February 2026

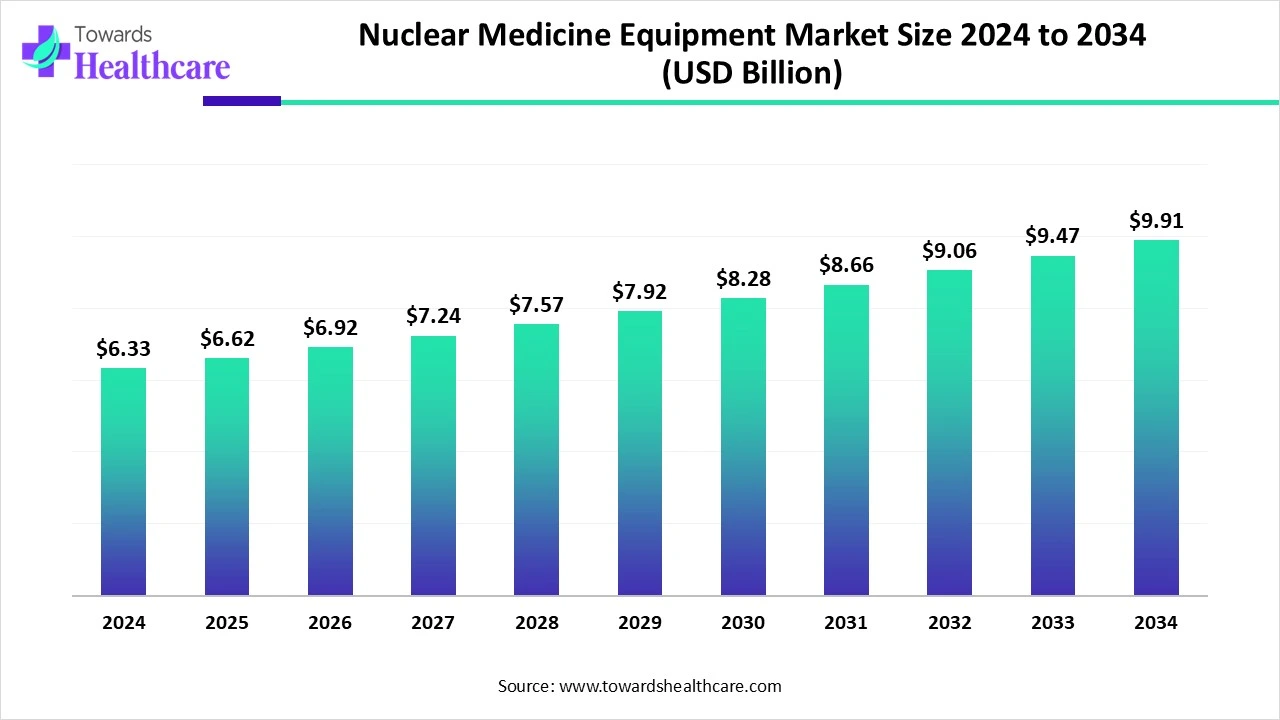

The global nuclear medicine equipment market size in 2024 was US$ 6.33 billion, expected to grow to US$ 6.62 billion in 2025 and further to US$ 9.91 billion by 2034, backed by a robust CAGR of 4.58% between 2025 and 2034.

The nuclear medicine equipment market is experiencing steady growth, driven by increasing demand for early and precise diagnosis of chronic diseases such as cancer and cardiovascular disorders. Advancements in imaging technologies, including PET and SPECT scanners, are enhancing diagnostic accuracy and treatment planning. Growing awareness of personalized medicine, rising healthcare investments, and the expanding use of radiopharmaceuticals are further boosting market expansion. Additionally, aging populations and improved access to healthcare are contributing to the rising adoption of nuclear medicine equipment.

