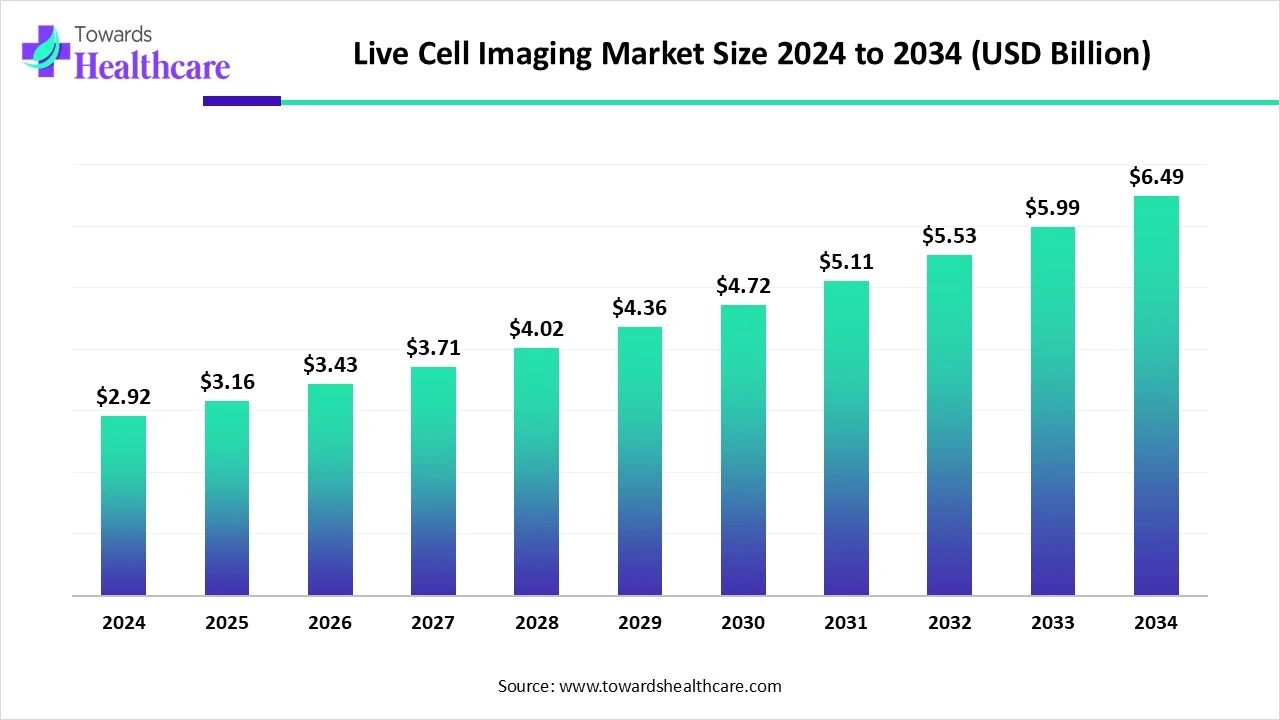

The global live cell imaging market size is calculated at US$ 2.92 billion in 2024, grew to US$ 3.16 billion in 2025, and is projected to reach around US$ 6.49 billion by 2034. The market is projected to expand at a CAGR of 8.34% between 2025 and 2034.

