February 2026

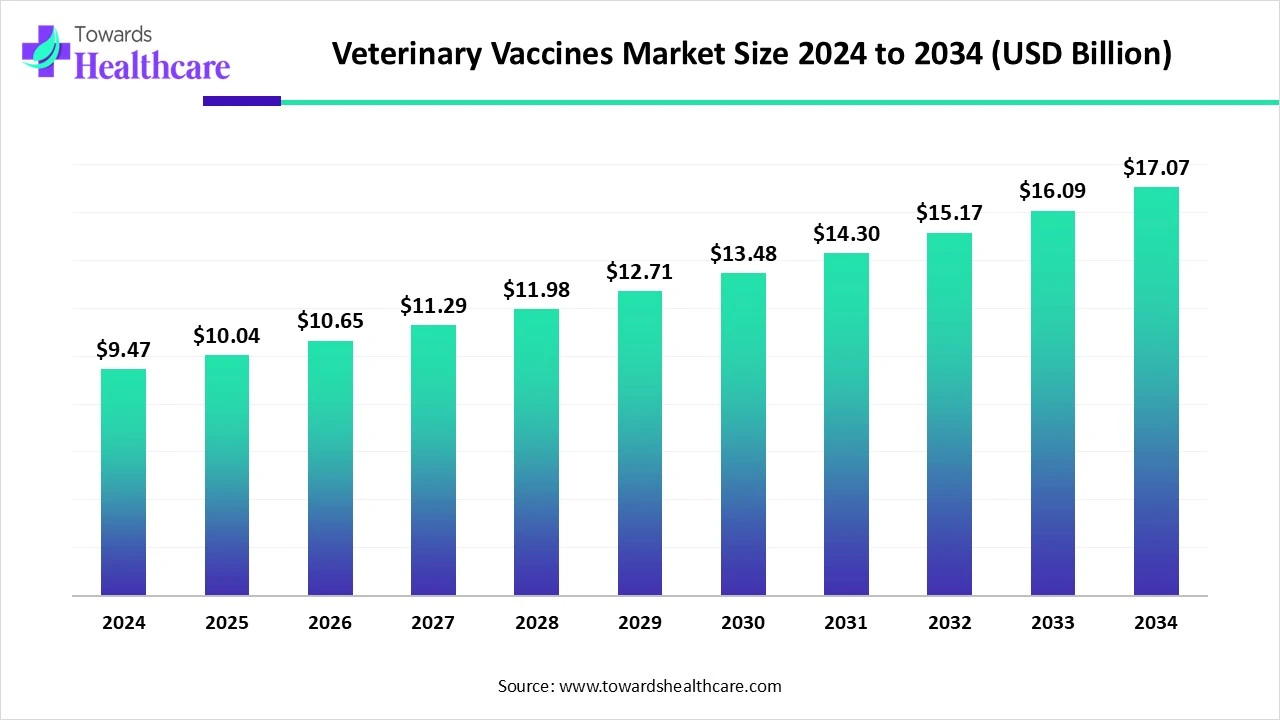

The veterinary vaccines market size is calculated at US$ 10.04 billion in 2025, grew to US$ 10.65 billion in 2026, and is projected to reach around US$ 18.11 billion by 2035. The market is expanding at a CAGR of 6.07% between 2026 and 2035.

The veterinary vaccines market is experiencing steady growth, driven by rising livestock numbers, rising pet ownership, and the escalating risk of zoonotic illnesses. Biotechnology developments like DNA and recombinant vaccines are improving vaccine safety and efficacy, which encourages adoption even more. Furthermore, the need for efficient vaccination programs is being fueled by government initiatives supporting animal health as well as the growing demand for food high in protein. Alongside advancements in vaccine delivery techniques that increase convenience and compliance, the market is also profiting from increased awareness of companion animal preventive healthcare.

The veterinary vaccines market is expanding rapidly as animal health becomes a global priority, supported by an increase in infectious disease cases in livestock and pets. Growing consumer spending on companion animal care, along with the intensifying demand for safe and sustainable livestock production, is boosting vaccine adoption. Live attenuated and vector-based vaccines are examples of technological developments that are increasing efficacy, and government and private sector vaccination program initiatives are driving further market expansion. Additionally, growing knowledge of how vaccines can stop the spread of zoonotic diseases to people gives the market growth even more significance.

