January 2026

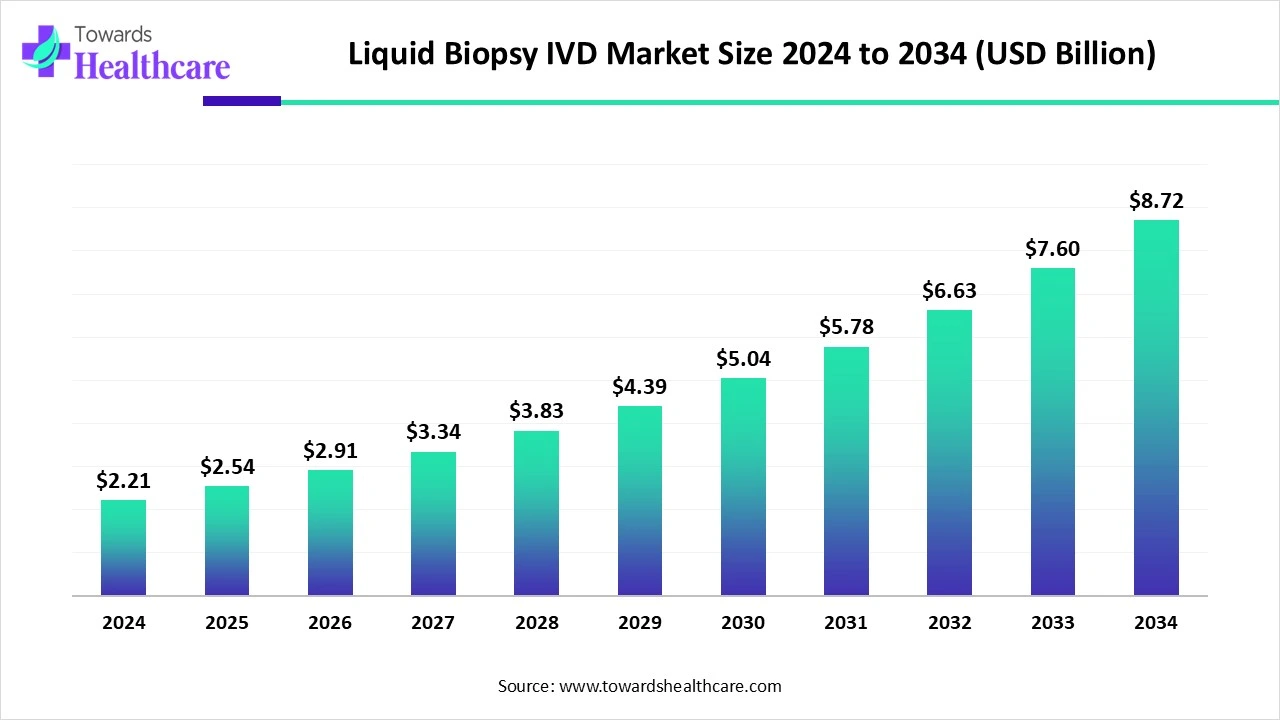

The global liquid biopsy IVD market size was valued at US$ 2.21 billion in 2024 and is projected to grow to US$ 2.54 billion in 2025. Forecasts suggest it will reach approximately US$ 8.72 billion by 2034, registering a CAGR of 14.79% during the period.

The growing desire for non-invasive methods of diagnosing illnesses is expected to have a favourable effect on the uptake of liquid biopsy IVD. There will be a huge demand for precise diagnosis techniques as the number of patients with different types of cancer increases significantly. Additionally, the market expansion will be accelerated by the increasing number of active clinical trials for the development of novel remedies. Furthermore, a number of benefits linked to liquid biopsy, including its less invasive nature, enhanced accuracy, and post-treatment monitoring, will boost industry demand.

