February 2026

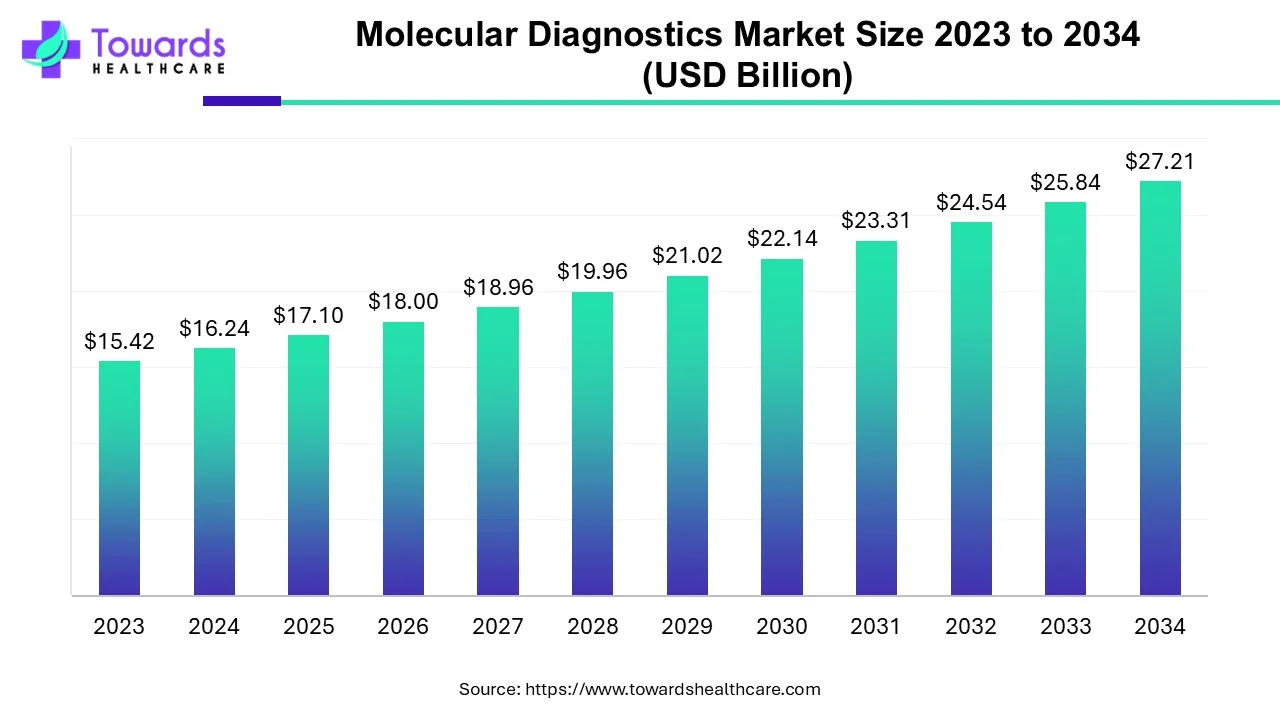

The molecular diagnostics market size is forecasted to expand from USD 17.1 billion in 2025 to USD 28.66 billion by 2035, growing at a CAGR of 5.3% from 2026 to 2035.

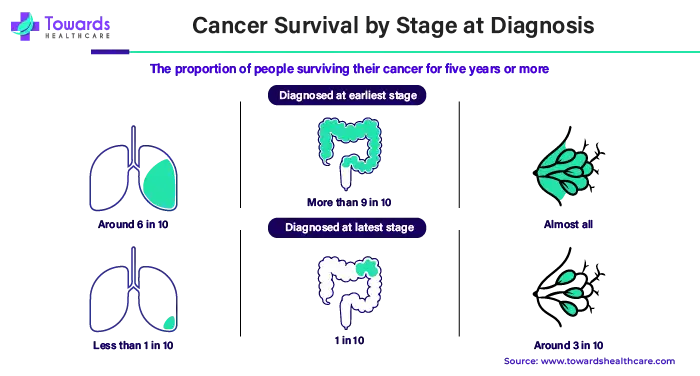

If diagnosed early, around 6 out of every 10 persons with lung cancer can live for 5 years or more. When lung cancer is found in its most advanced state, this number drops to less than 1 in every 10 people.

Molecular diagnostics is analyzing molecules such as DNA, RNA, or proteins in a tissue sample in a laboratory to diagnose a disease or a risk of developing it such as cancer. Molecular diagnostics include various tests such as biomarker tests, liquid biopsies, tumor sensing tests, and genetic tests. It is also called molecular pathology. Doctors can conduct a molecular test for a common inherited hereditary malignancy. For example, in breast cancer, they can look for specific hereditary abnormalities in the BRCA1 and BRCA2 genes that may raise the patient's risk of ovarian and breast cancer.

