February 2026

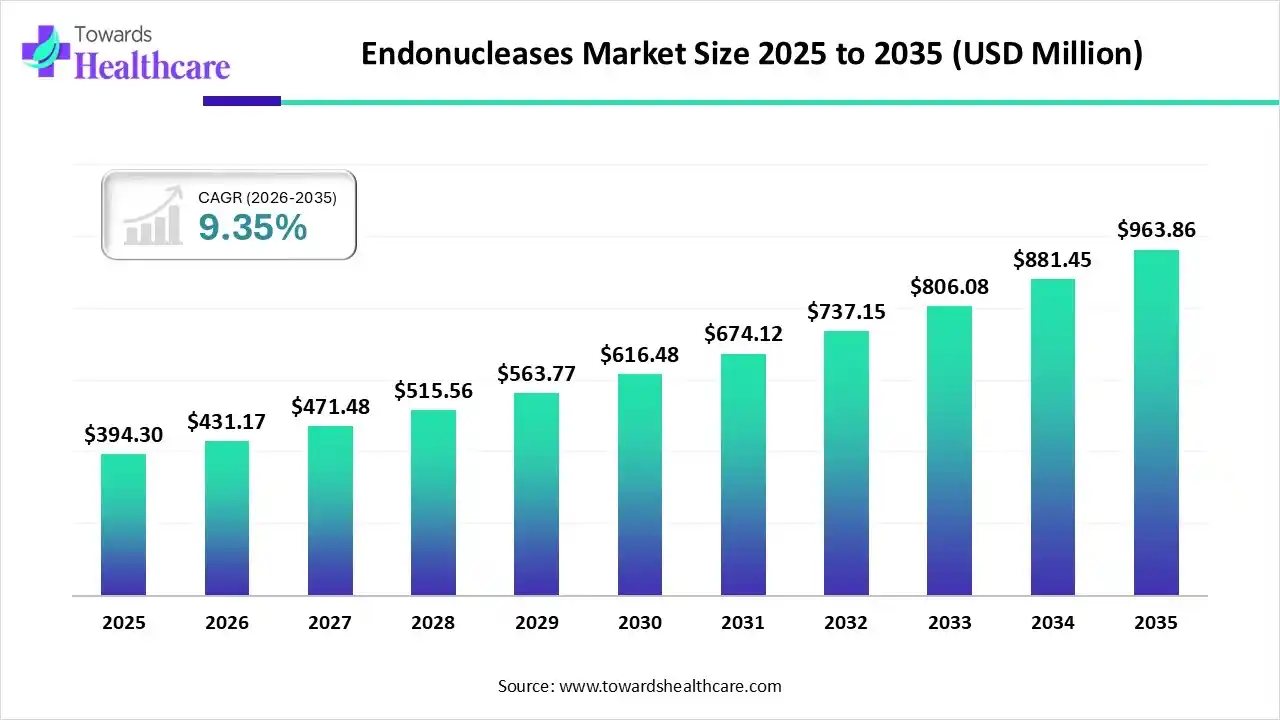

The global endonucleases market size was estimated at USD 394.3 million in 2025 and is predicted to increase from USD 431.17 million in 2026 to approximately USD 963.86 million by 2035, expanding at a CAGR of 9.35% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 431.17 Million |

| Projected Market Size in 2035 | USD 963.86 Million |

| CAGR (2026 - 2035) | 9.35% |

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Technology / Mode of Action, By End-User, By Region |

| Top Key Players | New England Biolabs (NEB), Thermo Fisher Scientific, Promega Corporation, Sigma-Aldrich, Takara Bio, Agilent Technologies, Qiagen |

The Endonucleases Market refers to the global market for enzymes that cleave the phosphodiester bonds within nucleic acid chains, playing a critical role in molecular biology, genomics and biotechnology research. These enzymes are widely utilized in applications such as DNA and RNA analysis, genome editing, cloning, next-generation sequencing (NGS), and CRISPR-based therapies.

