February 2026

The global ready-to-use pharmaceutical packaging market size is calculated at USD 10.4 in 2024, grew to USD 11.15 billion in 2025, and is projected to reach around USD 20.97 billion by 2034. The market is expanding at a CAGR of 7.24% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 11.15 Billion |

| Projected Market Size in 2034 | USD 20.97 Billion |

| CAGR (2025 - 2034) | 7.24% |

| Leading Region | North America |

| Market Segmentation | By Container Type, By End Use, By Region |

| Top Key Players | Gerresheimer AG, West Pharmaceutical Services, Schott AG, Stevanato Group, AptarGroup, SGD Pharma, Datwyler, Nipro Corporation, Berry Global |

For the packaging and filling of pharmaceuticals, as a substitute for the conventional bulk primary packaging, the use of ready-to-use (RTU) packaging is increasing. Their advantages, such as pre-sterilized or pre-treated container-closure systems, contribute to this rise. Furthermore, they also enhance the filling efficiency, flexibility in small-batch production, and the safety of the products, so they are becoming a preferred choice for pharmaceuticals. Moreover, new developments are also being conducted to increase their flexibility in operational protocols. Thus, the use of ready-to-use containers and closure systems is expected to streamline the pharmaceutical fill-finish operations.

The use of AI in revolutionizing the pharmaceutical packaging sector. With the help of AI or robotics, the efficiency and accuracy of ready-to-use pharmaceutical packaging processes are enhanced. This, in turn, also contributes to the increased safety and affordability. At the same time, the use of AI makes it easier and faster to improve the product quality in compliance with the regulatory standards, which in turn amplifies the approval process, resulting in benefiting the industry and consumers. Furthermore, with the increasing application of AI and robotics, new transformations in ready-to-use pharmaceutical packaging are expected in the future.

Growing Needs for Drug Safety

Due to the increasing use of various drug products, the demand for the use of ready to use pharmaceutical packaging is increasing. At the same time, contamination caused during the production process can also be reduced with the use of this packaging. This, in turn, increases their use the highly sensitive drugs such as biologics or injections. Furthermore, they also offer a prefilled solution that helps in enhancing the accurate dosing of the drugs. Moreover, the safety of the medications is improved with the help of ready-to-use pharmaceutical packaging. Thus, all these factors drive the ready-to-use pharmaceutical packaging market growth.

High Prices

The equipment used in the production of ready-to-use pharmaceutical packaging materials is highly sophisticated. This, in turn, increases the cost required in their production. Similarly, the materials used are expensive. Moreover, maintaining sterility as well as continuous testing also adds to the cost. Thus, all these factors make ready-to-use pharmaceutical packaging expensive.

Increasing Use of Advanced Medications

The growing incidence of diseases is increasing the demand for the use of advanced treatment approaches. Thus, the use of advanced medications is increasing the use of ready-to-use pharmaceutical packaging to enhance the safety of the medication. Furthermore, the dose control provided by these packaging solutions also contributes to their growing demand. At the same time, it also maintains the stability of the sterile products. Furthermore, they comply with the regulations laid by regulatory bodies, which in turn, makes them a preferred choice. Thus, this promotes the ready-to-use pharmaceutical packaging market growth.

For instance,

The sterile vials segment, by container type, held the major share in the market in 2024. The sterile vials provided protection, stability, as well as dose control to various biologics or vaccines used by injection. This, in turn, contributed to the market growth.

The fastest growth is expected by the sterile syringes segment under the container type during the forecast period. The use of sterile syringes is growing due to their accurate dosing control and sterilized conditions, which reduce the risk of contamination. Furthermore, this enhances the convenience as well as patient outcomes.

By end user, the glass segment led the market in 2024. The use of glass for various injectables enhanced their use. At the same time, due to no reactivity with the drugs, it was the preferred option for ready-to-use packaging. This promoted the ready-to-use pharmaceutical packaging market growth.

By end user, a significant growth is expected in the plastic segment in the forecast period. The use of plastic is increasing due to its advantage of being lightweight. Furthermore, they can be moulded in different shapes and sizes easily, as well as are affordable, which contributes to their growing use in the market.

North America dominated the ready-to-use pharmaceutical packaging market in 2024. North America consisted of well-established industries. These pharmaceutical industries enhanced the development of new packaging solutions. This, in turn, contributed to the market growth.

The industries in the U.S. are focusing on the development of new materials as well as the application of ready-to-use pharmaceutical packaging. This, in turn, increases the number of collaborations between them. This is further supported by the government.

Due to the rising use of ready-to-use packaging in various drug products, the development as well as production of these products have increased. At the same time, the use of technologies is enhancing their applications.

Asia Pacific is expected to host significant growth in the ready-to-use pharmaceutical packaging market during the forecast period. The healthcare sector in Asia Pacific is advancing with the adoption of new technologies as well as skilled personnel. This, in turn, increases the demand for the use of ready-to-use packaging solutions. This enhances the market growth.

The industries in China are developing various ready-to-use pharmaceutical packaging solutions. At the same time, due to their rising use in hospitals, the industries are utilizing new technologies to meet these rising demands, as well as to improve their applications.

