February 2026

The global ankylosing spondylitis market size is calculated at USD 6.7 billion in 2025, grew to USD 7.09 billion in 2026, and is projected to reach around USD 11.83 billion by 2035. The market is expanding at a CAGR of 5.85% between 2026 and 2035.

The ankylosing spondylitis market is primarily driven by the increasing research activities and the rising prevalence of autoimmune disorders. Innovative biologics are developed for the prevention, diagnosis, and treatment of ankylosing spondylitis (AS). Government bodies provide funding for research and manufacturing of pharmaceuticals. Artificial intelligence (AI) revolutionizes the market by streamlining the diagnosis and treatment of AS.

| Key Elements | Scope |

| Market Size in 2025 | USD 6.7 billion |

| Projected Market Size in 2035 | 11.83 billion |

| CAGR (2025 - 2035) | 5.85% |

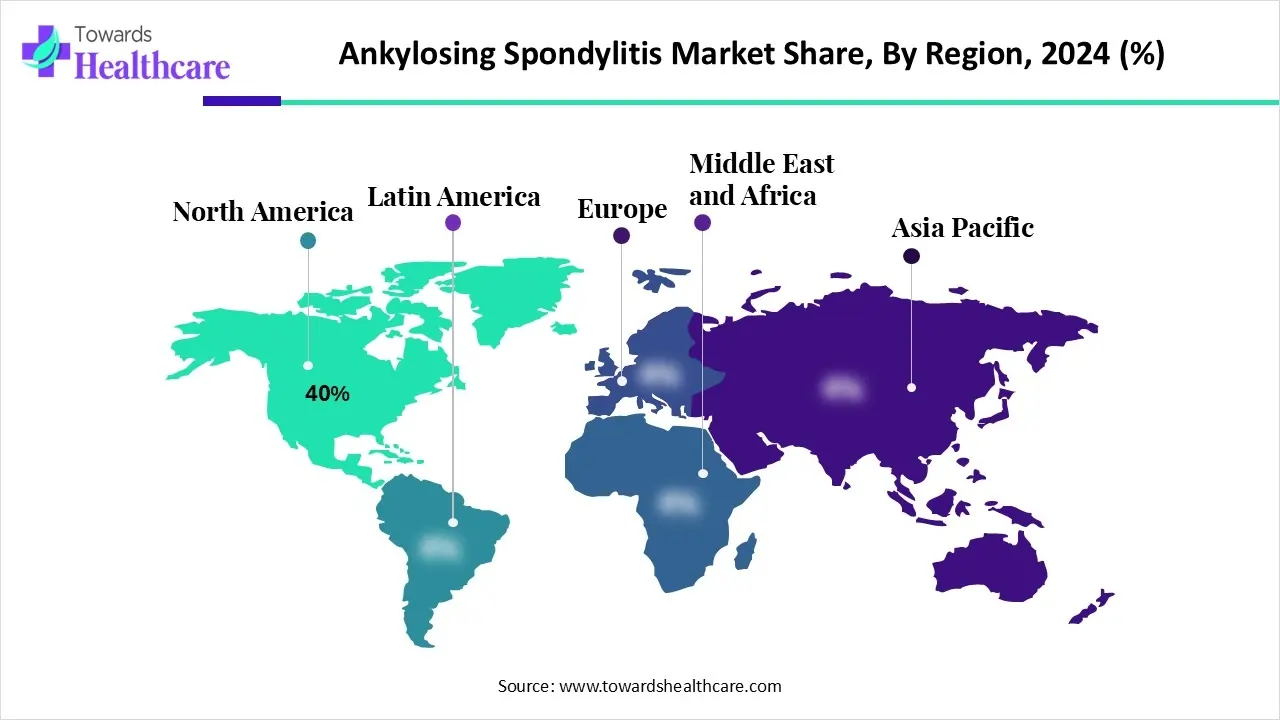

| Leading Region | North America by 40% |

| Market Segmentation | By Drug Class, By Route of Administration, By Disease Stage, By Diagnostic Method, By End-User, By Region |

| Top Key Players | AbbVie, Inc., Johnson & Johnson, Gilead Sciences, Janssen Pharmaceuticals, Inc., Suzhou Zelgen Biopharmaceuticals Co., Ltd., Amgen, Inc., Samsung Biologics, Fresenius Kabi |

