February 2026

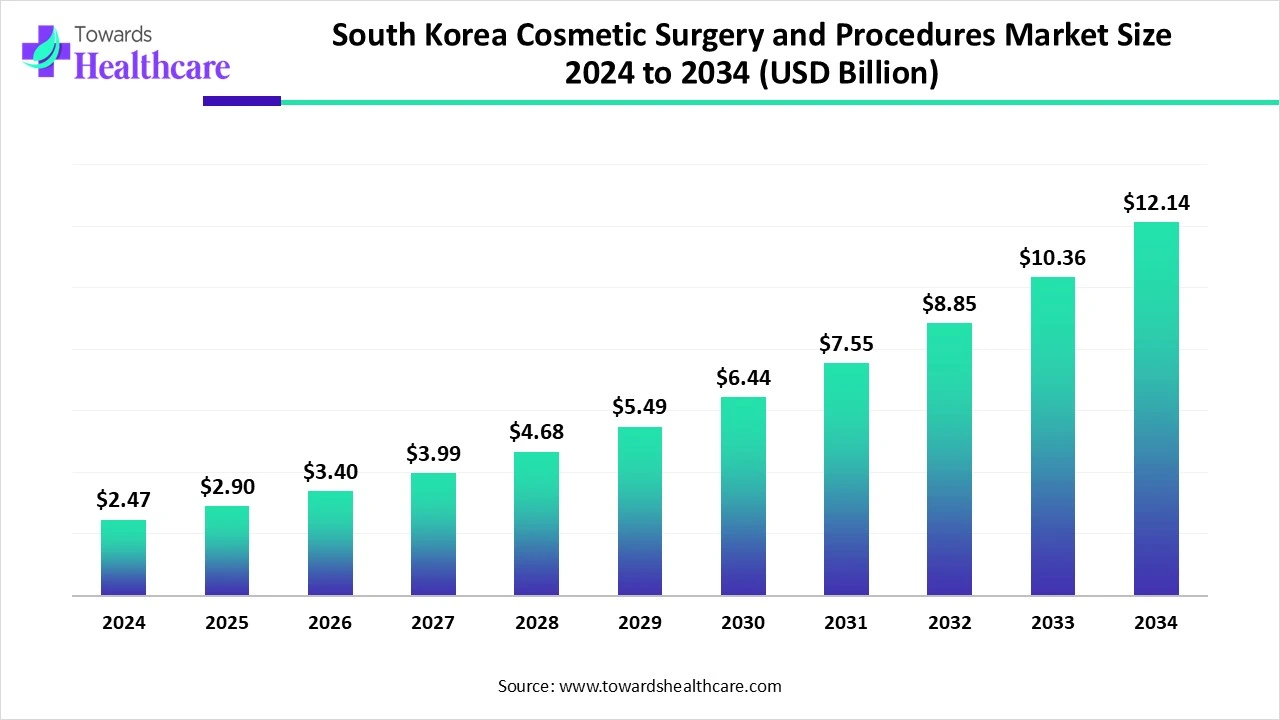

The global South Korea cosmetic surgery and procedures market size is calculated at USD 2.47 in 2024, grew to USD 2.9 billion in 2025, and is projected to reach around USD 12.14 billion by 2034. The market is expanding at a CAGR of 17.23% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.9 Billion |

| Projected Market Size in 2034 | USD 12.14 Billion |

| CAGR (2025 - 2034) | 17.23% |

| Market Segmentation | By Procedure Type, By Age Group, By Gender |

| Top Key Players | Evolus Inc., AbbVie Inc., RevanceGalderma, Cynosure, Syneron Candela, Alma Laser, Lumenis, Airsculpt Technologies, Inc., Solta Medical |

A large number of people are undergoing various cosmetic surgeries in South Korea. Depending upon the capital basis, Korea ranks first, with 13.5 cosmetic procedures performed per 1000 individuals as per the International Society of Aesthetic Plastic Surgery (ISAPS). But these numbers represent the surgeries conducted by the aesthetic plastic surgeons and not general practitioners, which indicates that the actual surgeries conducted may be higher. This, in turn, attracts people worldwide, enhancing medical tourism. Thus, the rising cosmetic surgeries increases the research conducted in this field as well.