To bring public health and animal care into alignment, veterinary vaccination campaigns are being coordinated under the One Health framework to combat zoonotic threats such as bird flu. Increased worries about the human transmission of avian influenza have prompted governments and industry participants to expedite poultry vaccine testing. By combining environmental animal and human health strategies, veterinary vaccinations serve as a vital line of defense against pandemics. Increasing international cooperation in immunization and surveillance underscores the growing significance of such initiatives for public health and food security.

Pilot studies of avian flu vaccination in poultry demonstrate high protection, opening the door for wider commercial operations adoption. For regulatory approval and farmer confidence, field trials are essential for validating vaccine performance under actual farming conditions. For illnesses like avian flu that are hazardous to both agriculture and public health, successful demonstrations are especially crucial. It is anticipated that widespread distribution of avian flu vaccines will become commonplace as more nations fund these studies, improving biosecurity in the production of poultry.

The development, monitoring, and discovery of vaccines for animals are increasingly incorporating artificial intelligence. Businesses are using data science platforms, digital diagnostics, and AI-driven predictive analytics to expedite regulatory reporting, enhance decision-making, and accelerate vaccine R&D. Predictive models improve outbreak surveillance and vaccination scheduling for livestock and companion animals, while generative AI tools are poised to revolutionize clinical documentation and study reporting.

Mass Vaccination Drives Against Emerging Livestock Diseases

Large-scale vaccination campaigns are being prompted by high-impact outbreaks such as foot and mouth disease and lumpy skin disease, particularly in areas that rely on livestock. These programs seek to prevent financial losses, preserve farmer livelihoods, and reduce mortality. In addition to providing immediate disease control, they also help governments stabilize the agricultural economy, improve regional biosecurity, and lessen dependency on imports.

High Development and Manufacturing Costs

It costs a lot of money to develop veterinary vaccines, and it calls for sophisticated R&D, specialized facilities, and strict quality control procedures. Due to these high barriers to entry, smaller biotech companies are unable to innovate and launch their products on time. Further driving up production costs are sterile manufacturing standards and intricate cold chain logistics, which frequently lead to higher end-user prices that limit adoption in the low-income veterinary vaccines market.

Growing Focus on the One Health Approach

Innovation in vaccines is being driven by the growing understanding of the interdependence of environmental, animal, and human health. To prepare for pandemics, governments and international organizations are encouraging investments in veterinary vaccines because zoonotic disease is a global threat. This strategy opens new funding and collaboration opportunities across sectors.