The healthcare sector in India is developing, which in turn increases the use as well as the demand for ready-to-use pharmaceutical packaging solutions. At the same time, the rising use of biologics also enhances their use.

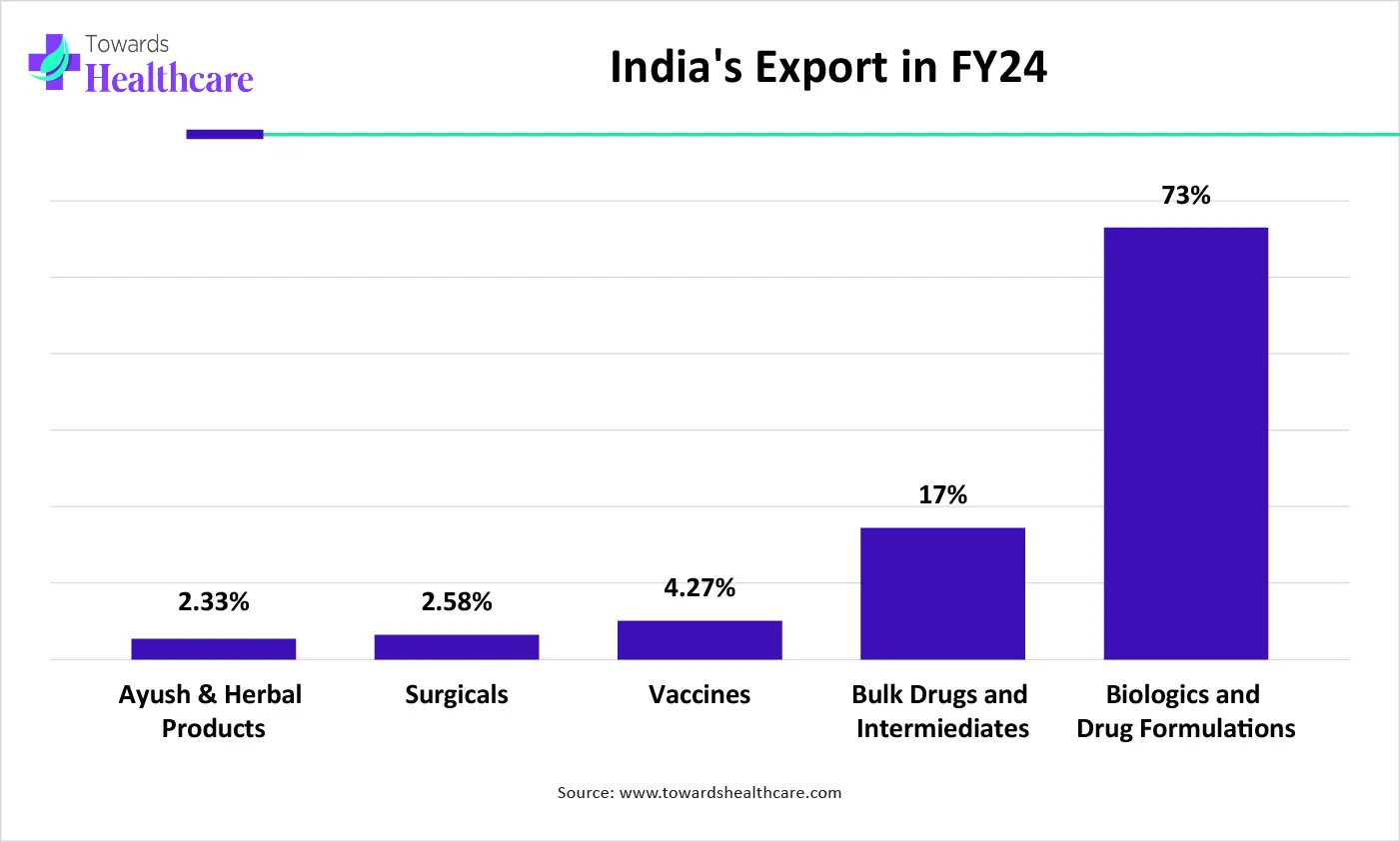

The graph represents the total percentage of pharmaceutical products exported from India in FY 24. It indicates that there is a rise in the export of biologics. Hence, it increases the demand for new ready-to-use pharmaceutical packaging solutions for safe and efficient export. Thus, this in turn will ultimately promote the market growth.

Europe is expected to show lucrative growth in the ready-to-use pharmaceutical packaging market during the forecast period. Due to rising diseases, the use of biologics is increasing in Europe. This, in turn, increases the demand for ready-to-use pharmaceutical packaging solutions, promoting the market growth.

The use of ready-to-use pharmaceutical packaging solutions is increasing in Germany due to their reliability. Furthermore, this increases their production, which in turn leads to rising collaboration between companies.

In the UK, due to growing diseases, the use of ready-to-use pharmaceutical packaging is increasing. At the same time, new packaging solutions in compliance with the regulations of regulatory bodies are also being developed.

By Container Type

By End Use

By Region

February 2026

February 2026

February 2026

February 2026