January 2026

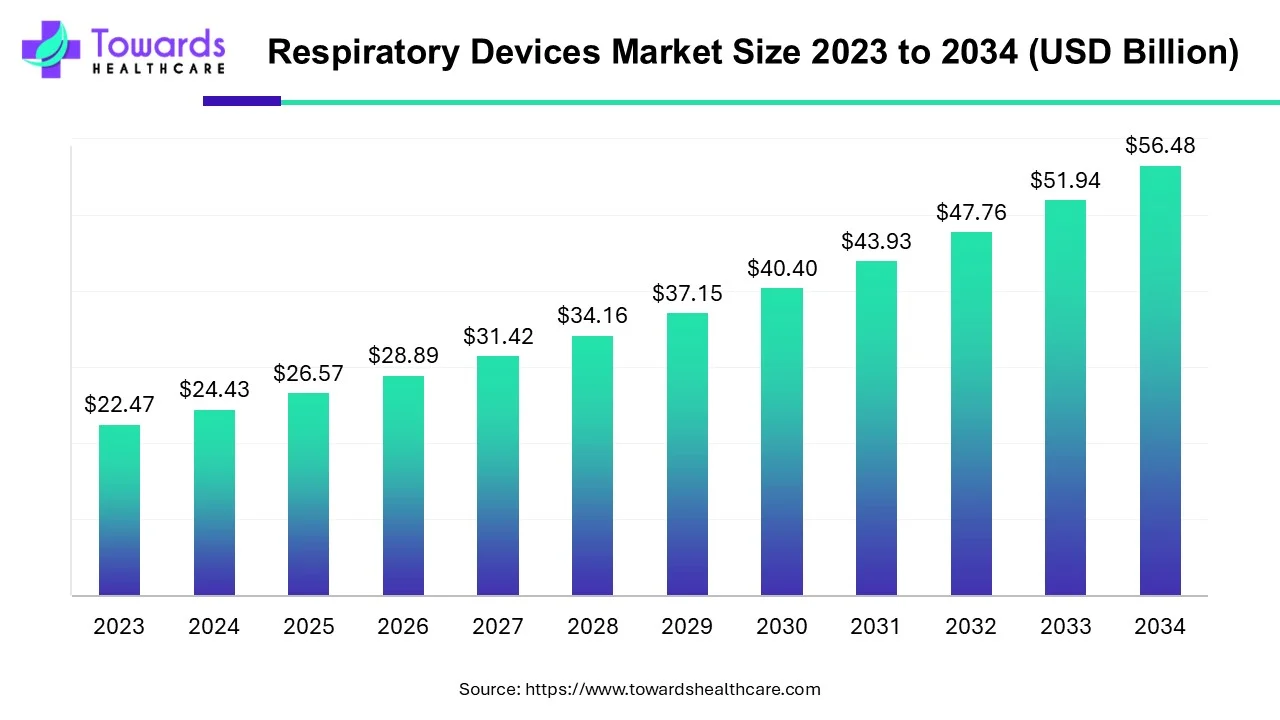

The respiratory devices market is anticipated to grow from USD 26.57 billion in 2025 to USD 56.48 billion by 2034, with a compound annual growth rate (CAGR) of 8.74% during the forecast period from 2025 to 2034, because rising prevalence of respiratory disorders.

Over several years, the quality of respiratory drugs has been impressively leveled up and there is an extensive range of respiratory disorders that can be benefited from such advanced devices. Respiratory tools aid in the elimination of mucus from the respiratory tract as well as the enhancement of pulmonary functions. Numerous devices are easy to use and provide the user with more flexibility than they would otherwise have. The emphasis on respiratory devices and quality of life has increased dramatically, particularly since the COVID-19 Pandemic. Although there exists a lot of unknowns for people.

