January 2026

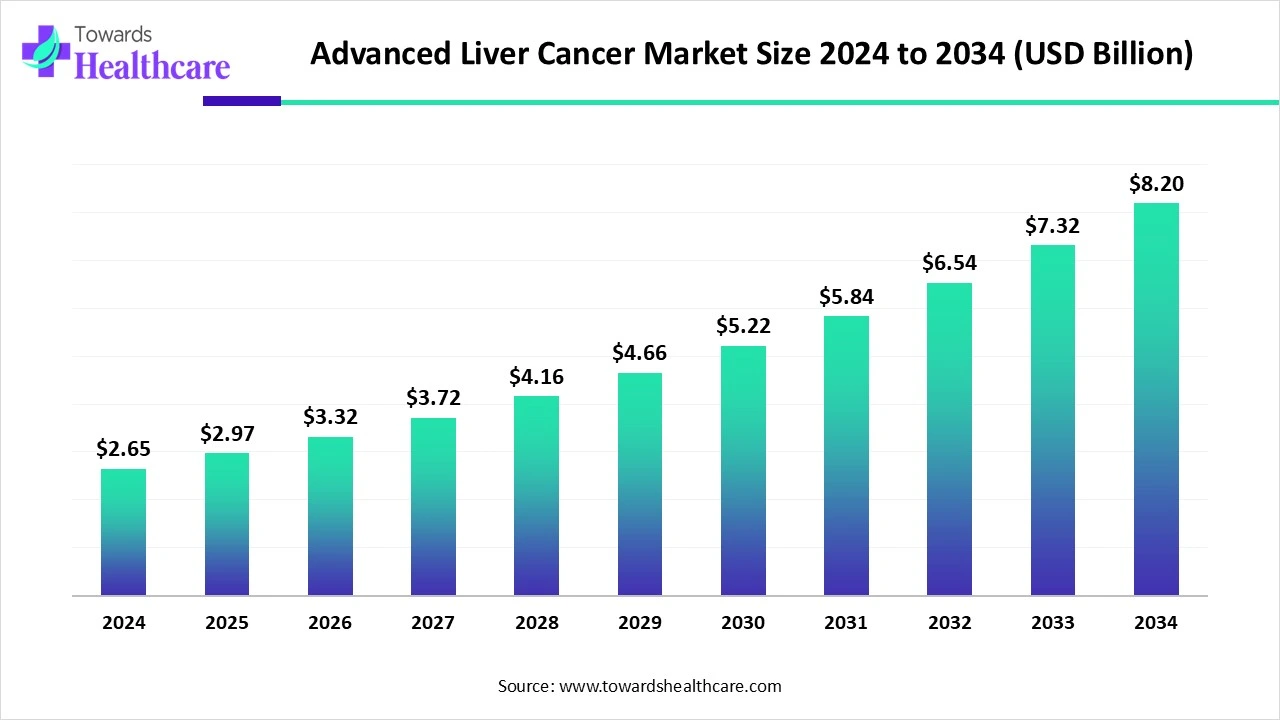

The global advanced liver cancer market size is calculated at US$ 2.65 billion in 2024, grew to US$ 2.97 billion in 2025, and is projected to reach around US$ 8.2 billion by 2034. The market is expanding at a CAGR of 11.94% between 2025 and 2034.

In 2025, across the world, growth in liver cancer cases, widespread demand for novel and highly efficacious therapies employed in these cases are fueling broad investment in the R&D area. Moreover, ongoing breakthroughs in AI technologies, like deep learning, machine learning, are boosting the development of innovative and excellent sophisticated diagnostic tools for early detection and disease progression among patients. The global advanced liver cancer market is experiencing a huge focus on the development of targeted therapies, immunotherapies, and combination therapies. As well as tremendous advances in minimally invasive procedures are also influencing enhanced patient comfort and outcomes.

