February 2026

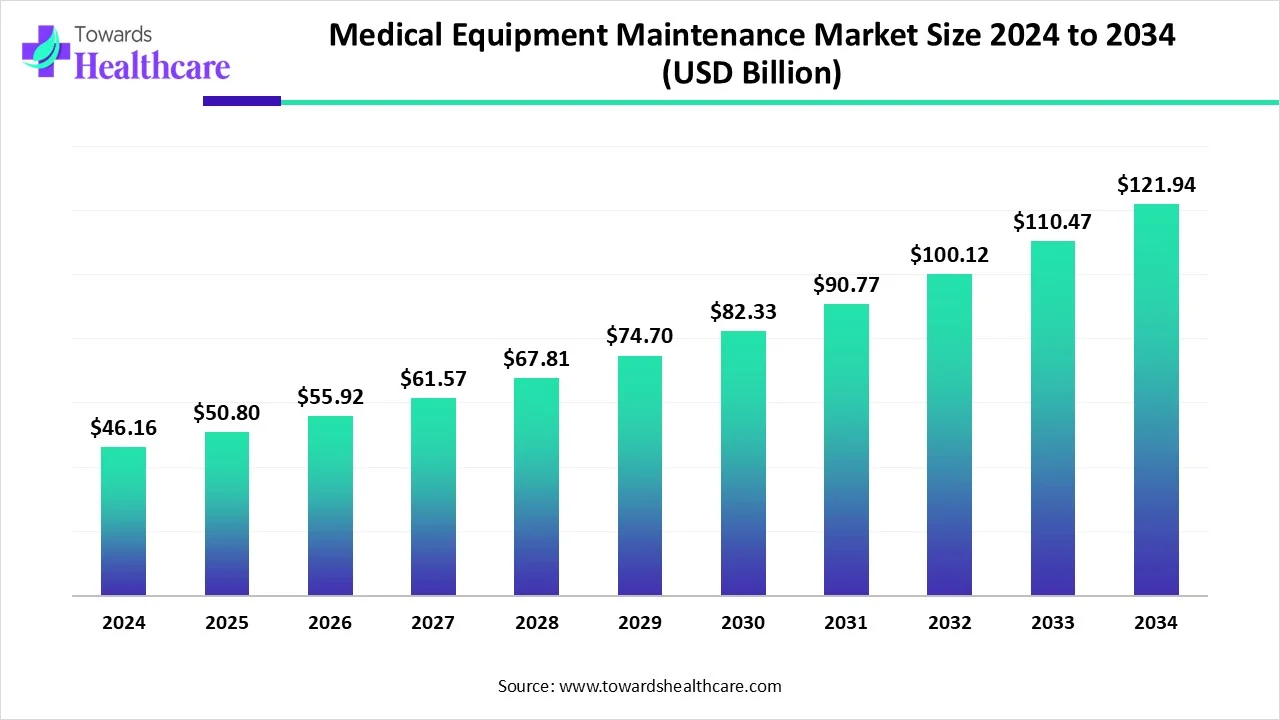

The global medical equipment maintenance market size is calculated at USD 46.16 billion in 2024, grows to USD 50.8 billion in 2025, and is projected to reach around USD 121.94 billion by 2034. The market is expanding at a CAGR of 10.04% between 2025 and 2034.

Medical equipment maintenance is the organized set of activities aimed at ensuring medical devices are functioning correctly, safely, and efficiently through regular inspection, calibration, repair, and preventive care. It involves both scheduled and unscheduled actions to maintain performance standards, extend equipment lifespan, and ensure compliance with regulatory and safety requirements in healthcare settings. The market is growing due to the increasing adoption of advanced and complex medical technologies, which require regular servicing to ensure safety and efficiency. Aging equipment across healthcare facilities also demands frequent maintenance to remain operational. Additionally, stringent regulatory standards, growing healthcare infrastructure in developing regions, and the rising trend of outsourcing maintenance services are all contributing to the market expansion.

