January 2026

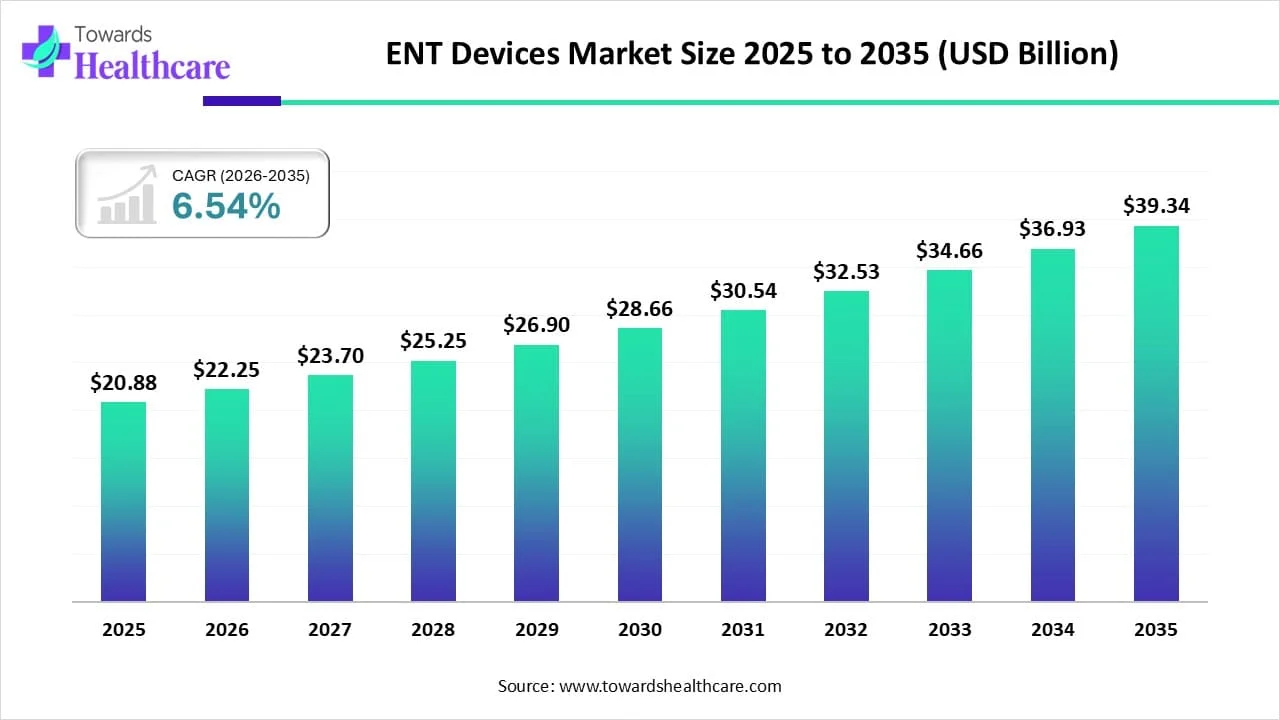

The global ENT devices market size is calculated at US$ 20.88 billion in 2025, grew to US$ 22.25 billion in 2026, and is projected to reach around US$ 39.34 billion by 2035. The market is projected to expand at a CAGR of 6.54% between 2026 and 2035.

