February 2026

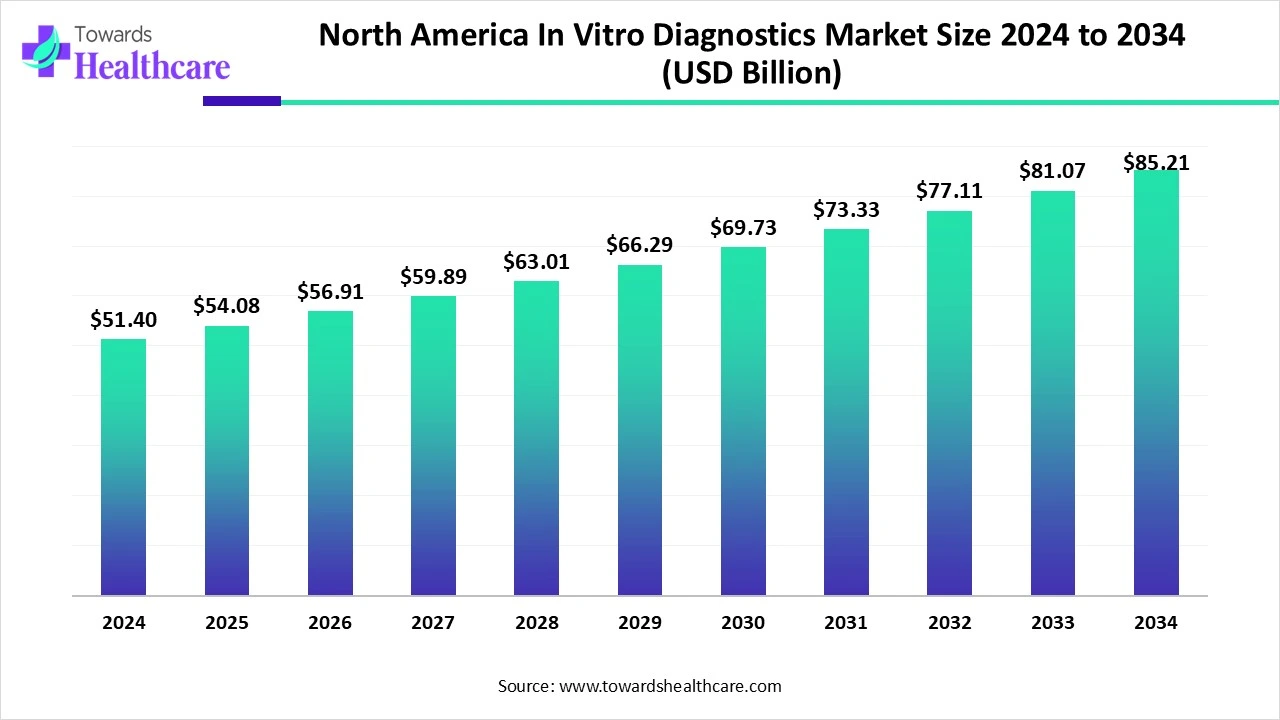

The North America in-vitro diagnostics market size is calculated at USD 51.4 billion in 2024, grew to USD 54.08 billion in 2025, and is projected to reach around USD 85.21 billion by 2034. The market is expanding at a CAGR of 5.23% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 54.08 Billion |

| Projected Market Size in 2034 | USD 85.21 Billion |

| CAGR (2025 - 2034) | 5.23% |

| Market Segmentation | By Product, By Technology, By Application, By End-use, By Region |

| Top Key Players | Abbott, bioMérieux SA, Bio-Rad Laboratories, Inc., BD, Siemens Healthcare GmbH, QIAGEN, Quidel Corporation, F. Hoffmann-La Roche Ltd, Sysmex Corporation, Charles River Laboratories International, Inc., Quest Diagnostics, Agilent Technologies, Inc., Danaher |

The importance of diagnostic testing is growing, according to the World Health Organization (WHO). Methods for diagnosis in medical treatment. In vitro diagnostics (IVD) have a specific role in the healthcare industry since they are the first step toward providing appropriate care or treatment. They are used throughout life and at every stage of the healthcare process, giving medical practitioners the information they need to screen and diagnose patients, prevent and monitor illness, and treat patients. For the purposes of epidemiological surveillance, they are also essential.

