February 2026

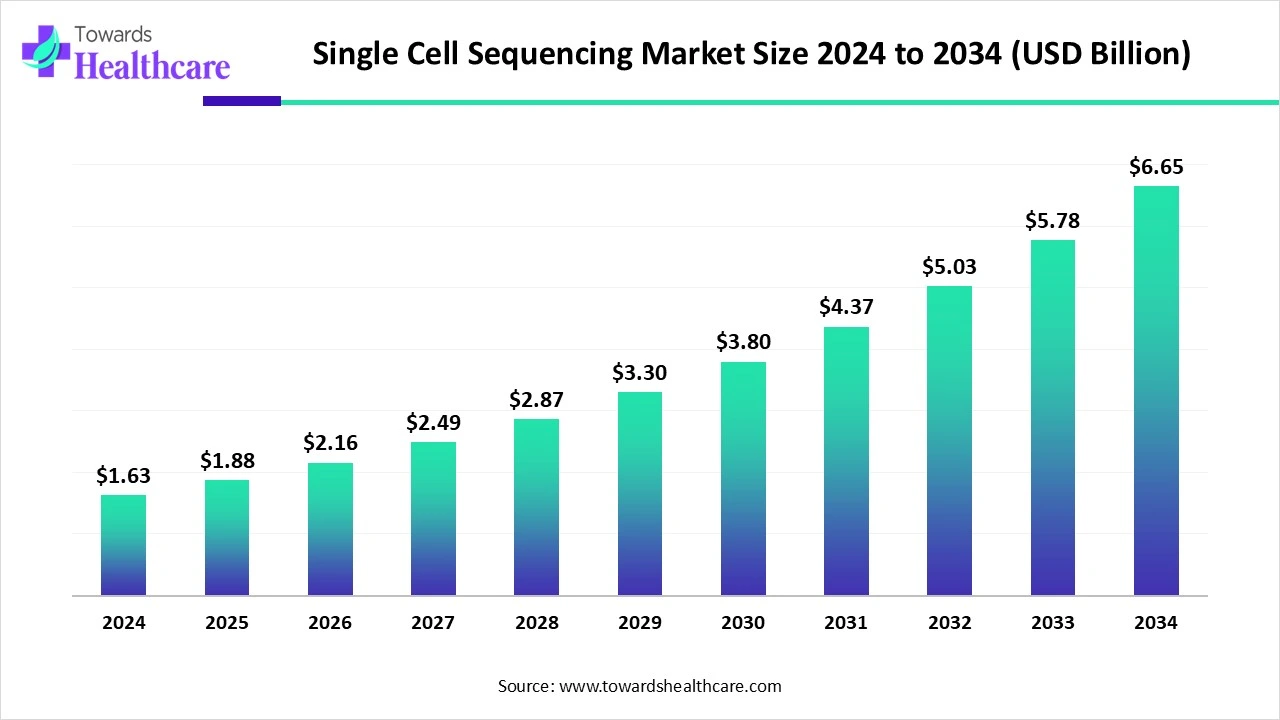

The global single cell sequencing market size began at US$ 1.63 billion in 2024 and is forecast to rise to US$ 1.88 billion by 2025. By the end of 2034, it is expected to surpass US$ 6.65 billion, growing steadily at a CAGR of 15.05%.

The single cell sequencing market is witnessing strong growth due to its ability to analyze individual cells with high precision, enabling breakthroughs in cancer research, immunology, and personalized medicine. Technological advancements, increasing research funding, and growing adoption in clinical and academic settings are driving market expansion. As demand for deeper biological insights rises, single-cell sequencing continues to gain traction across pharmaceutical, biotechnology, and healthcare research sectors globally.