The ankylosing spondylitis market is experiencing robust growth, driven by the increasing prevalence of spondyloarthropathies, early diagnosis initiatives, rising adoption of biologics, and the growing demand for targeted immunotherapies. It includes pharmaceuticals, biologics, biosimilars, diagnostics, monitoring tools, and supportive care services used for the treatment and long-term management of AS, a chronic, progressive inflammatory disease primarily affecting the axial skeleton. The market covers TNF inhibitors, IL-17 inhibitors, JAK inhibitors, NSAIDs, DMARDs, physical therapy solutions, diagnostic imaging, and disease monitoring technologies.

AI and machine learning (ML) algorithms transform the prevention, diagnosis, and treatment of AS. They are embedded in diagnostic tools, such as X-ray and MRI, to analyze imaging data, increasing the accuracy of AS diagnosis. They also enable healthcare professionals to identify novel biomarkers involved in disease progression. Furthermore, they can also suggest appropriate treatment regimens based on patients’ conditions, as well as predict treatment responses to aid patient-specific treatment planning.

Which Drug Class Segment Dominated the Ankylosing Spondylitis Market?

TNF Inhibitors

The TNF inhibitors segment held a dominant position in the market with a share of approximately 45% in 2024, driven by the growing need for targeted therapies and the demand for symptom relief. THF inhibitors, such as etanercept, adalimumab, and infliximab, suppress the immune system by targeting TNF, thereby reducing inflammation in the joints. As TNF inhibitors directly act on the immune system, they treat a disease from its root cause. They prevent structural damage to the bones and enhance the overall well-being of patients.

IL-17 Inhibitors

The IL-17 inhibitors segment is expected to grow at the fastest CAGR of approximately 12% in the ankylosing spondylitis market during the forecast period. IL-17 inhibitors, such as secukinumab and ixekizumab, block the IL-17A pathway, reducing inflammation in arthritis. Several studies have demonstrated the safety and effectiveness of IL-17 inhibitors. They have also found that IL-17 inhibitors produce favorable response rates compared to other therapeutics.

Emerging Biologic Therapies

The emerging biologic therapies segment is expected to grow in the coming years, due to growing research activities and advancements in genomic technologies. As ankylosing spondylitis is also caused by genetic mutations, novel cell and gene therapies are under development. Researchers have shifted focus to the development of personalized medicines and determining their safety profile.

Why Did the Subcutaneous Segment Dominate the Ankylosing Spondylitis Market?

Subcutaneous

The subcutaneous segment contributed the biggest revenue share of approximately 50% in the market in 2024, due to the development of advanced subcutaneous (s.c.) delivery devices and the administration of drugs directly under the skin. Usually, IL-17 inhibitors (secukinumab) are administered through the s.c. Route. Advanced devices enable patients to self-administer the drug, eliminating the need for skilled professionals. The s.c. Route causes less discomfort and is easier to administer, enhancing patient compliance.

Oral

The oral segment is expected to grow with the highest CAGR of approximately 13% in the ankylosing spondylitis market during the studied years. The oral route is more convenient and reduces adverse effects related to injections. They can be modified to enable sustained release and immediate release based on patients’ conditions. Tofacitinib and Upadacitinib are administered through the oral route for the treatment of AS.

Intravenous

The intravenous segment is expected to grow significantly, due to high bioavailability and faster onset of action. Drugs administered through the intravenous (i.v.) route have shown clinical significance and improvements in signs and symptoms. The i.v. The route eliminates the first-pass metabolism pathway and administers the drug directly into the bloodstream. It transports the drug to different body parts.

How the Moderate Ankylosing Spondylitis Segment Dominated the Ankylosing Spondylitis Market?