Endonucleases support precision cutting of nucleic acids for both research and therapeutic purposes, contributing to advancements in diagnostics, drug development, and personalized medicine. Market growth is driven by increasing adoption of molecular biology techniques , rising investments in R&D, expansion of genomics and biotechnology sectors, and the growing focus on gene therapies and precision medicine globally.

Integration of AI-based technology in endonucleases drives the growth of the market as the incorporation of AI-driven technology with genome editing systems provides unparalleled precision and effectiveness, which could potentially transform the treatment of mutational diseases and oncology. The AI-driven technology tool searches datasets of known enzyme structures and suggests sequence variations. By the incorporation of AI-based sequence and structural bioinformatics, enzyme developments have been quicker, lowering timelines and efforts in the lab, which drives the growth of the market.

pyogenes Cas9 (SpCas9) is the most significantly used CRISPR endonuclease for genome engineering, but there are other Cas enzymes available. These enzymes have unique properties and can target various types of nucleic acids, including dsDNA (Cas9, Cas12), ssRNA (Cas13), or ssDNA (Cas14).

Restriction endonucleases can facilitate genetic recombination and genome rearrangement by cutting DNA at specific sites. This causes the exchange of genetic material among different DNA molecules, involving to genetic evolution and diversity.

Restriction enzymes have been one of the major forces that enabled the cloning of genes and transformed molecular biology. New technologies, like Golden Gate Assembly and Gibson Assembly, continue to emerge and expand our ability to create novel DNA molecules.

