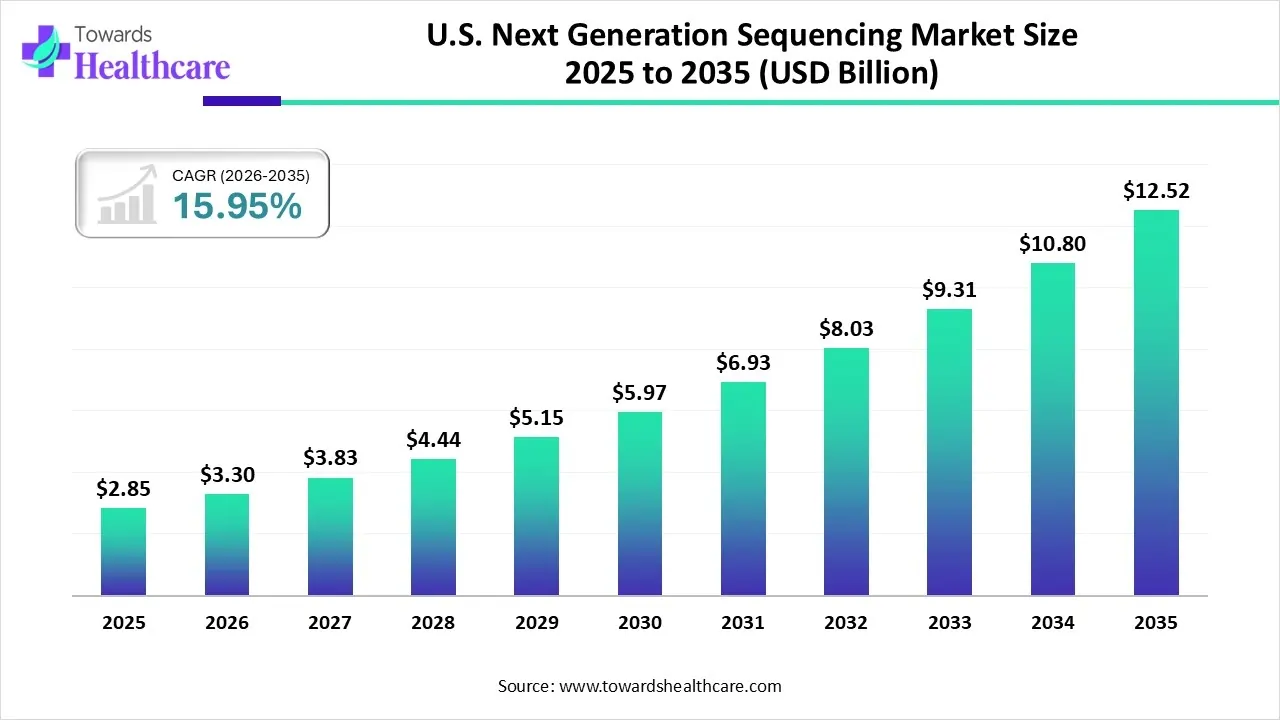

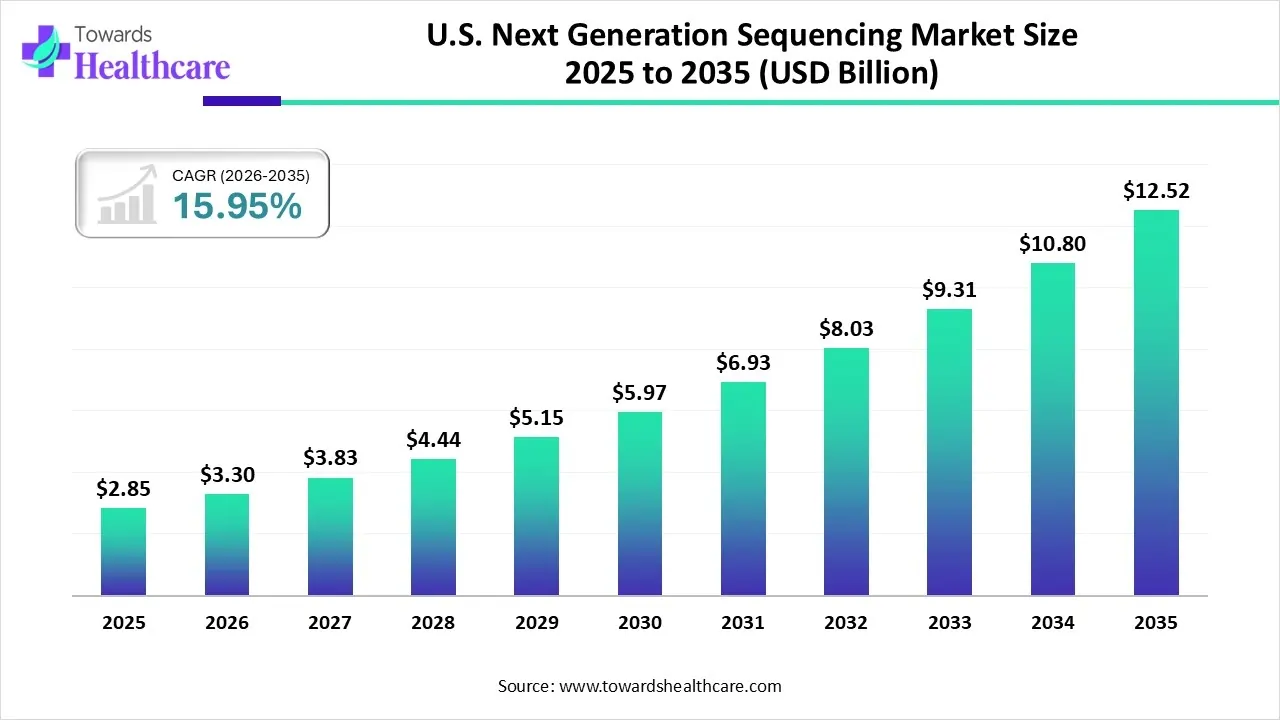

Revenue, 2025

USD 2.85 Billion

Forecast, 2035

USD 12.52 Billion

Report Coverage

United States

U.S. Next Generation Sequencing Market Size, Growth, Top Players with Recent Development

The U.S. next generation sequencing market size is calculated at USD 2.85 billion in 2025, grew to USD 3.3 billion in 2026, and is projected to reach around USD 12.52 billion by 2035. The market is expanding at a CAGR of 15.95% between 2026 and 2035.