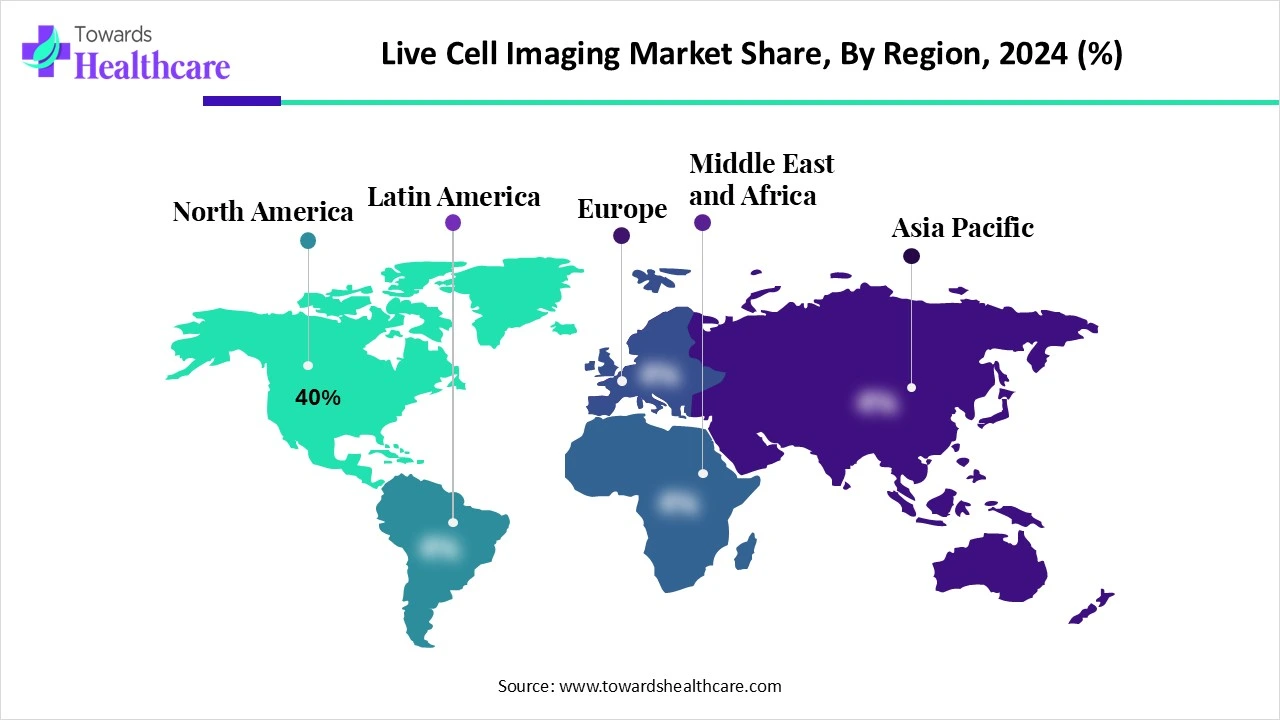

The live cell imaging market is expanding due to the strong academic research, growing public and private funding. North America dominates the market due to high investment in life sciences and personalized medicine, driving demand for modern imaging technologies, while Asia Pacific is the fastest growing due to increasing initiatives, an aging population, and the requirement for improved disease modelling, and increasing demand for live cell imaging.

| Metric | Details |

| Market Size in 2025 | USD 3.16 Billion |

| Projected Market Size in 2034 | USD 6.49 Billion |

| CAGR (2025 - 2034) | 8.34% |

| Leading Region | North America share by 40% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., GE Healthcare Life Sciences (Cytiva), Olympus Corporation, Leica Microsystems (Danaher Corporation), Nikon Corporation, ZEISS Group, Bio-Rad Laboratories, Inc., Bruker Corporation, Molecular Devices LLC (a division of Danaher Corporation), PerkinElmer, Inc., Luminex Corporation, GE Healthcare Life Sciences, Andor Technology Ltd. (Oxford Instruments), Hudson Robotics, CrestOptics S.r.l., CytoSMART Technologies B.V., Ibidi GmbH, Phase Focus Limited, IncuCyte (Sartorius AG), Leica Biosystems |

Live Cell Imaging Market refers to the global industry focused on the development, manufacturing, and application of technologies and instruments that enable the visualization and analysis of living cells in real time. These imaging systems allow scientists to study cellular processes, interactions, and dynamics without killing or fixing cells, thus providing critical insights into cell biology, drug discovery, cancer research, immunology, and other life science fields. Live cell imaging typically includes microscopes equipped with fluorescence, confocal, phase contrast, or bright-field imaging capabilities, along with software for image acquisition, processing, and analysis.