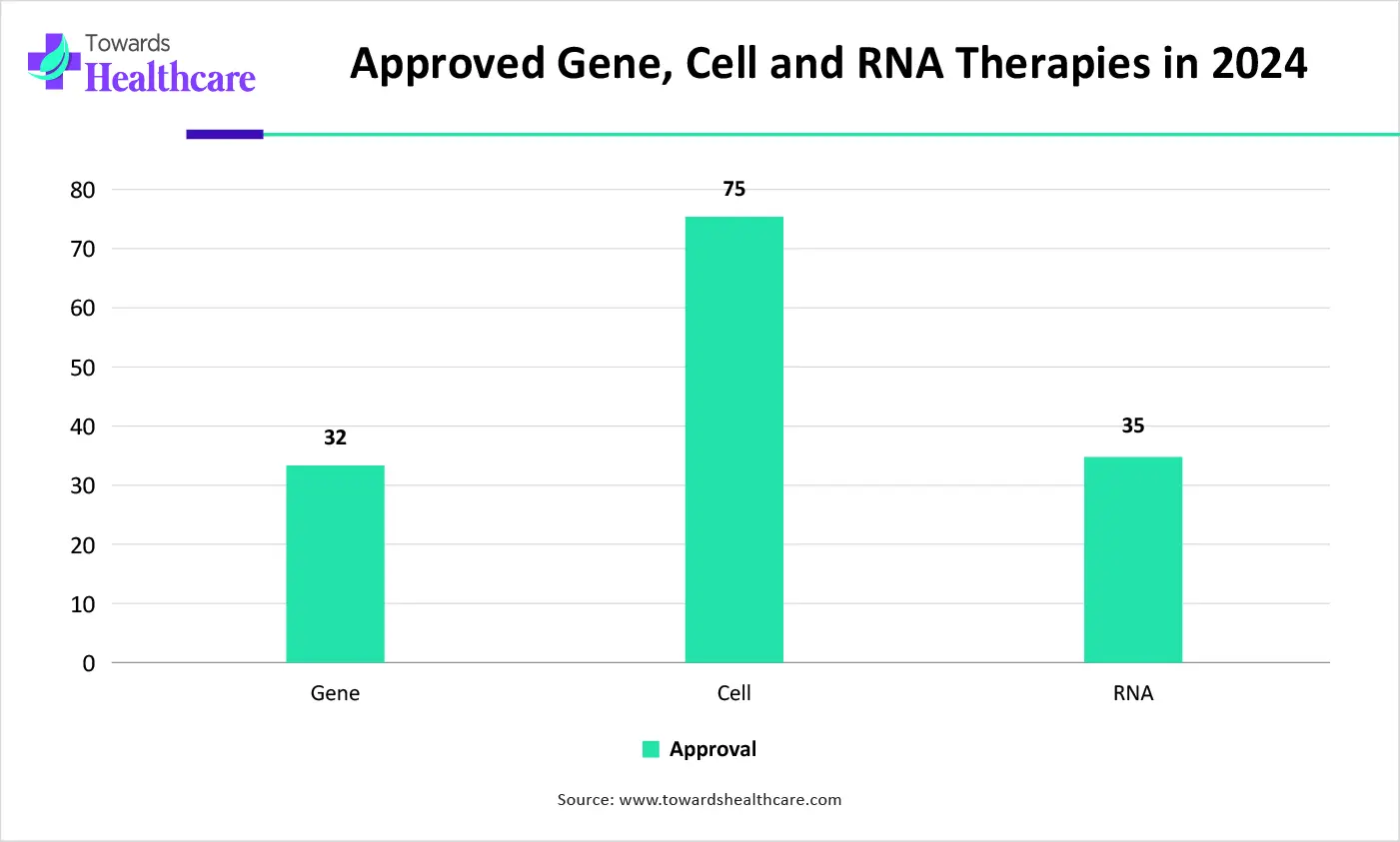

| Type of Therapy | Approval |

| Gene | 32 |

| Cell | 75 |

| RNA | 35 |

Which Product Led the Endonucleases Market in 2024?

In 2025, the restriction endonucleases segment held the dominant market with a 40% share, as restriction endonucleases have been a staple in molecular biology for decades, often appearing as a simple tool for cutting DNA. They offer unparalleled opportunities for diagnosing DNA sequence content and are used in fields as disparate as criminal forensics and basic research. Enzymes are that they provide the means to actually precisely cut through a double strand of DNA.

CRISPR-Cas Endonucleases

Whereas the CRISPR-Cas endonucleases segment is the fastest growing in the market, as CRISPR-Cas9 gene editing works by creating double-stranded breaks in the DNA and then taking advantage of cellular DNA repair mechanisms. CRISPR-Cas systems are becoming the most extensively used genome editing technology in molecular biology laboratories.

Why did the Genome Editing & CRISPR Applications Segment Dominate the Market in 2024?

The genome editing and CRISPR applications segment captured 35 % of the market share of the endonucleases market in 2025, as the CRISPR/Cas9 technology is characterized by its excessive versatility. In result, the sgRNA directs the endonuclease to a particular site in the genome. By attaching functional domains to Cas9, it is likely to target any functionality to a particular genomic location, including promoter introns, and sites.

NGS & DNA Sequencing Workflows

Whereas the NGS & DNA sequencing workflows segment is the fastest growing in the market as they are significant for targeted sequencing processes, like Restriction Site Associated DNA Sequencing (RAD-seq) and certain amplicon-based methods. This strategy focuses the sequencing effort on specific genomic regions of interest, creating the process more affordable and enabling greater sequencing sensitivity and depth.

Why is the Enzyme-Based DNA Cleavage Segment Dominant in the Market?

In 2025, the enzyme-based DNA cleavage segment held the dominating with 50% share of the endonucleases market, as they cut to completion DNA substrates with only one site, as effective as they cleave substrates with numerous sites. Their cleavage capability is not inhibited at high enzyme concentration because of site-saturation, and is not improved by adding particular oligos.

Recombinant Endonuclease Platforms

Whereas the recombinant endonuclease platforms segment is the fastest growing in the market, as recombinant endonucleases such as restriction enzymes and engineered nucleases like ZFNs, TALENs, and CRISPR/Cas systems recognize and cut DNA at particular nucleotide sequences. Recombinant DNA technology supports improving food production. Fruits and vegetables, which were prone to attacks from pests, have undergone genetic modifications to be more resistant.

