January 2026

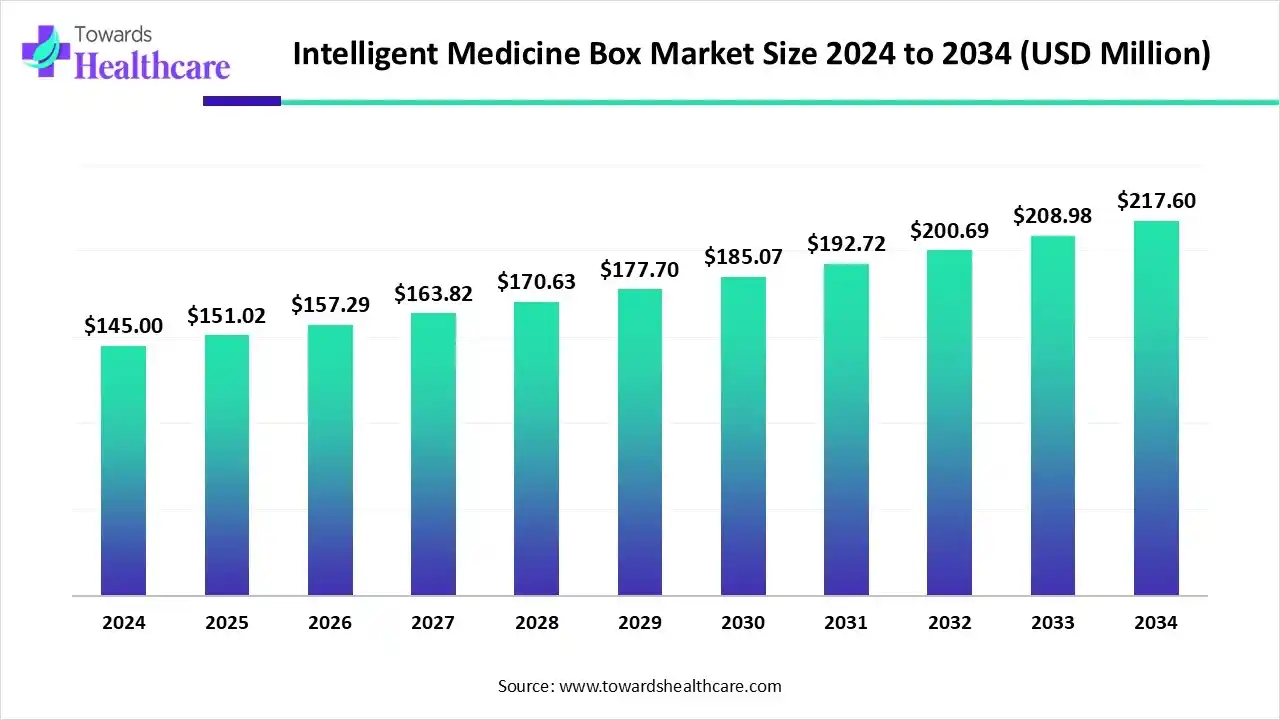

The global intelligent medicine box market size is calculated at US$ 151.02 million in 2025, grew to US$ 157.28 million in 2026, and is projected to reach around US$ 226.79 million by 2035. The market is expanding at a CAGR of 4.15% between 2026 and 2035.

The rising trend of AI, IoT, and biometrics is driven by the urgent need for improved medication management and patient adherence. The global intelligent medicine box market encompasses smart pill boxes, dispensers, hero automatic medication dispenser, MedaCube, DoseTap smart pill box, etc. They feature security, safety, monitoring, reporting, enhanced reminders, and dispensing.