In the upcoming years, universal and AI-based IVDs might significantly enhance healthcare decision-making. This viewpoint discusses current developments and difficulties in the translation of smart diagnostics. The current method of evaluating health and illness might be completely changed by the incorporation and application of AI in IVDs. These AI-enabled gadgets will also perform better at detecting and predicting illnesses than current non-AI techniques. The FDA has recently issued a number of guidance documents for manufacturers creating AI-driven clinical tools, acknowledging the potential of AI to enhance treatment decisions. These documents include recommendations for remote data collection, clinical decision support tool development, and the regulatory submission of standalone software-based medical devices.

Early Disease Diagnosis Awareness

Better treatment and care in the future are made possible by early infectious illnesses. It makes it possible for patients and medical professionals to make important decisions about support and treatment. The importance of early illness detection is highlighted by a growing understanding of its advantages. Early illness detection can result in significant treatment cost reductions. For instance, early cancer detection can cut treatment costs by two to four times in some high-income nations, according to the World Health Organization. Furthermore, for individuals with serious illnesses like cancer, an early diagnosis frequently saves their lives.

Strict Regulations & Growing Competition

There are a number of obstacles facing the North America in-vitro diagnostics market. It takes a lot of money and experience to navigate the complicated regulatory environment, which is a major obstacle for smaller businesses. Market saturation may result from the competitive character of the industry, where significant competitors are constantly enhancing their product lines and technical prowess.

Increasing Demand for Rapid & Precise Disease Diagnosis

The market for in vitro diagnostics will continue to grow as researchers and healthcare professionals use advanced diagnostic tools to prevent illnesses, intervene early, and track therapy. This is due to the growing demand for accurate and quick disease detection in a world that is becoming more health-aware. Furthermore, the market will be able to drive greater efficiency and better patient outcomes due to continuous technological breakthroughs, growing healthcare digitalization, and the development of sophisticated diagnostic capabilities.

By product, the reagents segment held the largest share of the market in 2024. Because of their constant quality and reliable impact, in vitro diagnostic reagents are widely used in clinical testing and medical research. They provide technical information for sickness prevention and control, as well as the basis for scientific inquiry and therapy. Chemical reagents, which comprise dyes, buffers, surfactants, and basic chemicals, are the most basic kind of diagnostic reagents.

By product, the services segment is estimated to be the fastest-growing in the North America in-vitro diagnostics market during the forecast period. As the prevalence of chronic diseases like cancer rises, so too should the need for in vitro diagnostic (IVD) services. IVD services encompass a wide range of goods and services, including stability studies, biomarker testing, reagent quality control testing, characterization of biologic active species, and analytical validation services, according to Intertek and Thermo Fisher Scientific. The safety, quality, and regulatory compliance of IVD items depend on these services.

By technology, the immunoassay segment led the market in 2024. Immunoassays are often used in food testing, medication research, clinical diagnostics, and drug monitoring. Advanced immunoassays with high sensitivity and speed are presently being developed. Furthermore, multiplex bead-based assays, smartphone-based immunoassay formats, and lateral flow immunoassay formats are some of the latest developments that have made it simpler to track and manage health-related concerns in real time.

By technology, the microbiology segment is expected to grow at the fastest in the North America in-vitro diagnostics market CAGR during the forecast period. The diagnostics microbiology laboratory is evolving rapidly due to the growing need for more comprehensive therapeutically relevant information on hazardous microorganisms in a shorter period of time. With the increasing use of molecular techniques for organism identification and characterisation, medical microbiologists will have to guide the transition from culture-based to genomic-based research. This will guarantee that testing helps their companies make the greatest judgments about patient care.

