January 2026

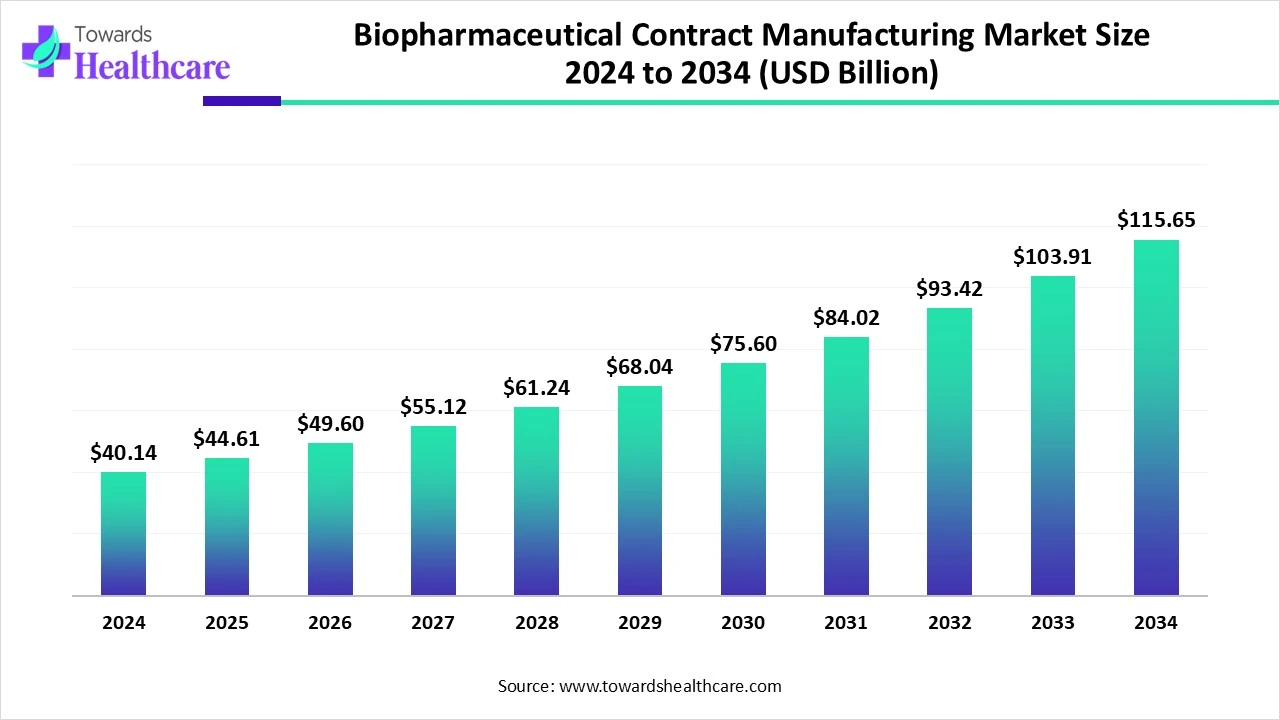

The global biopharmaceutical contract manufacturing market size is calculated at US$ 40.14 billion in 2024, grew to US$ 44.61 billion in 2025, and is projected to reach around US$ 115.65 billion by 2034. The market is projected to expand at a CAGR of 11.14% between 2025 and 2034.