| Metric | Details |

| Market Size in 2025 | USD 2.54 Billion |

| Projected Market Size in 2034 | USD 8.72 Billion |

| CAGR (2025 - 2034) | 14.79% |

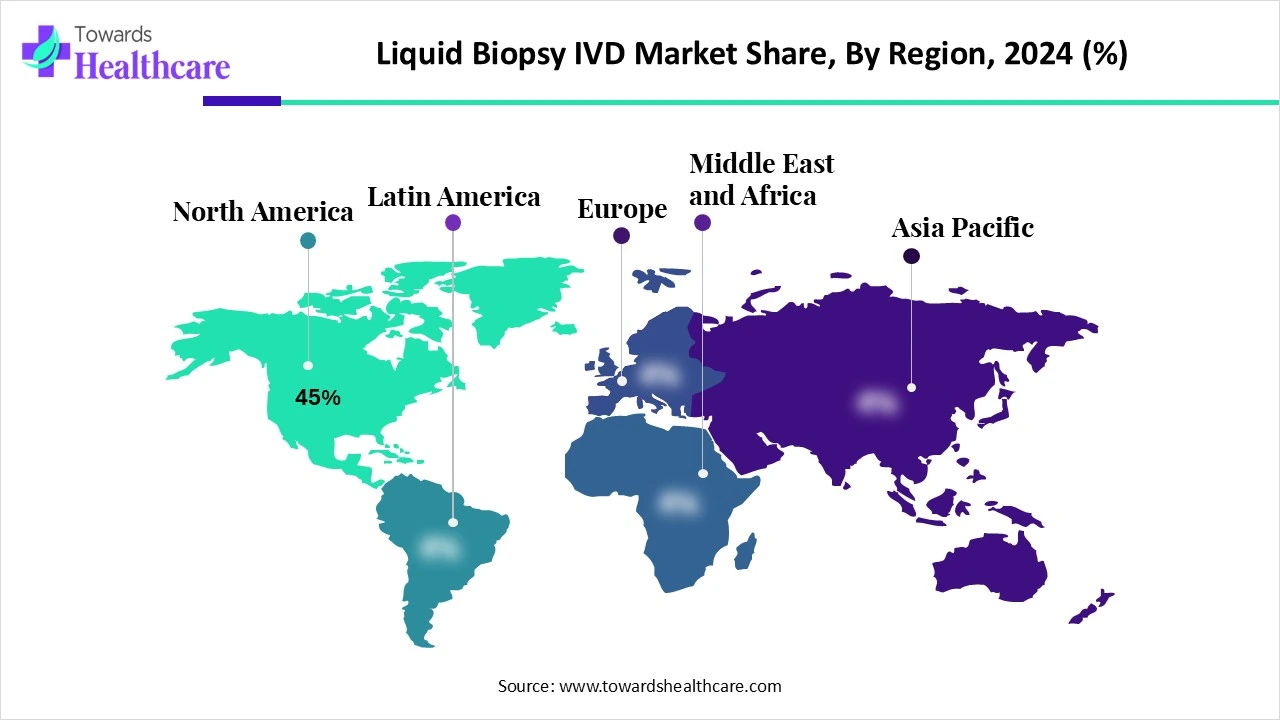

| Leading Region | North America Share 45% |

| Market Segmentation | By Biomarker Type, By Technology, By Application, By Sample Type, By End User, By Region |

| Top Key Players | Guardant Health, Inc., Roche Diagnostics, Illumina, Inc., Exact Sciences Corporation, Qiagen N.V., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Freenome, Inc., Natera, Inc., Lucence Diagnostics, Caris Life Sciences, Invitae Corporation, GRAIL, Inc., Biocept, Inc., Agilent Technologies, Inc., Inivata (NeoGenomics), STRATA Oncology, Mission Bio, Predicine, Inc., Myriad Genetics, Inc. |

The liquid biopsy IVD (in vitro diagnostics) market refers to the industry segment that provides non-invasive blood-based or fluid-based diagnostic solutions to detect and monitor cancer and other diseases using circulating tumor DNA (ctDNA), RNA, exosomes, circulating tumor cells (CTCs), and other biomarkers. Unlike traditional tissue biopsies, liquid biopsies are minimally invasive, enable real-time monitoring, and are especially useful for early detection, treatment selection, and recurrence monitoring. Technological advancements in NGS, PCR, and digital platforms, along with increasing adoption in oncology, prenatal testing, and transplant monitoring, are driving market growth.

Cancer is a growing concern, especially in developing countries. There is a growing need for cancer diagnosis and treatment services. A large number of people are unable to diagnose and treat cancer due to a lack of awareness and resources. Hence, governments are taking initiatives to provide cancer care.

For instance,

The precision of the cellular information taken from the liquid biopsy samples is improved using artificial intelligence (AI). AI is capable of analysing enormous volumes of cellular, proteomic, and genomic data that are taken from liquid biopsy samples using sophisticated algorithms and machine learning. The market for liquid biopsy IVD is being driven by AI, which is also improving patient outcomes and expanding the use of liquid biopsy in healthcare.

Advantages Over Other Methods are Increasing Liquid Biopsies

In experimental studies, liquid biopsies and enhanced MRD testing can be very helpful due to their non-invasiveness and speed of turnaround. When utilised in conjunction with tissue profiling and patient selection, liquid biopsy may lead to more rapid responder identification, better effectiveness results, and more economical studies. It is possible for liquid biopsy to evolve from its current function as an extra diagnostic technique to a crucial component of the treatment continuum with more funding and clinical proof.