By application, the infectious diseases segment was dominant in the market in 2024. Healthcare systems throughout the world are under stress due to the intricate interactions between long-standing and new issues that define the present global health environment. These difficulties include the widespread increase in infectious disease outbreaks, environmental health hazards, and non-communicable diseases (NCDs). Effective public health responses to infectious illnesses, including COVID-19, HIV, and Lyme disease, depend on early identification. Quick case detection enables prompt intervention, lowering transmission rates and medical costs.

By application, the oncology segment is anticipated to witness the fastest growth in the North America in-vitro diagnostics market during 2025-2034. Cancer is the second leading cause of mortality globally. Early cancer detection and access to effective anti-cancer treatment can lead to improved quality of life and higher survival rates. IVDs can identify a variety of human cancers, and between 30 and 50 percent of them are preventable. Despite the fact that screening and prevention are essential measures to reduce the global incidence of cancer, access to these services is unequal, especially in LMICs.

By end-use, the hospitals segment dominated the market in 2024. The diagnostic services provided by multispecialty hospitals, which are built to give various kinds of institutions access to cutting-edge medical equipment, systems, and technology, enable those working in the healthcare sector to achieve the best results every day. Emergency care and diagnostic services are among the many medical treatments offered by multispecialty hospitals.

By end-use, the homecare segment is expected to achieve the highest CAGR in the North America in-vitro diagnostics market during the predicted timeframe. Because of at-home diagnostics, the healthcare industry is changing. These diagnostics are making critical medical tests less stressful and simpler to acquire at a time when convenience is vital. Home health diagnostics are becoming more and more popular as people look for simpler ways to keep an eye on their health.

North America dominates the North America in-vitro diagnostics market. Its highly developed healthcare infrastructure, significant investments in cutting-edge diagnostic technology, and rising need for precise and prompt diagnostic solutions are all factors contributing to its leadership. The strong healthcare systems in the U.S. and Canada encourage innovation, which speeds up the creation and uptake of novel IVD technology. For instance, businesses such as Thermo Fisher Scientific have made major investments in molecular diagnostics and next-generation sequencing, greatly improving their capacity for illness monitoring and detection. Additionally, the region's dedication to research and development guarantees ongoing improvements in diagnostic techniques, therefore reinforcing its position as a global leader. North America continues to lead the market, establishing standards for quality and innovation in medical diagnostics by concentrating on enhancing patient outcomes and using technology.

Among the 1,530 in vitro diagnostics startups in the US are Foundation Medicine, Guardant Health, GRAIL, Natera, and Cepheid. Of them, 496 have obtained Series A+ financing, 7 have become unicorns, and 933 businesses have received money.

39 new businesses have been established on average every year during the last ten years. Remarkably, a number of these firms were started by former students of the Massachusetts Institute of Technology, Harvard University, and Stanford University.

A joint experiment is in progress to evaluate the usage of a single eSTAR submitted to Health Canada and the FDA. The results of a pilot study with nine participants will be used to assess eSTAR's viability. The IMDRF Non-In Vitro Diagnostic Device Market Authorization Table of Contents (nIVD MA ToC) will be used by the chosen participants to access the non-In Vitro Diagnostic eSTAR. The Canada Health Transfer, which assists provinces and territories in covering the cost of testing and other medical care, will also receive funding from the federal government of Canada in 2024. In 2023–2024, the federal government contributed $49.4 billion, which accounted for almost 22% of healthcare spending in provinces and territories.