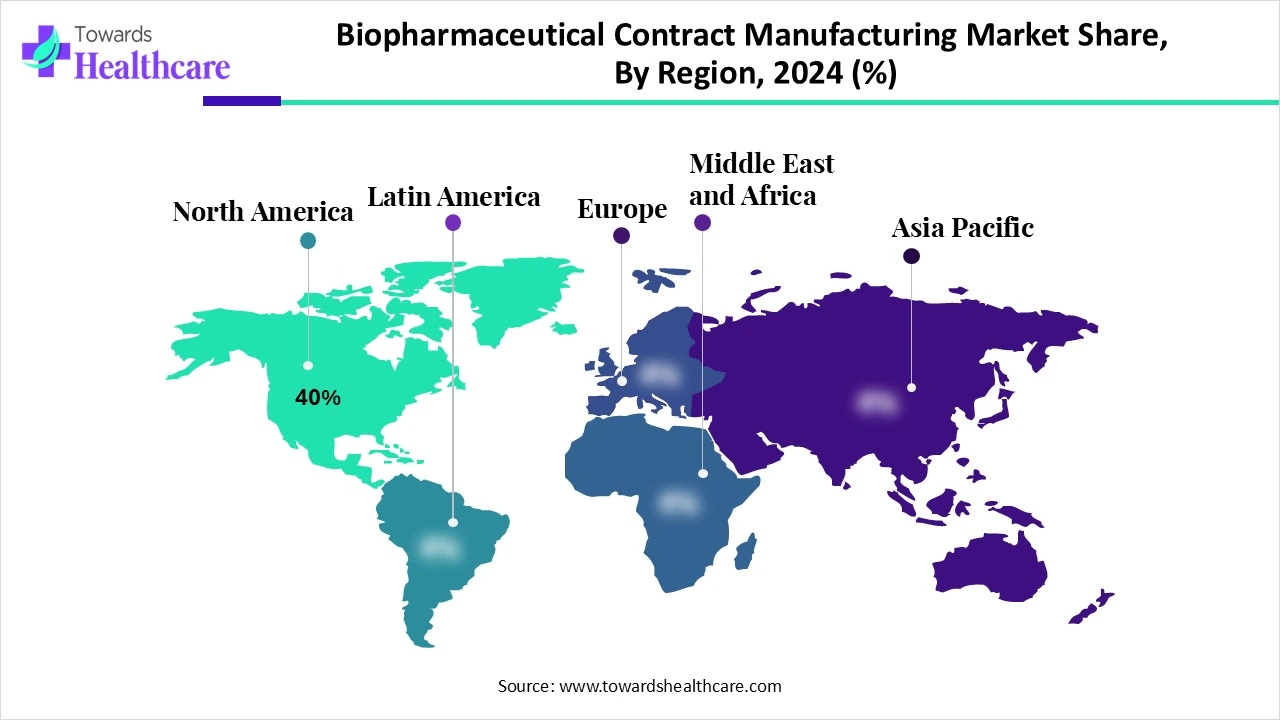

The biopharmaceutical contract manufacturing market is expanding due to the increasing demand for biologics, biosimilars, and monoclonal antibodies. Major biopharmaceutical organizations are increasingly outsourcing production to lower expenses and increasing access to advanced healthcare technology. North America is dominant in the market due to the presence of advanced infrastructure and regulatory expertise like the FDA. Asia Pacific is the fastest-growing market due to increasing investment in biosimilar and biologics development, and the presence of a skilled workforce.

| Metric | Details |

| Market Size in 2025 | USD 44.61 Billion |

| Projected Market Size in 2034 | USD 115.65 Billion |

| CAGR (2025 - 2034) | 11.14% |

| Leading Region | North America Share by 40% |

| Market Segmentation | By Product Type, By Manufacturing Type, By Technology, By Service Type, By Scale of Operation, By Therapeutic Area, By End User, By Region |

| Top Key Players | Lonza Group AG, Catalent, Inc., Samsung Biologics Co., Ltd., Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim BioXcellence, Patheon (Thermo Fisher Scientific), WuXi Biologics, AMRI (Albany Molecular Research Inc.), Rentschler Biopharma SE, Vetter Pharma International GmbH, Recipharm AB, CordenPharma International, AGC Biologics, Jubilant Biosys Ltd, BioVectra Inc., Baxter BioPharma Solutions, Cobra Biologics (part of Bidco Group), Syngene International Ltd, Novasep Holding SAS, Wuxi AppTec |

The biopharmaceutical contract manufacturing market refers to the industry segment where third-party manufacturers provide services for producing biopharmaceutical products on behalf of biotechnology and pharmaceutical companies. These services include development, manufacturing, and sometimes packaging of biologics drugs such as monoclonal antibodies, recombinant proteins, vaccines, cell and gene therapies, and other complex biological drugs. Contract manufacturing organizations (CMOs) help biopharma companies scale up production, reduce capital expenditure, ensure regulatory compliance, and accelerate time-to-market.

Integration of AI in the biopharmaceutical contract manufacturing drives the growth of the market as AI-based technology across pharmaceutical manufacturing is renovating traditional practices, from drug discovery to patient care, allowing more effective research, advancement, and manufacturing techniques. Artificial Intelligence (AI) is used in the simulation of human intelligence in machines. Integrating AI in medical devices renovates healthcare by enhancing diagnostics, targeting treatments, and improving patient outcomes. Integrating AI in healthcare lowers operational burdens and increases the standard of care, making it more accessible, precise, and patient-centered. AI systems analyze huge patient data, medical records, imaging data, and genetic profiles to extract valuable insights, support healthcare professionals, improve patient health, and optimize operational efficiency in healthcare settings and progressing manufacturing practices.

For Instance,

Increasing Advancement in Biologics and Biosimilars

Biosimilars have emerged as a solution that offers considerable cost savings and increased patient access, marking a major step forward for healthcare systems and patients.5 However, this development does not simplify distribution; rather, it adds layers of complexity. These include managing a dual market with both originator and biosimilar products, navigating complex pricing and rebate strategies, and addressing perception challenges among healthcare providers and patients. This complexity, in turn, fuels the expansion of the biopharmaceutical contract manufacturing market.