Choosing the best device for individuals' specific medical conditions may be a bit hard. An individual suffering from chronic lung disease may require an entirely different respiratory device than an individual suffering from other respiratory diseases. However, the use of advanced technology and the availability of a variety of products have made it easier. Some of the respiratory devices include nebulizers, air cleaners, suction machines, portable oxygen cylinders, pulse oximeters, portable emergency oxygen systems, home oxygen concentrators, and others.

Artificial intelligence (AI) can revolutionize respiratory devices, enhancing efficiency and accuracy. AI introduces automation in respiratory devices, thereby continuously monitoring patient data such as respiratory patterns and blood gas levels. The advent of digital displays in respiratory devices enables accurate dosing of drugs and combat the entry of medications after a certain dose. AI can adjust ventilation parameters in real-time, ensuring respiratory support. AI and machine learning (ML) enable personalized treatments based on a patient’s medical history. Thus, AI and ML can transform healthcare by delivering new and essential insights from the vast amount of data generated during the delivery of healthcare.

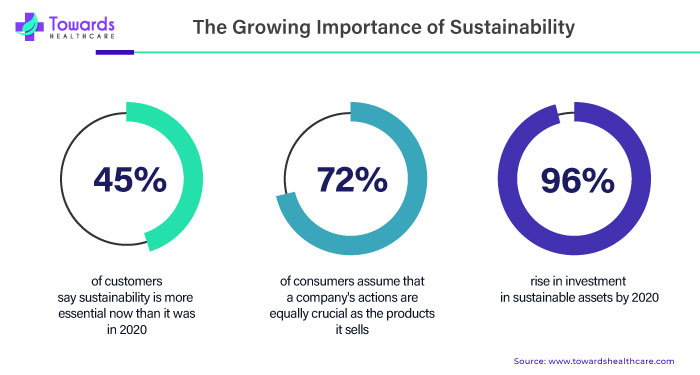

Sustainability should be a top priority for MedTech. The global healthcare sector accounts for around 4.4% to 5% of the total greenhouse gas emissions. It is estimated that climate change will lead to an additional 250,000 people dying annually from 2030 to 2050. Hence, numerous MedTech companies take measures to reduce carbon impact on the environment.

As devices encompass more digital and electronic items, waste issues expand beyond single-use plastics and evolve into increasingly serious ones. From production methods to packaging and product recycling in the the final year of their shelf life, there are numerous fields where MedTechs can concentrate on lowering not only CO2 but also the wider environmental impacts of their goods.

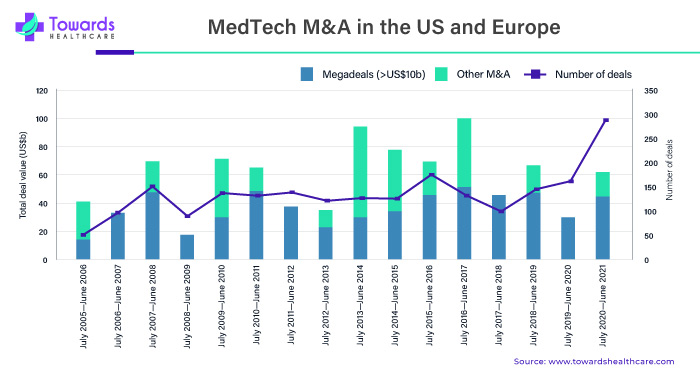

"MedTechs are making substantial investments in distant medical capacities. Baxter agreed to buy connected care specialist Hillrom for $10.5 billion in September 2021. Patients constantly desire to get medical treatment at their residence or nearby," CEO Jose (Joe) Almeida told Ernst & Young LLP, "whereas medical facilities and other healthcare facilities are turning to digital health tools to broaden accessibility, enhance effectiveness, and reduce costs." Baxter and Hillrom have joined forces to address the challenges of a constantly shifting global healthcare landscape.