| Metric | Details |

| Market Size in 2025 | USD 1.88 Billion |

| Projected Market Size in 2034 | USD 6.65 Billion |

| CAGR (2025 - 2034) | 15.05% |

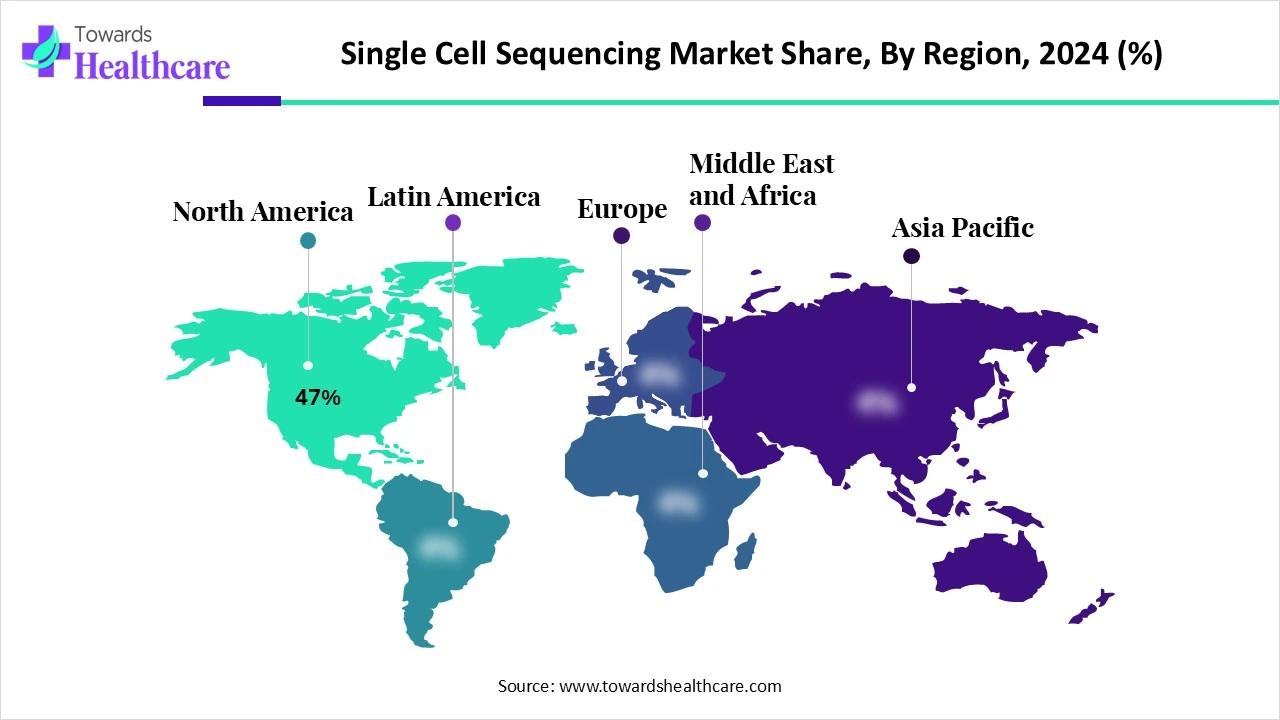

| Leading Region | North America Share 47% |

| Market Segmentation | By Technology, By Workflow Stage, By Application, By End User, By Region |

| Top Key Players | 10x Genomics, Inc., Illumina, Inc., BD Biosciences (Becton, Dickinson and Company, Fluidigm Corporation (Standard BioTools), Parse Biosciences, Mission Bio, Takara Bio Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, Dolomite Bio (Blacktrace Holdings), S2 Genomics, Inc., Singleron Biotechnologies, Q2 Solutions (IQVIA), Miltenyi Biotec, Bruker Corporation, Scipio Bioscience, BioSkryb Genomics, ReadCoor (acquired by 10x Genomics), Resolve Biosciences |

The Single Cell Sequencing Market focuses on technologies and solutions that enable the genomics, transcriptomic, epigenomic, and multi-omic profiling of individual cells. Unlike bulk sequencing, single cell sequencing (sc-seq) uncovers cellular heterogeneity, detects rare cell populations, and maps cell lineage, function, and disease mechanisms with high resolution. It is revolutionizing oncology, immunology, neurology, developmental biology, and precision medicine.

Growth is driven by innovations in droplet-based microfluidics, barcoding, and spatial sequencing, along with the expansion of multi-omics and AI-driven data analysis platforms. Innovation is significantly advancing the single cell sequencing market by enhancing the accuracy, speed, and scalability of cell analysis. New microfluidics, automation tools, and AI-powered data analysis are streamlining workflows and reducing costs. These developments are enabling broader applications in disease research, drug discovery, and precision medicine, driving increased interest across both clinical and academic settings.

Advancements in Sequencing Technologies: New platforms offer faster, more accurate, and high-throughput sequencing, making single-cell analysis more efficient and accessible.

Increasing Collaborations and Partnerships: Strategic alliances between biotech firms, academic institutions, and pharma companies are accelerating R&D and commercialization.