AI can be used in various processes in the South Korea cosmetic surgery and procedure market. With the help of AI, accurate and quick outcomes can be predicted by assessing medical images, which will help doctors during consultations. The surgical designs can be enhanced by detecting the complications involved with the procedure. This, in turn, minimizes human errors, costs, and improves patient safety. Therefore, AI can be used in new research that improves the procedures and allows plastic surgeons to harness the power of AI with high standards of patient care. Thus, AI is helping to reshape cosmetic surgeries in unimaginable ways.

Rising Awareness

Due increasing use of social media or any other online platform, the awareness about the Korean beauty standards as well as cosmetic surgeries is increasing. At the same time, the safety and potential outcomes of these cosmetic surgeries drive the demand. Moreover, the rising use of non-invasive techniques is also attracting people. Therefore, all these factors encourage people to carry out various cosmetic surgeries, which in turn, enhance their appearances. Thus, all these factors drive the South Korea cosmetic surgery and procedures market growth.

Risk of Complications

Cosmetic surgeries, which use invasive techniques, have a higher risk of scarring, infections, swelling, etc., which can lead to dissatisfaction among clients. Furthermore, the risk of failure in the surgeries can also lead to negative results. Thus, all these factors limit the use of South Korean cosmetic surgery and procedures.

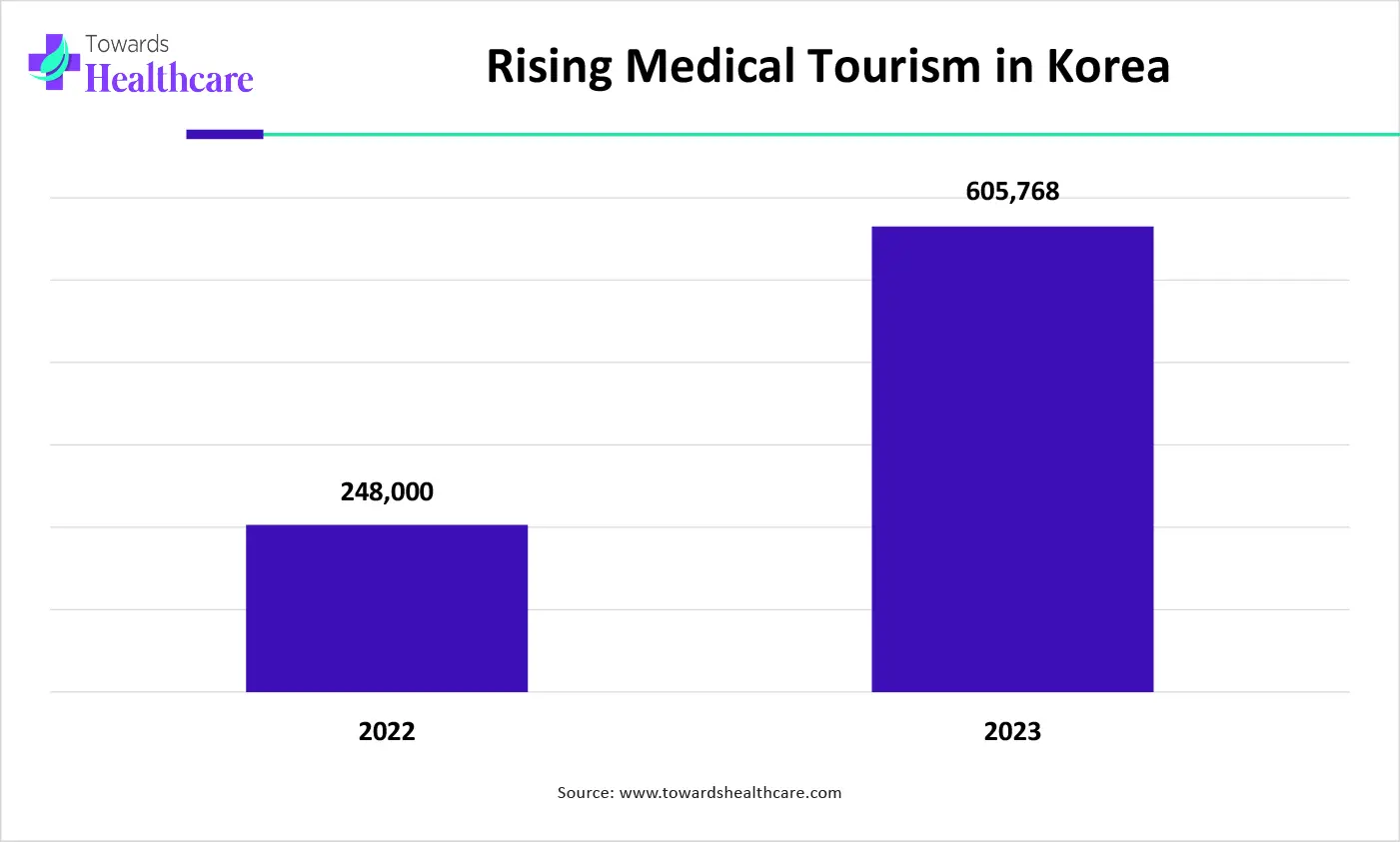

Increasing Medical Tourism

South Korea uses various new technologies as well as skilled personnel for delivering high-quality cosmetic surgeries. Hence, this, along with the rising awareness, increases the medical tourism in South Korea. At the same time, the favourable results as well as the affordable process of the cosmetic procedures and surgeries attract people from different regions. Moreover, the use of non-invasive procedures is also contributing to attracting the population. Thus, all these factors promote the South Korea cosmetic surgery and procedures market growth.

For instance,

