December 2025

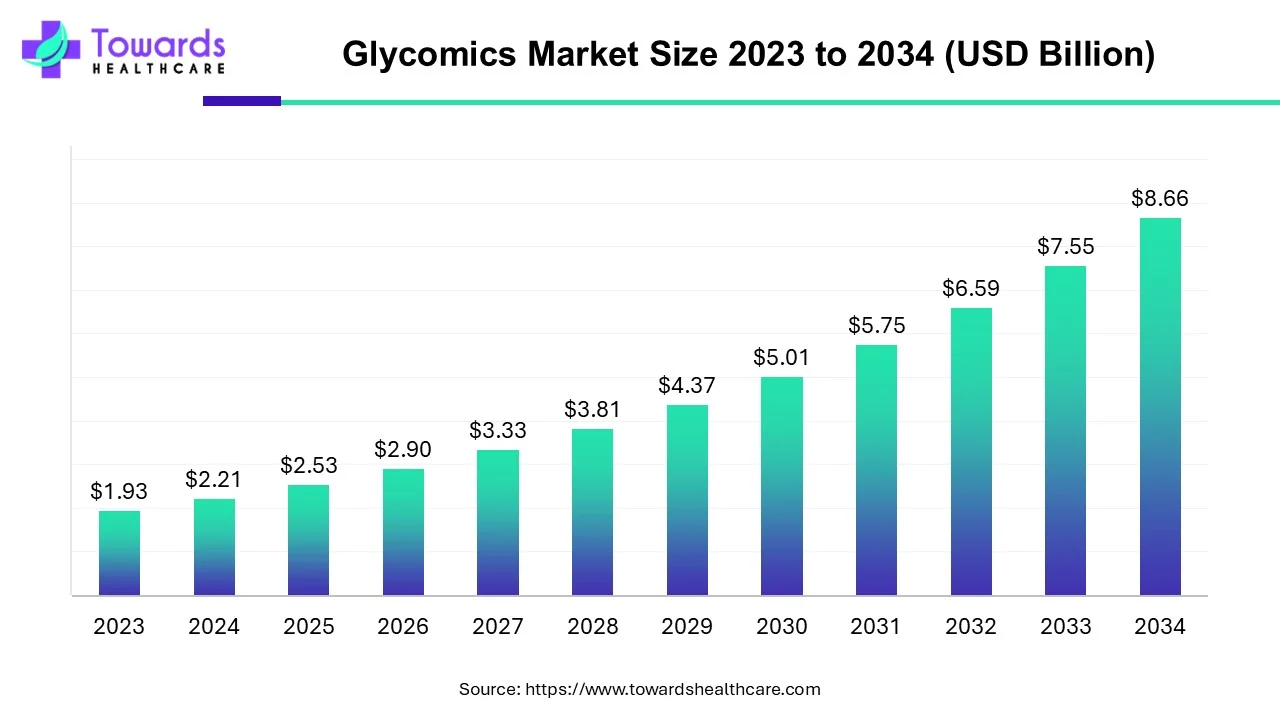

The global glycomics market size is calculated at US$ 2.21 in 2024, grew to US$ 2.53 billion in 2025, and is projected to reach around US$ 8.66 billion by 2034. The market is expanding at a CAGR of 14.64% between 2024 and 2034.

The thorough investigation of all glycans expressed in biological systems is known as glycomics. Because the glycosylation mechanism is extremely sensitive to the biochemical environment, glycan indicators present both significant potential and obstacles to the detection of illness. The advancement of knowledge regarding the function of the glycome in several biological domains has been greatly accelerated by the creation of novel analytical techniques. In the post-genome/proteome era, glycomics is a new science focused on identifying and clarifying the structural roles of glycans in certain biological processes.

Though there are several chances to help it reach its full potential in terms of offering insights into the mechanisms of glycan synthesis and analysis of glycomics data, the development of AI-based methodologies in glycomics is still in its infancy. Artificial intelligence (AI)--base glycosylation techniques do not rely on biological characteristics like enzyme kinetics since they provide precise predictions based on vast quantities of training data. Clinical uses, including cancer diagnosis, patient classification, and therapy, might greatly benefit from the combination of AI with glycosylation.

Glycomics in Precision Medicine

Glycans are significant modulators of many biological processes that influence how each individual responds to medication therapy and how susceptible they are to prevalent complicated disorders. Genetic, demographic heritage, age, illness stages, and exposure to certain foods and environments are some of the factors that contribute to the heterogeneity and variety of glycans. The need to incorporate glycomics into precision medicine has been emphasized by mounting evidence of the function glycomes play in human health.

Complex Analytical Methods

The intricacy of analytical techniques for distinct types of glycans is a glaring obstacle in glycomics. Distinct extraction or glycan release techniques are needed for each class; these techniques are frequently distinct analytical techniques or combinations of techniques, such as mass spectrometry, NMR, HPLC, etc.

Development of Recombinant Glycans

The synthesis of glycans is expected to become almost as simple and accessible in the future as that of proteins and nucleic acids. Biologists should be able to readily obtain glycoconjugates with uniformly homogenous glycans so they may investigate the glycans' structural and functional roles in greater detail. Almost all of the key glycosyltransferases and glycosidases are now available in recombinant form, which should significantly improve our capacity to alter glycoconjugates for studies of structure/function correlations.