| Table | Scope |

| Market Size in 2026 | USD 157.28 Million |

| Projected Market Size in 2035 | USD 226.79 Million |

| CAGR (2026 - 2035) | 4.15% |

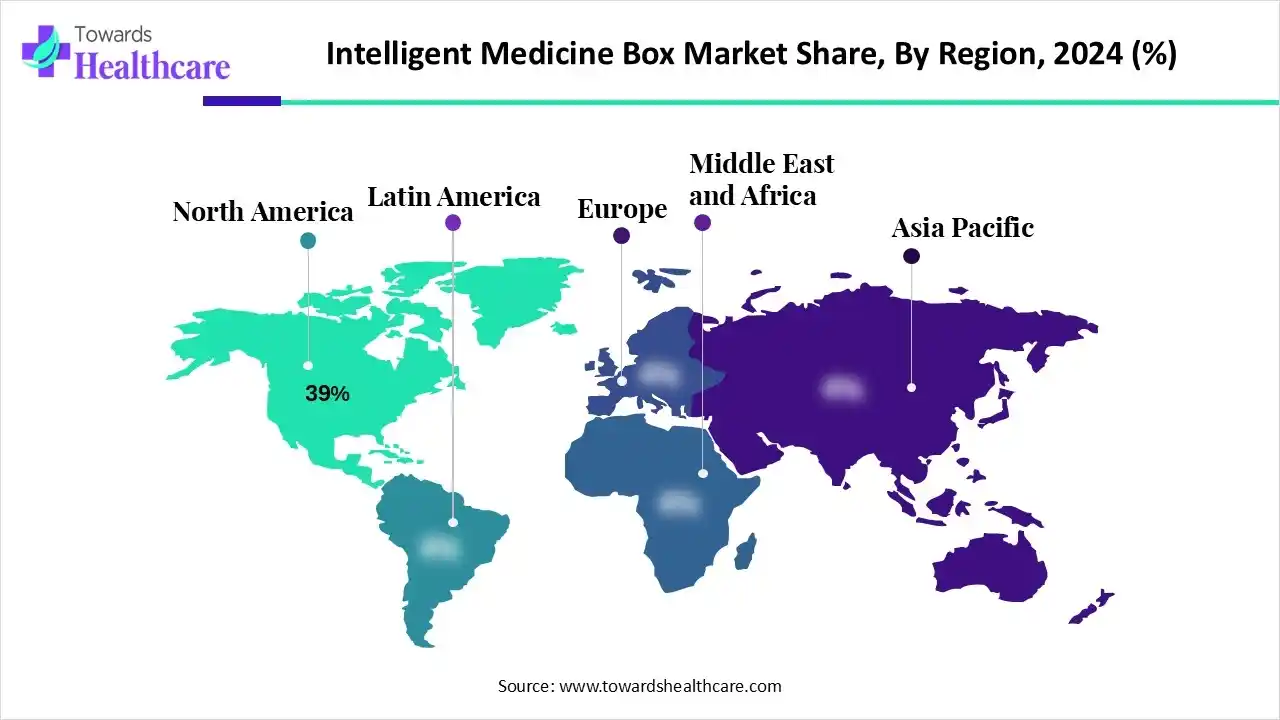

| Leading Region | North America by 39% |

| Market Segmentation | By Product Type, By Connectivity Type, By Application, By End User, By Deployment Mode, By Region |

| Top Key Players | MedMinder Systems, Inc., Philips Healthcare, AdhereTech, Inc., Hero Health, Inc., AiCure, Inc., Vitality Health Technologies, Clever Health Solutions, PillDrill LLC, etectRx, Inc., RxSafe, LLC, iHealth Labs, Inc., Livi Smart Health, SimpleMed+ Solutions, CareAngel Technologies, OtoSense Health, TabTime, Inc., Mobisante, Inc., SmartMed Systems, GlowCaps (Vitality Inc.), CareClinic Health Solutions |

The increased focus on reducing medication errors and costs, and favorable regulatory policies, drives the healthcare industry. The intelligent medicine box market involves the development, manufacturing, and deployment of smart medication management devices designed to improve patient adherence, track dosage schedules, and reduce medication errors. These devices use IoT connectivity, sensors, reminders (audio, visual, or app notifications), cloud platforms, and AI-driven analytics to monitor medication intake in real time. They are widely applied in home healthcare, elderly care, chronic disease management, and hospital outpatient programs. The market is driven by rising chronic disease prevalence, increasing geriatric population, expanding home healthcare adoption, and government initiatives for patient safety and digital health integration.