| Table | Scope |

| Market Size in 2026 | USD 10.65 Billion |

| Projected Market Size in 2035 | USD 18.11 Billion |

| CAGR (2026 - 2035) | 6.07% |

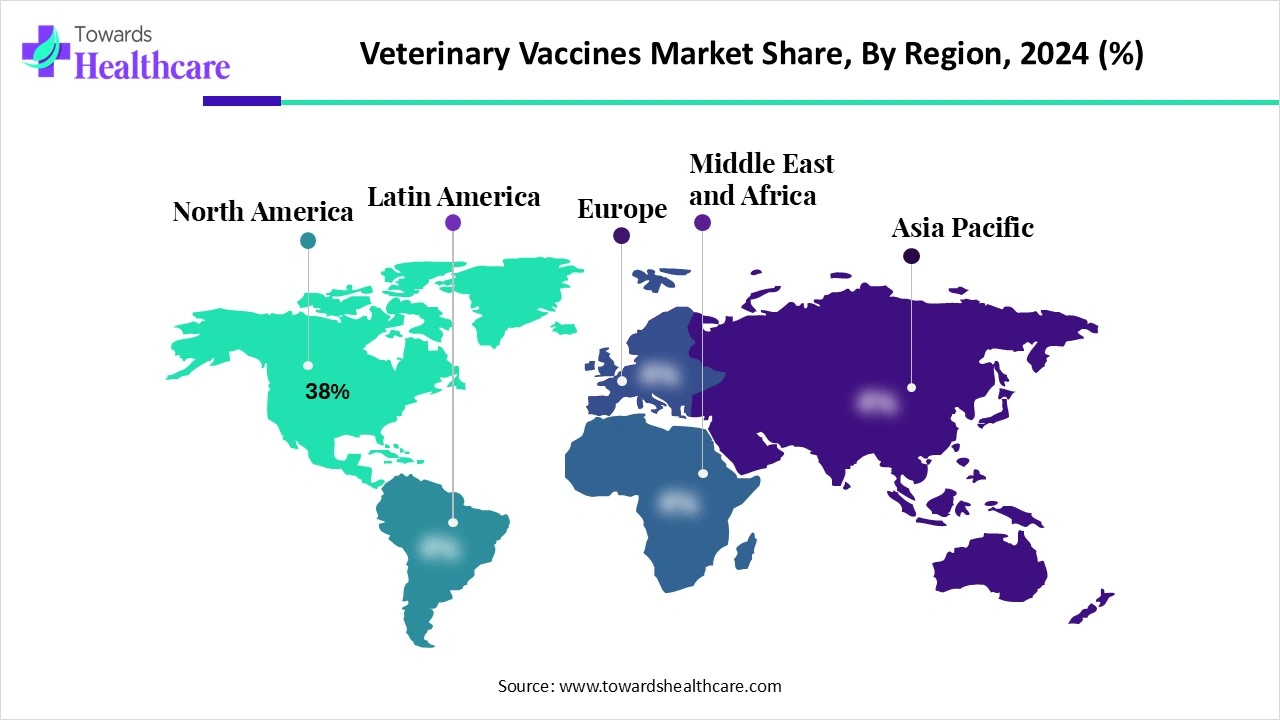

| Leading Region | North America Share 38% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Animal Type, By Vaccine Type / Technology, By Platform / Formulation, By Indication / Disease Category, By Distribution Channel / End Use |

| Top Key Players | Zoetis, Boehringer Ingelheim Animal Health, Merck Animal Health (MSD Animal Health), Elanco Animal Health, Ceva Santé Animale (Ceva), Virbac, Vetoquinol, HIPRA, Phibro Animal Health Corporation, Indian Immunologicals Ltd, IDT Biologika, Biogenesis Bago, Vaxxinova, USP (contract vaccine mfrs / notable CDMOs), Laboratorios HIPRA (regional R&D & production specialists),Zoetis/Pharma regional subsidiaries & legacy Merial/Bayer-derived portfolios, Bharat Biotech / Indian & Chinese biopharma vaccine manufacturers, Merial legacy assets / integrated players, Kemin Industries, Numerous specialized biotech startups & academic spinouts |

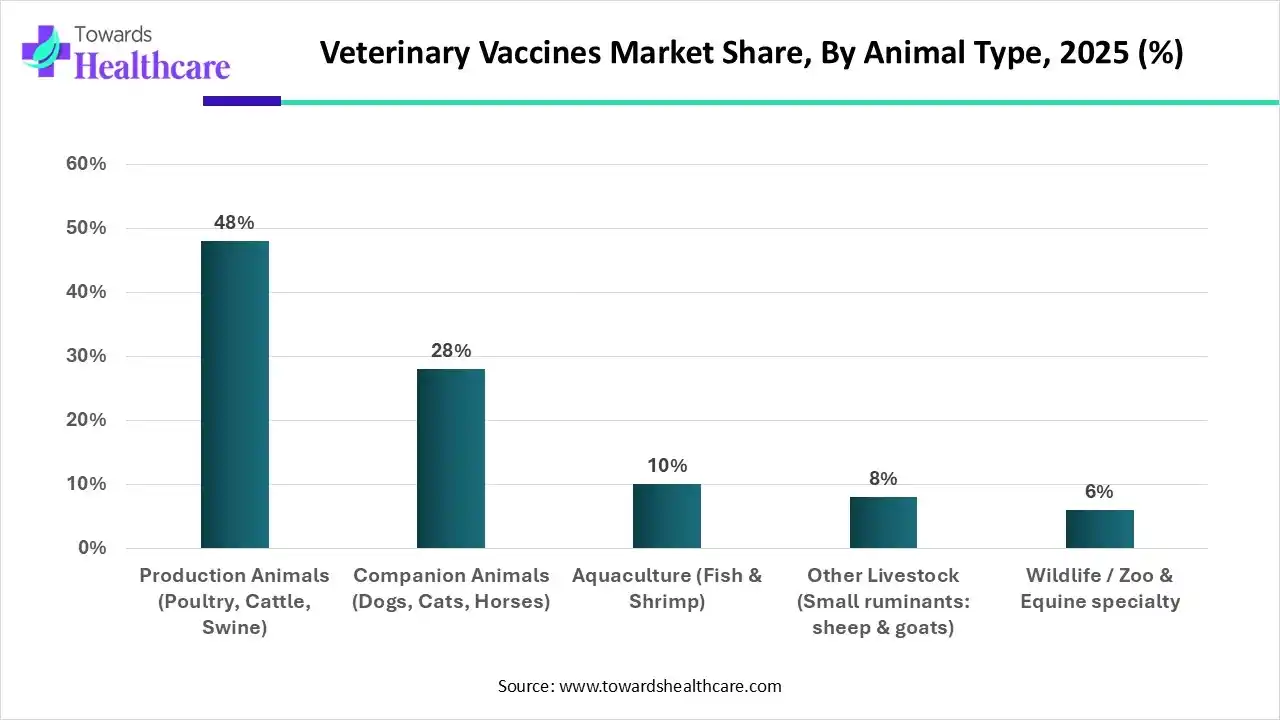

How did the Production Animals Segment Dominate the Veterinary Vaccines Market in 2025?