| Table | Scope |

| Market Size in 2025 | USD 6.62 Billion |

| Projected Market Size in 2034 | USD 9.91 Billion |

| CAGR (2025 - 2034) | 4.58% |

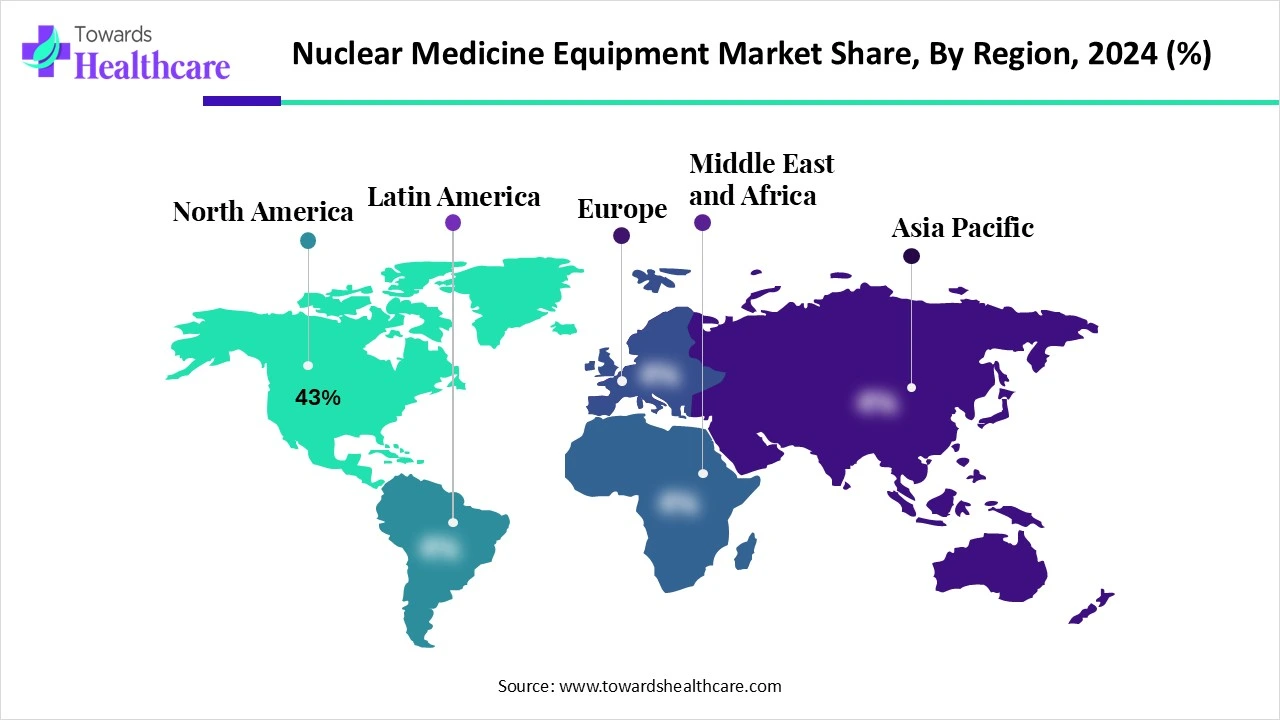

| Leading Region | North America Share 43% |

| Market Segmentation | By Product Type, By Application, By End User, By Modality, By Detector Technology, By Region |

| Top Key Players | GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Spectrum Dynamics Medical, Bruker Corporation, MR Solutions Ltd., CUBRESA Inc., Digirad Corporation, DDD-Diagnostics A/S, Neusoft Medical Systems, Mediso Ltd., Shenzhen Anke High-tech Co., Ltd., United Imaging Healthcare, Positron Corporation, Biosensors International, AnkeBio, Beijing Sinovision Medical Technology Co., Ltd., Advanced Accelerator Applications, Reflexion Medical |

The market comprises diagnostic and therapeutic imaging systems that utilize radioactive isotopes to visualize organ function, metabolism, and molecular activity in real time. The key modalities include SPECT (Single Photon Emission Computed Tomography) and PET (Positron Emission Tomography), often integrated with CT or MRI. These systems are critical in oncology, cardiology, neurology, and endocrinology for detecting diseases at an early stage, monitoring therapeutic response, and guiding personalized treatment. Market growth is driven by the rising burden of chronic diseases, shift to precision diagnostics, and increased availability of radiotracers.

The nuclear medicine equipment market is evolving through technological advancements like hybrid imaging systems, improved detector materials, and AI integration for enhanced image analysis. These innovations are increasing diagnostic accuracy and enabling personalized treatment. Additionally, the growing use of radiopharmaceuticals and the rising demand for non-invasive imaging are shaping the market’s future growth.

AI is significantly impacting the market by enhancing image reconstruction, improving diagnostic accuracy, and streamlining workflow efficiency. It enables faster image processing, supports early disease detection, and assists in personalized treatment planning through data-driven insights. AI also reduces human error and optimizes the use of radiopharmaceuticals, improving overall patient outcomes. As AI technologies continue to evolve, they are expected to further transform nuclear imaging by making it more precise, efficient, and accessible.

Growing Demand for Early and Accurate Diagnosis

The increasing focus on early and precise disease detection is driving the nuclear medicine equipment market, as it helps improve patient outcomes through timely intervention. Functional imaging tools like PET and SPECT allow clinicians to assess disease activity at a molecular level, even before symptoms appear. This growing reliance on accurate diagnostics supports more targeted therapies, reduces treatment costs in the long run, and strengthens the demand for advanced nuclear imaging technologies across healthcare systems.