The U.S. next generation sequencing market is primarily driven by the rapidly expanding genomics sector and the growing awareness of early diagnosis and treatment. Next-generation sequencing (NGS) is increasingly adopted in research and clinical settings, with the support of R&D investments and advancements in genomic technologies. Integrating artificial intelligence (AI) in the NGS streamlines workflow and data analysis, enhancing efficiency and accuracy.

Key Takeaways

- U.S. next generation sequencing industry poised to reach USD 2.85 billion by 2025.

- Forecasted to grow to USD 12.52 billion by 2035.

- Expected to maintain a CAGR of 15.95% from 2026 to 2035.

- By product type, the sequencing instruments segment dominated the market with a share of 35% in 2024.

- By product type, the consumables & reagents segment is expected to witness the fastest growth in the market over the forecast period.

- By application, the clinical diagnostics segment held a major revenue share of 40% in the U.S. next generation sequencing market in 2024.

- By application, the drug discovery & development segment is expected to show the fastest growth over the forecast period.

- By end-user, the hospitals & diagnostic laboratories segment accounted for the highest revenue share of 45% in the market in 2024.

- By end-user, the biopharmaceutical & CROs segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By sequencing type, the whole genome sequencing (WGS) segment held a dominant revenue share of 30% in the market in 2024.

- By sequencing type, the exome sequencing segment is expected to grow with the highest CAGR in the market during the studied years.

- By technology, the sequencing by synthesis (SBS) segment contributed the biggest revenue share of 50% in the U.S. next generation sequencing market in 2024.

- By technology, the solid-phase/other NGS technologies segment is expected to expand rapidly in the market in the coming years.

Quick Facts Table

| Key Elements |

Scope |

| Market Size in 2025 |

USD 2.85 billion |

| Projected Market Size in 2035 |

USD 12.52 billion |

| CAGR (2026 - 2035) |

15.95% |

| Market Segmentation |

By Product Type, By Application, By End-User, By Sequencing Type, By Technology |

| Top Key Players |

PerkinElmer, Inc., Pacific Biosciences of California, Inc. (PacBio), 10x Genomics, Inc., New England BioLabs, Inc., Azenta US, Inc., Promega Corporation, GenScript USA, Inc., BD (Becton, Dickinson and Company), Hamilton Company, Clear Labs, Inc., Ultima Genomics, Inc., DNAnexus, Inc., Element Biosciences, Inc., Twist Bioscience Corporation, NeoGenomics Laboratories, Inc. |

Sequencing the Future: The U.S. NGS Boom

The U.S. next generation sequencing market is experiencing robust growth, driven by the increasing use of genomics in precision medicine, declining sequencing costs, growth in clinical and research applications, and rising demand for large‑scale genomic data. It encompasses technologies, instruments, consumables, reagents, software/informatics, and services that enable high‑throughput sequencing of DNA/RNA for research, clinical diagnostics, drug discovery, agrigenomics, and other applications. It covers workflows from sample preparation through sequencing and bioinformatic interpretation.

U.S. Next Generation Sequencing Market Outlook

- Industry Growth Overview: The market is expected to expand rapidly in the coming years, driven by the progress in bioinformatics, robotics, liquid handling, and nucleic acid preparation. The development of portable NGS devices and the growing demand for point-of-care diagnostics propel the market.

- Major Investors: Private equity firms and venture capitalists invest heavily in biotech startups to facilitate the adoption of NGS technologies and derive novel diagnostics and therapeutics. Funding enables companies to set up their research and manufacturing infrastructure.

- Startup Ecosystem: The startup ecosystem is maturing, driven by the increasing venture capital investments and advanced technologies. Element Biosciences, InheriNext, and Fabric Genomics are some biotech startups in the U.S.

AI-based computational tools play a pivotal role in the strategic planning of experiments, assisting researchers in predicting outcomes, optimizing protocols, and anticipating potential challenges. AI in NGS technology streamlines the experimental workflow, thereby automating and reducing manual errors in sample preparation. AI and machine learning (ML) algorithms analyze vast amounts of data and several workflow management systems. They enable the classification of raw sequencing data with unprecedented precision, allowing for more accurate variant detection and discovery of robust biomarkers.

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the U.S. Next Generation Sequencing Market?

The sequencing instruments segment held a dominant presence in the market with a share of 35% in 2024, due to the availability of automated instruments and widespread applications. Sequencing instruments enable researchers to determine the order of the four DNA bases for various applications, such as genomic research and clinical diagnostics. They offer high efficiency and flexibility in sequencing, minimizing hands-on tasks. Some developers design portable sequencers to be used at various locations.

Consumables & Reagents

The consumables & reagents segment is expected to grow at the fastest CAGR in the U.S. next generation sequencing market during the forecast period. Consumables & reagents are essential components of NGS experiments. Numerous companies offer their proprietary reagents, enabling researchers to fulfill their research requirements. They are affordable and can elevate epigenome analysis and DNA/RNA sequencing research.

Services

The services segment is expected to show lucrative growth due to the availability of suitable equipment and software. Contract research organizations (CROs) have skilled professionals to provide tailored solutions to complex problems. They offer whole-genome sequencing services, non-invasive prenatal testing services, and genetic characterization of cell lines. They offer affordable services, especially to companies that lack suitable infrastructure.