| Metric | Details |

| Market Size in 2024 | USD 46.16 Billion |

| Projected Market Size in 2034 | USD 121.94 Billion |

| CAGR (2025 - 2034) | 10.04% |

| Leading Region | North America |

| Market Segmentation | By Equipment, By Service, By Service Providers, By End Use |

| Top Key Players | GE HealthCare, Siemens Healthineers AG, Medtronic, Aramark, Koninklijke Philips N.V., B. Braun SE, AlphaSource Group, Althea Group |

AI is transforming the market by enabling predictive maintenance, which helps identify potential issues before equipment fails. This reduces unexpected downtime, extends the lifespan of devices, and ensures reliable performance. AI can analyze vast amounts of data in real time, allowing for smarter diagnostics and more efficient maintenance scheduling. It also supports decision-making by providing insights into equipment usage and performance trends. As a result, healthcare providers can enhance operational efficiency, lower maintenance costs, and improve overall patient safety and care delivery.

Growth in the Medical Equipment Market

As a higher volume of devices increases, the need for regular servicing to ensure safety and functionality increases. More advanced and complex technologies are adopted, and specialized maintenance becomes essential to manage performance, prevent breakdowns, and comply with regulatory standards. The rising equipment base creates ongoing demand for maintenance services to support uninterrupted healthcare delivery and maximize equipment lifespan.

Cost Constraints

High cost servicing, especially for advanced machines like MRI’s make regular uptake unaffordable for many healthcare facilities. A limited budget often prioritizes essential services over maintenance, particularly in public or low-income settings. Hiring skilled technicians and relying on expensive OEM contracts adds to the financial burden. As a result, many institutions delay or skip preventive maintenance, opting for repairs only when breakdowns occur, which can compromise patient safety and equipment longevity.

Strategic Agreement and Collaboration

Strategic agreement and collaboration present a key opportunity for the medical equipment maintenance market by enabling access to advanced technologies, expertise, and wider service networks. Partnership between healthcare providers, OEM’s and third-party service providers can reduce costs, improve service efficiency, and ensure faster response times. Collaboration also supports the training standardization of maintenance protocols and better compliance with regulations. These alliances can expand market reach, especially in emerging economies, by leveraging shared resources and infrastructure to deliver reliable maintenance solutions at scale.

For Instant,

By equipment, the imaging equipment segment held a dominant presence in the market in 2024. The great use of imaging devices like MRI, CT scanners, and X-rays in diagnosing tools requires regular maintenance to ensure accuracy and safety. Additionally, rapid technological advancements in imaging systems have heightened the need for specialized maintenance services to manage complex and evolving equipment. As reported by the Centers for Disease Control and Prevention, around 129 million individuals in the United States are living with at least one significant chronic illness. To support diagnosis and treatment, commonly used imaging tools include X-rays, MRI machines, CT scanners, and ultrasound devices, which play a key role in identifying and monitoring these health conditions.

By equipment, the surgical instruments segment is anticipated to grow at the fastest CAGR in the medical equipment maintenance market during the studied years. The increasing burden of chronic diseases, such as cancer and cardiovascular conditions, has led to an increase in surgical procedures. Technological advancements, including robotic-assisted and smart instruments, are also fueling demand. Moreover, the shift towards minimally invasive surgeries requires specialized tools. Additionally, the aging global population is contributing to more age-related surgeries, further driving the need for surgical instruments and their regular maintenance. The World Health Organization estimates that by 2030, one in six people around the world will be aged 60 or above. Looking further ahead, the population of those aged 60 and older is projected to rise significantly, reaching 2.1 billion by 2050

By service, the corrective maintenance segment accounted largest share in the market in 2024. This is due to the frequent need for repairs when equipment malfunctions or breaks down, as healthcare facilities rely heavily on functional equipment. Corrective maintenance focuses on restoring equipment to its original state, addressing failures caused by constant use. The increasing prevalence of chronic diseases, along with the rising demand for medical equipment in hospitals and healthcare settings, further drives the need for corrective maintenance, fueling the medical equipment maintenance market growth.