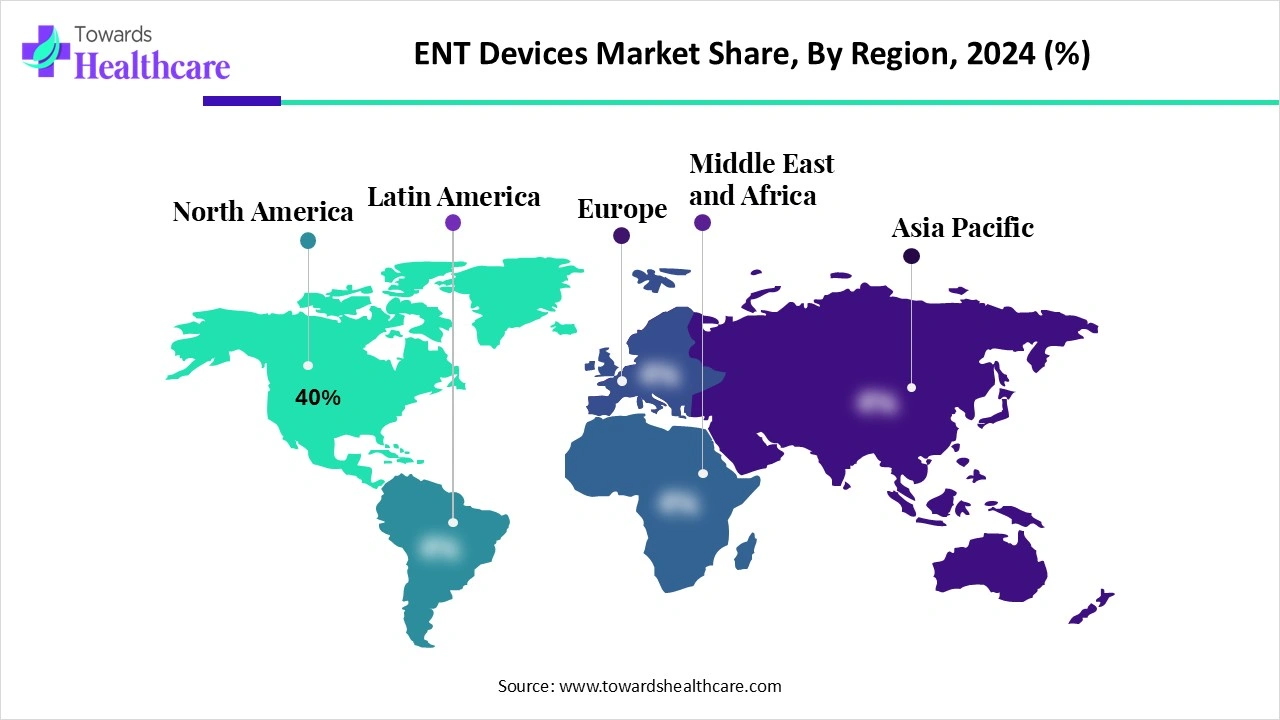

The ENT devices market is expanding due to the growing aging population, increasing prevalence of hearing loss, and high demand for minimally invasive ENT procedures. North America is dominated in the market as increasing awareness and early adoption of diagnostics technology and continuous medical technology innovation, while Asia Pacific is the fastest growing, as increasing government support and advancement in novel ENT procedures.

| Metric | Details |

| Market Size in 2026 | USD 22.25 Billion |

| Projected Market Size in 2035 | USD 39.34 Billion |

| CAGR (2026 - 2035) | 6.54% |

| Leading Region | North America share by 40% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Region |

| Top Key Players | Medtronic plc, Stryker Corporation, Smith & Nephew plc, Cochlear Ltd., Sonova Holding AG, Starkey Hearing Technologies, GN Hearing (ReSound), William Demant Holding A/S (Oticon), Karl Storz SE & Co. KG, Olympus Corporation, Interacoustics A/S, Welch Allyn (Hill-Rom), WS Audiology, Heine Optotechnik GmbH & Co. KG, Rion Co., Ltd., Acclarent, Inc. (Johnson & Johnson), Innerscope Hearing Technologies Inc., Zsquare Medical, Eartec Co., Ltd., Ambu A/S |

The ENT Devices Market comprises medical instruments and diagnostic tools used for the treatment, management, and surgical intervention of ear, nose, and throat conditions. These include hearing loss, sinusitis, otitis media, tonsillitis, snoring, and voice disorders. Devices span from diagnostic endoscopes and hearing aids to surgical instruments and implantable solutions. The market is driven by an aging population, growing prevalence of ENT disorders, advancements in minimally invasive ENT procedures, and technological innovations in hearing restoration and navigation systems.

Integration of AI in ENT devices drives the growth of the market as the incorporation of AI-driven technology enhances diagnostic precision, improves treatment approaches, and improves patient outcomes. This progression brings to the fore the significant role of education and training in exploiting AI's potential in the field. AI applications from expecting hearing loss evolution and optimizing cochlear implant settings to treating chronic sinusitis and envisaging the success of management for obstructive sleep apnea. Evolving applications of AI-driven technology include better analysis of hearing, speech, or sleep-disordered breathing. These and other uses provide clinical decision help, modernise care, and renovate the practice of otolaryngology-head and neck surgery.

