February 2026

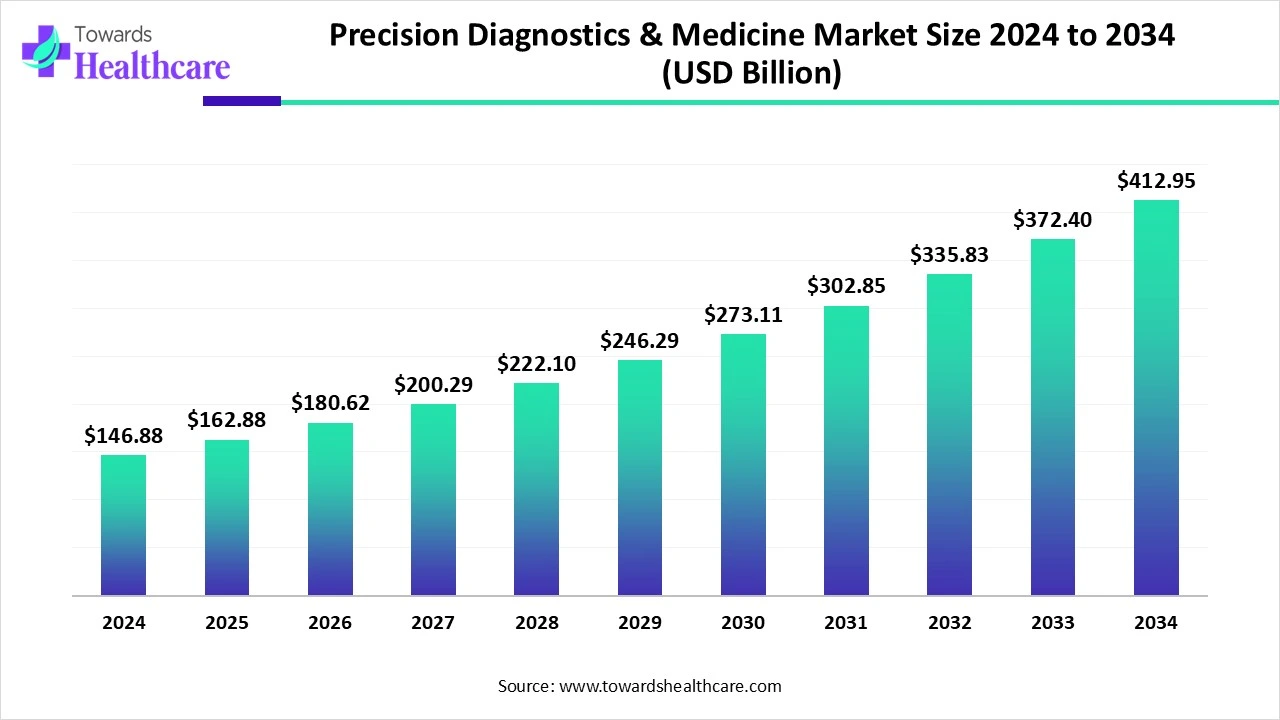

The global precision diagnostics & medicine market size reached USD 162.88 billion in 2025, grew to USD 180.61 billion in 2026, and is projected to hit around USD 457.91 billion by 2035, expanding at a CAGR of 10.89% during the forecast period from 2026 to 2035.

The integration of computer algorithms and precision diagnostics artificial intelligence systems into modern healthcare has made digital healthcare data analysis significant worldwide. Advancements in the clinical applications of precision care, including next-generation sequencing and CRISPR/Cas9 gene editing technologies, expanded the spectrum of genetic testing.

Researchers, physicians, and medical professionals can make informed decisions about medical treatments and medications based on the genetic profile of individuals. NGS and other genetic tests can analyze many datasets regarding patients' health information, which helps to recommend tailored treatment plans to treat various health conditions. This health-related data generated by digital systems helps physicians to precisely diagnose, prevent, and treat any health condition by delivering accurate test results.

The precision diagnostics & medicine market refers to the integrated field of healthcare where diagnostic tests and molecular profiling are used to tailor treatment strategies based on a patient’s unique genetic, environmental, and lifestyle characteristics. Precision medicine spans genomics, proteomics, metabolomics, and digital biomarkers, and aims to predict disease risk, diagnose accurately, and select the most effective treatment, especially in oncology, rare diseases, neurology, and cardiology. Growth is driven by advancements in next-generation sequencing, companion diagnostics, and AI-powered data interpretation.

Artificial intelligence can predict patient outcomes, enhance diagnostic processes, and allow personalization of treatments. AI improves the diagnostic potential of diseases and introduces accuracy and efficiency in disease detection. AI enables tailored medical interventions based on the unique characteristics of patients. The funding from several private equity companies aims to modernize the development of AI models for cancer detection and decision support.