AI Integration in live cell imaging is driving the growth of the market, as AI-driven technology improves the pathology imaging by rapidly and accurately analysing huge amounts of data, identifying subtle patterns and irregularities that are missed by human eyes. AI algorithms improve the accuracy of diagnosing diseases such as cancer by detecting particular cellular changes. For Instance, MMI CellDetector is an AI analysis software that robotically notices and counts cells from any tissue. The software uses advanced algorithms to analyse microscopic images and accurately detect even in challenging images with flexible lighting and staining conditions, which drives the growth of the market.

For Instance,

What is Live Cell Imaging Used for?

Live-cell imaging allows scientists to observe and record the behavior of living cells over time, offering a dynamic view of cellular processes as they happen naturally. This approach enhances the study of cells beyond what traditional microscopy can achieve. By combining advanced techniques like fluorescence and confocal microscopy with the ability to keep cells alive and supported, live-cell imaging enables real-time visualization of cellular activities. This ensures observations are as close to the cells' natural state as possible, driving the growth of the live-cell imaging market.

Challenges of Live Cell Imaging

The primary challenges in live-cell imaging include keeping the biological sample alive under appropriate environmental conditions, setting the correct time-lapse sampling rate, and preventing bleaching of the fluorescent markers over time. These issues restrict the growth of the live cell imaging market.

Recent Advancements in Hardware and Software of Live Cell Imaging

Recent advancements in hardware and software are transforming live cell imaging by improving resolution, speed, and analytical potential. Developments in fluorophores and biosensors have broadened the scope of live cell imaging through non-invasive tracking of cellular dynamics. Hybrid fluorophores combine the durability and brightness of synthetic dyes with the specificity of protein sensors, enhancing super-resolution microscopy and opening new growth opportunities for the live cell imaging market.

By product type, the live cell imaging systems segment led the live cell imaging market, due to it provides real-time measurements made at the temporal frequency essential to effectively sample the dynamics of many biological processes. Such real-time, single-cell measurements eradicate artifacts that arise from endeavouring to renovate time courses from snapshots of various cells taken at different times. Using live-cell imaging systems to renovate perspectives in drug discovery

On the other hand, the live cell imaging software segment is projected to experience the fastest CAGR from 2025 to 2035, as it is a significant tool that enables investigators to envisage and study the behaviour of living cells in real-time. This method has transformed the field of molecular biology, allowing researchers to gain insights into the cellular processes and mechanisms that were previously inaccessible. This software allows quantitative analysis of cellular processes, with tracking movement, measuring changes in fluorescence intensity, and evaluating cellular morphology variations over time.

By application, the cancer research segment dominated the live cell imaging market in 2024, because live cell imaging enables the tracking of tumor cell behavior, including growth, invasion, and response to treatments. Cancer-specific markers and pathways are monitored in real time using live cells. Live cell imaging methods provide real-time inspection of almost every feature of cellular function under a diversity of normal and experimental conditions.

The drug discovery & development segment is projected to grow at the highest CAGR from 2025 to 2035, as evolving processes such as cellular proliferation, tissue formation, and replication are well-suited for study by live cell imaging. Considering these processes requires visualizing the three-dimensional and temporal patterns of protein localization and gene expression. Live cell imaging robotically commonly used in drug development and discovery, specifically throughout the in-vitro research phase, as appreciated information about the kinetics of cell and gene molecules can be obtained through it.

By end user, the academic & research institutes segment led the market in 2024, due to this imaging enables researchers to imagine small amounts of proteins with minimal disruption to molecular and cellular function. It is used by scientists to obtain a better understanding of biological function through the study of cellular dynamics.

The pharmaceutical & biotechnology companies segment is projected to experience the fastest CAGR from 2025 to 2035, as living cells have emerged as valuable platforms for drug delivery because of their benefits of advanced liquidity, stability, and low immunogenicity. Pharmaceutical and biotechnology companies heavily rely on live cell imaging for different vital applications, including personalized medicine, development, and drug discovery.