For Instance,

High Cost of Equipment and Procedures

The expensive nature of nuclear medicine equipment and procedures restricts market growth, as many healthcare facilities struggle to afford the initial investment and upkeep. Devices like PET and SPECT scanners require substantial funding, and the high operational costs, including radiotracers and trained personnel, make it difficult to achieve widespread implementation. This financial challenge is especially significant in low-resource settings, limiting patient access to advanced diagnostic tools and slowing the expansion of nuclear imaging services globally.

Rising Development of Theragnostic

The growing development of theragnostics presents a major future opportunity in the nuclear medicine equipment market, as it combines diagnostics and targeted therapy using the same radiopharmaceutical. This dual approach allows for personalized treatment plans, improved patient outcomes, and reduced side effects, particularly in oncology. As healthcare shifts towards precision medicine, theragnostic enables real-time treatment monitoring and better disease management. Its expanding applications are driving demand for advanced nuclear imaging systems and radiotracer production, fueling market growth.

For Instance,

The SPECT systems segment led the nuclear medicine equipment market in revenue due to its broad clinical applications and relatively lower cost compared to other imaging technologies. These systems are widely adopted for routine diagnostic procedures, especially in cardiology and oncology, due to their reliability and availability. Improvements in image resolution and hybrid imaging capabilities have increased their effectiveness, making them a preferred choice in many healthcare settings and contributing to their dominant market position.

The PET systems segment is projected to grow rapidly due to its increasing use in advanced diagnostic imaging and treatment planning. Its ability to detect cellular changes before anatomical abnormalities appear makes it valuable in cancer and brain disorder evaluation. Continued innovation in radiotracers and hybrid technologies is also expanding their clinical utility, driving faster adoption.

The PET/CT subsegment is experiencing rapid growth as it delivers both functional and structural imaging in one session, improving clinical decision-making. Its ability to pinpoint disease location and activity with high precision is especially beneficial in cancer care. The rising preference for integrated diagnostic solutions, along with advancements in imaging software and radiotracers, is boosting its demand across hospitals and diagnostic centers, making it one of the fastest-growing areas in nuclear medicine imaging.

In 2024, the oncology segment held the largest revenue share in the nuclear medicine equipment market due to the rising global incidence of cancer and the growing demand for early, accurate tumor detection and treatment planning. Nuclear imaging techniques like PET and SPECT are widely used in cancer diagnosis, staging, and therapy monitoring. The increasing use of targeted radiopharmaceuticals and advancements in hybrid imaging technologies have further strengthened the role of nuclear medicine in oncology, driving its market dominance.

The neurology segment is projected to witness the highest growth in the nuclear medicine equipment market as brain disorders become increasingly common with an aging population. Imaging tools like PET and SPECT are gaining traction for their ability to detect functional brain changes before structural symptoms appear. As demand rises for early diagnosis and monitoring of conditions like dementia and movement disorders, the use of advanced nuclear imaging in neurological applications is expanding rapidly during the forecast period.

The hospitals segment dominated the nuclear medicine equipment market in 2024, as hospitals are better equipped with specialized staff, high-end imaging systems, and comprehensive diagnostics capabilities. They serve as referral centers for advanced imaging procedures and are often involved in clinical research and theranostics. With increasing patient inflow for chronic disease management and access to government and private healthcare funding, hospitals remain the key hubs for adopting and utilizing nuclear medicine technologies on a large scale.

The diagnostic imaging centers segment is projected to grow at the fastest CAGR in the medicine equipment market as they offer flexible, accessible systems. Their ability to adopt new technologies quickly and cater to increasing outpatient referrals makes them attractive for both patients and physicians. This shift towards early diagnosis, along with rising demand for specialized and affordable imaging options, is fueling the rapid expansion of these centers during the forecast period.

The hybrid imaging systems segment led the nuclear medicine equipment market in 2024 and is set to grow at a faster pace due to its advanced capabilities that merge structural and functional imaging for more comprehensive diagnostics. These systems, such as PET/CT and SPECT/CT, provide clearer, more accurate results, improving disease localization and treatment monitoring. Their growing use in complex conditions like cancer and neurological disorders, along with rising demand for integrated imaging solutions, is fuelling strong market momentum.

In 2024, the traditional NaI (Sodium iodide) detectors segment led the nuclear medicine equipment market due to its longstanding presence in clinical settings and ease of integration with conventional imaging systems. Its affordability compared to advanced technologies and consistent performance in routine diagnostic procedures made it a preferred option for many healthcare providers, especially in cost-sensitive regions. These factors collectively reinforced its leading position in terms of market revenue share.