Major Challenges of Pharmaceutical Outsourcing

Pharmaceutical companies face several challenges when outsourcing, such as quality control, regulatory compliance, supply chain disruptions, and risks to intellectual property. Navigating the complex and intricate landscape of pharmaceutical regulations is one of the biggest hurdles in third-party manufacturing, which in turn restricts the expansion of the biopharmaceutical contract manufacturing market.

Increasing Innovation in Biopharmaceutical Development and Manufacturing

Advancements in custom biopharmaceutical development are opening new opportunities for more effective and personalized therapies. The bio/pharmaceutical industry's progress is propelled by rapid innovations in manufacturing technologies. As these technologies evolve, there's a noticeable shift toward continuous manufacturing (CM), which allows for real-time monitoring, better scalability, and improved quality control. These developments not only boost manufacturing efficiency but also enhance treatment quality and increase access to vital therapies. With ongoing scientific and technological progress, the future of biopharmaceutical production looks promising, offering hope globally and fostering growth in the biopharmaceutical contract manufacturing market.

For instance,

By product type, the monoclonal antibodies segment led the biopharmaceutical contract manufacturing market, due to monoclonal antibodies used to make drugs that are more successful at treating many diseases, such as some cancers. Using monoclonal antibodies as a treatment is that they’re more accurate than other treatments. This increases the effectiveness and reduces side effects. Monoclonal antibody quality is standard for entirely production batches, which is significant for use as therapy, as well as for diagnostics.

On the other hand, the cell therapies segment is projected to experience the fastest CAGR from 2025 to 2034, as it has huge potential applications that include managing cancers, autoimmune disease, infectious disease, and urinary problems, rebuilding damaged cartilage in joints, repairing spinal cord injuries, enhancing a weakened immune system, and serving patients with neurological disorders.

By manufacturing type, the drug substance manufacturing segment is dominant in the biopharmaceutical contract manufacturing market in 2024, as pharmaceutical contract manufacturers have huge potential to expedite time-to-market. Emerging a novel drug is a complex, many-year process. By outsourcing production to experienced CDMO pharma companies, pharmaceutical companies leverage existing infrastructure and expertise, avoiding the requirement to build novel services or hire dedicated personnel. Pharma contract manufacturing often includes modern technology and specialized processes, like sterile filling, high-containment manufacturing, and solid dosage formulation.

The drug product manufacturing segment is projected to grow at the fastest CAGR from 2025 to 2034, as the pharmaceutical contract manufacturing process involves the outsourcing of drug product manufacturing to third-party manufacturers. It includes the use of progressive technologies like artificial intelligence and machine learning to augment various stages of drug development and manufacturing. These include improved product quality, lower costs, faster production, and compliance with complex regulations.

By technology, the upstream processing segment led the biopharmaceutical contract manufacturing market in 2024 due to this process includes media preparation, inoculum expansion, fermentation or cell culture, and harvest. It has enhanced efficiency, lowered contamination challenges, improved product quality, and improved scalability. It also allows process intensification, cause to higher productivity and cost savings.

The analytical & quality testing segment is projected to experience the fastest CAGR from 2025 to 2034, as it offers affordable solutions, skillful expertise, and scalable services to meet broad industry needs. Contract manufacturing analytical testing component, more resources allocated to R&D, production, and other significant areas. This can lead to a growing revolution. Outsourcing offers the flexibility and scalability desired to adapt to these variations.

By service type, the manufacturing services segment led the biopharmaceutical contract manufacturing market in 2024, as these services provide many advantages such as scalability, accelerated time to market, core competency benefit, expertise access, quality assurance, and regulatory compliance. It involves the production of a broad range of pharmaceutical products, from tablets and capsules to injectables, ointments, and more.

On the other hand, the regulatory support services segment is projected to experience the fastest CAGR from 2025 to 2034, as these services support conducting clinical trials, assisting with site selection, and research monitoring to confirm adherence to protocols and good clinical practices. This contains management of data, patient safety oversight, and government compliance. By leveraging these services, pharmaceutical and biotech companies modernise development, lower costs, and speed up time-to-market while ensuring quality and regulatory adherence.

By scale of operation, the commercial-scale manufacturing segment led the biopharmaceutical contract manufacturing market in 2024 due to this scale of manufacturing where approved therapies are commercialized, they're manufactured at scale, marketed to consumers and healthcare companies, and sold. Commercial-scale operations that focus on meeting excellent market demand and offering products or services to end consumers. It includes businesses of various sizes, from small enterprises to large enterprises.

On the other hand, the clinical-scale manufacturing segment is projected to experience the fastest CAGR from 2025 to 2034, as this manufacturing is a dedicated form of pharmaceutical manufacturing that focuses on producing drugs that are used for clinical research. Working with clinical trial materials needs special manufacturing technology and careful attention to detail to ensure security and safety. Clinical scale manufacturing involves supplying the appropriate quantities of the IMP at the correct time while maintaining high safety and quality standards.