Companion Diagnostics

The companion diagnostics involve the use of in vitro diagnostic devices that help to select the appropriate therapeutic drug. They are applicable to cancer diagnosis, primarily breast cancer, and many other therapeutic interventions. They encompass molecular biological testing such as polymerase chain reaction, next-generation sequencing, liquid biopsy technologies, gene sequencing, and in situ hybridization. They are approved and regulated by the U.S. Food and Drug Administration and the European Medicines Agency. They ensure the safety and efficacy of drugs or biologics by screening the correct patients for treatments.

What Challenges are Faced in Presenting Precision Medicine to Patients?

There can be variations in the practicals and protocols of many hospitals and institutions that prefer to use their own methodologies. It becomes difficult to gather a vast amount of data from diverse healthcare systems. The implementation of different techniques hinders access to complex and novel diagnostic technologies.

What are the Potential Benefits of the Healthcare System?

The implementation of diagnostics in the clinical workflow presents several benefits in terms of standardized protocols and access to patients. The digital applications can collect real-world evidence and measure patient outcomes in real life to plan treatments accordingly.

| Metric | Details |

| Market Size in 2026 | USD 180.61 Billion |

| Projected Market Size in 2035 | USD 457.91 Billion |

| CAGR (2026 - 2035) | 10.89% |

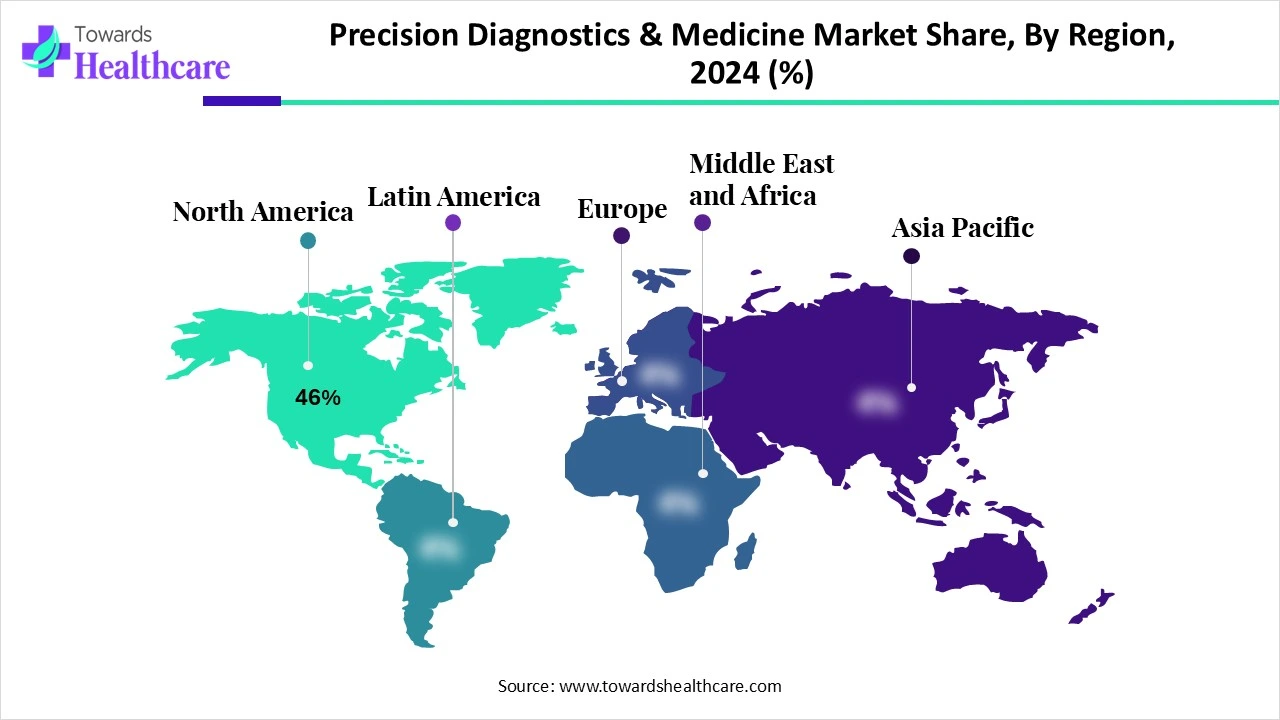

| Leading Region | North America Share 46% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Technology, By Product & Service, By Application, By End User, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific, Roche Diagnostics, Qiagen N.V., Guardant Health, Exact Sciences, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, F. Hoffmann-La Roche Ltd., 23andMe, Invitae Corporation, Myriad Genetics, Color Health, Natera, Inc., Tempus Labs, Caris Life Sciences, Genomic Health, NeoGenomics Laboratories, Strata Oncology |