The production animals segment dominated the market by 48% in 2025 since the global animal husbandry industry still depends heavily on livestock vaccination to maintain food safety, productivity, and disease prevention. This market segment occupies the largest share due to the growing demand for animal protein and the need to minimize financial losses caused by infectious outbreaks.

The companion animals segment is estimated to be the fastest-growing segment during 2025-2034 due to increased pet ownership, pet humanization, and increased spending on animal healthcare. Adoption of preventive pet vaccination programs against illnesses like rabies, parvovirus, and distemper is accelerating. Demand is also rising as more people become aware of the benefits of vaccinating pets against zoonotic diseases. Additionally, the market expansion in the category is being driven by growing disposable incomes and a strong emotional bond with pets.

Why did the Live-Attenuated Vaccines Segment Dominate the Market in 2025?

The live-attenuated vaccines segment held the largest share of the veterinary vaccines market by 34% in 2025, because they are economical in large-scale animal vaccination programs and can produce robust long long-lasting immune responses. They have become even more dominant due to their widespread use of livestock and poultry. These vaccines are particularly important in areas with high rates of infectious disease. Furthermore, they remain at the forefront of veterinary medicine due to their demonstrated ability to reduce widespread outbreaks.

The recombinant & subunit vaccines segment is estimated to be the fastest growing category during the predicted timeframe, propelled by biotechnology breakthroughs and their safety record, which eliminates the possibility of reverting to virulence. Demand for these cutting-edge vaccines is being driven by increased awareness of precision animal health solutions. Wider adoption is being driven by global pharmaceutical companies' increasing investments in R&D. Additionally, the market penetration of next-generation vaccines is being accelerated by regulatory approvals.

| Segment | Share 2025 (%) |

| Parenteral (Injectable) Vaccines | 61% |

| Oral / Water-administered Vaccines | 22% |

| Intranasal / Mucosal (spray/drop) vaccines | 9% |

| Slow-release / Depot formulations | 8% |

Which Platform/Formulation Segment Dominated in 2025?

The parenteral (injectable) vaccines segment dominated the veterinary vaccines market by 61% because of their extensive use, demonstrated effectiveness, and long history of incorporation into veterinary healthcare procedures. They currently control the market. Routine vaccination campaigns for pets and livestock make extensive use of them. Reliable immunization results are guaranteed by the simplicity of standardized dosage. Their string position in the international market is further supported by the widespread acceptance of these products by veterinarians.

The oral/water administered vaccines segment is anticipated to grow at the highest rate during the forecast period, driven by their capacity to lessen animal handling stress, suitability for mass vaccination in poultry and aquaculture, and simplicity of administration. The growing need for effective rage scale vaccination campaigns is consistent with this pattern. The stability of oral vaccines is improving due to increasing innovations. These choices are also preferred by farmers to lower labor expenses and animal stress during vaccination campaigns.

Why did the Respiratory & Enteric Infectious Disease Segment Dominate the Market?

The respiratory & enteric infectious diseases segment dominated the veterinary vaccines market by 42% in 2025, due to the substantial morbidity and mortality rates these conditions cause in poultry and livestock. Improving herd health productivity and profitability in animal agriculture depends on preventing such diseases. Preventive vaccinations are essential due to the financial burden of these illnesses in order to guarantee herd safety. Farmers are also compelled by international trade regulations to give priority to these vaccinations.

The zoonotic targets & public-health relevant segment is anticipated to be the fastest growing during 2025-2034, reflecting increasing concerns about diseases that transmit between animals and humans, such as rabies, avian influenza, and brucellosis. Rising focus on One Health initiatives is accelerating their demand globally. Governments and NGOs are strongly promoting these vaccines to reduce cross-species transmission. Growing media coverage of zoonotic outbreaks further encourages adoption among both pet owners and livestock keepers.

Why did the Veterinary Clinics & Hospitals Segment Dominate the Market in 2025?