By therapeutic area, the oncology segment led the biopharmaceutical contract manufacturing market in 2024 due to contract manufacturing providing targeted drug therapies for the treatment of cancer, which significantly comprises gene therapies, monoclonal antibodies (mAbs), and highly potent active pharmaceutical ingredients (HPAPIs). These applications, in many other cases, are therefore carefully controlled manufacturing processes.

On the other hand, the rare diseases segment is projected to experience the fastest CAGR from 2025 to 2034, as rare disease contract manufacturing organizations provide expertise, scale, and efficacy of established manufacturers. It enables them to bring products to market rapidly and more affordably. It is a form of outsourcing where a third-party producer produces components or products on behalf of a healthcare organization.

By end user, the biopharmaceutical companies segment led the biopharmaceutical contract manufacturing market in 2024, as it includes outsourcing the production of pharmaceutical products to a third-party manufacturer, which offers services like drug development, manufacturing, and compliance with regulatory requirements. Contract manufacturing provides flexibility and scalability. Pharmaceutical organizations often face variations in demand for their products.

On the other hand, the generic biologic manufacturers segment is projected to experience the fastest CAGR from 2025 to 2034, as generic biologics companies incur minimum costs in making generic drugs, only the expenses of manufacturing, without the expenses of drug discovery and drug development, and are therefore able to maintain profitability at a lower price. Biologic drug manufacturers, significantly more controls on the variability of their product than other manufacturers.

North America is dominant in the biopharmaceutical contract manufacturing market share by 40% in 2024, during the forecast period, as increasing resources of each country in North America are allocated for healthcare, varying as it has its own political, economic, and increasing spending in healthcare. This region is forefront of healthcare innovation by investing heavily in research, which has led to new treatments and medical devices. It provides a medical education system that drives highly specialized providers who, in turn, administer patient-centered care rooted in the choice of patients.

For Instance,

The U.S. has emerging technologies that have huge potential to replace existing medical practices and create healthcare delivery more efficiently and affordably. Significant investment in research and development is growing innovation and outsourcing requirements, particularly for biosimilars and biologics.

The Canadian healthcare industry has provided important services to millions of Canadians each year. The Canadian healthcare sector provides a broad range of services to healthcare providers, which drives the growth of the market. The increasing demand for personalized medicine and biologics has led to the diversification of manufacturing capabilities.

Asia Pacific is the fastest-growing region in the biopharmaceutical contract manufacturing market in 2024, as this region has strong potential for growth and healthcare organizations that drive innovation. Growing health awareness leading to enhanced health demand has, directly and indirectly, pressurized the ruling governments in the region to invest in the health sector, which drives the growth of the market.

For Instance,

In China, growing government funding in advanced healthcare services and increasing expansion of the domestic pharmaceutical and biotechnology sector growing regional manufacturing capabilities. The rapid growth of the healthcare industry in China has led to a significant talent pool, specifically in the areas of advanced digital skills and management expertise helps advance contract manufacturing, contributing to the growth of the market.

In India, clinical trials are emerging as a significant activity as it is a vital component of the drug discovery and development program, boosting the demand for contract development and manufacturing services.

Europe is notably growing in the market during the forecast period, as a strong presence of leading pharmaceutical companies such as Sanofi, Novartis, and Roche, which rapidly outsource manufacturing. The variety of experts contributing to the regulation of medicines in the EU encourages the exchange of knowledge, ideas, first-hand experience, and standard practice, which attracts worldwide clients, contributing to the growth of the market.

In Germany, increasing development in healthcare technologies such as electronic health records (EHR), automation, integration of AI, and predictive analysis has increased the productivity and effectiveness of outsourcing medical services. The German healthcare sector is increasingly attractive, a focus of media interest, a trend increasing by developments like statutory liberalization, the mergers of healthcare service providers, and IT solutions that enhance the efficiency of authorities and service providers, which drives the growth of the market.

The medical care division stands at £280 billion in the UK, along with digital healthcare solutions, which are an increasingly noteworthy portion. NHS trusts and private healthcare providers in Britain are adapting to advanced digital transformation, essentially transforming the medical services operations, which drives the growth of the market. Commercial organisations are progressively being contracted to serve health and social care in the UK, which contributes to the growth of the market.

In July 2025, Stephen Lam, Chief Executive Officer of Tanvex, stated, “We are adopting the name Bora Biologics to honor the legacy, reputation, and partnership power of a Bora brand, while seamlessly integrating its strengths with our commercialization success in the U.S. and our ground-breaking vision and commitment to advancing biologics development. We believe that Bora Biologics will play a significant role in the future of biologics development.”

By Product Type

By Manufacturing Type

By Technology

By Service Type

By Scale of Operation

By Therapeutic Area

By End User

By Region

January 2026

February 2026

December 2025

December 2025