Apart from diagnosis, a variety of tests are critical for evaluating therapy efficacy and detecting medication resistance. For example, in HIV treatment, quantitative molecular assays monitor viral load. A large increase in viral load may suggest resistance to the present treatment. In such circumstances, doctors can do DNA sequencing on the patient's HIV strain to uncover resistance-associated alterations. This information enables for a quick switch to other drugs, ensuring that the infection remains under control.

We are still in the early stages of understanding the meaning of these genetic changes and their involvement in illness development. While the ability to analyze DNA sequences for disease detection has greatly improved, a better understanding of these changes is required. We have a wealth of information, but the problem now is to successfully interpret it and translate it into actionable insights. This ongoing study focused on unraveling the complexities of diseases, holds tremendous promise for establishing more precise diagnostics and personalized treatment strategies.

Some of the FDA Approved Molecular Diagnostic (COVID-19) Tests by April 2023:

In February 2024, India made "momentous progress" in climbing up molecular diagnostics and is employing the largest digital programme for TB and monitoring surveillance, an official said during a convention for health writers in the national capital. Even though tuberculosis (TB) is one of the leading causes of death and disability in India, it affects millions of people each year.

Molecular tests are essential tools in diagnostics, capable of detecting specific genetic material or protein signatures. Among these, nucleic acid amplification tests (NAATs) are particularly noteworthy. They employ techniques like polymerase chain reaction (PCR), NASBA, or deep sequencing to amplify a specific sequence of nucleic acid. PCR, driven by rapid temperature changes, is a chemical reaction that exponentially increases the amount of genetic material from a sample. Each PCR cycle doubles the genetic material, and running many cycles can generate millions or even billions of copies. This sensitivity allows molecular PCR tests to detect even trace amounts of nucleic acid in a sample.

NAATs have diverse applications in laboratory medicine, spanning infectious disease diagnostics, oncology, and genetics. For instance, oncologists can use molecular tests to identify genetic abnormalities in a tumor, enabling personalized cancer treatment. Infectious disease specialists can utilize NAATs to quickly determine the cause of an infection and detect genetic markers indicating antibiotic resistance, thus optimizing treatment strategies. Moreover, these tests can identify chromosomal abnormalities or genetic changes that increase the risk of developing certain diseases or disorders.

In the infectious disease diagnostics, NAATs offer significant improvements in accuracy and speed over traditional methods like cultures. Laboratories utilizing these molecular testing solutions can provide healthcare providers with quicker and more precise answers, facilitating timely and effective treatment decisions.

Molecular diagnostics have emerged as a sensitive and largely accurate method for early detection of infectious diseases. The COVID-19 pandemic accelerated the adoption of such methods as the need for early disease detection was very crucial. Monitoring the efficacy of treatment modalities, early diagnosis, and predictive medicine are some of the potential applications of molecular diagnostics to improve patient outcomes. Molecular diagnostics comes with an advantage that its solution can detect biomarkers at very low concentrations which ultimately leads to enable early disease detection or diagnosis. These tests are affordable and can be done at the point of care. The tests' detection methods include DNA sequencing, microarrays, fluorescent probes, and Fluorescence In-Situ Hybridization.

Infants born to HIV-positive moms have a significant challenge in early diagnosis. Maternal antibodies that cross the placenta can interfere with antibody-based HIV tests for up to 18 months, delaying a definite diagnosis. This delay is especially concerning because such infants have a high death and morbidity rate within the first two years.

Fortunately, qualitative nucleic acid testing has become the predominant method for identifying HIV infection in young infants. These assays directly identify viral components such as HIV pro-viral DNA or RNA, avoiding the problem of maternal antibodies. For instance, one such test is the COBAS AmpliPrep/COBAS TaqMan HIV-1 Qualitative Test. This test requires only 70 µl of whole blood or a dry blood spot and accurately detects specific sections (gag and LTR) of the HIV-1 genome. Rising demand for the use of such tests is adding to the growth of the molecular diagnostics market.

Successful treatment and improved patient survival rate are significantly possible with molecular diagnostics which in turn fosters the molecular diagnostics market growth. Diagnostic biomarkers enable the identification of diseases as earliest possible which further enables and eases the onset of reliable treatment for the diagnosed disease.

Globally in 2020, a WHO-recommended rapid molecular test was utilized as the initial diagnostic test for 1.9 million (33%) of the 5.8 million people newly diagnosed with tuberculosis, up from 28% in 2019. There was significant diversity across countries. Of the 5.8 million people newly diagnosed with tuberculosis worldwide in 2020, 73% had a recorded HIV test result, up from 70% in 2019. Regionally, the largest percentages were attained in the WHO African and European regions.