AI algorithms and AI-powered applications are used to support medical professionals in ongoing research and clinical settings. AI has become an integral part of the digital health systems that shape the future of modern medicine. AI and ML models assist in medical data processing and medical reporting, expanding the intelligent medicine box market.

The smart pill boxes/multi-compartment dispensers segment dominated the market in 2024, with a revenue share of approximately 42%, owing to their core role in medication management and integration within the digital health ecosystem. It facilitates real-time adherence monitoring and connectivity with mobile health applications. It also allows remote therapeutic monitoring and integration with wearable devices.

The integrated mobile app solutions segment is expected to grow at the fastest CAGR in the intelligent medicine box market during the forecast period due to their major assistance with enhanced medication adherence and remote patient and caregiver monitoring. The emerging trends and innovations include AI, ML, personalized medicine, enhanced security, advanced communication, and voice assistance. The health management platforms use AI and IoT to provide proactive, personalized, and secure support for patients and caregivers.

The Bluetooth Low Energy (BLE) segment dominated the market in 2024, with a revenue share of approximately 38%, owing to the urgent need for ensuring security and privacy, and optimizing power consumption. It enables verification, safety features, and supports enhanced user-friendliness. It optimizes power consumption and facilitates remote monitoring by caregivers.

The Wi-Fi/cloud-based systems segment is estimated to grow at the fastest rate in the intelligent medicine box market during the predicted timeframe due to various potential features such as real-time data transmission, remote monitoring, and emergency alerts. These systems allow AI-powered personalization and automated pharmacy decision support. They help to overcome digital infrastructure challenges and enhance security and compliance.

The chronic disease management segment dominated the market in 2024, with a revenue share of approximately 40%, owing to improved medication adherence and enable remote patient monitoring by smart medicine boxes. They enhance patient safety and security, improve overall health, and reduce costs. They prevent medication errors, reduce hospital visits, and help in monitoring and reporting.

The post-operative/rehabilitation care segment is anticipated to grow at a notable rate in the intelligent medicine box market during the upcoming period due to enhanced patient empowerment through a user-friendly interface, reduced caregiver burden, and direct-to-provider communication. It provides intelligent health insights with the help of integrated health monitoring and predictive analytics. It gives real-time updates to caregivers in the form of SMS, mobile applications, or email notifications.

The homecare patients segment dominated the market in 2024, with a revenue share of approximately 45%, owing to the core functions of smart medicine boxes for patient empowerment in the form of automated reminders and user-friendly operations. These smart medical boxes enhance safety and security by tracking expiration dates, giving wrong dose warnings, and preventing unauthorized access. They enable remote monitoring and communication for improved healthcare.

The long-term care/nursing homes segment is predicted to grow at a rapid rate in the intelligent medicine box market during the studied period due to the key roles of smart medicine boxes in automating medication dispensing, enhancing medication adherence, and providing secure and transparent management. They prevent dosing errors, give alerts to patients, and allow remote monitoring. They provide secure access and drive supply management, which is vital in long-term care facilities.

The standalone devices segment dominated the market in 2024, with a revenue share of approximately 48%, owing to the automatic dispensing, audio-visual reminders, scheduled access control, and alerts. They are beneficial for independent living due to improved medication adherence, simplified management, and enhanced safety. They ensure reliability during power outages and protect the users from medication errors.

The cloud-integrated/IoT platforms segment is expected to grow at the fastest CAGR in the intelligent medicine box market during the forecast period due to the importance of smart medicine boxes as a crucial bridge between patients and healthcare providers. These advanced platforms utilize IoT connectivity to enhance safety, medication adherence, and remote monitoring. They facilitate personalized care, analyze large datasets, and ensure data security.