Why Increasing Hearing Issues?

Hearing issues become more common with age for both men and women. Millions suffer from allergies, ranging from pollen to dust, which can lead to long-term problems in the ear, nose, and throat, requiring treatment by an ENT allergist. Symptoms of allergy-related ENT problems often mimic headaches, coughing, runny noses, and sneezing. The prevalence, risk factors, and treatment options for ENT conditions differ between developed and developing countries. In developing nations, limited healthcare resources, especially for surgery, and unstable healthcare systems increase the demand for ENT devices, fueling the growth of the ENT devices market.

High Cost Challenges of ENT Devices

Hearing aids are highly tailored to each customer's needs. Returned units are not resold, and sellers typically absorb the cost of these products. To prevent losses, the expense of returned devices is incorporated into the final price, making the devices more expensive overall. This practice restricts the growth of the ENT devices market.

What are the Recent Advances in Cochlear Implants?

Advances in cochlear implants, bone-conduction devices, auditory brainstem implants, and regenerative medicine provide new options for restoring hearing in patients with sensorineural and conductive hearing loss, as well as inner ear disorders. These innovations seek to improve auditory function and elevate the quality of life. Recent ENT imaging systems enable 3D visualization, allowing practitioners to observe even subtle anatomical features. This progress enhances diagnosis accuracy and supports the development of more precise treatment strategies, fostering growth in the ENT devices market.

By product type, the diagnostic ENT devices segment led the ENT devices market, due ENT diagnostics comprise endoscopy, audiometry, tympanometry, and the application of imaging technology. These devices are intended to provide high precision and enable medical care professionals to identify a broad range of conditions more effectively. Early and precise diagnosis in ENT is significant as it directly influences the effectiveness of treatment. Timely identification of conditions such as hearing loss, sinus problems, or throat abnormalities prevents more complications, lowers discomfort, and enhances overall patient health. Modern ENT diagnostic devices offer a non-invasive and highly effective process for identifying these conditions at an early stage, confirming that patients receive the care they necessity promptly.

On the other hand, the hearing aids & implants segment is projected to experience the fastest CAGR from 2025 to 2034, as it provides major advantages that contribute to better communication, improved quality of life, and customization for patients' requirements. Attain improved results in a youngster with hearing loss in cases where the severity of disability renders hearing aids incapable of offering satisfactory sound information, as they need sufficient cochlear reserve so that acoustic detention occurs.

By applications, the hearing loss segment dominated the ENT devices market in 2024, as modern devices are used to enhance listening in the condition by those with normal hearing, as well as those with severe hearing loss. It progresses hearing and speech comprehension, so they participate more fully in daily life activities.

The skull base & cochlear disorders segment is projected to grow at the highest CAGR from 2025 to 2034, as electronic devices are used in this disease to improve hearing. Based on the choice of patients who have serious hearing loss from inner-ear damage and can't hear well with hearing aids, these devices are used. A cochlear implant does not restore normal hearing, but it helps people to understand speech with less reliance on lip reading and to notice sounds.

By end user, the hospitals segment led the market in 2024, due to in-hospital ENT providers helping to regulate the ideal treatment option to support easing symptoms, with medications, antibiotics, or surgery. The ENT section in a hospital specializes in treating and diagnosing conditions related to the ear, nose, and throat. It handles challenges like hearing loss, throat disorders, sinus infections, and balance problems, ensuring comprehensive care for these vital organs.

The ENT clinics & ambulatory surgical centers segment is projected to experience the fastest CAGR from 2025 to 2034, as they are additional coordinated and organized than the hospital surgical settings, where doctors have less personal control. ENT specialists manage hearing, swallowing, and speech, breathing and sleep problems, head and neck, allergies and sinuses, skin disorders, and other disorders related to ENT.

By technology, the endoscopy & visualization systems segment dominated in the ENT devices market in 2024, as it is usually a safe procedure with minimal challenges. Millions of ENT endoscopy techniques have been successfully performed globally with very low risk rates. Presently, endoscopy is a routine procedure performed daily in ENT polyclinics as an ordinary examination process. It uses sterile instruments and strict actions to avoid infection. Surgical visualization systems not only offer advanced visualization but are also designed to overcome the challenges related to data management, shortening the process of data capture, connectivity, and processing.