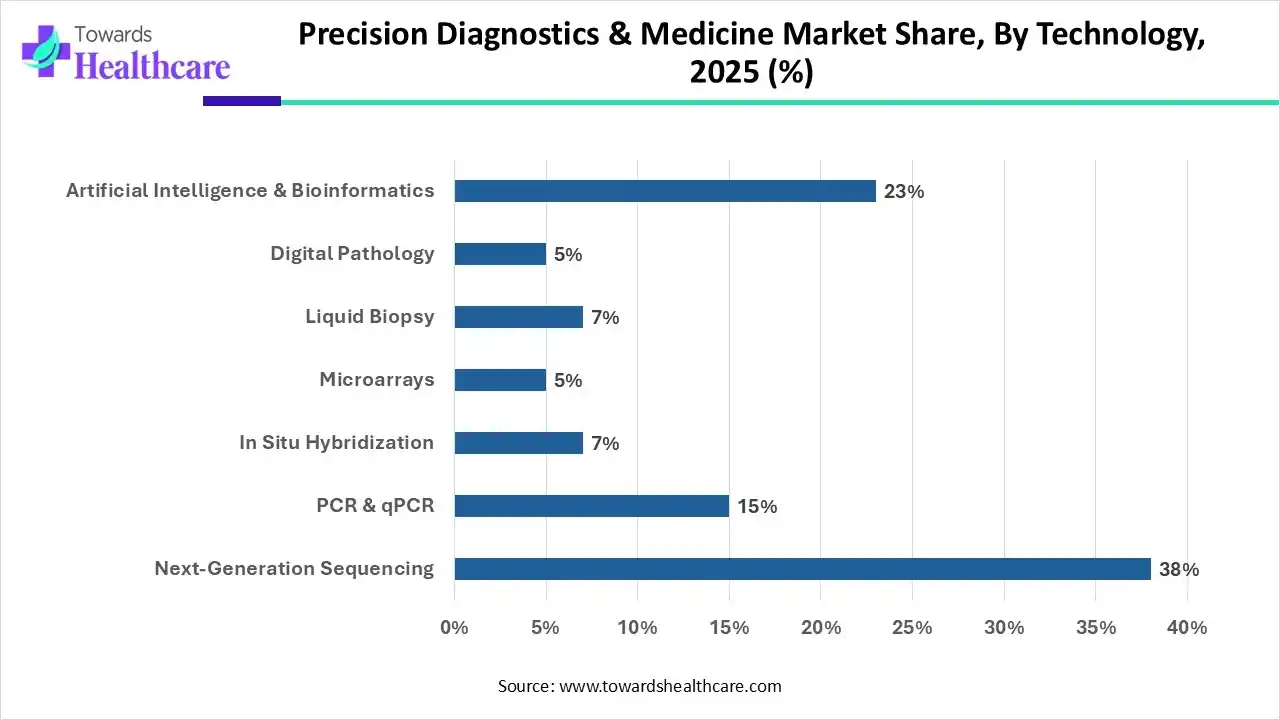

How does the Next-Generation Sequencing (NGS) Segment Dominate the Precision Diagnostics & Medicine Market in 2025?

The next-generation sequencing segment dominated the market by 38% in 2025, owing to the advantages of NGS over traditional methods. The NGS offers high-throughput, cost-effectiveness, speed, data resolution, versatility, and accuracy. It allows the detection of rare genetic variants, which are the principal driving forces behind genetic mutations, cancer, or any diseased. NGS has expanded across agriculture, ecology beyond research and medicine. It is applicable in plant breeding programs to help breeders select plants and desired traits having resistance to adverse conditions and improved crop yield potential. NGS contributes to tracking pathogens and invasive species to manage disease outbreaks and protect ecosystems.

The liquid biopsy segment is expected to grow at the fastest CAGR during the forecast period due to its promising impact in the oncology field. Liquid biopsies revolutionized cancer research by providing deep insights into the diagnosis, prevention, monitoring, and treatment of cancer. The leading companies, like Thermo Fisher Scientific, provide end-to-end workflow solutions in oncology research that enable applications of liquid biopsies. They are linked to strong sample preparation tools and automated technologies to drive accurate results in cancer care.

How did the Diagnostic Kits & Assays Segment Dominate the Precision Diagnostics & Medicine Market in 2025?

The diagnostic kits & assays segment dominated the precision diagnostics & medicine market by 43% in 2025, owing to the increased focus on reduced trial and error in treatment selection. These kits and specific assays help to specify targeted therapies for specific disease subtypes. They help clinicians to track disease progression and treatment response in patients. These tools and techniques are widely applicable to making advancements in drug development and clinical trials. They ensure streamlined clinical trials through the development of companion diagnostics. Pharmaceutical companies use these assays to identify potential drug targets and design tailored targeted therapies.