By service, the preventive maintenance segment is expected to grow at the fastest rate in the market during the forecast period. The growth is driven by the need for regular inspection, calibration, and part replacements to prevent unexpected equipment failure. Preventive maintenance helps reduce downtime, extends equipment life, and ensures compliance with strict regulatory standards. With the rising adoption of advanced medical technologies and a growing aging population, healthcare facilities are increasingly investing in preventive services to enhance safety, improve efficiency, and manage operational costs effectively.

By service providers, the original equipment manufacturer (OEM) segment was dominant in the market in 2024. The leadership is largely due to OEM’s deep understanding of their equipment, enabling them to provide accurate, specialized, and high-quality maintenance services. They offer comprehensive services contracts, including post-warranty support, which builds ds strong long-term partnership with healthcare providers. OEMs also ensure strict compliance with safety and regulatory standards, which is crucial in the healthcare industry. Their reputation for reliability, access to genuine parts, and technical expertise makes them the preferred choice for maintenance.

By service providers, the small/third-party providers segment is predicted to grow at the fastest CAGR in the medical equipment maintenance market due to its cost-effectiveness and flexibility. These providers often offer services at. Significantly lower cost, 30 to 50% less than OEM’s making them a popular choice for budget-conscious healthcare facilities. They are known for their quick response times, ability to service a wide range of equipment brands, and adaptability to regional needs. Their growing expertise and tailored solutions are driving demand, especially among hospitals looking for efficient and affordable maintenance options.

By end-use, the hospitals segment held the highest share of the medical equipment maintenance market in 2024. This dominance is primarily due to the wide range of critical equipment used in hospital settings, including imaging systems, surgical instruments, and life support devices, all of which require routine maintenance and function effectively. Hospitals conduct a high volume of diagnostic and therapeutic procedures, making reliable and well—maintained equipment essential. Furthermore, hospitals must comply with strict regulatory and safety standards, which further drive the demand for regular maintenance services to reduce equipment downtime and ensure consistent, high-quality patient care.

By end-use, the ambulatory surgical centers segment is anticipated to grow at a significant rate in the medical equipment maintenance market during the studied years. The ambulatory surgical centers provide cost-effective outpatient surgical procedures, reducing hospital stay costs. Technological advancements such as minimally invasive and robotic-assisted surgeries have expanded the type of procedures that can be performed in these centers. Additionally, favorable preference in these centers. Additionally, favorable reimbursement policies and the increasing preference for outpatient and the increasing preference for outpatient care are driving ASC demand, creating a greater need for specialized maintenance services to ensure the smooth functioning of mechanical equipment.

North America dominated the medical equipment maintenance market in 2024. This dominance is driven by the region’s advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and high prevalence of chronic diseases, which increase demand for consistent equipment servicing. Additionally, strong regulatory frameworks ensure compliance with safety standards, further supporting routine maintenance. High healthcare spending and significant investments in medical infrastructure also play a key role, making North America the most prominent region in this market.

The U.S. market is expanding due to several key factors. The aging population and rising prevalence of chronic diseases increase the demand for medical devices, driving the need for regular maintenance. Additionally, the adoption of advanced technologies, like robotic surgical systems, requires specialized maintenance services. Strict regulatory standards, such as those from the FDA, ensure equipment compliance, further boosting demand. The growth of Independent Service Organizations (ISOs) offering cost-effective solutions also contributes to the market's expansion, providing healthcare providers with affordable maintenance options.

For Instance,

The market in Canada is growing steadily due to several key factors. Increasing adoption of advanced medical technologies, such as imaging and surgical systems, demands regular and specialized maintenance. Strict regulatory standards also require routine servicing to ensure compliance and patient safety. Additionally, hospitals are focusing on cost-efficiency and extending equipment lifespan. The rise of predictive maintenance technologies like IoT and AI, along with expanding healthcare infrastructure, is further fueling the demand for reliable maintenance services across the country.