Why is the Pharmaceutical & Biotechnology Companies Segment Dominant in the Market?

In 2025, the pharmaceutical & biotechnology companies segment held the dominating 40% share of the endonucleases market, as endonuclease enzymes are significant for repairing damaged DNA. Bacterial restriction endonucleases kill invading viruses in pharmaceutical organizations. In food biotechnology, restriction endonucleases enable the development of genetically modified organisms with enhanced characteristics.

CROs & Genomics Service Providers

Whereas the CROs and genomics service providers segment is the fastest growing in the market, as endonucleases offer contract research organizations (CROs) and genomics service providers with exact and reliable tools for fundamental DNA manipulation, allowing efficient molecular cloning, advanced gene editing, and specialized next-generation sequencing (NGS) library preparation.

In 2025, North America led the endonucleases market with 38% of the share, driven by a well-developed research infrastructure, including various academic institutions and commercial laboratories, which drives innovation in enzyme-associated technologies and the acceptance of cutting-edge equipment such as CRISPR-Cas9. Supportive guidelines and an emphasis on quality and safety, particularly by agencies such as the FDA, promote trust in advanced-quality, GMP-grade endonucleases.

For instance,

The U.S. has a well-developed biotechnology sector and robust research infrastructure, which drives demand for advanced-quality endonucleases in different applications, including drug discovery and manufacturing of vaccines, biologics, and cell and gene therapies.

For instance,

Asia Pacific is set to experience rapid growth in the endonucleases market, as this region is experiencing rapid manufacturing growth with the increase of biotech startups, generics production, and novel biomanufacturing services, all of which need endonucleases for applications such as nucleic acid cleanup and purification during manufacturing.

Increasing India's leadership in Atmanirbhar Bharat, genomic medicine, and cost-effective advanced therapeutics. India is vigorously promoting genome editing (GE) in farming and healthcare, launching the world's first GE rice varieties for environment resilience, which drives the growth of the market.

Europe is growing significantly in the endonucleases market as a strong presence of leading biopharmaceutical organizations, and a focus on robust therapies like cell and gene therapies increases the demand for endonucleases in production technology, like the production of monoclonal antibodies and recombinant proteins, which contributes to the growth of the market.

The UK possesses an advanced biotechnology infrastructure that helps extensive R&D in genomics and precision medicine. Increasing partnerships among the universities and biotech firms further enhances market growth and revolution in the field.