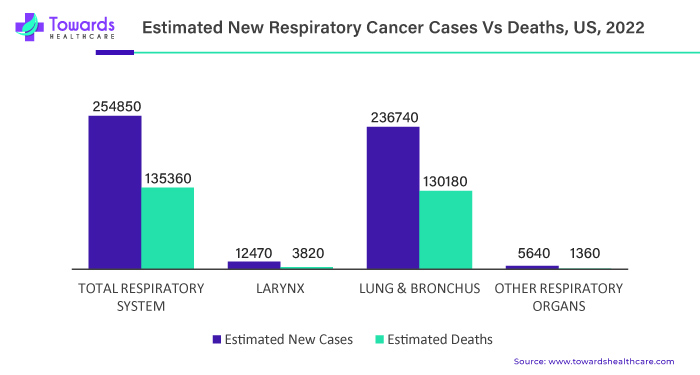

Rising cases of respiratory disorders such as respiratory cancers, asthma, COPD, tuberculosis, and others across the globe are prominently generating demands for respiratory devices, which ultimately results in the respiratory devices market growth. Here are some of the facts related to the respiratory disorders:

In addition, rising tobacco smoking, air pollution, and allergens are some of the major risk factors that are resulting in respiratory disease conditions. Tobacco smoking is considered one of the world’s largest health problems. According to the WHO, more than 8 million people globally die from tobacco use annually. Thus, rising tobacco consumption and air pollution result in severe respiratory health conditions and increases the demand for the respiratory device, which in turn bolsters the respiratory devices market growth.

The high cost associated with advanced respiratory devices such as oxygen concentrators, ventilators, continuous positive airway pressure (CPAP) machines, and several others acts as a barrier to the growth of the respiratory devices market. As a result of the high cost of product, it limits the extensive adoption of such devices especially in medical facilities with low resources.

In cases of severe respiratory distress, including in patients undergoing surgeries requiring general anesthesia or patients with acute respiratory distress syndrome (ARDS) ventilators are essential life-supporting tools. These exhaustive devices can be highly expensive. On top of it, for proper operation and patient safety, ventilators need routine maintenance, calibration, and servicing. The price of maintenance agreements, replacement parts, and certified technicians also increases the overall cost of the device, which in turn hinders market growth. During the COVID-19 pandemic, there was a massive increase in the demand for ventilators.

As a result, the cost of mechanical ventilators—basic but effective equipment—rose sharply, from an average of $25,000 to more than $50,000. Several countries with limited healthcare facilities and low medical budgets suffered from an insufficient number of ventilators due to their high costs. In addition, Obstructive sleep apnea is a breathing disorder that is frequently treated with continuous positive airway pressure (CPAP) machines. CPAP machines can be expensive, especially for patients without medical coverage, despite being less expensive than ventilators. The price includes the CPAP machine itself, as well as filters, masks, and, hoses. CPAP machines also require routine maintenance and eventually need to be replaced, which further increases the overall cost of the device.

Some of the product’s offerings by some major market players are listed in the table given below:

| Company | Products |

| Olympus Corporation |

|

| Medtronic |

|

| GE HealthCare |

|

| Koninklijke Philips N.V. |

|

By type, the therapeutic devices segment held a dominant presence in the market in 2024. Some common types of therapeutic respiratory devices include airway management devices, ventilators, inhalers, and nebulizers. Different types of therapeutic devices have different conditions and are used depending on a patient’s condition. Inhalers are used to directly deliver drugs to the lungs. A positive airway pressure machine is used to treat sleep apnea by delivering a constant stream of air pressure. Advancements in technology and the rising prevalence of respiratory disorders augment the segment’s growth. The development of novel drug delivery systems also supports the segment’s growth.

By type, the diagnostic & monitoring devices segment is predicted to witness significant growth in the market over the forecast period. Respiratory devices such as spirometers and oximeters are also used for monitoring the breathing conditions of patients. Favorable government policies for screening and early detection of respiratory diseases promote the segment’s growth. The U.S. government launched the “Healthy People 2030” initiative to increase the prevention, detection, and treatment of respiratory disorders, owing to the presence of 25 million cases of asthma in the U.S.