Application Insights

Why Did the Clinical Diagnostics Segment Dominate the U.S. Next Generation Sequencing Market?

The clinical diagnostics segment contributed the biggest revenue share of 40% in the market in 2024, due to the growing demand for point-of-care diagnostics and the increasing awareness of early diagnosis and screening of genetic disorders. NGS is widely used in clinical diagnostics due to its high speed, accuracy, and the capacity of massive parallel sequencing. NGS diagnostics enable the identification of novel gene mutations, including complex mutations like chromosomal translocations.

Drug Discovery & Development

The drug discovery & development segment is expected to grow with the highest CAGR in the U.S. next generation sequencing market during the studied years. The increasing need for personalized medicines due to rapidly changing demographics augments the segment’s growth. NGS allows researchers to study disease progression, identify novel biomarkers, and design drugs based on protein structure. From January 2025 to September 2025, the U.S. Food and Drug Administration (FDA) approved 9 biologics for various purposes.

Research & Academia

The research & academia segment is expected to grow significantly due to widespread applications of NGS in various diseases. NGS is used to bulk-sequence tumors and identify genetic mutations in tumors, aiding in the development of targeted therapies and monitoring cancer progression through liquid biopsies. Apart from cancer, NGS is used in microbial and infectious diseases, genetic and rare diseases, and agrigenomics.

End-User Insights

How the Hospitals & Diagnostic Laboratories Segment Dominated the U.S. Next Generation Sequencing Market?

The hospitals & diagnostic laboratories segment held the largest revenue share of 45% in the market in 2024, due to favorable infrastructure and suitable capital investments. Hospitals have professionals from diverse disciplines, providing multidisciplinary expertise to patients. They adopt advanced tools and technologies to provide personalized treatment. Hospitals conduct clinical trials, benefiting patients from novel products before market approval.

Biopharmaceutical & CROs

The biopharmaceutical & CROs segment is expected to expand rapidly in the U.S. next generation sequencing market in the coming years. Biopharmaceutical companies & CROs have suitable research infrastructure to develop novel diagnostics and therapeutics. Large companies collaborate with CROs as they focus on multiple experiments simultaneously. This helps them to focus on their core competencies, such as product sales and marketing.

Academic & Research Institutes

The academic & research institutes segment is expected to grow at a notable CAGR, due to research funding from government and private organizations. The availability of affordable NGS kits, tools, and reagents promotes research activities in academic & research institutes. The increasing collaboration among researchers from diverse locations also propels the segment’s growth.

Sequencing Type Insights

Which Sequencing Type Segment Led the U.S. Next Generation Sequencing Market?

The whole genome sequencing (WGS) segment led the market with a share of 30% in 2024, due to high resolution and greater precision. Whole genome sequencing (WGS) is a comprehensive method for analyzing entire genomes. It is particularly used to identify inherited disorders, characterize the mutations that drive cancer progression, and track disease outbreaks. WGS delivers large volumes of data in a short amount of time to support the assembly of novel genomes.

Exome Sequencing

The exome sequencing segment is expected to witness the fastest growth in the U.S. next generation sequencing market over the forecast period. Exome sequencing is a method of sequencing protein-coding regions of the genome. It is preferred to identify coding variants across a broad range of applications, including population genetics, genetic disease, and cancer studies. It is more cost-effective compared to WGS. It produces a smaller, more manageable dataset for faster and easier data analysis.

Targeted Sequencing

The targeted sequencing segment is expected to grow in the upcoming years, due to enhanced read depths and precision for specific regions. Targeted sequencing enables researchers to modify the genetic sequence from a particular location, allowing them to make desired changes. This helps them develop personalized cell and gene therapy products. The major advantage of targeted sequencing is its efficiency, eliminating the added costs and computational resources.

Technology Insights

What Made Sequencing by Synthesis the Dominant Segment in the U.S. Next Generation Sequencing Market?

The sequencing by synthesis (SBS) segment accounted for the highest revenue share of 50% in the market in 2024, due to high throughput, accuracy, and cost-effectiveness. SBS is the most conventional technique of NGS, as it is easier and versatile. It generates the highest yield of error-free reads, enabling robust base calling across the genome. Moreover, it ensures uniform coverage and accuracy across difficult-to-sequence genome regions.

Solid-Phase/Other NGS Technologies

The solid-phase/other NGS technologies segment is expected to show the fastest growth over the forecast period. Solid sequencing technology is a high-throughput method for sequencing DNA that uses a DNA ligase enzyme for the sequencing process. DNA ligase has high specificity in recognizing correct base pairing, improving the accuracy. Solid sequencing allows the parallel processing of millions of sequences.

Semiconductor/Ion Torrent

The semiconductor/ion torrent segment is expected to grow in the U.S. next generation sequencing market in the forthcoming years, due to high speed and simplicity. Thermo Fisher Scientific offers Ion Torrent technology that translates chemically encoded information into digital information on a semiconductor chip. Ion torrent/semiconductor technology eliminates the use of optics-based technology as it involves direct detection, enhancing cost-effectiveness.

Regional Analysis

Which Factors Influence the U.S. Next Generation Sequencing Market?

Numerous factors influence market growth, including the increasing development of personalized medicines, favorable government support, and an evolving regulatory landscape. The FDA recently announced that it can approve personalized treatments for rare and deadly genetic diseases based on data from a handful of patients. The National Institute of Health (NIH) has established a new Genomics-enabled Learning Health System (gLHS) to identify and advance approaches for integrating genomic information into existing learning health systems.

The rising prevalence of genetic disorders, the growing geriatric population, and the increasing awareness of prenatal testing foster market growth. More than 30 million Americans are affected by over 7,000 rare diseases. The NCI reported that approximately 2 million women undergo NIPT in the U.S. annually. The number of Americans aged 65 years or older is projected to grow from 58 million in 2022 to 82 million by 2050.