For instance,

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Rapid urbanization and increased healthcare investments have led to the expansion of hospitals and diagnostic centers, boosting demand for maintenance services. The region also faces a rising burden of chronic diseases and an aging population, resulting in greater use of medical devices. Moreover, the integration of advanced technologies like IoT and AI into equipment maintenance is improving service efficiency, further accelerating market growth across the region.

China’s market is expanding rapidly due to the growing use of advanced medical technologies, including imaging and surgical systems, which require regular upkeep. Strict regulatory standards are pushing healthcare facilities to prioritize maintenance for compliance and patient safety. Additionally, hospitals are outsourcing services to specialized providers for better efficiency. The adoption of AI, IoT, and predictive analytics is also streamlining maintenance operations. Coupled with the country's expanding healthcare infrastructure, these factors are collectively driving strong growth in the market.

India’s market is growing due to the increasing adoption of advanced medical technologies, which require specialized upkeep. Strict regulatory compliance standards and a strong focus on patient safety are also driving demand for regular maintenance. Additionally, government initiatives like “Make in India” and increased healthcare spending, such as the Ayushman Bharat scheme, are fostering the growth of the healthcare sector and boosting the need for reliable maintenance services for medical equipment across the country.

Europe is expected to see significant growth in the market during the forecast period. The increasing complexity of medical devices, such as MRIs and CT scanners, requires specialized maintenance to ensure compliance and optimal performance. Many European healthcare facilities also rely on aging equipment, driving demand for regular servicing. Additionally, strict regulatory standards, such as the EU Regulation 2017/745, mandate maintenance for patient safety. The growing emphasis on preventive maintenance strategies to reduce costs and downtime further supports market growth in the region.

The adoption of advanced medical technologies, including imaging systems and surgical robots, is increasing the demand for specialized maintenance services to ensure their efficiency and regulatory compliance. Strict regulatory standards require regular checks and maintenance to ensure patient safety. Additionally, the government’s focus on improving healthcare infrastructure and rising healthcare expenditure further fuels the demand for reliable medical equipment. These combined factors are driving the expansion of the maintenance market in the UK.

Germany's market is expanding due to the country’s strong healthcare sector and technological advancements in medical devices. The high demand for precision and reliability in devices like diagnostic imaging and surgical equipment has led to increased investments in regular maintenance. Additionally, Germany's aging population is creating greater healthcare needs, further driving the demand for functional medical equipment. The government’s commitment to improving healthcare services and infrastructure is also playing a significant role in boosting the market for maintenance services.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The burgeoning medical device sector and the growing demand for advanced patient care boost the market. Numerous government organizations support the development of novel medical devices and their maintenance solutions to enhance their productivity. They launch initiatives to provide access to high-quality healthcare among the general population. The increasing investments and collaborations also contribute to market growth.

In January 2024, African Asset Finance Company (AAFC) announced the expansion of its EASE (Equipment as a Service) Healthcare program is Southern Africa. The program provides access to high-quality equipment, including maintenance, training, and support, to businesses and organizations across Africa. (Source: Businesswire)

The Saudi Food and Drug Authority launched a digital awareness campaign to educate people about the safe and proper use of medical devices and supplies intended for home use. The Authority highlighted the significance of purchasing home medical devices from licensed suppliers that offer after-sales services, including maintenance. (Source: Arab News)

In November 2024, the Indian government’s Rs 500 crore MedTech scheme aims to rejuvenate domestic manufacturing in the medical equipment sector, which has largely shifted towards imports and pseudo-manufacturing. Rajiv Nath, the Forum Coordinator of the Association of Indian Medical Device Industry (AiMeD), expressed enthusiasm, stating that the initiative will encourage domestic players, who had become importers and pseudo-manufacturers, to return to full-scale manufacturing and produce both products and components in-house.

By Equipment

By Service

By Service Providers

By End Use

By Regions

February 2026

February 2026

January 2026

January 2026