North America dominated the market in 2025, with a revenue share of approximately 39%, owing to AI-driven features, IoT connectivity, mobile health integration, and enhanced connectivity and interoperability. The government supports research and development, drives broad digital health initiatives, and advances the regulatory framework. The funding provided by governments is used for research, which boosts the use of digital health tools. The expansion of digital health infrastructure and data sharing leads to enhanced access to intelligent devices. A regulatory framework focuses on cost reduction and introduces market-based solutions for medication management.

The U.S. government led various intelligent medicine initiatives, such as Operation Smart Medicine, FDA guidance, and the Centers for Medicare & Medicaid Services (CMS) and pharmaceutical benefit managers (PBMs) regulations. The National Institutes of Health (NIH) supports these programs to align with the goals of the "Make America Healthier Again" (MAHA) initiative. They promote technologies to improve the management of medications, particularly for chronic diseases.

The Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by improved electronics manufacturing, advanced medical devices, digital health initiatives, and expanding telemedicine. The Asian Pacific countries are launching government-led digital and smart health initiatives to boost the development and deployment of smart medical technology, like smart medicine boxes.

This region is expected to grow significantly in the global market due to the aging population, rising rates of chronic diseases, increasing demand for remote patient monitoring, and expansion of telemedicine services. The Asian Pacific countries, like China, launched a pilot program that aims to deploy robots in elderly care. Moreover, countries like Hong Kong hold the presence of a government-funded primary care clinic.

In September 2025, the Asia Pacific Medical Technology Association (APACMed) Tech forum united policymakers and global medtech leaders to advance India’s contribution to healthcare excellence.

The Indian government is actively supporting the expansion of the medical technology (MedTech) and digital health sector. Certain developments in India are driven by the Andhra Pradesh BRAIN Program, support for startups, focus on geriatric care, and the growing market. The Indian government planned to support 75 startups in digital health, telemedicine, and AI through a special incentive scheme.

Europe is expected to grow at a notable rate in the market in 2024, driven by increased demand for home care, heightened health consciousness, and digital health programs. The European Union (EU) led certain initiatives such as AI in healthcare, European Health Data Space (EHDS), Digital Europe Program, Digital Health Recommendations, and medical device regulations. Private companies are developing products to address medication adherence, while German health insurers have approved a smart digital drug management and dispensing system.

The EU is promoting a digital-first approach to healthcare, and high-level activities set the framework for their development and integration. The private sector players and individual member states create and implement smart medication technology.

The establishment of a legal and financial framework allows the development, approval, and use of several digital health applications that include smart dispenser functions. Private companies in Germany develop and allow the marketing of smart pill dispensers. The Digital-Gesetz (Digital Act) in Germany has created a legal framework for several digital health solutions.

The R&D process for medical devices, like a smart medicine box, involves device discovery and concept, design and development, verification and validation, regulatory submission and approval, and post-market surveillance.

Key Players: Koninklijke Philips N.V., Becton, Dickinson and Company (BD), Medtronic, Omnicell Inc., Capsa Healthcare, Swisslog Healthcare, etc.

The distribution to hospitals and healthcare facilities encompasses centralized automated dispensing systems, medical and pharmaceutical wholesalers, integrated management systems, and IT-enabled supply chain management.

Key Players: MedMinder, Hero Health, AdhereTech, Capsule Technologies.

They include automated reminders and tracking, remote monitoring and caregiver alerts, enhanced patient safety features, and integration with healthcare services.

Key Players: AdhereTech, MedMinder, Hero Health, Koninklijke Philips N.V., Omnicell, Inc., Tenovi.

By Product Type

By Connectivity Type

By Application

By End User

By Deployment Mode

By Region

South America

Europe

Austria

Asia Pacific

MEA

January 2026

December 2025

December 2025

November 2025