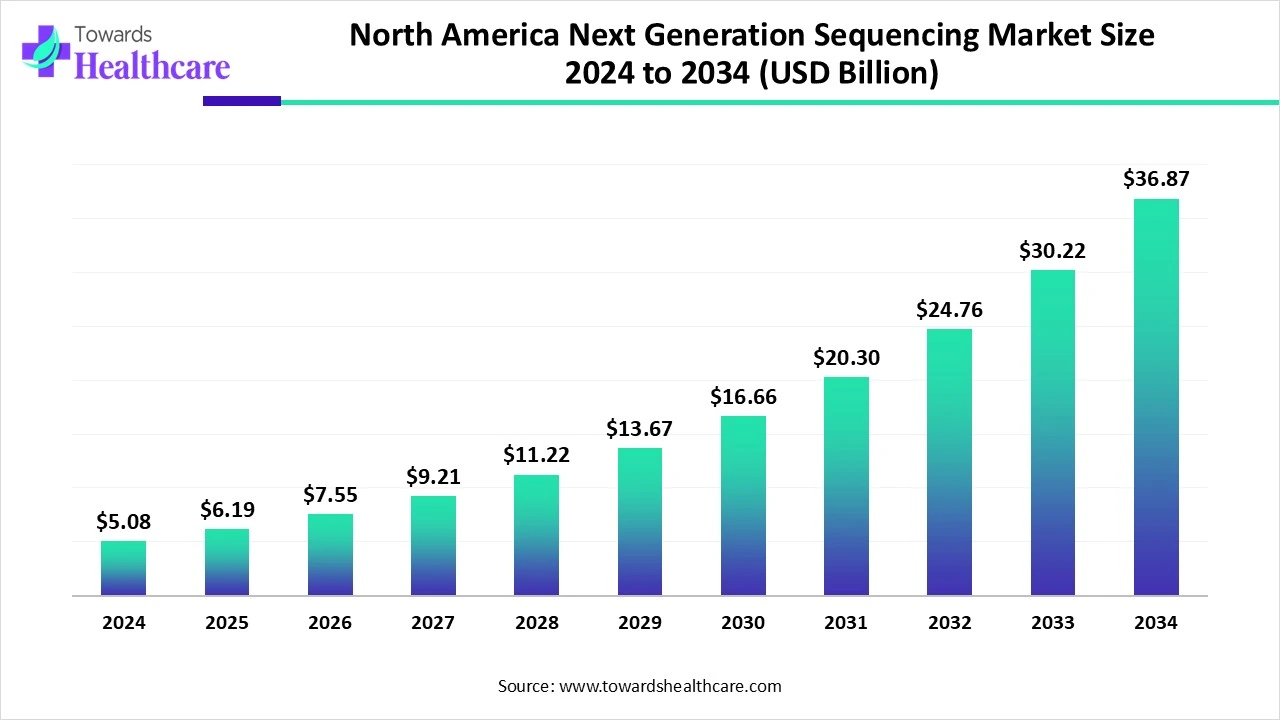

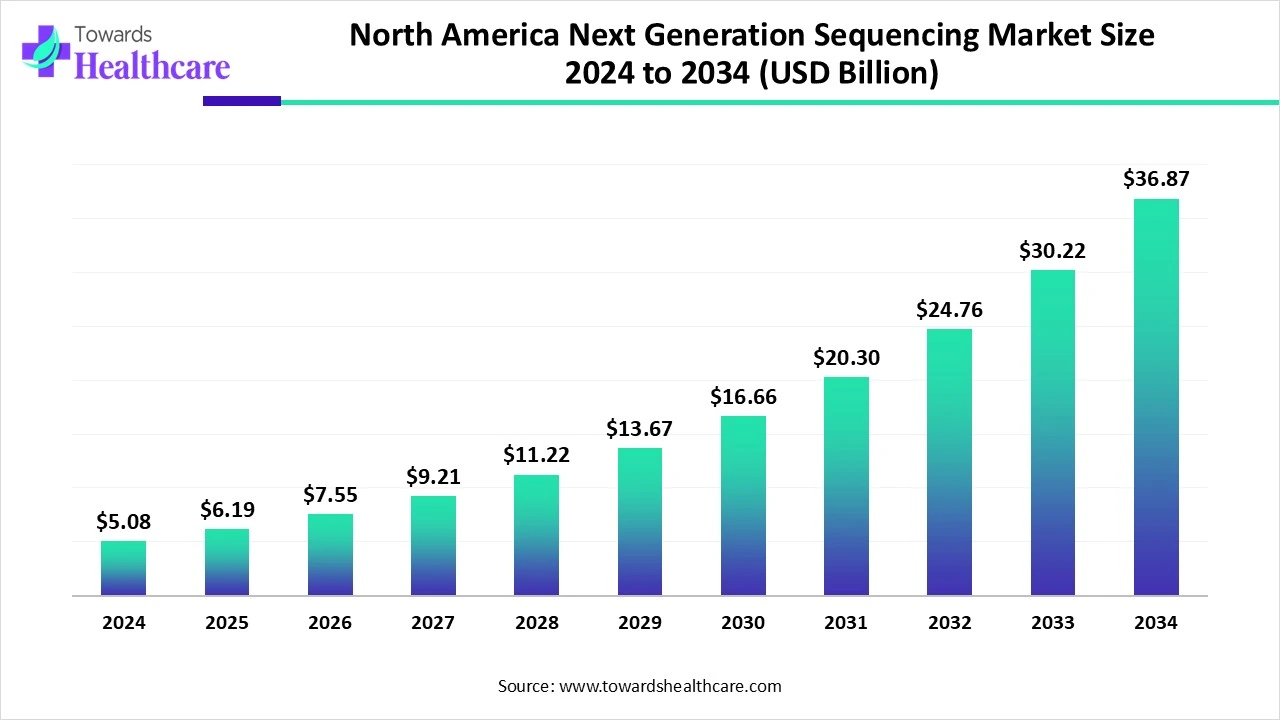

North America Next Generation Sequencing Market Size and Growth

The North America next generation sequencing market size is calculated at USD 5.08 in 2024, grew to USD 6.19 billion in 2025, and is projected to reach around USD 36.87 billion by 2034. The market is expanding at a CAGR of 21.93% between 2025 and 2034.