By technology, the fluorescence microscopy segment dominated in the live cell imaging market in 2024, as fluorescence microscopy of live cells has become an essential part of recent cell biology. Fluorescent protein tags, live cell dyes, and different procedures to fluorescently label proteins of interest offer a wide range of tools to investigate effectively any cellular process under the microscope. Fluorescence imaging of live cells is applied to observe dynamic cellular processes and track cellular biomolecules and structures over a period.

On the other hand, the super-resolution microscopy segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as super-resolution fluorescence microscopy provides novel promises to research molecular processes with greater detail than with traditional microscopies. Super-resolution microscopy gives microscopists the capacity to see past the diffraction boundary. Researchers have used the technique to produce attractive images of immovable samples.

North America dominated the live cell imaging market share by 40% in 2024, as the North American medical care system invested huge resources in medical research and pharmaceutical development, which has led to advanced discoveries and enhanced treatments in a variety of fields. Many physicians in North America are relying on these progressive imaging modalities due to advancements in technology, growing patient demand, and economic support from the government, which causes the growth of the market.

For Instance,

The United States is home to major global leading life science-based companies. From Boston to San Francisco, these cities attract huge talent and increased funding in the life sciences sector. In the U.S., demand for medical imaging is increasing due to continue as an explosion of progressive imaging technologies, shifts in how patients receive care, novel therapies based on imaging, and the pressures of an aging population, which drive the market growth.

For Instance,

Imaging technology in Canada is growing through innovations in clinical practices and research methodologies. Present developments focus on refining evidence-based practices, discovering innovative imaging procedures, and improving diagnostic processes with artificial intelligence. The presence of major federal agencies like NIH, NSF, and FDA provides grants and support for scientific research and healthcare innovation, contributing to the growth of the market.

Asia Pacific is estimated to be the fastest-growing live cell imaging market during the forecast period, as the rising emergence of personalized medicine (PM) treatment increases the demand for live cell imaging technology. Asia Pacific pharma sectors seek to ensure open new opportunities for innovation and collaboration to increase financial scale, R&D research, and competitiveness, driving the growth of the market.

Increasing healthcare initiative, such as the Healthy China 2030 Initiative and National AI Strategy, increases AI adoption in healthcare. AI is quickly expanding in cancer management, diagnostic imaging, and telemedicine. In China, medical imaging has become a commonly used application because of several developing benefits of AI in the healthcare imaging services, which contribute to the growth of the market.

India's healthcare is fast transforming medical imaging, driving innovations that improve the accuracy of diagnostics, streamline healthcare workflows, and increase access to quality care. The Indian medical industry has been a trailblazer in innovating low-cost products and services, which drives the growth of the market.

Europe is expected to grow significantly in the live cell imaging market during the forecast period, as Europe is noteworthy in its multifaceted networks for research and advanced healthcare technology. Europe has a compressed and varied network of such cutting-edge facilities, that advantageous for all investigators and permits them to conduct a large-scale cutting-edge digital network for the study of live cell imaging, which drives the growth of the market.

Germany is a significant player in the worldwide life sciences sector, fostering a strong ecosystem of pharmaceutical, biotechnology, and healthcare technology companies. The German government is developing a novel pharma strategy along with several reforms to enhance the environment for the pharmaceutical industry. Germany’s life sciences landscape is growing a shift towards digital health technologies, AI-driven drug discovery, and precision medicine, which is increasing the demand for live cell imaging.

Increasing government support for healthcare technology, for instance, in August 2024, the UK Government launched a £400m public-private investment initiative, goal to rising advancement the pharmaceutical and life sciences companies. The UK is a hub of several biotech organizations, including the renowned 'golden triangle', made up of Oxford, Cambridge, and London, which contributes to the growth of the market.

In March 2025, Dr Mike Nicholds, CEO and Co-Founder, Newcells Biotech, Stated, “The launch of our novel imaging suite and improved fibrotic disease screening assay is a significant step in our strategy to offer innovative, market-leading in vitro models that advance the discovery and safe development of new drugs. We are committed to continuous innovation of our solutions to remain at the cutting-edge and best support our customers’ research needs.” (Source - Bio Industry)

By Product Type

By Application

By End User

By Technology

By Region

January 2026

January 2026

January 2026

January 2026