Technical Challenges

Liquid biopsy findings may not be as reliable if circulating tumour components, including CTCs and cfDNA, are difficult to isolate and analyse technically. Though they are being addressed by ongoing technology improvements, these issues are nevertheless important to take into account.

What are the Growth Opportunities in the Liquid Biopsy IVD Market?

Because liquid biopsy techniques may diagnose cancer early, monitor tumour progression, and assess clinical prognosis, the market for liquid biopsy is growing as a result of greater knowledge about cancer. Furthermore, the need for non-invasive diagnostics and treatments has increased due to the development of new technologies, which is anticipated to fuel demand for liquid biopsies in the years to come. A major factor driving the market's expansion is the growing expenditures made by industry participants in clinical studies aimed at creating novel diagnostic tools.

By biomarker type, the circulating tumor DNA (ctDNA) segment held the largest share of the liquid biopsy IVD market in 2024. As demonstrated by its growing use in clinical practice, circulating tumour DNA (ctDNA) has become a dynamic biomarker in cancer. With its tumor-specific properties, ctDNA may be utilised to detect drug resistance, track response, and guide therapy choices.

By biomarker type, the tumor educated platelets (TEPs) segment is estimated to grow at the highest CAGR during 2025-2034. TEPs, or tumor-educated platelets, are found all over the body and are essential for the growth and spread of tumours. Platelet status might therefore be regarded as a distinct blood-based biomarker that may be able to forecast prognosis and the effectiveness of treatment. TEPs and other liquid biopsies have drawn a lot of interest lately as sensitive, safe, and minimally invasive patient care options.

By technology, the next-generation sequencing (NGS) segment led the liquid biopsy IVD market in 2024. A key advancement in oncology, next-generation sequencing (NGS) is revolutionising the way that cancer is diagnosed and treated. By enabling thorough genomic sequencing of tumours, detecting genetic changes that propel the spread of cancer, and enabling individualised therapy regimens that target particular mutations, NGS improves patient outcomes.

By technology, the PCR-based assays segment is estimated to witness the fastest growth during the upcoming period. PCR amplification is a very sensitive technique for assessing gene expression. With the PCR test, one cell out of 10–100 million lymphocytes can express a tumour marker. To present, this method has been applied to identify tumour cells in about 18 distinct solid tumour types, with the most extensively studied being melanoma and prostate and breast cancer. In biopsies of solid tissue, lymph nodes, bone marrow, peripheral blood, and other bodily fluids, PCR-based tests have been utilised to identify cancer cells.

By application, the cancer diagnosis and screening segment held the major share of the liquid biopsy IVD market in 2024. A cutting-edge, minimally invasive diagnostic technique called liquid biopsy is transforming the treatment of cancer by making it possible to identify and examine biomarkers linked to the disease in physiological fluids like blood, urine, or cerebrospinal fluid. A more accessible and reproducible approach of following cancer growth, identifying early-stage tumours, and evaluating therapy responses is liquid biopsy, as opposed to standard tissue samples, which necessitate invasive procedures.

By application, the PCR-minimal residual disease (MRD) monitoring segment is anticipated to grow at the highest CAGR during the predicted period. It is essential to analyse MRD levels in order to detect the recurrence of cancer (relapse) and the attainment of a profound molecular response (remission) in response to oncological therapy. MRD testing is currently being used for solid tumour disorders and has gained widespread acceptance for the monitoring of haematological malignancies.

By sample type, the blood segment was dominant in the liquid biopsy IVD market in 2024. A person's organs, blood cells, tissues, and overall health are all impacted by cancer, and blood tests are frequently used to assist doctors detect the condition. Additionally, blood tests may be performed on patients to assist physicians figure out which therapies to include in their plan, track the effects of these treatments on the cancer, and determine whether the illness has returned.

By sample type, the urine segment is estimated to be the fastest-growing during the forecast period. One bodily fluid that may be utilised to identify illnesses and tumours is urine. It is simple to gather and non-invasive. Urine cytology is a simple test with a 95% (95% CI 94–95%) specificity and a 37% (95% CI 35–39%) sensitivity. When it comes to identifying high-grade tumours, it performs well.

By end-user, the clinical laboratories & diagnostic centers segment captured the largest share of the liquid biopsy IVD market in 2024. In order to properly diagnose illnesses, track patient health, and inform treatment choices, clinical labs and diagnostic centres are essential to the healthcare industry. With the use of cutting-edge equipment and knowledgeable staff, they offer a broad range of services, from simple blood tests to sophisticated imaging and genetic testing. Their efforts are crucial to providing prompt and efficient medical care.