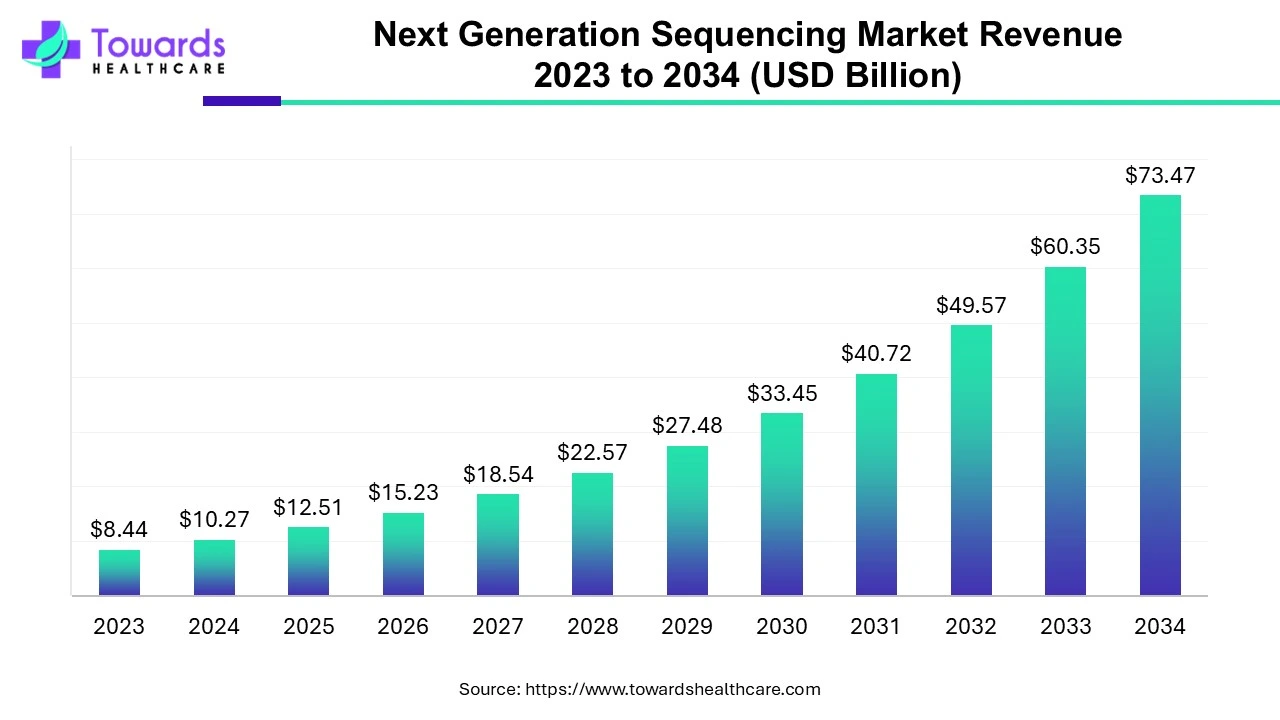

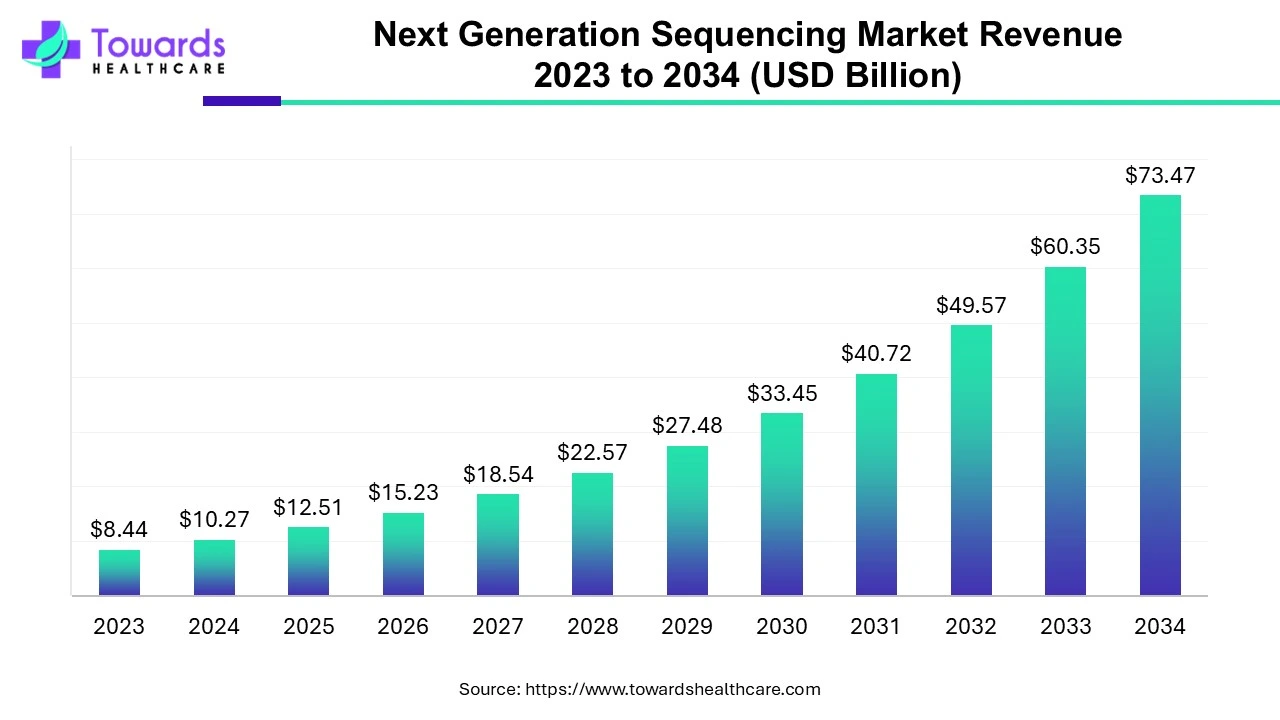

Next Generation Sequencing Market Size and Growth

The global next generation sequencing market size is calculated at US$ 10.27 billion in 2024, grew to US$ 12.51 billion in 2025, and is projected to reach around US$ 73.47 billion by 2034. The market is expanding at a CAGR of 21.74% between 2024 and 2034.

Company Landscape

Illumina, Inc.

Company Overview

- Corporate Information:

- Headquarters: San Diego, California, U.S.

- Year Founded: 1998

- Ownership Type: Public (NASDAQ: ILMN)

- History and Background:

- Founded to develop and market systems for genetic variation and biological function analysis.

- Early focus on microarray-based products for genotyping and gene expression.

- Acquired Solexa in 2007, gaining the key Sequencing by Synthesis (SBS) technology that established its dominance in NGS.

- Key Milestones/Timeline:

- 2002: Launched the first system, the Illumina BeadLab.

- 2007: Acquired Solexa, securing the dominant SBS sequencing technology.

- 2014: Launched the high-throughput HiSeq X Ten Sequencing System.

- 2023-2024: Continued rollout and expansion of the NovaSeq X Series platform for ultra-high throughput sequencing.

- Mid-2024: Completed the spin-off of GRAIL, a multi-cancer early detection company, following regulatory mandates.

- Business Overview

- Business Segments/Divisions:

- Core Illumina: Comprises the sequencing and array platforms, consumables, and services for research and clinical markets. (Primary revenue driver).

- Note: Post-2024, GRAIL is no longer a segment of Illumina due to the spin-off.

- Geographic Presence:

- Global operations, serving over 155 countries.

- Strong presence in North America, Europe, and Asia-Pacific.

- Key Offerings:

- NGS Instruments: NovaSeq X Series, NextSeq 2000, MiSeq Series, iSeq.

- Consumables: Reagents, flow cells, and library preparation kits for various sequencing applications.

- Software and Services: DRAGEN Bio-IT Platform for fast data analysis, Illumina Connected Analytics (ICA), and sequencing services.

- End-Use Industries Served:

- Academic & Research Institutions

- Hospitals & Clinical Laboratories (e.g., Oncology, Reproductive Health)

- Pharmaceutical & Biotechnology Companies (Drug discovery and development)

- Applied Markets (e.g., Agrigenomics, Forensics, Consumer Genomics)

- Key Developments and Strategic Initiatives

- Mergers & Acquisitions:

- June 2025: Announced acquisition of SomaLogic to accelerate its proteomics business and advance its multiomics strategy.

- Partnerships & Collaborations:

- Jan 2025: Partnered with NVIDIA to accelerate genomic analysis and advance precision health using AI.