The graph represents a comparison of the total number of visits by foreigners to Korea for medical purposes recorded in the year of 2022 and 2023. It indicates that there will be a rise in medical tourism in the coming years. Hence, it increases the demand for the use of various new cosmetic surgeries as well as procedures. Thus, this in turn will ultimately promote the market growth.

By procedure type, the non-invasive segment dominated the market in 2024 and is estimated to be the fastest growing at a notable CAGR during the forecast period. The use of non-invasive procedures provided faster results, along with no surgical signs. This contributed to the South Korea cosmetic surgery and procedures market growth.

By age group type, the 30-54 segment dominated the South Korea cosmetic surgery and procedures market in 2024. The age group between 30-54 preferred South Korean cosmetic surgeries to reduce the aging signs.

By age group type, the 13-29 segment is anticipated to grow significantly during the forecast period. Increasing awareness through various online platforms is enhancing the use of South Korean cosmetic procedures as well as surgeries within the 13-29 age group.

By gender type, the female segment dominated the global South Korea cosmetic surgery and procedures market in 2024. To enhance the appearance as well as to boost confidence, women preferred cosmetic surgeries.

By gender type, the male segment is predicted to be the fastest growing during the forecast period. The cosmetic procedures and surgeries among men are increasing due to rising influences as well as to increase confidence.

South Korea cosmetic surgery and procedures market is estimated to grow substantially during the forecast period. The increasing awareness, as well as rising beauty standards within the population, is increasing the demand along with the use of cosmetic surgeries and procedures. At the same time, influenced by the K-pop or K-drama idols and actors are also contributing to the same. Furthermore, the rising use of advanced technologies, skilled personnel, as well as advanced non-invasive procedures is enhancing the quality of these surgeries. Thus, this, in turn, also raises the medical tourism, which is further supported by the government. Hence, all these factors are promoting the market growth.

For instance,

By Procedure Type

By Age Group

By Gender

February 2026

November 2025

November 2025