| Metric | Details |

| Market Size in 2025 | USD 2.97 Billion |

| Projected Market Size in 2034 | USD 8.2 Billion |

| CAGR (2025 - 2034) | 11.94% |

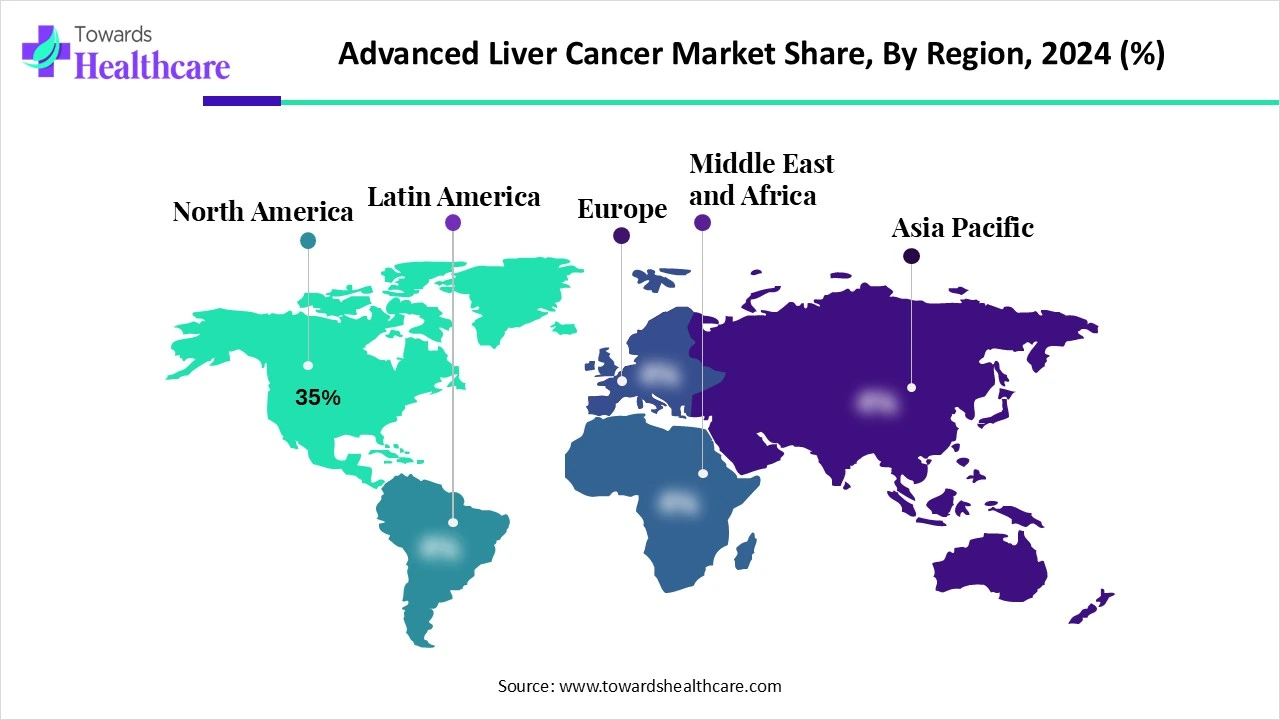

| Leading Region | North America Share 35% |

| Market Segmentation | By Cancer Type, By Treatment Type, By Drug Class, By End User, By Route of Administration, By Diagnosis & Monitoring Method, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb, Eli Lilly and Company, Novartis AG, Pfizer Inc., Merck & Co., Inc., AstraZeneca PLC, Ipsen, Sanofi, Johnson & Johnson, Bayer AG, Taiho Pharmaceutical Co., Ltd., Exelixis, Inc., BeiGene, Ltd., Takeda Pharmaceutical Company Limited, Genentech, Inc., Shanghai Pharmaceuticals Holding Co., Ltd., Hengrui Medicine Co., Ltd., Zai Lab Limited, Incyte Corporation |

The advanced liver cancer market refers to the global market for the diagnosis, treatment, and management of liver cancers that have progressed beyond early stages, including locally advanced or metastatic hepatocellular carcinoma (HCC), intrahepatic cholangiocarcinoma (ICC), and other rare liver malignancies. Advanced liver cancer is characterized by tumors that cannot be removed surgically due to size, location, or spread to distant organs. Treatment options include systemic therapies such as targeted therapies, immunotherapies, chemotherapy, and locoregional therapies aimed at improving patient survival and quality of life.

