February 2026

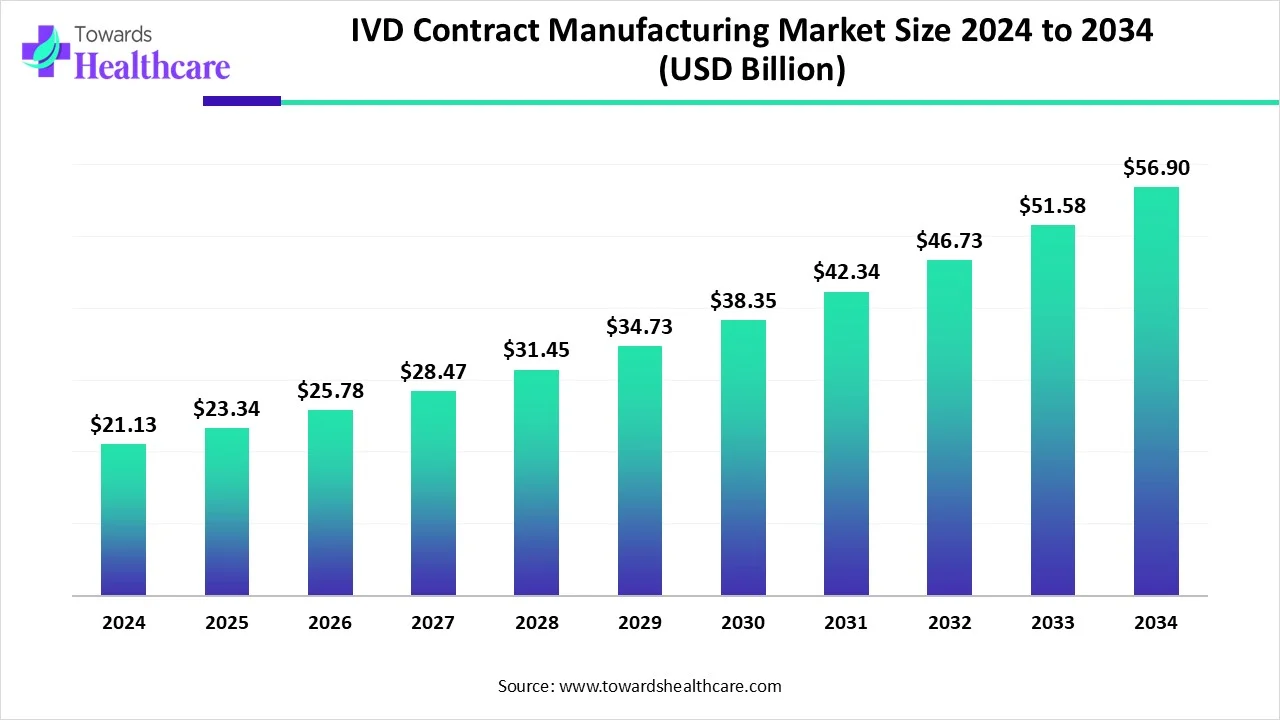

The global IVD contract manufacturing market size is calculated at US$ 23.34 billion in 2025, grew to US$ 25.77 billion in 2026, and is projected to reach around US$ 62.99 billion by 2035. The market is expanding at a CAGR of 10.44% between 2026 and 2035.

IVD contract manufacturing is rising rapidly as a result of the increasing demand from diagnostic laboratories and healthcare organizations for one-stop-shop solutions. The motivation for this development is the aim for faster reaction times, more productivity, and lower costs in the diagnostic process. Additionally, leasing IVD equipment has emerged as a popular business model that enables smaller laboratories and research facilities to obtain state-of-the-art diagnostic technology without having to make the first financial commitment.

The assurance of dependable, high-quality components, cost savings through economies of scale, and effective production processes are just a few advantages of collaborating with an experienced IVD contract manufacturer. The production of medical device components depends heavily on IVD contract manufacturing, especially in the domains of diagnostics and therapeutic devices. For the IVD test component, selecting the right partner is crucial to ensuring the quality, accuracy, and efficiency required for these crucial components.

Artificial intelligence (AI) has advanced significantly in clinical care over the past few years. More products have been approved for clinical use, while more innovative applications for research use only have been released onto the market, and several others are still in the development stage. In recent years, diagnostic companies have been collaborating with AI companies to utilize more sophisticated machine learning techniques, thereby enhancing the efficacy of data analysis for patient care. The goal is to utilize developed algorithms to standardize and simplify test findings, making them accessible to any medical professional, regardless of their skill level. In this approach, AI technology may assist doctors, lab workers, and pathologists in making complex choices.