AI is positively impacting the market by streamlining data analysis, improving accuracy, and uncovering complex cellular patterns faster than traditional methods. With vast datasets generated in single-cell studies, AI algorithms help identify gene expression trends, cell types, and disease-related biomarkers more efficiently. This accelerates research, supports drug discovery, and enables personalized medicine. As AI tools become more advanced, their integration is expected to enhance scalability and broaden the applications of single-cell sequencing in both research and clinical settings.

Advancements in Single cell Technologies

Ongoing improvements in sequencing technologies are fueling growth in the single cell sequencing market by making the process more scalable, reliable, and affordable. Modern platforms offer better resolution and can analyze larger cell populations in less time, helping researchers uncover rare cell types and subtle gene expression changes. These technological leaps are expanding the practical us of single-cell analysis across various disciplines, encouraging more widespread adoption in both academic and clinical research settings.

For Instance,

High Cost of Instruments and Reagents

The high expenses of single cell sequencing tools and reagents limit broader adoption by making it difficult for smaller labs and academic institutions to invest in the technology. These systems often require not only a large upfront investment but also continuous spending on consumables and maintenance. As a result, many researchers and facilities are unable to implement single-cell methods, allowing market growth and restricting access to genomic research.

Integration of Multi-omics Approaches

Combining multi-omics techniques with single-cell sequencing offers a promising opportunity, as it helps decode intricate cellular processes by analyzing DNA, RNA, and proteins together. These layered insights improve disease characterization, therapeutic target identification, and personalized treatment strategies. As research moves towards deeper biological understanding, the demand for integrated analysis is rising, paving the way for advanced applications and accelerating adoption across healthcare and pharmaceutical research sectors.

For Instance,

The single-cell RNA sequencing (scRNA-seq) segment led the market in 2024 due to its ability to provide detailed insights into gene expression at the individual cell level, which is crucial for understanding cellular diversity, disease mechanisms, and developmental biology. Its widespread adoption in cancer research, immunology, and neuroscience, along with the availability of user-friendly platforms and robust analytical tools, significantly contributed to its dominance in revenue share.

The multi-omics segment is witnessing rapid growth in the single cell sequencing market as it enables researchers to analyze multiple biological layers from a single layers from a single cell simultaneously. By combining gene expression, protein levels, and epigenetic changes, this approach offers deeper biological insights compared to single-omics methods. The increasing use of multi-omics in precision medicine and complex disease studies is propelling its adoption, contributing to its high growth rate during the forecast period.

The dominance of the library preparation & sample handling segment in the 2-24 single cell sequencing market is driven by the growing need for precise contamination-free workflows. This stage is essential for maintaining the integrity of individual cell states, especially in studies requiring high sensitivity. Additionally, the rise in automated platforms and kits designed for single-cell applications has made this segment more accessible has made this segment more accessible and efficient, leading to higher adoption and revenue contribution.

The data analysis & visualization segment is projected to grow at the fastest CAGR in the single cell sequencing market due to the increasing complexity and volume of data generated from advanced sequencing technologies. Research requires robust analytical tools to interpret diverse cellular behaviors and gene expression patterns. The rise of AI-driven analytics, machine learning models, and user-friendly visualization platforms is accelerating adoption, enabling deeper biological insights and driving for more efficient and scalable data processing solutions.

In 2024, the oncology segment dominated the market due to the growing need for detailed insights into tumor heterogeneity, cancer progression, and treatment resistance. Single-cell technologies enable the precise identification of rare cancer cell populations, aiding in early diagnosis and personalized therapies. With rising cancer cases globally and increasing adoption of precision medicine, researchers and clinicians are increasingly turning to single-cell sequencing to develop targeted treatment strategies and improve patient outcomes, driving significant market demand in oncology.

The immunology & infectious disease research segment is witnessing rapid growth due to the need for precise mapping of immune cell diversity and pathogen-host interactions. Single-cell sequencing helps uncover rare immune cell populations and track how infectious diseases progress at the cellular level. With growing outbreaks and the demand for effective immune-targeted therapies, researchers are increasingly relying on the technology to accelerate discoveries and improve patient outcomes, driving strong market expansion during the forecast period.

In 2024, the academic & research institutions segment dominated the single cell sequencing market due to increased government and private funding for life science research. These institutions are at the forefront of expanding cell heterogeneity, disease mechanisms, and developmental biology using advanced genomic tools. Their demand for high-throughput and precise sequencing technologies to support large-scale studies has significantly contributed to market revenue, making them a key driver of innovation and adoption in the single-cell sequencing space.

