February 2026

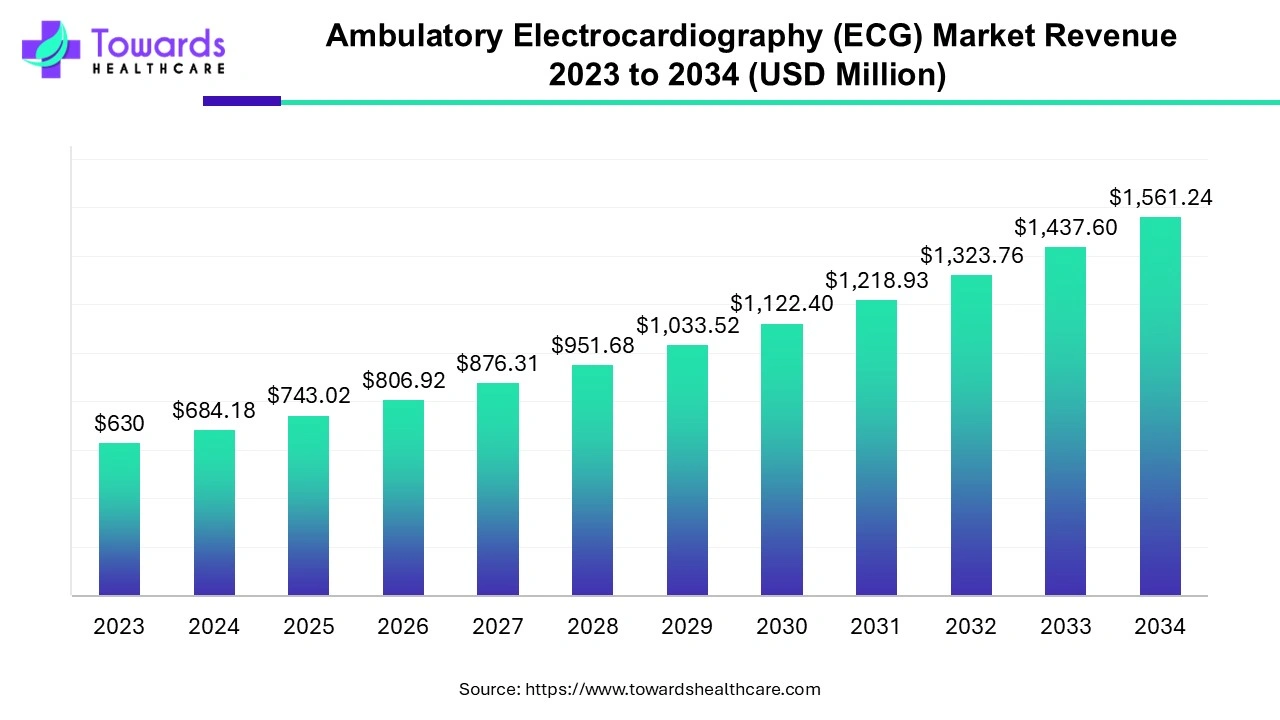

The global ambulatory electrocardiography (ECG) market was estimated at US$ 630 million in 2023 and is projected to grow to US$ 1561.24 million by 2034, rising at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2034.

The ambulatory electrocardiography (ECG) market deals with the manufacturing and distribution of ECG monitoring devices. These devices are portable and are designed for prolonged and continuous surveillance of cardiac rhythm. Portable ECG devices are useful in monitoring cardiac rhythm in the natural environment of the patients. Ambulatory devices are highly useful in detecting infrequent or transient cardiac events that can be used by professionals to analyze any serious health risks in the future.

The demand for ambulatory ECG is growing due to the growing number of people with cardiovascular diseases (CVDs). To date, it is the leading cause of death worldwide, according to the WHO. Healthcare professionals recommend the use of portable ECGs for people who are at a high risk of cardiovascular diseases, such as obese people, people with a family history of cardiovascular diseases, diabetic people, or people who have already gone through healthcare procedures for cardiovascular issues.