1. Demand for Accurate Diagnostics

The growing chronic diseases and shift towards preventive care are increasing the demand for accurate diagnostic tools, which are increasing the use of IVD kits and driving their contract manufacturing.

2. Expanding Outsourcing Trends

The growing development of new IVD solutions is increasing their manufacturing complexities, production cost, and regulatory hurdles, which are increasing the outsourcing trends, leading to a rise in IVD contract manufacturing.

3. Flourishing Innovations

The growing technological advancements are increasing the collaboration with IVD contract manufacturers to develop new point-of-care testing, personalized assays, and molecular diagnostics.

Cost reduction & managing regulatory requirements

Since outsourcing manufacturing requires a significant capital investment, businesses are opting to do so in order to free up funds for operational expansion and the development of new products. These risks, which include supply chain disruptions and delays, product or manufacturing changes, a lack of manufacturing and packaging experience, supplier incapacity to meet present or future demand, IVD assay variability, incomplete documentation, specification changes, and regulatory non-compliance, raise the overall cost for IVD manufacturers. Reliability in clinical tests, regulatory compliance, lot-to-lot continuity, and production continuity all depend on risk reduction for the essential raw materials. Since IVD service providers' regulatory knowledge and quality standards lower these risks, IVD makers are increasingly using IVD outsourcing.

IP protection challenges

Intellectual property (IP) protection is a significant challenge for companies in the IVD contract manufacturing sector. As technology advances and outsourcing to less expensive nations increases, the likelihood of intellectual property theft or infringement also rises. Protecting their innovations, processes, and proprietary technologies from competitors is a challenge for manufacturers.

Point-of-care demand

The IVD contract manufacturing market is driven by the growing need for point-of-care testing (POCT), which has increased dramatically as a result of the requirement for quick diagnostic fixes. Adoption of point-of-care testing has increased, according to the Centers for Disease Control and Prevention (CDC). The research and production of sophisticated point-of-care diagnostics are major priorities for well-known businesses like Abbott Laboratories and Roche Diagnostics.

| Key Elements | Scope |

| Market Size in 2026 | USD 25.77 Billion |

| Projected Market Size in 2035 | USD 62.99 Billion |

| CAGR (2026 - 2035) | 10.44% |

| Leading Region | North America |

| Market Segmentation | By Product, By Service, By Technology, By End-use, By Region |

| Top Key Players | Jabil Inc., Sanmina Corporation, TE Connectivity, Celestica Inc., Savyon Diagnostics, West Pharmaceutical Services, Inc., Thermo Fisher Scientific, KMC Systems, Cenogenics Corporation, Novo Biomedical, Cone Bioproducts, Invetech, AVIOQ Inc., Meridian Bioscience Inc., Nemera |