The pharmaceutical & biotechnology companies segment is anticipated to witness the fastest CAGR in the single cell sequencing market during the forecast period due to growing investments in precision medicine and targeted drug development. These companies are increasingly adopting single-cell technologies to understand disease progression, identify novel biomarkers, and optimize therapeutic strategies. The rising number of clinical trials and collaborations with research institutions further accelerates the use of single-cell sequencing tools in drug discovery and development workflows.

North America dominated the market share by 47% in 2024, with the highest revenue share due to its advanced healthcare infrastructure, strong presence of key market players, and significant investments in genomics research. The region benefits from high adoption rates of cutting-edge technologies, robust funding from the government and private sectors, and a large number of ongoing clinical and academic studies. Additionally, supportive regulatory policies and the availability of skilled professionals further drive market growth in North America.

The U.S. market is expanding due to increased investment in precision medicine, rising prevalence of chronic and genetic diseases, and growing demand for advanced diagnostics. The country’s strong research infrastructure, presence of major biotechnology firms, and consistent funding from institutions like the NIH foster innovation. Additionally, rapid adoption of single-cell technologies in cancer, immunology, and neurology research is accelerating market growth, making the U.S. a leading contributor to global advancements in this field.

The Canadian market is expanding due to rising government and academic investments in genomics and personalized medicine. The presence of collaborative research institutions and biotech startups is fostering innovation in single-cell technologies. Additionally, increasing demand for precision diagnostics in oncology and immunology, along with improved access to high-throughput sequencing platforms, is driving adoption. Canada's supportive regulatory environment and growing focus on life sciences are further contributing to the market’s steady growth trajectory.

Asia-Pacific is expected to grow at the fastest CAGR in the market due to increasing investments in life sciences research, expanding healthcare infrastructure, and rising awareness of precision medicine. Countries like China, India, and Japan are rapidly adopting advanced genomic technologies. Government support for biotech innovation, growing collaborations between academia and industry, and the rising prevalence of chronic and infectious diseases are also accelerating the adoption of single-cell sequencing across the region.

The China market is increasing due to significant government funding in genomics research, expansion of biotechnology companies, and strong academic collaborations. China's focus on precision medicine and large population base generates high demand for personalized healthcare solutions. Additionally, domestic companies are increasingly developing cost-effective sequencing platforms, while international partnerships are enhancing technology access. These factors, along with rising investments in cancer and rare disease research, are driving the market’s rapid growth in the country.

The India market is growing due to rising investments in genomics research, increasing government initiatives in biotechnology, and expanding collaborations between research institutions and global biotech firms. The growing burden of cancer and rare genetic diseases is also fueling demand for advanced diagnostic tools. Additionally, the presence of cost-effective research talent and infrastructure is attracting international partnerships, accelerating market expansion

Europe is advancing the market through significant public and private research funding, collaborative initiatives, and a strong focus on precision medicine. Countries like Germany, the UK, and the Netherlands are investing in genomic infrastructure and academic partnerships. The region's emphasis on cancer, immunology, and neuroscience research further supports adoption. Additionally, strict regulatory frameworks and ethical research practices enhance data reliability, making Europe a key contributor to global single-cell sequencing advancements.

The UK market is growing due to strong government funding for genomics research, increasing demand for precision medicine, and a robust academic and biotech ecosystem. Initiatives like Genomics England and partnerships with the NHS are driving innovation and clinical adoption. Additionally, the country’s focus on cancer, neurology, and rare disease research further supports the expansion of single-cell sequencing technologies.

The German market is expanding due to increasing investments in biomedical research, a strong presence of leading academic institutions, and support from government initiatives like the German Human Genome-Phenome Archive. The country's focus on cancer genomics, immunology, and neurodegenerative disease research, along with collaborations between biotech firms and research institutes, is driving the adoption of advanced single-cell technologies across clinical and research applications.

In October 2024, Parse Biosciences launched the Parse GigaLab™, designed to revolutionize single-cell sequencing by scaling up to billions of cells annually. Using its advanced Evercode™ technology, the GigaLab supports projects involving 10 million or more cells and currently handles up to 2.5 billion cells per year. Early studies already surpass existing public datasets. Dr. Theis noted that such large-scale datasets are essential for training predictive health models and commended Parse's speed and scale in accelerating scientific breakthroughs.

By Technology

By Workflow Stage

By Application

By End User

By Region

February 2026

February 2026

January 2026

January 2026