Eventually, the applications of AI algorithms among various markets are accelerating. Whereas in the case of respective due to heterogeneity of liver cancer and breakthroughs in AI technologies are driving the widespread adoption of AI. Moreover, these innovative and sophisticated technologies are assisting in liver cancer diagnosis by utilizing deep learning (DL) and convolutional neural networks (CNNs) approaches. AI usually analyzes the medical images (CT, MRI, ultrasound) and extracts quantitative features from medical images (radiomics).

For instance,

Accelerating R&D Activities and Early Diagnosis Technologies

In 2025, the advanced liver cancer market is fueled by a continuously rising focus on research and development of new therapies and therapeutic solutions for liver cancer. Alongside these innovative therapies, mainly encompass combination therapies and biosimilars. Also, major advances in early detection imaging technologies, including MRI, CT scans, and AI-enhanced tools, are boosting prior diagnosis with strategies for customized treatments. Besides this, significant government initiatives and funding for cancer research approaches and awareness programs are also driving the overall market growth.

Escalating Spending on Therapies and Restricted Access

Primarily involved challenges in the advanced liver cancer market are a rise in expenses for novel and advanced therapies, like targeted therapies and immunotherapies. This limitation may create a major barrier for patients in low-to-moderate moderate-income countries. In these countries, because deficient healthcare system creates another hurdle with limited access, leading to undetected or being diagnosed at later stages. As well as restricted access to diagnostic services and advanced healthcare facilities may also hinder market expansion.

Breakthroughs in Therapies and Liquid Biopsy Technology

In the coming era, the active emergence of novel research activities and the development process for new immunotherapies and targeted therapies will create developing premier opportunity for the global advanced liver cancer market. Furthermore, broader exploration of the application of combination therapies, like as targeted therapies with immune checkpoint inhibitors, is impacting the market development, and the wider progress and adoption of liquid biopsy tests for early detection of liver cancer is another robust area in the future.