The moderate ankylosing spondylitis segment held the largest revenue share of approximately 48% in the market in 2024, due to the faster progression of the disease. During moderate AS, the pain may spread up the spine to the neck. The symptoms of moderate AS are more visible compared to the early stage of AS, allowing healthcare professionals to monitor visible signs of the disease and make effective clinical decisions.

Early-Stage Ankylosing Spondylitis

The early-stage ankylosing spondylitis segment is expected to expand rapidly with a CAGR of approximately 10% in the ankylosing spondylitis market in the coming years. People are becoming more aware of screening and early diagnosis of early-stage AS. Early-stage AS may involve frequent stiffness and pain in the lower back and buttocks. It is usually treated through physical therapy and medications.

Severe/Advanced Ankylosing Spondylitis

The severe/advanced ankylosing spondylitis segment is expected to show lucrative growth. Severe stage results in progressive back stiffness, impaired posture, and breathing difficulties. It is difficult to treat with medications and physical therapy alone. Some patients may need joint repair or replacement surgeries when severe joint damage is present. Treatment relieves stiffness and pain, maintains spinal motion, and prevents further complications.

What Made MRI the Dominant Segment in the Ankylosing Spondylitis Market?

MRI

The MRI segment accounted for the highest revenue share of approximately 40% in the market in 2024, due to the high accuracy of MRI to detect early changes of spondylitis. MRI is more sensitive than CT or plain radiography in detecting inflammatory changes. AI and ML are leveraged in MRI to enhance the accuracy and precision of diagnosis. They also assist healthcare professionals in analyzing imaging data.

Digital Spine Monitoring Tools

The digital spine monitoring tools segment is expected to witness the fastest growth with a CAGR of approximately 13% in the ankylosing spondylitis market over the forecast period. Advances in mobile technologies, electric health, and smartphone applications are being developed to diagnose AS. Smartphone apps and wearable sensors are used for remote monitoring, eliminating the need for visiting healthcare organizations. This also enables healthcare professionals to continuously monitor a patient, providing personalized treatment.

Blood Biomarkers

The blood biomarkers segment is expected to grow at a notable CAGR due to simplicity in diagnostic tests and high affordability. Patients suffering from AS have AS-specific mRNA biomarkers in their whole blood. Numerous in vitro and point-of-care diagnostics are developed to evaluate whole blood and quantify biomarkers from the blood. Ongoing efforts are made to identify novel biomarkers that are involved in disease progression.

Which End-User Segment Led the Ankylosing Spondylitis Market?

Hospitals

The hospitals segment led the market with a share of approximately 45% in the market in 2024, due to favorable infrastructure and the presence of skilled professionals. Hospitals have professionals from various disciplines, providing multidisciplinary expertise to patients. Patients prefer visiting a hospital for AS treatment due to favorable reimbursement policies. Hospitals are involved in clinical trials that benefit patients with innovative treatment before market approval.

Specialty Rheumatology Clinics

The specialty rheumatology clinics segment is expected to show the fastest growth with a CAGR of approximately 12% over the forecast period. Specialty clinics possess skilled professionals to provide personalized treatment and care. They also adopt specialized equipment that focuses on rheumatology for diagnosis and medication, as well as physical medicine and rehabilitation for non-surgical management.

Ambulatory Care Centers

The ambulatory care centers segment is expected to grow in the upcoming years. Ambulatory care centers provide outpatient services for AS. They have skilled professionals and suitable infrastructure for conducting minor or minimally invasive surgeries. Ambulatory care centers focus on pain management, maintaining mobility, and preventing spinal stiffness, enabling patient comfort and well-being.

North America dominated the global market with a share of approximately 40% in 2024. The availability of state-of-the-art research and development facilities, a robust healthcare infrastructure, and the presence of key players are factors that govern market growth in North America. Countries like the U.S. and Canada are at the forefront of conducting research and clinical trials for innovative biologics. Government organizations launch initiatives to promote screening and early diagnosis of AS.