The solid-state detectors (CZT) segment is projected to witness the fastest growth in the nuclear medicine equipment market owing to its compact design, better energy resolution, and ability to function effectively in low-dose imaging environments. Its compatibility with advanced imaging systems and rising preference for accurate, high-quality diagnostic tools are driving its adoption. Moreover, its potential to streamline workflow and reduce scan times is attracting interest from both hospitals and diagnostic centers, boosting its market expansion.

North America dominated the nuclear medicine equipment market share by 43% in 2024, due to its advanced healthcare infrastructure, widespread adoption of cutting-edge imaging technologies, and strong presence of leading market players. Increased investment in R&D, supportive reimbursement policies, and a growing elderly population with rising chronic disease prevalence further supported the region's leadership. Additionally, ongoing innovation and access to skilled medical professionals contributed to higher diagnostic and therapeutic procedure volumes across the region.

The U.S. market is growing due to rising demand for early and accurate disease diagnosis, increasing prevalence of chronic conditions like cancer and cardiovascular disorders, and advancements in imaging technologies. Strong healthcare infrastructure, high healthcare spending, favorable reimbursement policies, and ongoing R&D initiatives are also driving growth. Moreover, growing adoption of hybrid imaging systems and AI integration further accelerates market expansion in the U.S.

For Instance,

The Canadian market is expanding due to the rising incidence of chronic diseases, especially cancer and heart conditions, which require advanced diagnostic imaging. Government support for healthcare infrastructure, increasing investments in medical imaging technologies, and growing awareness of early diagnosis are boosting demand. Additionally, collaborations between academic institutions and industry players are fostering innovation in radiopharmaceuticals and imaging systems, contributing to market growth.

Asia-Pacific is anticipated to grow at the fastest CAGR in the nuclear medicine equipment market due to rising healthcare investments, growing awareness of nuclear imaging’s diagnostic benefits, and increasing prevalence of cancer and cardiovascular diseases. Expanding healthcare infrastructure, favorable government initiatives, and a growing aging population are further driving demand. Additionally, countries like China, India, and Japan are witnessing increased adoption of advanced imaging technologies and radiopharmaceuticals, creating a strong growth trajectory for the regional market.

China’s market is expanding due to rising cancer and chronic disease cases, growing demand for early and accurate diagnostics, and significant government investments in healthcare infrastructure. The country is also witnessing an increase in the adoption of advanced imaging technologies and radiopharmaceuticals. Additionally, strong support for domestic manufacturing and research is accelerating innovation, making China a key player in the global nuclear medicine landscape.

India's market is growing due to increasing cancer and cardiac cases, rising awareness about early diagnosis, and expanding access to advanced healthcare services. Government initiatives to improve medical infrastructure and the growing presence of private diagnostic centers are also contributing to market growth. Additionally, the adoption of advanced imaging technologies and rising investment in nuclear medicine research are fueling the expansion of this sector in India.

Europe is strengthening its approach to the nuclear medicine equipment market by investing in advanced imaging technologies and expanding public healthcare funding. Countries like Germany, France, and the UK are increasing their focus on precision diagnostics and personalized medicine. Collaborations between research institutes and medical device companies are driving innovation, while supportive regulatory frameworks and rising awareness about early disease detection are further boosting the adoption of nuclear imaging systems across the region.

The UK market is expanding due to increased government investments in healthcare infrastructure and rising demand for early disease detection. Advancements in imaging technologies and a growing elderly population requiring diagnostic services are also contributing to growth. Additionally, partnerships between research institutions and industry players are accelerating innovation, while NHS support for precision medicine enhances the adoption of nuclear imaging systems across the country.

The German market is growing due to rising incidences of chronic diseases like cancer and cardiovascular conditions, which require advanced diagnostic imaging. Strong government support for healthcare modernization, along with significant investments in research and development, is further driving demand. Additionally, the presence of key market players and the increasing adoption of hybrid imaging technologies are boosting the market’s expansion across the country.

In June 2025, SHINE Technologies celebrated a successful first year of its medical isotope product, Ilumira™ (n.c.a. lutetium-177), achieving strong global growth. Since its launch in June 2024, Ilumira has been shipped to 19 countries with over 95% on-time, in-full delivery performance, expanding distribution across Asia, Europe, Australia, and the Middle East. Greg Piefer, CEO of SHINE, shared his pride in Ilumira’s impact, stating, “Every shipment represents hope” for cancer patients worldwide.

By Product Type

By Application

By End User

By Modality

By Detector Technology

By Region

February 2026

February 2026

December 2025

February 2026