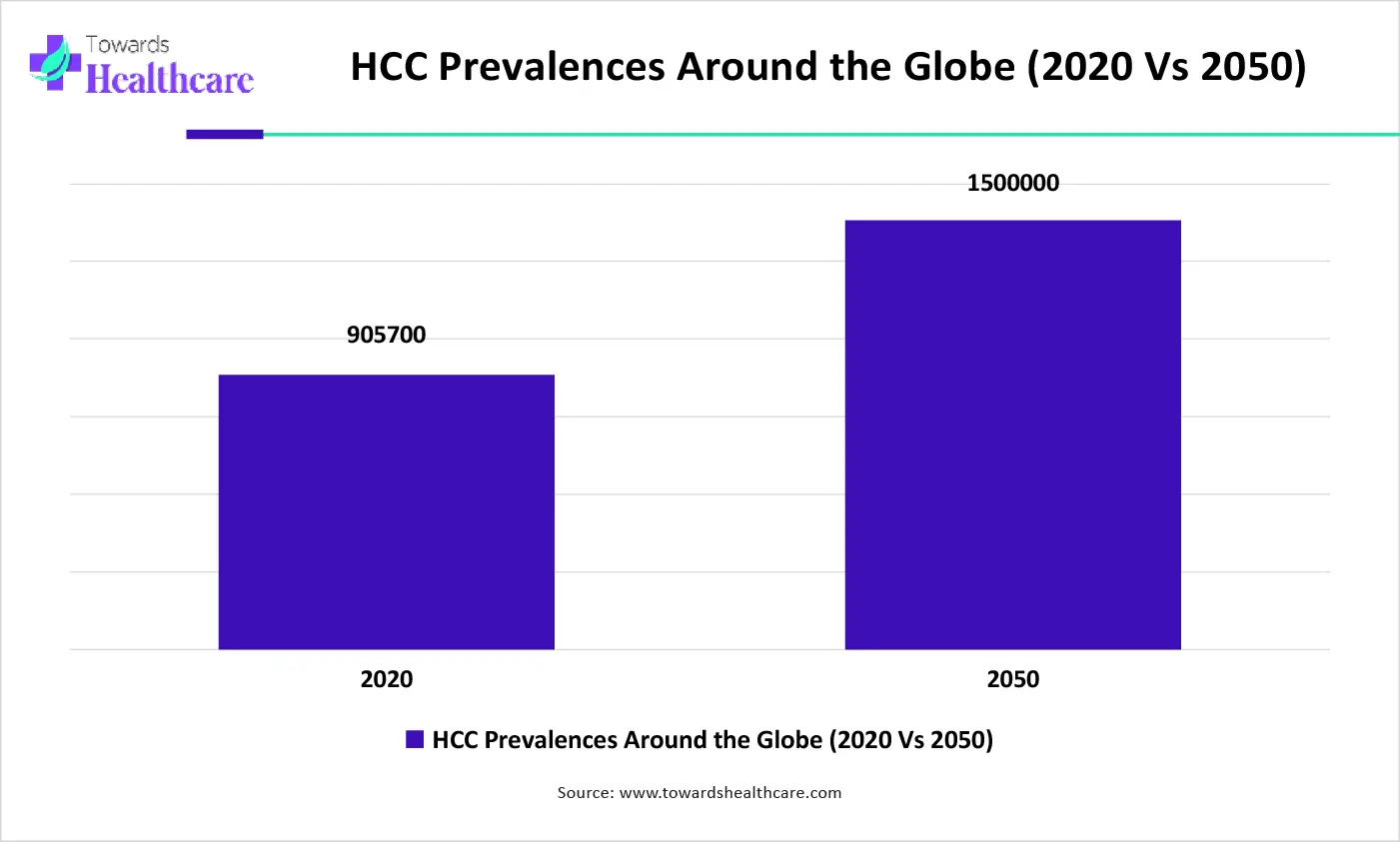

The hepatocellular carcinoma (HCC) segment held the biggest revenue share of the market in 2024. The segment is influenced by factors such as chronic hepatitis B and C infections, alcoholic liver disease, non-alcoholic steatohepatitis (NASH), and NAFLD. Along with this, due to increased resistance to existing therapies and escalated mortality rates linked with advanced HCC are fueling the ultimate segment growth. And, these conditions are widely supporting to evolution of innovative and targeted therapies by heavy investments in research activities.

During 2025-2034, the intrahepatic cholangiocarcinoma (ICC) segment is anticipated to expand at a rapid CAGR. Due to limited advanced treatment solutions for ICC patients, especially uncovered adherence to efficient systemic therapies, this is increasingly fostering the development and adoption of new treatment approaches. Additionally, a major factor referred to as next-generation sequencing has shown that various ICC tumors harbor targetable mutations, resulting in a surge in clinical trials to evaluate targeted therapies. This enhanced recognition of the molecular guidelines of ICC is paving the way for highly tailored and efficacious treatment plans.

In 2024, the systemic therapy segment was dominant in the global advanced liver cancer market. The segment is driven by growing concerns relevant to HCC in developed regions and the shortage of existing therapies. Moreover, advances in diagnostic tools and imaging techniques are allowing prior and more precise detection of HCC, contributing to more patients being eligible for systemic therapies.