By end-user, the liquid biopsy startups & biopharma companies segment is estimated to grow at the highest rate during the forecast period. Because of its promise for early cancer diagnosis, illness monitoring, and personalised therapy, liquid biopsy is seeing tremendous expansion. To take advantage of this expanding industry, startups and biopharma firms are concentrating on creating and launching liquid biopsy technology. The growing prevalence of cancer, the growing need for less invasive diagnostic techniques, and developments in molecular technology such as next-generation sequencing are some of the main motivators.

North America dominated the liquid biopsy IVD market share by 45% in 2024. Due to its well-established hospital and healthcare infrastructure, which attracts investment from a variety of sources, this area leads the worldwide liquid biopsy market and offers an optimal environment for research and development. Advanced diagnostic methods like liquid biopsy are created and expanded with the help of these highly sophisticated facilities. The development of liquid biopsy technologies is further aided by the presence of top pharmaceutical and biotechnology firms in this area as well as academic research facilities.

In the U.S., there will likely be 618,120 cancer-related fatalities and 2,041,910 new cancer cases in 2025. While the incidence of cancer increases dramatically with age, anybody may acquire it; in the United States, those 65 and over account for 59% of cancer diagnoses, while people 50 and older account for 88%. At some time in their lives, 40 out of 100 men and 39 out of 100 women in the United States are expected to get cancer.

According to Canadian Cancer Statistics, 44% of Canadian women and 45% of Canadian men will get cancer at some point in their lives. The number of new cancer cases continues to rise as Canada's population ages and grows. The risk of developing cancer increases significantly with age.

Asia Pacific is estimated to host the fastest-growing liquid biopsy IVD market during the forecast period. The market will grow as a consequence of population growth, new businesses, and better health care infrastructure. There is a high incidence of cancer and a sizable population in the Asia Pacific region. In addition to increased collaboration between the government, academic institutions, and private companies for the distribution and administration of these cancer screening tests, free screening for breast, cervical, and lung cancer has grown in recent years.

One of China's greatest public health threats is cancer, which is becoming more and more common and varies significantly by location and population. This mounting burden poses a major public health risk. According to data released in 2024, China recorded over 4.8 million new cases of cancer and about 2.5 million cancer-related deaths in 2022. With an estimated 1.06 million new cases and 0.73 million deaths from the disease annually, lung cancer has emerged as China's most significant health concern.

Under the "Strengthening of Tertiary Cancer Care Centres Facilities" programme, State Cancer Institutes (SCIs) can get a one-time grant of up to ₹120 crore, and Tertiary Cancer Care Centres (TCCCs) can receive up to ₹45 crore, including the State contribution. Currently, there are 20 TCCCs and 19 SCIs approved nationwide. With specialised facilities and skilled staff, these organisations play a vital role in providing advanced cancer care, diagnostics, research, and capacity building. In order to provide high-quality care and fortify the public health infrastructure, TCCCs and SCIs are essential.

Europe is expected to grow significantly in the liquid biopsy IVD market during the forecast period. because people are becoming more conscious of cancer and prenatal screening. A number of market participants are also concentrating on obtaining funds to build a liquid biopsy platform employing cutting-edge technology. Over the course of the projected period, the European government's growing strategic measures to increase cancer screening and other pathology testing will also support regional growth.

In Germany, a large number of doctors and nurses are available to give cancer care, which is covered by extensive social health insurance. New cancer treatments and biosimilars are extremely easily accessible in Germany. Efforts are underway to enhance patient well-being through financial, psychological, and rehabilitation services, as well as to increase survival estimates through care focus.

The number of cancer patients in the UK has increased from around 3 million in 2020 to almost 3.5 million now. This figure is going to keep rising. Early diagnosis is a priority for the NHS and is still essential for increasing survival. The NHS's early diagnostic project has spearheaded remarkable advancements in early diagnosis.

In May 2025, the company's founder and CEO, Triantafyllos Tafas, PhD, said, QCDx is happy to enter the commercialisation phase after developing our proprietary RareScopeTM technology. This funding can accelerate important milestones, including the development of our CLIA clinical laboratory, a high-sensitivity breast cancer monitoring test, exclusive multiplex immunofluorescence reagent kits, and the introduction of our next-generation rare-cell imaging device. We owe our lenders and investors a huge debt of gratitude for their trust and support during a challenging market cycle.

By Biomarker Type

By Technology

By Application

By Sample Type

By End User

By Region

January 2026

December 2025

October 2025

October 2025