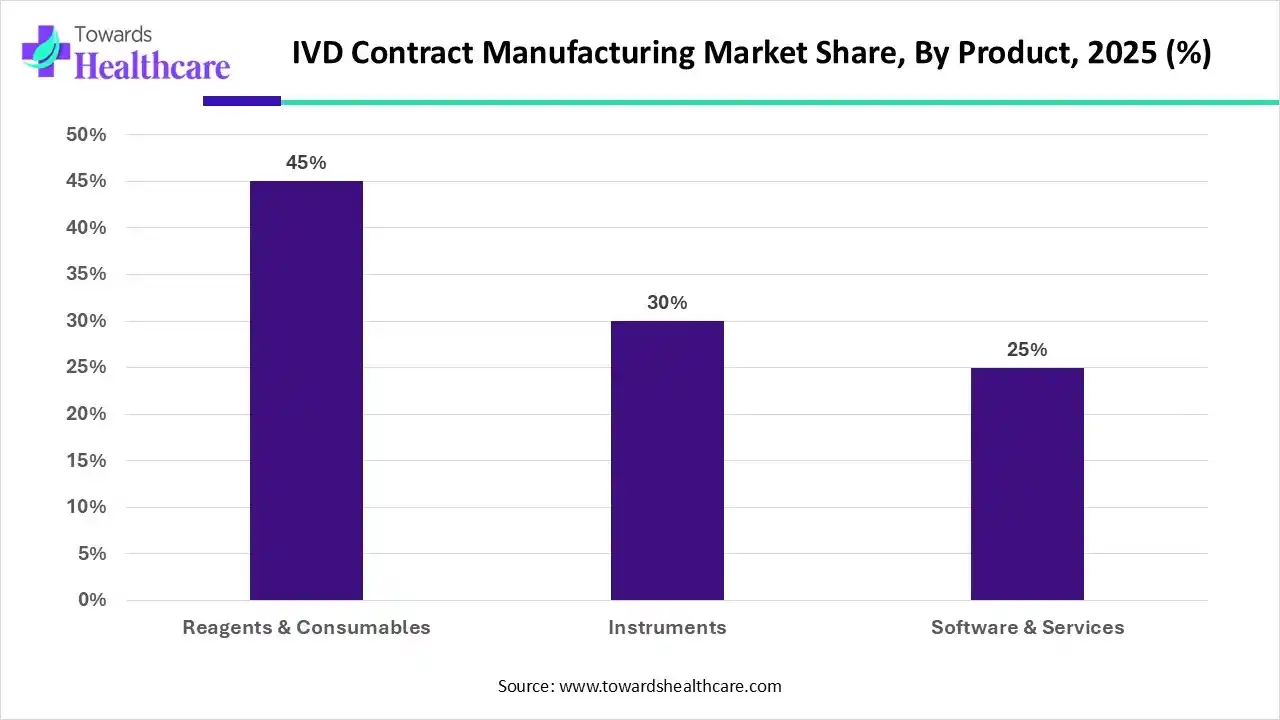

Which Product Type Dominated the Market in 2025?

By product, the reagents & consumables segment dominated the IVD contract manufacturing market by 45% in 2025. The practice of hiring a certified third-party manufacturer to produce equipment, components, or completed items is known as contract manufacturing. It increases the flexibility of the production process and allows companies to focus their time and resources on other critical business needs. The U.S. Food and Drug Administration (FDA) regulates IVD reagents according to their intended application and associated risk.

By product, the instruments segment is expected to grow significantly in the IVD contract manufacturing market during the forecast period. IVD devices are intended for use in clinical laboratory settings. Results from screening and diagnostic tests are accurate and dependable because of IVD equipment' integrated software and simple processes. Clinical laboratories can conduct established gene panels, create and execute their own next-generation sequencing (NGS) assays, or explore a range of clinical research applications.

| Segment | Share 2025 (%) |

| Manufacturing Services | 50% |

| Assay Development Services | 30% |

| Other Services | 20% |

What Made the Manufacturing Services Segment Dominant in the Market in 2025?

By service, the manufacturing services segment was dominant in the IVD contract manufacturing market by 50% in 2025. The availability of ISO-certified manufacturing facilities, the administration of whole projects and production, support for quality and regulations, and flexibility in terms of process and scale all contribute to an increase in the demand for manufacturing services.

By service, the assay development segment is expected to grow at a lucrative rate in the IVD contract manufacturing market during the forecast period. The process of creating and promoting diagnostic tests is never straightforward. Contract manufacturers thus provide assay design and optimization services in addition to contract manufacturing components and whole commercial kits. Contract manufacturers are also responsible for managing all suppliers and assay providers along the whole supply chain.

Why the Immunoassays Segment Dominated in 2025?

By technology, the immunoassays segment dominated the IVD contract manufacturing market in 2025. The rising prevalence of cancer, heart disease, and autoimmune disorders has raised demand for tailored medications. Immunoassay can help determine the optimal treatment plan for patients. Outsourcing may be a more cost-effective option, especially for smaller companies that are unable to produce immunoassays in-house. Contract immunoassay manufacturing's adaptability allows for rapid scale production that meets project requirements.

By technology, the clinical chemistry segment is expected to grow at a significant rate in the IVD contract manufacturing market during 2025-2034. Clinical chemistry is essential in modern medicine. Among its most important applications are disease diagnosis and monitoring. Clinical chemistry is used to monitor the effectiveness of a treatment as well as to aid in diagnosis. One of the main advantages of clinical chemistry is its ability to generate accurate and trustworthy measurements of the biochemical components in body fluids. This facilitates the early detection of sickness, which is essential for effective treatment and management.

Which End-Use Type Dominated the Market in 2025?

By end-use, the medical device companies segment held the largest share of the IVD contract manufacturing market in 2025. Medical devices are one of the most widely used products in in vitro diagnostics. From taking samples to analysing samples to finally predicting the data, everything requires medical devices. Due to this, medical device companies heavily rely on contract manufacturing for supply chain management. It ensures that the growing demand for medical devices is fulfilled on time.

By end-use, the academic & research institutions segment is expected to grow significantly in the IVD contract manufacturing market during the predicted timeframe.