In this systemic therapy segment, the targeted therapy sub-segment held a major share of nearly 45% in 2024. Across the globe, advancing understanding related to the genetic and molecular aspects of liver cancer is assisting researchers to establish drugs that can particularly target cancer cells. However, the transforming approaches in those targeting specific proteins or pathways involved in cancer cell progression have been fueling the diverse treatment solutions and personalizing the ultimate options.

Moreover, the immunotherapy segment will grow rapidly in the coming era. Widespread benefits of these immunotherapies, mainly ICIs, can optimize survival and offer long-term cancer control in a certain HCC patient pool, as well as increasing movement towards combination therapies in ongoing clinical trials, such as anti-angiogenic agents and tyrosine kinase inhibitors, which are focusing on further boosting treatment outcomes.

Primarily, the tyrosine kinase inhibitors (TKIs) segment experienced dominance in the market. In the last few years, Imatinib, Gefitinib, and Cetuximab have been approved as TKIs in different cancers, including liver cancer. However, these kinds of TKIs support targeted therapy by inhibiting cell proliferation. They possess enhanced effectiveness with reduced toxicity, hence are used before and after the surgery process in cancer. Alongside breakthroughs in drug delivery, like nanoparticle-based TKI delivery, are greatly assisting in drug absorption, bioavailability, and targeted delivery, potentially accelerating efficacy and reducing side effects.

The immune checkpoint inhibitors (ICIs) segment is estimated to register the fastest expansion. Ongoing research activities have explored several immune checkpoints over the CTLA-4 and PD-1/PD-L1, including LAG-3, TIM-3, and TIGIT, to develop new ICI therapies. And, different clinical trials represented that a combination of atezolizumab (anti-PD-L1) and bevacizumab (anti-VEGF) notably enhanced overall survival and progression-free survival compared to sorafenib in first-line treatment of advanced HCC.

In the global advanced liver cancer market, the hospitals segment dominated with a major share in 2024. Due to the presence of many specialized activities in hospitals for liver cancer treatment, the expansion of hospitals is being experienced. Mainly, they comprise liver resection, liver transplantation, Transarterial Chemoembolization (TACE), Radiofrequency Ablation (RFA), and radiation therapy. Apart from this, hospitals are increasingly offering expanded access for chemotherapy, targeted therapy, and immunotherapy in liver cancer.

On the other hand, the specialty clinics segment is predicted to expand at a rapid CAGR. They are broadly emphasising personalized treatment approaches. As well as a wide range of adoption of minimally invasive procedures like TACE and robust facilities available for earlier detection and diagnosis, such as liquid biopsy assays, AI for image analysis, and point-of-care diagnostic services, are driving the segment expansion.

In the global market, the oral segment accounted for the dominating share in 2024. This route is preferred due to its easy access and non-invasiveness. Few challenges have resulted in innovative approaches in this drug delivery system, such as nanoparticles, micelles, and biopolymer-based formulations, to enhance the effectiveness of oral treatments for advanced liver cancer. As this can be convenient for patients, leading to decreased frequent hospital visits and ultimately resolving healthcare burden concerns.

Although the intravenous (IV) segment is estimated to register the fastest expansion during 2025-2034, consistent studies have demonstrated that many immunotherapies are administered via the IV route directly into blood bloodstream, such as nivolumab (an anti-PD-1 antibody) and ipilimumab (an anti-CTLA-4 antibody) via IV infusion. This gives immense outcomes in patients, as well as administration of other therapies, like Atezolizumab (an anti-PD-L1 antibody) and bevacizumab (an anti-VEGF antibody), and Tivantinib & Cabozantinib are supporting in IV administration with the development of combination therapies for IV delivery system.

By capturing the biggest share, the biopsy segment dominated the global advanced liver cancer market in 2024. Major advantages of this approach are that it is a minimally invasive procedure, which comprises ultrasound-guided or laparoscopic biopsies to resolve patient discomfort. Furthermore, extensive liver biopsies, particularly when combined with advanced imaging techniques, are necessary for ensuring the presence of liver cancer and determining its stage and extent. Also, the molecular analysis of biopsy samples enables accurate tumor characterization, allowing clinicians to select strong, personalized treatment solutions.