The veterinary clinics & hospitals segment dominated the veterinary vaccines market by 38% because they serve as the main hubs for diagnostics, vaccinations, and preventative animal care. Their dominance is reinforced by their accessibility to both pet owners and livestock farmers. Their reach is further expanded by veterinary specialists and well-established supply chains. Clinics are further consolidating their dominance by extending their offerings to include comprehensive preventive care.

The government/public health programs segment is estimated to witness the fastest growth during the upcoming timeframe, encouraged by programs for mass livestock vaccination, the elevation of transboundary animal disease, and vaccination campaigns with a public health focus. This growth is also fueled by mass campaigns and subsidies. International cooperation in the fight against disease is also fueling growth. Additionally, budgets for animal healthcare infrastructure are being increased by governments in emerging economies.

North America dominated the veterinary vaccines market share 38% in 2024, enjoying the benefits of robust livestock production, high pet ownership, cutting-edge veterinary healthcare infrastructure, and ongoing innovation from top pharmaceutical companies. Sturdy regulatory structures also facilitate long-term dominance. The presence of major vaccine manufacturers provides additional strength to this region. Additionally, steady revenue growth is guaranteed by the rising demand for high-end pet healthcare.

The U.S. market is witnessing steady growth, driven by the prevalence so sophisticated veterinary infrastructure, rising expenditures on animal healthcare, and high pet ownership rates. The widespread use of preventive vaccination against illnesses like rabies, canine distemper, and respiratory infections in cows reflects a high level of awareness among both livestock farmers and pet owners. The market also gains from strict regulatory frameworks that guarantee the safety and effectiveness of vaccines as well as ongoing innovation by top pharmaceutical companies. Additionally, influencing the nation's market dynamics is the rising demand for high-end preventive care products and companion animal vaccinations.

Asia Pacific is anticipated to be the fastest-growing region in the veterinary vaccines market during 2025-2034, driven by government-led immunization programs, growing pet adoption, the quick growth of livestock farming, and growing awareness of animal health. There are a ton of growth prospects due to the region's large animal populations. Infrastructure related to animal health is seeing increased investment in emerging economies. Additionally, the adoption of vaccines in this area is being accelerated by supportive policies for the prevention of livestock diseases.

The India market is expanding rapidly, driven by the nation's substantial growing demand for meat and dairy products and government-run disease prevention vaccination campaigns. The livestock industry is bolstering preventive healthcare practices through mass vaccination campaigns against avian influenza, brucellosis, and foot and mouth disease. Companion animal vaccination demand is rising in tandem with the growing pet adoption rate in cities, resulting in a twofold growth opportunity. Further bolstering long-term market expansion in India are the emphasis on enhancing rural veterinary infrastructure and collaborations between public and private entities.

In the veterinary vaccines industry, research and development (R&D) is concentrated on creating new vaccines for companion and livestock animals, enhancing antigen stability, and developing delivery systems like oral and intranasal formulations. Additionally, efforts are focused on next-generation technologies to improve safety and efficacy, such as vector-based vaccines, mRNA, and recombinant DNA.

Key players include: Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, and Elanco Animal Health.

Clinical trials evaluate vaccine safety, dosage optimization, and immune response across different animal species. Regulatory bodies such as the USDA (United States Department of Agriculture), EMA (European Medicines Agency), and CDSCO (India) oversee approval processes to ensure product safety, effectiveness, and compliance with veterinary health standards.

Key players include: Ceva Santé Animale, Virbac, Indian Immunologicals Ltd., HIPRA.

In the veterinary vaccines market, patient support focuses on helping veterinarians and animal owners make sure that both livestock and companion animals are properly informed about vaccination programs. Reminders for vaccinations, electronic record-keeping platforms, and helplines for farmers and pet owners are among the services offered. To gain trust, businesses also promote certifications like ISO GMP, Halal, and Organic, and offer instructional materials on preventing zoonotic diseases. Through outreach initiatives, emphasis is placed on enhancing accessibility in rural areas to guarantee that the advantages of preventive care are felt by a larger animal population.

Key players include: Zoetis Inc., Boehringer Ingelheim, Virbac, Elanco Animal Health, and Ceva Santé Animale

In February 2025, Elanco Animal Health entered an agreement with Medgene to commercialize a highly pathogenic avian influenza vaccine for dairy cattle. The CEO of Elanco remarked, “Elanco is pleased to partner with Medgene and believes this product will become part of a routine vaccination protocol for the U.S. dairy industry.”

By Animal Type

By Vaccine Type / Technology

By Platform / Formulation

By Indication / Disease Category

By Distribution Channel / End User

By Region

February 2026

February 2026

February 2026

February 2026