It is estimated that around 0.2-0.5% of the total population in the U.S. suffers from AS. There are over 658 active rheumatology physician group practices in the U.S., providing AS treatment. The U.S. has a well-established clinical trial infrastructure, accounting for 91 clinical trials as of November 2025. Of these, 18 trials are active.

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 12% in the coming years. The increasing prevalence of ankylosing spondylitis, the expanding middle-class population, and sedentary lifestyles boost the market. The growing research and development activities and the increasing adoption of advanced technologies propel market growth. The burgeoning healthcare sector, along with the rising number of biotech startups, contributes to market growth.

The prevalence rate of AS in China is approximately 0.29% with a male-to-female ratio of approximately 3:1, and most cases occur in the adolescent period. The nation focuses on bridging the gap between the number of rheumatologists and patients. Currently, there are 12,189 rheumatology and immunology specialists in China for over 200 million patients.

Europe is considered to be a significantly growing area, due to favorable government support and growing demand for personalized medicines. The European Medicines Agency (EMA) regulates the approval of AS diagnostics and therapeutics. Healthcare organizations in European nations have advanced infrastructure for providing personalized care. The rapidly expanding biopharmaceutical sector, along with increasing investments by government and private bodies, fosters market growth.

The UK Research and Innovation (UKRI) and the National Institute for Health and Care Research (NIHR) are the major government funding agencies that provide funding for research on numerous disorders. The NIHR allocated £199,500 for research concerning AS in FY 2023-24. AS affects approximately 200,000 people in the UK, causing severe pain and spinal fusion.

Latin America is rapidly embracing advanced ankylosing spondylitis therapies. The ankylosing spondylitis market is expanding due to improved diagnostic capabilities and a rising patient population. Key players are targeting this region through strategic partnerships to increase the availability of effective, modern treatments for inflammatory diseases. The overall trend is highly positive.

Argentina is seeing significant growth driven by heightened disease awareness. There is a noticeable shift towards advanced treatment modalities like biologic agents for Ankylosing Spondylitis. Local initiatives are focusing on early diagnosis and management, improving patient outcomes, and stimulating demand within the rheumatology specialty clinics across the country.

The Middle East and Africa region presents lucrative opportunities for AS therapeutics. The ankylosing spondylitis market expansion in MEA is driven by increased investment in healthcare infrastructure and rising awareness of chronic inflammatory diseases. Challenges remain, such as the high cost of biologics, but partnerships are forming to expand patient access to crucial treatment options.

The UAE market for ankylosing spondylitis drugs is experiencing a strong upswing. The increased incidence of the condition and demand for effective treatments are fueling growth. There is an increasing focus on new biologic and small-molecule therapies, particularly through hospital pharmacies, reflecting the nation's high standard of specialized care.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings (in AS):

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals:

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Research & Development Infrastructure:

Innovation Focus Areas:

Competitive Positioning:

SWOT Analysis:

Recent News & Updates:

Press Releases:

Industry Recognitions/Awards:

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings (in AS):

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals:

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Research & Development Infrastructure:

Innovation Focus Areas:

Competitive Positioning:

SWOT Analysis:

Recent News & Updates:

Press Releases:

Industry Recognitions/Awards:

| Companies | Headquarters | Offerings | Revenue (2024) |

| Pfizer, Inc. | New York, United States | Xeljanz or Xeljanz XR for the treatment of adult patients with active AS | $63.6 billion |

| Sandoz Group AG | Basel, Switzerland | Hyrimoz, either alone or in combination with non-biologic DMARDs, for treating AS | $10.4 billion |

| Novartis AG | Basel, Switzerland | Cosentyx is the first and only interleukin-17A inhibitor for adults with AS | $11.9 billion |

| Augurex Life Sciences Corp. | Canada | SPINEstat is a first-of-its-kind multiplex biomarker assay for the diagnosis and management of AS | - |

| Eli Lilly and Company | Indiana, United States | Taltz is a biologic injection that treats adults with active AS | $45.04 billion |

By Drug Class

By Route of Administration

By Disease Stage

By Diagnostic Method

By End-User

By Region

February 2026

February 2026

February 2026

February 2026