The data interpretation software & AI tools segment is expected to grow at the fastest CAGR in the market during the forecast period due to the potential of AI algorithms in analyzing complex medical data, including laboratory test results, patient records, imaging scans like X-rays, MRI, and CT scans. AI-powered predictive analytics helps clinicians identify the potential for developing risks to patients that will drive proactive and preventative interventions. AI is involved in the automation of routine administrative tasks such as billing, record management, and appointment scheduling. This software and AI tools enable enhanced data analysis, better patient experience, and improved patient engagement.

| Segment | Share 2025 (%) |

| Oncology | 52% |

| Rare & Genetic Diseases | 12% |

| Infectious Diseases | 10% |

| Cardiology & Metabolic Disorders | 8% |

| Neurology | 7% |

| Preventive & Wellness Screening | 11% |

What made Oncology the Dominant Segment in the Precision Diagnostics & Medicine Market in 2025?

The oncology segment dominated the precision diagnostics & medicine market by 52% in 2025, owing to the shift of medical systems towards the prevention of diseases. The implementation of precision technologies in cancer care helps to avoid adverse drug reactions and increases patient adherence to treatments. Precision oncology is the best way to find, diagnose, and treat cancer. It is the future of oncology research and cancer treatment due to faster clinical trials, market reach of new drugs, and more efficient treatments. It increases the accessibility of life-saving drugs to cancer patients who need them. Many cancer patients can receive targeted therapy from the beginning and can recover more quickly.

The cardiology & metabolic disorders segment is expected to grow at the fastest CAGR during the forecast period due to improved diagnostic accuracy and early detection of health conditions. Patients can receive personalized treatment and management with the help of a key aspect of precision medicine called pharmacogenomics. It is potentially possible to enhance understanding of novel therapeutic targets and disease mechanisms. Precision diagnostics are more cost-effective than traditional imaging techniques, which reduces the need for expensive and invasive procedures.

How does the Hospitals & Diagnostic Laboratories Segment Dominate in the Precision Diagnostics & Medicine Market in 2025?

The hospitals & diagnostic laboratories segment dominated the market by 48% in 2025, owing to more accurate and timely diagnosis. These healthcare systems can experience enhanced efficiency and streamlined workflows. They focus on developing specialized services and expertise with optimal utilization of resources, research, and data-driven decision-making. AI and machine learning optimize testing processes in laboratories, reduce human error, and deliver accurate test results. Advanced technologies such as mass spectrometry, positron emission tomography, computed tomography, etc., play a major role in precision diagnostic laboratories. These healthcare services deliver psychological and emotional benefits by empowering families of patients with medical knowledge.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR in the precision diagnostics & medicine market during the forecast period due to improved clinical trial efficiency, enhanced drug efficacy, and safety. The biopharmaceutical companies are leveraging cutting-edge technologies like NGS, digital biomarkers, AI, machine learning, etc. They are focusing on data-driven insights through multi-omics profiling, advanced analytics, and real-world data analysis. The collaborative efforts and strategic investments can overcome challenges in the personalized medicine market.

North America dominates the precision diagnostics & medicine market share by 46% in 2025, owing to genomic research, biomarker discovery, and sequencing technologies. The U.S. FDA is strengthening its presence by encompassing databases, bioinformatics tools, and regulatory standards. It focuses on making a healthy America and the world by giving funding assistance to molecular biology research and innovations. The U.S. FDA and the EMA support new collaborations between biopharmaceutical companies and research institutes. They drive advancements in genetic testing by providing accuracy, efficiency, and precision in test results.

The U.S. FDA supports digital diagnostics, over-the-counter, and point-of-care tests. It also drives in vitro diagnostic tests, which are also crucial in pandemic and epidemic situations. The Precision Medicine Initiative, introduced by President Obama, is an extensive research effort to revolutionize medical treatments and healthcare.

Asia Pacific is expected to grow at the fastest CAGR in the precision diagnostics & medicine market during the forecast period due to supportive genomics initiatives, large patient populations, and the rise of local diagnostic startups in countries like China, India, and Japan. In September 2024, the U.S., India, Japan, and Australia announced the launch of the Cancer Moonshot Initiative to reduce the prevalence of cancer in the Indo-Pacific. There is great potential in India’s healthcare sector to generate employment opportunities with the expansion of businesses and investments. The various systems, including health insurance, hospitals, infrastructure, pharmaceutical and biotechnology companies, etc., encompass the healthcare industry in Asian Pacific.

The Ministry of Health and Family Welfare has taken initiatives to establish advanced research and diagnostic laboratories. In February 2025, the Ministry of Science & Technology reported an increase in the Indian economy from US$ 10 billion to $130 billion under the Prime Minister’s leadership, who aims to raise it to US$ 300 billion. The National Research Foundation plays a major role in funding next-generation research in personalized medicine and genomics.

By Technology

By Product & Service

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026