The biomarker testing segment is anticipated to register rapid growth. Nowadays, the advances involved in the AFP detection, like electrochemical, optical, and piezoelectric sensors, are encouraging a more specific detection approach over the conventional methods. AFP testing is employed in screening, diagnosis, and monitoring disease progression, whereas genomics profiling is driving comprehensive analysis of genetic alterations in HCC. Also, the combined approaches of AFP testing with other biomarkers are assisting in demonstrating a complete picture of the disease.

North America experienced market share by 35% in 2024, dominance due to the presence of major pharmaceutical industries, such as Bristol Myers Squibb, Merck, and Roche (Genentech). These companies are promoting research, development, and commercialization of liver cancer treatments, further contributing to the market's growth. Also, the advanced healthcare infrastructure in North America offers the adoption of novel diagnostic and treatment technologies, leading to better patient outcomes.

The U.S. has been seeing novel developments in diagnostic technologies, such as AI-assisted imaging and liquid biopsy, which are supporting early detection and treatment precision. Moreover, the development of novel drugs and therapies, like targeted therapies such as multi-kinase inhibitors (MKIs), and the increasing emphasis on tailored solutions, are incorporating as growth factors to market expansion.

For this market,

Due to the raised focus on healthcare expenditures and escalated awareness about liver cancer and the application of screening and diagnostic tests is fueling market expansion in Canada. In Canada, the growing prevalence of liver cancer is fueled by chronic alcoholism is a major cause of liver cancer, mainly in high-HDI countries like Canada.

For instance,

During 2025-2034, the Asia Pacific is estimated to grow fastest, as both global and local pharmaceutical companies are widely involved in R&D activities. These R&D activities primarily foster the development of novel therapies applied in liver cancer, such as targeted therapies and immunotherapies. Along with this, in ASAP, increased healthcare spending, especially in the infrastructure of hospitals and specialty clinics, is resulting in higher access to advanced diagnostic and treatment measures for liver cancer.

The huge burden of cancer cases in India is mainly driving demand for novel and robust therapies in liver cancer treatment. Additionally, in India, hospital pharmacies currently possess a crucial share of the market due to their significant role as primary diagnosis and treatment centers.

For this market,

In China, increasing incidences of HCC, as well as the inclusion of new drugs on China's National Reimbursement Drug List (NRDL), can actively raise their accessibility and market penetration. Moreover, modifications in China's regulatory landscape are supporting both domestic and multinational companies for market entry.

For instance,

Across Europe, the market is experiencing significant growth. Incorporation of many factors, like revolutionary steps in diagnostic imaging, like MRI and CT scans, can lead to coupling in precise diagnosis, staging, and monitoring. On the other hand, the market is seeking expansion due to the development of newer therapies, such as targeted drugs, immunotherapies, and minimally invasive treatment options.

For instance,

The presence of robust healthcare systems consisting of highly sophisticated diagnostic tools for liver cancer is propelling the respective market growth. Also, Germany encompasses major leading companies, like Bayer AG, Merck KGaA, and Affimed are in the German liver cancer therapeutics area. Germany has excellent hospitals and experienced specialists in hepatobiliary (HPB) oncology, such as surgeons, medical oncologists, interventional radiologists, and hepatologists.

Combined factors are contributing to the market expansion, such as growing demand for precision medicine in diverse areas, like liver cancer in the UK. Besides this, the adoption of Artificial intelligence is being integrated into treatment planning and diagnosis, potentially enhancing outcomes.

For instance,

By Cancer Type

By Treatment Type

By Drug Class

By End User

By Route of Administration

By Diagnosis & Monitoring Method

By Region

January 2026

January 2026

January 2026

January 2026