By application, the sleep apnea segment held the largest share of the market in 2024. The rising prevalence of sleep apnea and growing awareness of its treatment propel the segment’s growth. Approximately 425 million individuals worldwide have moderate-to-severe obstructive sleep apnea. Most of the cases are undiagnosed, hence, several government agencies are increasing awareness among the general public for its detection and treatment. Continuous positive airway pressure (CPAP) machine is the most commonly used respiratory device for sleep apnea patients.

By application, the COPD segment is expected to grow at the fastest rate in the market during the forecast period. The prevalence of COPD is rising due to air pollution and the increasing use of smoking and tobacco use. It is also the third leading cause of death globally. Respiratory devices like inhalers, nebulizers, and positive expiratory pressure devices are widely used. Technological advancements such as AI and ML have led to the latest innovations in respiratory devices for COPD patients.

By end-user, the hospital & ASCs segment led the global market in 2024. The segmental growth is attributed to suitable infrastructure, the presence of trained professionals, and favorable reimbursement policies. Hospitals provide all the necessary facilities and state-of-the-art treatment due to the availability of suitable capital investment. They are also part of clinical trials that provide access to novel devices before market approval.

By end-user, the specialty clinics segment is anticipated to show lucrative growth in the market over the coming years. The presence of specialized equipment and skilled professionals drive the segment’s growth. Specialty clinics provide affordable diagnosis and treatment. The increasing number of specialty clinics due to the rising prevalence of respiratory disorders also contributes to the segment’s growth.

North America dominated the respiratory devices market due to the robust healthcare infrastructure, the presence of prominent market players, and rising healthcare expenditure. Regulatory bodies such as the US FDA are engaged in establishing regulatory guidelines for producer planning to validate and market their respiratory or any other medical devices. For instance, in March 2023, the FDA recommended two guidelines for transitioning from specific COVID-19 pandemic regulations and activities to standard operations.

In addition, medical device manufacturers in North America are increasingly introducing innovative products and establishing strategic partnerships to boost productivity. For instance, in August 2023, GE Healthcare received approval from the US FDA for their “Portrait Mobile Wireless Solution” that continuously captures a patient’s respiratory rate. On the other hand, GE Healthcare in March 2020, partnered with Ford Motor Company, to speed up ventilator production — an effort intended to provide doctors with critical medical equipment for treating patients with COVID-19, a respiratory disorder caused by the new coronavirus.

Furthermore, Asia Pacific is projected to be the fastest-growing region in the respiratory devices market over the forecast period. Market players across the region are developing advanced solutions in the respiratory field. For instance, in February 2023, Olympus a Japanese medical device manufacturer received FDA approval for their single-use sinus debrided system CELERIS, which is used in sinus/rhinology procedures. Moreover, enhanced access to healthcare, contract-based manufacturing, swift technological advancements, rising R&D capacity, and government initiatives such as 100% foreign direct investment & schemes for medical device manufacturing in countries like India are crucial factors gaining traction in the respiratory devices market.

In an attempt to promote the implementation of technology in healthcare, the Chinese government executed 5G Telecom Adoption and eHealth rules (e-Hospital and e-Diagnostic). The country will keep up with its data utilization and availability policies, as well as inspire corporations to collaborate closely with SMEs. The medical device marketplace in Australia has matured, with significant growth in digital health devices and techniques incorporating modern components, IT robotics, imaging, design, and adaptive diagnostic technology platforms.

Colin Reisner, CEO and Co-founder of DevPro commented that an albuterol inhaler urgently needs to be developed that reduces environmental impact while maintaining its efficacy in treating respiratory conditions. The company partnered with Honeywell to develop this device. He also said that the supplier relationship with Honeywell for low-carbon propellant alternatives would accelerate the development of that product.

By Type

By Application

By End-User

By Region

January 2026

January 2026

January 2026

January 2026