On the other hand, the robotic-assisted ENT surgery segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2034, as it provides many advantages, including rapid recovery, reduced rate of postoperative infection, reduced pain, better postoperative immune function, and cosmetic results. Robotic-assisted surgery (RAS) gained popularity in numerous surgical specialties, and major institutions are recently investing in healthcare robotic technology for applications in general, neurological, cardiac, gynecological, and urological surgery. This advanced and stimulating technology is safe, has well-established or comparable approaches, and is effective as compared with traditional surgical approaches.

North America dominated the ENT devices market share by 40% in 2024, increasing support of governments and regulators for the production of medical devices in this region. Increasing healthcare spending on medical care services drives the growth of the market. Clinicians adopting advanced ENT technology that meets the needs of patients, strengthening human connection and enhancing healthcare results, patient experience, quality of care, and medical value, which contributes to the growth of the market.

For Instance,

In the United States, increasing cases of hearing loss for instance, around 2 to 3 out of every 1,000 children in the United States are born with a noticeable level of hearing loss in one or both ears. More than 90% of deaf children are born to hearing parents. Roughly 15% of American adults ages 18 and almost 40 million people in the U.S. have permanent hearing loss from exposure to loud noise; these factors all increase the need for advanced ENT devices to manage such conditions.

In Canada, one in eight patients presented with an ENT-related challenge. As of July 2025, 110 companies have received funding for ENT disorders. Strong presence of major ENT devices manufacturing companies such as Olympus Canada, Southmedic, and Innovia Medical, which are increasing advanced technology to drive the growth of the market.

Asia Pacific is estimated to be the fastest-growing ENT devices market during the forecast period, as it has a significantly large aging population, from 630 million in 2020 to about 1.3 billion by 2050. They are more prone to ENT conditions, driving the higher demand for ENT devices. Demand for hearing devices is increasing as technological advances and the increasing incidence of hearing loss in the Asia Pacific contribute to the growth of the market.

In China, psychological distress, predominantly anxiety and depression, is extensive in patients with otolaryngological diseases, and increasing air pollution levels have increased respiratory and ENT conditions in the urban populations, an increasing demand for ENT devices in China. The Chinese government has built an efficient healthcare system, which has enhanced the convenience of medical resources and lowered the healthcare burden of people to some extent, which also contributes to the growth of the market.

India's healthcare devices sector, driven by revolution and government incentives, drives the growth of the market. India has become the most populous country globally, which is associated with being the hub to one of the biggest demand areas for advanced healthcare devices and equipment, including ENT devices, which drives the growth of the market.

Europe is notably growing in the ENT devices market as European healthcare systems' goal is to offer comprehensive coverage to all citizens, so it increases investment in healthcare devices accessibility, driving the market growth. Increasing hospital and ENT clinics is enhancing the diagnosis and treatment rate.

The medtech sector in Germany plays a significant role in the medical care industry and is a main driver of revolution and technological advancement. Increasing innovation and research institutes contribute to the growth of the market.

The increasing prevalence of hearing impairment in the UK is mainly due to age-related hearing loss and noise-induced hearing loss. Increasing cases of sudden hearing loss due to various factors, such as inflammation, infection, trauma, and exposure to loud noise, are driving demand for ENT devices.

In June 2025, Dr. James R. White, Jr., co-founder and physician at Camellia ENT, stated, “The strategic business management insight and robust operational support allow us to stay focused on what matters most—delivering exceptional care to our patients. By partnering with Elevate, we’re able to maintain our clinical independence while continuing to grow, innovate, and thrive as a practice.” (Source - Businesswire)

R&D focuses on developing advanced hearing aids and implants with improved features.

Key Players: Medtronic, Inc., Stryker Corporation, and Olympus Corporation.

Clinical trials are conducted to study the safety and effectiveness in humans, which are then subsequently approved by regulatory agencies.

Key Players: Ethicon Endo-Surgery, Lumenis Be Ltd., and Intersect ENT.

It refers to providing consultation, technical troubleshooting, education, and rehabilitation resources.

By Product Type

By Application

By End User

By Technology

By Region

January 2026

January 2026

January 2026

January 2026