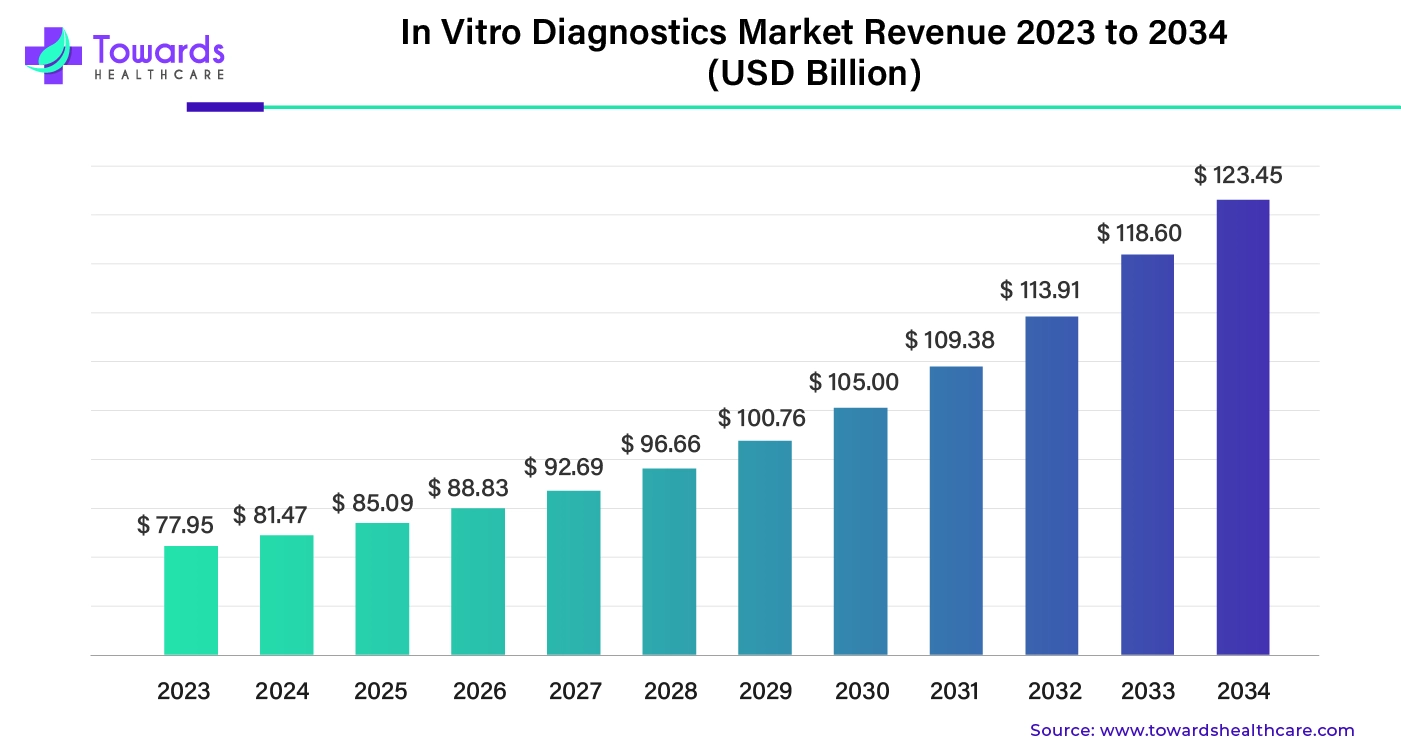

The global in vitro diagnostics market size was valued at around $77.95 billion in 2023. It's expected to grow steadily over the years, reaching approximately $123.45 billion by 2034. This growth is happening at an average annual rate of 4.45% between 2024 and 2034.

Research activities for IVDs involve developing novel devices with advanced properties and improving the functionalities of existing devices.

Key Players: bioMérieux, CD Formulation, and MBL Life Science. bioMérieux invests 12-13% of its sales in R&D, the highest of any other IVD company.

IVDs need to undergo clinical trials to assess their safety and efficacy, which as subsequently approved by regulatory agencies of respective nations.

Key Players: QbD Group, Proxima Clinical Research, and Veristat

IVD manufacturers and third-party providers provide the resources, guidance, and relevant expertise to patients about the use of IVDs.

Vitor Rocha, President of Cepheid, commented that Xpert HCV VL Fingerstick is the first HCV RNA detection and quantification technology sensitive enough for active case finding at the point of care in Canada. The device facilitates timely linkage to care within a single clinic visit and the potential to treat more people with HCV.

February 2026

February 2026

February 2026

February 2026