By product, the enzymes segment held the largest share of the glycomics market in 2023 and is estimated to grow at the fastest rate during the forecast period. In glycobiology, enzymes are essential for a number of reasons. For example, complicated carbohydrate synthesis involves transferases. Furthermore, a range of enzymes, including sulfatases, modify carbohydrates, and glycosidases metabolize them. These enzymes might thus be employed as practical instruments to comprehend the structure and function of carbohydrates.

By application, the drug discovery & development segment held the major share of the glycomics market in 2023. Understanding the fate of medications in the body and assessing their possible toxicity is made possible by the strong tools that glycomics provides for the analysis and optimization of drug metabolism pathways. Researchers can determine possible indicators for predicting medication safety and efficacy as well as clarify the metabolic pathways involved in drug biotransformation by examining the glycosylation patterns of drug metabolites and conjugates. The logical design of therapeutic drugs is guided by glycomic data, which offers important insights into the molecular interactions between glycans and target receptors in drug design and optimization.

By application, the diagnostics segment is expected to grow at the fastest rate in the glycomics market in 2023. While glycomic techniques for finding new biomarkers are relatively new, many commonly used biomarkers are either glycans or glycoconjugates. Conventional immunological methods and monoclonal antibody technologies have been employed to produce commonly used glycan biomarkers. The advancement of analytical techniques and tactics has advanced recently, opening the door for new biomarker discovery initiatives.

By end-use, the academic & research institutes segment captured the dominant share of the glycomics market in 2023. Research by academics and students is actively supported, prioritized, and encouraged by leadership at research institutions. Many prestigious, well-known professors at research institutions are leaders in their fields. Academic institutions profit from centers and institutes in several ways. Centers can help attract and retain academics, acquire research resources, foster research cooperation, foster a feeling of community and ongoing learning, provide organizational flexibility, address social issues, and raise money.

By end-use, the biopharmaceutical companies segment is estimated to achieve the fastest growth rate in the glycomics market during 2024-2034. According to Professor Michael Butler, who leads the Cell Technology Group (CTG) at the National Institute for Bioprocessing Research and Training (NIBRT), the biopharma industry benefits from the characterization and analysis of glycans because it can aid in the creation of therapeutic agents like monoclonal antibodies and other recombinant proteins. These are used in treatments for a number of severe illnesses, such as cancer, inflammatory disorders, and heart disease. Their strong affinity for molecular targets linked to illness determines the mode of action.

North America dominated the glycomics market in 2023. Numerous esteemed educational institutions, research institutes, and biotechnology businesses based in North America have made substantial contributions to the study. These institutions support cutting-edge research and innovation with their strong research infrastructure, modern labs, and established partnerships. The need for research and applications is driven by the region's thriving biopharmaceutical and healthcare sectors. Large pharmaceutical and biotech corporations are concentrated in North America, which results in substantial investments in drug discovery research, customized treatment, and the creation of glycan-based medicines.

Strong intellectual property protections and a supportive regulatory framework in the area promote the development and marketing of glycomics-based products. The safety and effectiveness of glycan-based diagnostics and treatments are guaranteed by the region's clearly established regulatory frameworks, which also offer clarity and advice for research.

Using a $35.4 million partner contribution since 2015, GlycoNet has invested $78.4 million domestically in glycomics research. There were 138 projects financed as of 2023. These initiatives concentrate on issues like addressing federal action on antibiotic resistance, treating heart conditions, Alzheimer's disease, and inflammatory diseases of the gastrointestinal tract, and creating platform technologies that will boost Canada's biomanufacturing capabilities and hasten the clinical application of scientific discoveries.

GlycoNet-funded research has resulted in the development of five biotechnology start-up firms, the submission of 65 patent applications, ten out-licensing agreements, and the commercialization of goods and services, which has increased the Canadian bioeconomy and created jobs as of 2023.

Europe is estimated to host the fastest-growing glycomics market during the forecast period. The region's market is expected to be stimulated by the presence of prestigious colleges and research institutes, a high rate of sickness, and a helpful research infrastructure. Furthermore, because research grants and finance programs are now available, biopharmaceutical companies and academic institutions may now conduct more thorough glycomics investigations and look into potential applications in healthcare.

In order to highlight innovative work in glycoscience and to give people a place to network and exchange ideas, the European Glycoscience Community has started hosting webinars. The CarboMet team is happy to announce the release of the new glycoscience roadmap, which follows several workshops held around Europe and more than 350 stakeholder engagements with top European scientists over the past three years. Despite being primarily headed by scientists from Europe, CarboMet has collaborated with several international networks, bringing attention to global glycoscience potential and difficulties.

Asia-Pacific is considered to be a significantly growing area, due to the rising prevalence of chronic disorders, increasing geriatric population, and the growing demand for early disease diagnosis. The rapidly expanding biopharmaceutical sector and new drug discovery research boost the market. The presence of suitable manufacturing infrastructure encourages foreign investors to set up their manufacturing facilities in Asia-Pacific countries. The increasing investments, collaborations, and mergers & acquisitions also contribute to market growth. The growing need for personalized therapeutics due to diverse demographics fosters the market.

In September 2024, GlycoNet and CQDM are pleased to announce that they have signed a contract to work together to advance drug development and discovery in Canada. "Working with CQDM creates exciting opportunities to further glycomics research and provide cutting-edge technologies and treatments that improve Canadians' quality of life," stated Dr. Elizabeth Nanak, CEO of GlycoNet. Better healthcare solutions can result from us exploring new medication research and development frontiers by pooling our resources and skills.

By Product

By Application

By End-use

By Region

December 2025

November 2025

November 2025

February 2026