- Apr 2025: Partnership with Tempus to drive genomic AI innovation.

- Sep 2025: Secured new pharma development partnerships to advance personalized cancer care.

- 2024-2025: Continued growth of the Alliance for Genomic Discovery with new members like Bristol Myers Squibb, GSK, and Novo Nordisk.

- Product Launches/Innovations:

- Mar 2025: Unveiled first-of-its-kind spatial transcriptomics technology.

- Oct 2025: Launched a 5-base solution to unlock simultaneous genomic and epigenomic insights.

- 2024: Launched the MiSeq i100 Series, a benchtop sequencer focused on simplified setup and sustainability.

- Capacity Expansions/Investments:

- Focus on continuously improving the efficiency and throughput of its NovaSeq X platforms.

- Regulatory Approvals:

- May 2025: Received regulatory approval in Japan for its Comprehensive Genomic Profiling Test for Cancer.

- Distribution Channel Strategy:

- Direct sales force globally to serve large research institutions and clinical labs.

- Partnerships for localized manufacturing (e.g., with HaploX in China in late 2023) and distribution in specific regions.

- Technological Capabilities/R&D Focus

- Core Technologies/Patents:

- Sequencing by Synthesis (SBS): Dominant short-read sequencing technology known for high accuracy and throughput.

- DRAGEN Bio-IT Platform: Highly accelerated secondary analysis software for NGS data.

- Array-based Technologies: For genotyping, gene expression, and methylation analysis.

- Research & Development Infrastructure:

- Significant annual R&D investment (over $1.16 billion in 2024).

- Focus on developing platforms that enable multiomic analysis (genomics, proteomics, epigenomics).

- Innovation Focus Areas:

- Cost-reduction (e.g., NovaSeq X aiming for sub-$200 whole human genome).

- Multiomics integration (e.g., proteomics, spatial transcriptomics).

- AI and advanced bioinformatics (e.g., DRAGEN software and partnership with NVIDIA).

- Competitive Positioning

- Strengths & Differentiators:

- NGS Market Dominance: Unrivaled market share and large installed base of sequencing instruments.

- Accuracy and Throughput: SBS chemistry is the industry standard for high-accuracy, high-throughput short-read sequencing.

- Comprehensive Ecosystem: Broad portfolio of instruments, reagents, software (DRAGEN), and services creating a high barrier to entry.

- Market Presence & Ecosystem Role:

- Essential Enabler: The foundational provider of sequencing technology for global genomics research and clinical applications.

- High Switching Costs: Customers are heavily invested in Illumina's platform, creating a strong "razor-and-blade" business model with recurrent revenue from consumables.