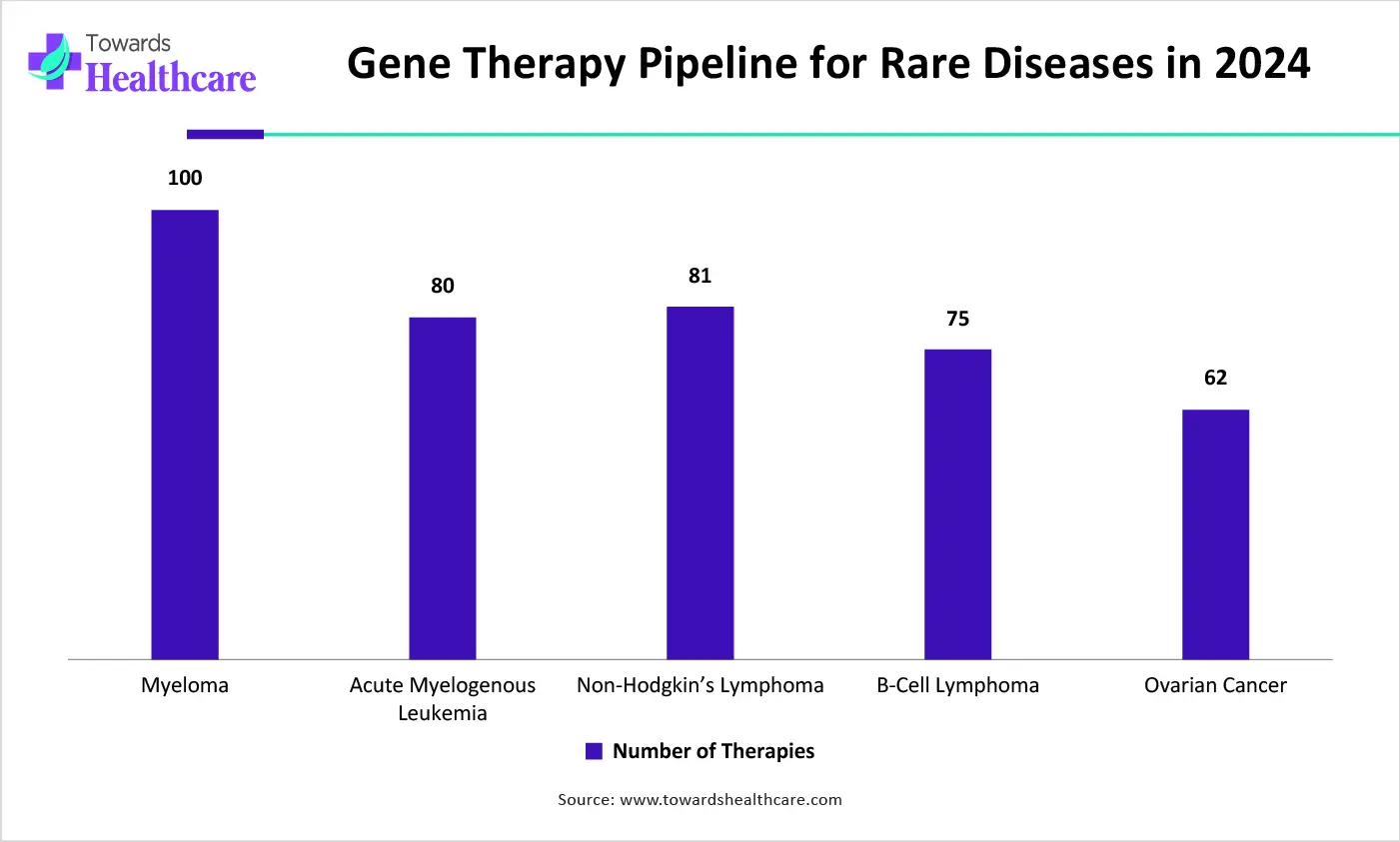

| Diseases | Number of therapies |

| Myeloma | 100 |

| Acute myelogenous leukemia | 80 |

| Non-Hodgkin’s lymphoma | 81 |

| B-cell lymphoma | 75 |

| Ovarian cancer | 62 |

| Company | Headquarters | Latest Update |

| New England Biolabs (NEB) | United States | In February 2025, New England Biolabs to Present Latest Innovations in Next Generation Sequencing Sample Preparation. |

| Thermo Fisher Scientific | United states | In August 2025, the MagMAX HMW DNA Kit is intended for the high-integrity isolation of High Molecular Weight DNA for long-read sequencing applications. |

| Promega Corporation | United States | In September 2025, Promega entered a strategic partnership with Watchmaker Genomics to license a novel engineered reverse transcriptase. |

| Sigma-Aldrich | United States | Benzonase endonucleases are chosen for an endonuclease that ensures exceptionally high purity and activity for the finished product. |

| Takara Bio | Japan | In September 2025, Takara Bio Europe announced the launch of Cellartis MSC EV Wonder, a defined, xeno-free medium engineered. |

| Agilent Technologies | United States | In December 2025, Agilent Technologies Inc. launched new 21 CFR Part 11 compliant software for its xCELLigence Real-Time Cell Analysis (RTCA) eSight system. |

| Qiagen | Germany | In July 2025, QIAGEN announced the launch of its novel QIAseq xHYB Long Read Panels, a suite of target enrichment solutions intended to unlock long-read sequencing of genomically challenging regions. |

By Product Type

By Deployment Type

By Application

By Technology / Mode of Action

By End-User

Regional Outlook

February 2026

February 2026

February 2026

February 2026