For instance,

Technological advancements are significantly improving the accuracy and efficiency of various medical devices, including ECG. AI is becoming a part of ECG in diagnosis, stratification and management. AI is useful in interpreting data & prediction, noticing ECG abnormalities, and other factors that can be useful in mitigating serious health issues in the future. With advancements in developing better AI and machine learning algorithms, the ambulatory electrocardiography (ECG) market has the opportunity to use these advanced algorithms to make even more powerful ECG devices in the future.

For instance,

Since there is more noise and artifacts created during everyday activities than during hospital monitoring, beat identification is more difficult for ambulatory monitoring. An ECG signal-to-noise ratio (SNR) that is low can occur when a patient engages in a variety of high-intensity physical activities.

The major growth factor of the ambulatory electrocardiography (ECG) market is the rising prevalence of cardiovascular disorders (CVDs). CVDs are major public health concerns, especially among the geriatric population. Sedentary lifestyles, heredity, and an imbalanced diet are the major causes of CVDs. In the WHO European region, CVDs result in over 42.5% of all deaths annually, accounting for 10,000 deaths per day. (Source: WHO) Government organizations launch initiatives to create awareness of screening and early diagnosis of CVDs. The WHO Regional Director for Europe set a target to reduce salt intake by 25%, saving an estimated 900,000 lives from CVDs by 2030.

North America dominated the ambulatory electrocardiography (ECG) market in 2023. North America is technologically advanced, with advanced healthcare infrastructure and organizations that continuously make efforts to provide innovative solutions to existing problems. The region holds a dominating position in technology, healthcare, and research & development. The U.S. and Canada are the two major countries that promote the growth of the market in North America.

The largest share of North America’s ambulatory electrocardiography (ECG) market was captured by the U.S. in 2023. The dominance of the country is due to advanced healthcare infrastructure, the presence of key market players, investments in R&D, and government support. The presence of organizations like the U.S. FDA gives an advantage to the U.S. because these organizations provide funding, guidance, and approvals for new devices, technology, therapy, therapeutics, drugs, and others.