- SWOT Analysis (Focused on NGS Segment):

- Strengths: Market leader, technological superiority in short-read accuracy/throughput, strong reagent recurring revenue, large installed base.

- Weaknesses: High cost of entry for new instruments, facing increased competition from long-read (PacBio, ONT) and ultra-low-cost short-read competitors.

- Opportunities: Expansion into clinical markets (oncology, reproductive health), multiomics (proteomics, spatial), AI-driven data analysis.

- Threats: Regulatory scrutiny (especially following the GRAIL divestiture), technological disruption from competitors, geopolitical risks (e.g., in the China market).

- Recent News and Updates

- Press Releases:

- Nov 2025: Whole-genome sequencing provides greater insight into genetic signals behind common diseases, according to a Nature study utilizing Illumina WGS and DRAGEN.

- Mar 2025: Responded to positive updates from the Chinese Ministry of Commerce regarding a previous purchasing ban.

- Feb 2025: Reported Q4 2024 and full-year 2024 financial results, with full-year revenue of $4.37 billion.

- Industry Recognitions/Awards:

- Jul 2025: Named to TIME's World's Most Sustainable Companies list for the second consecutive year.

ShapeThermo Fisher Scientific Inc.

Company Overview

- Corporate Information:

- Headquarters: Waltham, Massachusetts, U.S.

- Year Founded: 1956 (Formed from the merger of Thermo Electron and Fisher Scientific in 2006)

- Ownership Type: Public (NYSE: TMO)

- History and Background:

- World leader in serving science with a broad portfolio of instruments, reagents, consumables, and services.

- Entered the NGS market through the acquisition of Life Technologies, which developed the Ion Torrent semiconductor sequencing technology.

- Key Milestones/Timeline:

- 2006: Merger of Thermo Electron and Fisher Scientific.

- 2014: Acquired Life Technologies for $13.6 billion, gaining the Ion Torrent NGS platform.

- 2020: Launched the Ion Torrent Genexus System, a fully integrated, automated NGS platform.

- 2024: Completed the acquisition of Olink, significantly expanding its proteomics and multi-omics capabilities.

- Business Overview

- Business Segments/Divisions: (Revenue reported in 2024: $42.88 billion)

- Life Sciences Solutions: Includes NGS, biosciences, and other research tools (Key segment for NGS).

- Analytical Instruments: Mass spectrometry, chromatography, electron microscopy.

- Specialty Diagnostics: Diagnostic kits, instruments, and software.

- Laboratory Products and BioProduction: Lab equipment, consumables, and bioproduction materials.

- Pharma Services: Contract development and manufacturing (CDMO) and clinical trial solutions.

- Geographic Presence:

- Global presence with an extensive commercial engine and manufacturing footprint.

- Strong revenues from North America, Europe, and Asia-Pacific.

- Key Offerings:

- NGS Instruments: Ion Torrent Genexus System, Ion GeneStudio S5 Series (based on Ion Semiconductor sequencing).

- Reagents & Consumables: Ion AmpliSeq panels for targeted sequencing, library preparation kits.

- Bioinformatics: Ion Reporter software, Thermo Fisher Connect Platform.

- Broader Portfolio: Mass spectrometers, electron microscopes, and a vast array of lab supplies.

- End-Use Industries Served:

- Academic & Government Research

- Pharmaceutical & Biotechnology (Drug discovery, CDMO)

- Clinical Diagnostics (Oncology, Infectious Disease)

- Applied Testing (Food safety, Forensics, Environmental)

- Key Developments and Strategic Initiatives

- Mergers & Acquisitions:

- 2024: Completed the acquisition of Olink Holding AB (publ) for $3.1 billion, strengthening its position in proteomics and multiomics.

- Sep 2025: Completed acquisition of Solventum’s Purification and Filtration business.

- Oct 2025: Announced intent to acquire Clario Holdings, Inc. for deeper clinical insights.

- Partnerships & Collaborations:

- Oct 2025: Announced strategic collaboration with OpenAI to accelerate life science breakthroughs with AI.

- Mar 2024: Collaborated with Bayer AG for the development of companion diagnostic assays.

- 2024: Partnered with the National Cancer Institute on the myeloMATCH precision medicine trial for leukemia.

- Oct 2025: Announced R&D partnership with AstraZeneca BioVentureHub.

- Product Launches/Innovations:

- Mar 2024: Introduced the Ion GeneStudio S5 Prime, enhancing semiconductor sequencing for clinical and translational research.

- 2024: Launched the Accelerator™ Drug Development solution, leveraging CDMO and clinical research capabilities.

- Capacity Expansions/Investments:

- Apr 2025: Announced growth in capacity and capabilities for its pharma services through strategic expansion.

- Aug 2025: Opened a Manufacturing Center of Excellence site in North Carolina.

- Regulatory Approvals:

- Nov 2025: Received 510(k) Clearance in the U.S. for its EXENT System to aid in the diagnosis of Multiple Myeloma.

- Aug 2025: Received FDA Approval for an NGS-Based Companion Diagnostic for a Non-Small Cell Lung Cancer treatment.

- Distribution Channel Strategy:

- Leverages a massive, global commercial engine and the Fisher Scientific channel for widespread distribution of lab products and consumables.

- Direct sales force for high-value instruments and services (e.g., Ion Torrent).

- Technological Capabilities/R&D Focus

- Core Technologies/Patents:

- Ion Semiconductor Sequencing (Ion Torrent): Faster, simpler, and less expensive sequencing, particularly strong in targeted, clinical, and rapid turnaround applications.

- Applied Biosystems: Leading brand for PCR and other molecular biology tools.

- Olink Proteomics: Acquired highly multiplexed protein analysis technology (Proximity Extension Assay).

- Research & Development Infrastructure:

- Significant annual R&D investment ($1.4 billion in 2024).

- Focus on integrated workflows from sample preparation to data analysis.