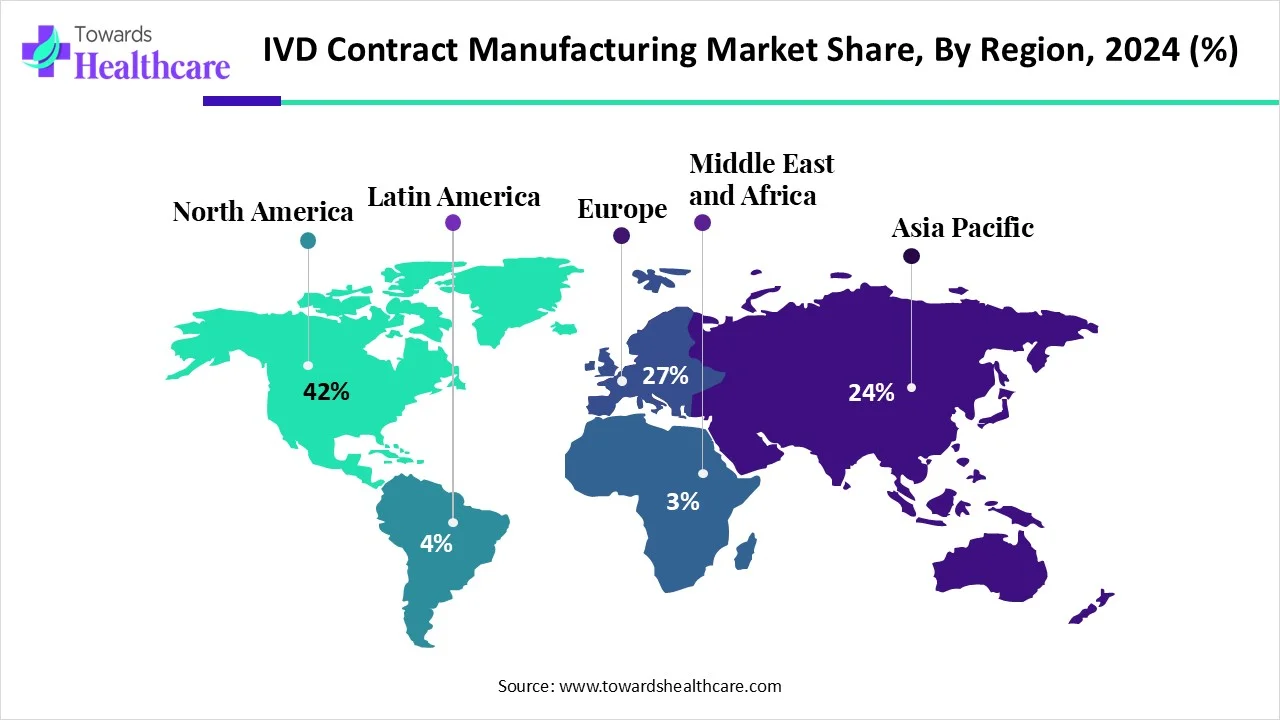

North America dominated the IVD contract manufacturing market share by 42% in 2025. Due to its substantial investments in R&D, high prevalence of chronic disorders, and robust healthcare system. The region's leadership position is also a result of its advantageous regulatory environment, the presence of significant industrial players, and its emphasis on technical breakthroughs. The need for customized medicine and cutting-edge diagnostics is rising, and North America is a major contributor to the expansion and development of IVD contract manufacturing.

The U.S. IVD Contract Manufacturing Market Trends

The Centers for Disease Control and Prevention (CDC) estimates that laboratory test results influence around 70% of healthcare decisions, which means that physicians heavily depend on them when making critical decisions about the care of their patients. Although laboratory-generated tests, also known as LDTs, are often used without this kind of monitoring, the U.S. Food and Drug Administration (FDA) regularly oversees tests developed by test producers outside of laboratories.

The Canada IVD Contract Manufacturing Market Trends

Health Canada had a total of 9,848 full-time equivalent employees (including internal services) and $6,842,293,219 in actual spending in 2023–2024. Additionally, Health Canada will collaborate with P/Ts to promote adherence to the Diagnostic Services Policy of the Department.

Asia Pacific is estimated to host the fastest-growing IVD contract manufacturing market during the forecast period. The market is growing as a result of the growing need for diagnostic tests, the rising incidence of diseases, and the growing number of mergers and acquisitions in the IVD industry. The constantly increasing number of older people in these countries is driving the demand for diagnostic testing. Additionally, as more private sector businesses enter this market, the IVD contract manufacturing market is growing.