The growing need for early identification of cancer and infectious disorders drives the demand for more efficient molecular diagnostic techniques. This stimulates research and development efforts for innovative tests capable of detecting diseases earlier and more accurately. The market is seeing an increase in the usage of these new tests in a variety of healthcare settings, from specialized cancer centers to ordinary clinical practices.

Molecular diagnostics has transformed healthcare by allowing for very accurate and sensitive diagnosis of diseases at the molecular level. Recent advances are moving this sector forward, resulting in significant growth in the molecular diagnostics market. Here's a breakdown of major advancements and their influence.

Next-generation sequencing enables parallel analysis of entire genomes or focused gene panels, allowing for more thorough genetic profiling for illness diagnosis, personalized medicine, and drug resistance testing. In addition, digital PCR outperforms classical PCR in terms of sensitivity and precision, allowing for the discovery of uncommon mutations and minimal residual illness. Miniaturizing diagnostic assays using microfluidic chips allows for portable, point-of-care (POC) examinations in decentralized settings, resulting in faster and more accessible diagnostics. Furthermore, CRISPR has enormous potential for disease identification, antimicrobial resistance (AMR) studies, and gene editing for therapeutic purposes.

Examples:

Both cancer and infectious diseases are major threats to world health. The World Health Organisation (WHO) estimates that cancer is the world's second biggest cause of death, while infectious illnesses continue to be a major source of morbidity and mortality, particularly in poor countries. Population aging, lifestyle changes, and the advent of novel infections all contribute to the increasing prevalence of these diseases.

Examples:

Thus, the growing demand for early identification of cancer and infectious disorders is driving the molecular diagnostics market forward. As the demand for accurate and rapid diagnosis develops, we should expect more developments in molecular testing technology to transform healthcare approaches to these difficult health situations.

Global M&A Deals in Molecular Diagnostics

| Date | Acquirer | Target | Country | Deal Value | Revenue of the Target Company (USD Mn) |

| Jul-23 | SD Biosensor | Meridian Bioscience | USA | USD 1.53 Bn | 333 |

| Mar-23 | Werfen | Immucor | USA | USD 2 Bn | 380 |

| Oct-22 | Thermo Fisher | The Binding Site Group | UK | USD 2.6 Bn | 220 |

| Jul-22 | Ginkgo Biowor | Zymergen | USA | USD 300 Mn | 15 |

| Mar-21 | Roche | GenMark | USA | USD 1.8 Bn | 198 |

| Mar-21 | Hologic | Diagenode | USA | USD 159 Mn | 30 |

The global molecular diagnostics market has a dynamic geographical landscape, with varied growth patterns across regions. North America currently dominates the market due to the over-burden of healthcare-associated infections and overuse of antibiotics across the region. The strong existence of some of the prominent market players is another reason for the region’s dominance. In addition, robust research and development, and well-established healthcare infrastructure in countries such as the U.S. and Canada are other major factors driving the North America molecular diagnostics market. In 2021, donor government spending for HIV through bilateral and international channels reached US$7.5 billion. In 2021, the United States remained the top donor to HIV activities, contributing US$5.5 billion and 73% of overall donor government spending. The United Kingdom was the second largest donor (at 5%), followed by Germany (at 3%), the European Commission (at 3%), and France.

Donor Government Funding for HIV, 2020-2021 (USD Million)

| Government | 2020 | 2021 |

| United States | 6,211 | 5,505 |

| United Kingdom | 612 | 385 |

| Germany | 246 | 246 |

| European Commission | 8 | 232 |

| France | 216 | 230 |

| Netherlands | 194 | 197 |

| Canada | 85 | 168 |

| Sweden | 94 | 106 |

| Japan | 258 | 99 |

| Other DAC | 68 | 76 |

| Norway | 41 | 56 |

| Other Non- DAC | 19 | 52 |

| Australia | 22 | 51 |

| Denmark | 41 | 42 |

| Italy | 33 | 31 |

| Ireland | 24 | 26 |

| Total | 8,172 | 7,502 |

On the other hand, Asia Pacific is projected to be the fastest-growing region in the molecular diagnostics market due to rising concerns over antimicrobial resistance (AMR) and increasing hospital-acquired infections. Government initiatives promoting antimicrobial resistance surveillance and rising healthcare expenditure are other factors contributing to the Asia Pacific molecular diagnostics market growth. Furthermore, the growing adoption of rapid diagnostic tests for faster and more accessible diagnostics, and expanding laboratories augment the market growth in Asia Pacific.

(**We also provide cross-sectional analysis in market segments)

By Product Type

By Technology

By Application

By Test Location

By Geography

February 2026

February 2026

February 2026

February 2026