- Innovation Focus Areas:

- Automated, rapid turnaround sequencing for the clinical setting (Genexus System).

- Multiomics integration, particularly through the combination of NGS and proteomics (Olink acquisition).

- AI and digital innovation to enhance data analysis and R&D pipelines.

- Competitive Positioning

- Strengths & Differentiators:

- Breadth of Portfolio: Unmatched scale and depth across the entire scientific workflow (NGS, mass spec, lab products, pharma services).

- Clinical Strength: Ion Torrent platforms are highly competitive for targeted clinical applications, offering a rapid, automated workflow.

- Integrated Solutions: Ability to offer end-to-end solutions, from drug discovery through clinical trials.

- Market Presence & Ecosystem Role:

- "World Leader in Serving Science": Highly diversified revenue streams insulate it from single-market fluctuations.

- Integrated Customer Base: Serves nearly every lab globally through the Fisher Scientific channel, providing cross-selling opportunities.

- SWOT Analysis (Focused on NGS Segment):

- Strengths: Industry-leading scale and commercial engine, strong position in clinical/targeted NGS (Ion Torrent), comprehensive multi-omics portfolio (Olink), financial stability.

- Weaknesses: Ion Torrent technology generally offers lower throughput than Illumina's high-end platforms, historically less dominant in the de novo whole-genome sequencing research market.

- Opportunities: Expansion of automated clinical NGS (Genexus), synergy from the Olink proteomics acquisition, utilizing AI in diagnostics, and growth in the biopharma CDMO space.

- Threats: Intense competition from Illumina and emerging long-read technologies, reliance on acquisitions for major growth, potential for technology obsolescence in a fast-moving market.

- Recent News and Updates

- Press Releases:

- Nov 2025: Receives 510(k) Clearance in the U.S. for EXENT System to aid in the diagnosis of Multiple Myeloma.

- Oct 2025: To acquire Clario Holdings, Inc. and announced collaboration with OpenAI.

- Aug 2025: Receives FDA Approval for an NGS-Based Companion Diagnostic for NSCLC treatment.

- Feb 2025: Reported Q4 2024 and full-year 2024 financial results, with annual revenue of $42.88 billion.

- Industry Recognitions/Awards:

- 2024: Named #18 on Fortune's America's Most Innovative Companies 2024 list.

- Aug 2025: Secured R&D 100 Awards for innovations accelerating discovery and development of therapies.

Top Companies & Their Offerings in the U.S. Next Generation Sequencing Market

| Companies |

Headquarters |

Expertise |

Offerings |

| Illumina, Inc. |

San Diego, California |

Equipment and reagents |

Illumina Protein Prep, NovaSeq X Series, NovaSeq 6000 System, DRAGEN Protein Quantification, Illumina Connected Multiomics |

| Thermo Fisher Scientific, Inc. |

Waltham, Massachusetts |

Systems and support, sequencing reagents, accessories, sequencing chips, and data analysis tools |

Ion Torrent library kits, Ion Chef system, Ion S5 system, integrated informatics solutions |

| Agilent Technologies, Inc. |

Santa Clara, California |

Sequencing workflow tools and software |

Library QC solutions, SureSelect Library Preparation and Target Enrichment, Agilent Magnis NGS Prep system, Agilent Bravo NGS platform |

| Danaher Corporation |

Washington D.C. |

Equipment |

Biomek NGeniuS Next Generation Library Prep System |

| Bio-Rad Laboratories, Inc. |

Hercules, California |

|

ddSEQ Single-Cell Isolator, SEQuoia Stranded RNA Library Prep Kit, digital PCR kits |

Other Companies

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc. (PacBio)

- 10x Genomics, Inc.

- New England BioLabs, Inc.

- Azenta US, Inc.

- Promega Corporation

- GenScript USA, Inc.

- BD (Becton, Dickinson and Company)

- Hamilton Company

- Clear Labs, Inc.

- Ultima Genomics, Inc.

- DNAnexus, Inc.

- Element Biosciences, Inc.

- Twist Bioscience Corporation

- NeoGenomics Laboratories, Inc.

Recent Developments in the U.S. Next Generation Sequencing Market

- In October 2024, Illumina launched its MiSeq i100 Series of sequencing systems to advance NGS capabilities for laboratories, offering rapid turnaround and ease of use. The MiSeq i100 and MiSeq i100 Plus systems are affordable, simple to use, and offer room temperature storage and shipping.

- In July 2024, Thermo Fisher Scientific collaborated with the National Cancer Institute (NCI) to conduct the myeloMATCH (Molecular Analysis for Therapy Choice) precision medicine umbrella trial. The trial involves the use of Thermo Fisher Scientific’s NGS technology to test patients’ bone marrow and blood for certain genetic biomarkers.

Segments Covered in the Report

By Product Type

- Sequencing Instruments

- Benchtop Sequencers

- High-throughput/Next-gen Sequencers

- Consumables & Reagents

- Library Prep Kits

- Flow Cells & Chips

- Sequencing Reagents

- Software & Informatics Tools

- Data Analysis Software

- Genomic Interpretation Platforms

- Services

- NGS Sample Prep & Sequencing Services

- Contract Research/Clinical Sequencing Services

By Application

- Clinical Diagnostics

- Drug Discovery & Development

- Research & Academia

- Agrigenomics/Animal & Plant Genomics

- Other Applications

By End-User

- Hospitals & Diagnostic Laboratories

- Biopharmaceutical & CROs

- Academic & Research Institutes

- Government & Public Health Organizations

- Others

By Sequencing Type

- Whole Genome Sequencing (WGS)

- Exome Sequencing

- Targeted Sequencing

- RNA Sequencing

- Other Sequencing Types

By Technology

- Sequencing by Synthesis (SBS)

- Semiconductor/Ion Torrent

- Pyrosequencing

- Solid-phase/Other NGS Technologies