The China IVD Contract Manufacturing Market Trends

Primary-level medical institutions, such as community health centers and township and village clinics, presently handle 52% of all medical visits in China. For basic medical treatment, China will also encourage individuals to visit primary-level medical institutions. The detection and treatment of more common and frequently occurring ailments at county-level or lower medical institutions is expected to result from these activities.

The India IVD Contract Manufacturing Market Trends

Since infectious diseases and non-communicable diseases (NCDs) are persistent issues in India, the diagnostics sector is the foundation of the patient care continuum. A few professionals in the diagnostics industry share their expectations for the Union Budget 2024 in an interview with ETHealthworld.

Europe is expected to grow significantly in the IVD contract manufacturing market during the forecast period. Driven by established healthcare infrastructure and cutting-edge technology, new R&D initiatives and the need for outsourced services are also improving patient care and healthcare facilities, which is propelling market expansion. Furthermore, there are several CDMOs and CDMOs that concentrate on IVD innovation spread throughout several European nations, including the UK, Germany, and France, which should support market expansion in this area.

The Germany IVD Contract Manufacturing Market Trends

There is a great deal of interaction between the different sectors in Germany, as laboratory services are rendered by inpatient institutions, practicing laboratory physicians, and directly in the offices and medical care centers of other specialist groups. About 840 microbiological specialists and 1,200 laboratory medicine specialists currently make up around 0.7% of Germany's total number of specialized physicians. Approximately 108,000 people work in medical laboratories, making up 1.8% of the total healthcare workforce. Laboratory diagnostics cost around 12.9 billion euros annually, or 150 euros per individual.

The UK IVD Contract Manufacturing Market Trends

The UK government will establish 160 community diagnostic centers (CDCs) a year earlier than planned, according to Health and Social Care Secretary Steve Barclay. By March 2024, all CDCs will be open to provide faster access to potentially life-saving tests and diagnoses. CDCs aim to provide patients more alternatives for where and how they are treated, as well as a greater variety of diagnostic testing closer to their homes, to help reduce hospital trips and help patients receive care much sooner. The government tried to maximise the independent sector with the help of £2.3 billion in capital investment.

South America is expected to grow significantly in the IVD contract manufacturing market during the forecast period, due to growing healthcare investments, which are driving the adoption of IVD products. Growing infectious diseases are also increasing their demand, where the growing outsourcing trends are leading to new collaborations with contract manufacturers, enhancing the market growth.

Brazil IVD Contract Manufacturing Market Trends

The growing patient population in Brazil is increasing the use of IVDs, promoting their contract manufacturing. Growing healthcare innovations and health awareness are also increasing their development and innovations, where the emerging startups are also driving the outsourcing trend for the IVD manufacturing.

MEA is expected to show lucrative growth in the IVD contract manufacturing market during the forecast period, due to the growing disease burden, which is increasing the demand for IVD solutions. The growing focus on preventive care and outsourcing trends is also increasing their demand, raising the dependence on contract manufacturers and promoting market growth.

Saudi Arabia IVD Contract Manufacturing Market Trends

Growing government initiatives and investments in Saudi Arabia are increasing the adoption of IVD solutions to control the growing chronic disease burden and increasing their contract manufacturing. Expanding diagnostic centres are also increasing their use, where outsourcing trends are accelerating their contract manufacturing.

1. R&D

The R&D of the IVD contract manufacturing focuses on the development of miniaturized point-of-care devices and the integration of high-precision assembly.

Key players: Jabil, Gerresheimer, TE Connectivity.

2. Clinical Trials and Regulatory Approvals

The adherence to the ISO 13485 and Quality system regulation (QSR), process validation, and design controls are evaluated in the clinical trials, and regulatory approvals for the IVD contract manufacturing.

Key players: Jabil Healthcare, Tecomet, KMC Systems.

3. Patient Support and Services

The patient-centric services focused on optimizing device usability and digital connectivity are provided in the patient support and services of the IVD contract manufacturing.

Key players: West Pharmaceutical Services, Sanmina, Jabil Healthcare.

In April 2025, according to Mukta Acharya, head of Tecan's Life Sciences Business, we are aggressively growing our product line to guarantee that labs have access to dependable, legal solutions that satisfy their demands both now and in the future as regulatory standards continue to change. Cisbio and Tecan have a long history of working together in the IVD industry. The move of these crucial ELISA kits is a calculated move to broaden the IVDR line of IBL specialist diagnostics.

By Product

By Service

By Technology

By End-use

By Region

February 2026

February 2026

January 2026

February 2026