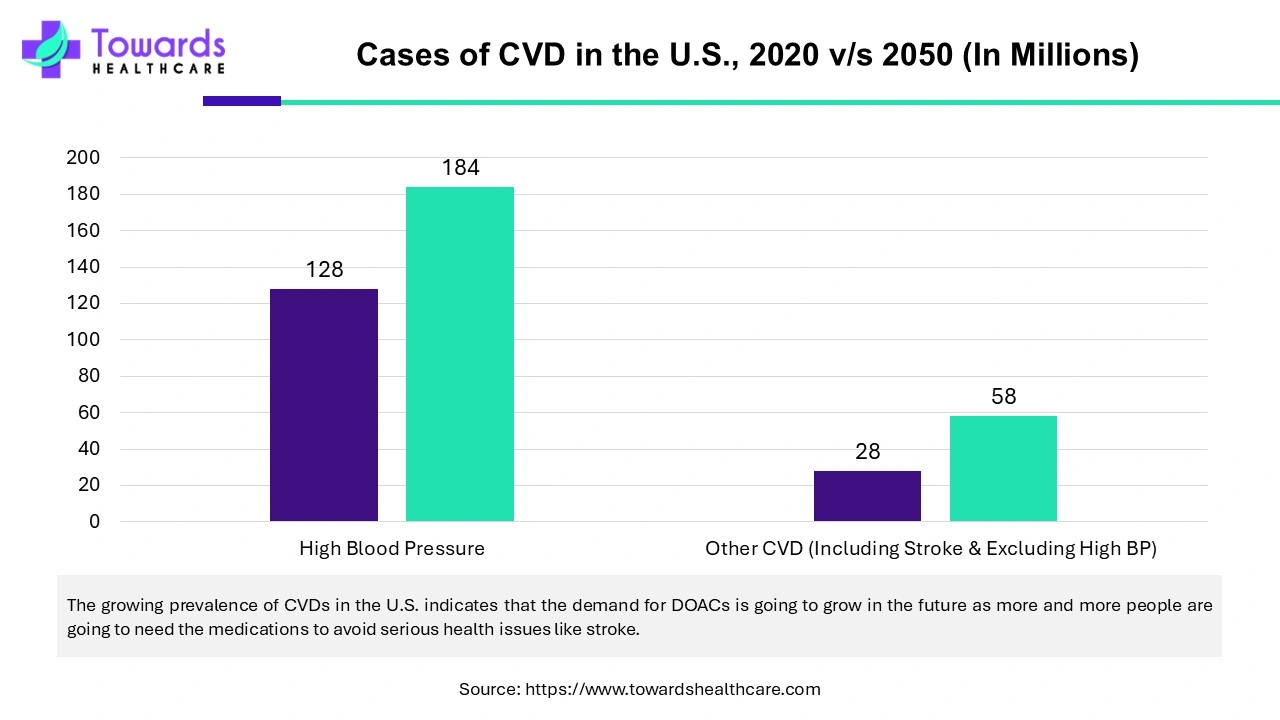

Apart from this, the country is among the top countries with CVDs. It is because of the sedentary lifestyle, unhealthy eating habits, and physical inactivity. From 2020 to 2050, the cases of CVDs are expected to increase to 55.13% in the U.S. The growing cases of CVDs and telehealth in the U.S. are significantly pushing organizations to develop ambulatory ECG and healthcare users to use these devices for health monitoring and preventive care.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The ambulatory electrocardiography (ECG) market in Asia Pacific is growing due to the growing number of CVD cases. The major contributors to the market’s growth are China, India, Japan, and South Korea.0

For instance,

To reduce the growing burden on the healthcare system of CVDs, the governments in the Asia Pacific are taking significant steps such as financial investments, awareness programs, health policies, and providing incentives. Apart from this, market key players are also establishing their branches and launching new devices in countries such as India and China, which have a high potential for growth.

For instance,

Europe is expected to grow at a notable CAGR in the ambulatory electrocardiography (ECG) market in the foreseeable future. The rising adoption of advanced technologies, increasing healthcare expenditure, and the growing awareness of ambulatory services drive the market. The increasing prevalence of CVDs and favorable government support boost the market. The burgeoning medical device sector and the rising investments & collaborations also contribute to market growth. The growing demand for point-of-care diagnostics potentiates the demand for ambulatory ECG.

Currently, more than 7.6 million people are living with heart and circulatory diseases in the UK, representing 4 million males and 3.6 million females. CVDs account for 11% of the total healthcare expenditure in the EU. In France, the management of CVDs costs €19.4 billion per year, representing 10.5% of the total expenditure of its health insurance branch. Moreover, the UK government has formed a 10-year health plan to improve outcomes in patients with heart attacks or strokes. This can be achieved through the delivery of more scans and tests, increasing collaborations, and greater use of apps and wearable technology. (Source: UK Parliament)

By type, the portable segment held the largest share of the market. This segment dominated because there are several advantages of using portable ECG monitors, such as early detection of heart conditions, continuous monitoring, patient empowerment, and cost-effectiveness. These devices are highly useful in telehealth or remote patient monitoring.

The patch segment is estimated to grow at the fastest rate during the forecast period. These devices can be used for extended periods, require less material for making, and are small, lightweight, and adhesive. These devices provide clinical flexibility, continuity, and convenience.

For instance,

By application, the hospital segment held the dominant share of the market. The majority of patients visit the hospital for regular health check-ups, to take health advice, and hospital admissions for prolonged care, due to which these devices are dominantly used by hospital staff. Hospitals are preferred due to the presence of all the necessary resources, including equipment, medicines, and healthcare professionals.

The home segment is anticipated to grow at the fastest rate in the ambulatory electrocardiography (ECG) market during the forecast period. The segment is growing due to the growing demand for remote health monitoring. It is highly useful in the case of patients who cannot commute to the hospital due to old age, disability, or long distances.

Mintu Turakhia, Chief Medical and Scientific Officer and EVP, Product Innovation at iRhythm, commented on the positive results of the Zio monitoring patch ECG device, that prior studies have demonstrated high wear time, high analyzable time, high diagnostic yield, and less retesting of Zio XT. The new data shows how their newest long-term continuous Zio monitor patch performs even better in the real world. (Source: Globenewswire)

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026