January 2026

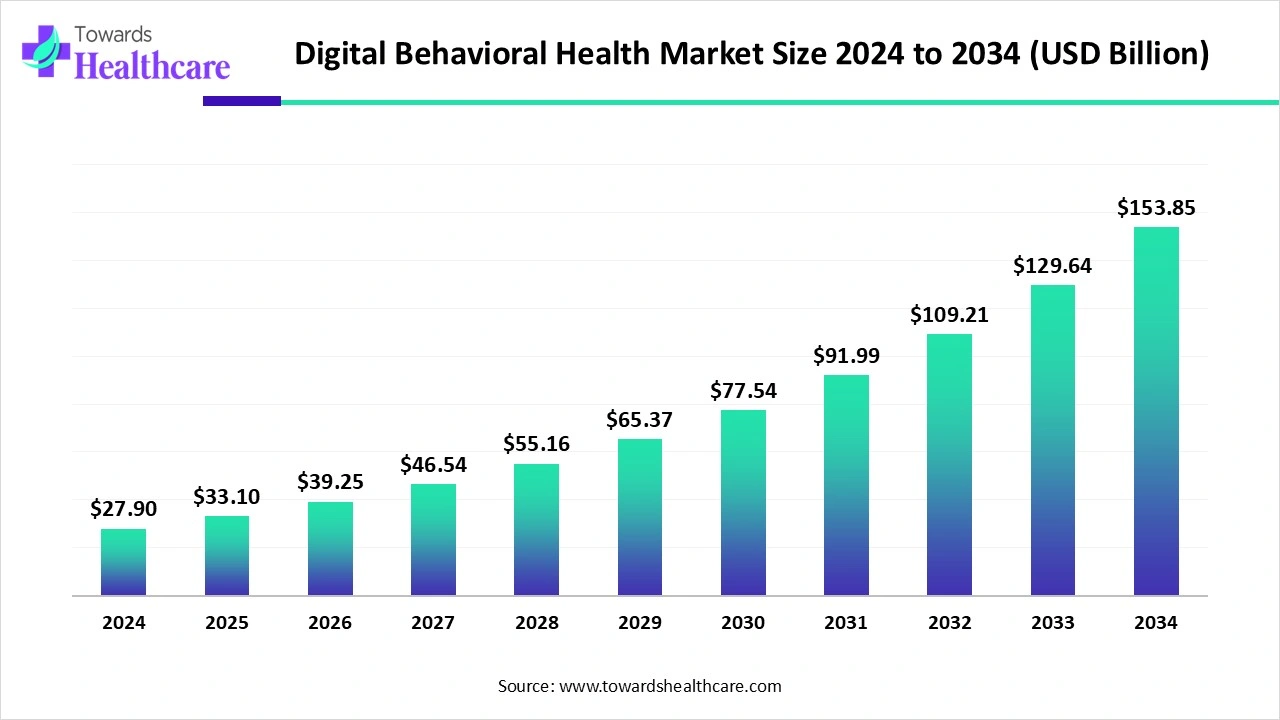

The global digital behavioral health market size is calculated at USD 27.9 billion in 2024, grew to USD 33.1 billion in 2025, and is projected to reach around USD 153.85 billion by 2034. The market is expanding at a CAGR of 18.6% between 2025 and 2034.

The digital behavioral health market is primarily driven by the increasing need for personalized mental health treatment. Digital behavioral health tools increase the accessibility and affordability of diagnosing and treating mental health conditions. Government organizations promote patients for screening and early diagnosis through several initiatives and funding. Artificial intelligence (AI) plays a crucial role in providing real-time monitoring of patient vital signs. Generative AI (genAI) and smartphone integration present future opportunities for patients and providers.

| Table | Scope |

| Market Size in 2025 | USD 33.1 Billion |

| Projected Market Size in 2034 | USD 153.85 Billion |

| CAGR (2025 - 2034) | 18.6% |

| Leading Region | North America |

| Market Segmentation | By Therapeutic Area, By Solution Type, By Technology, By End-User, By Distribution Channel, By Region |

| Top Key Players | Talkspace, BetterHelp (Teladoc Health), Cerebral, Headspace Health, Lyra Health, Ginger (Headspace), Spring Health, Woebot Health, Big Health, SilverCloud Health (Amwell), Quartet Health, Brightside Health, Meru Health, Happify Health, Mindstrong, 7 Cups, Eleos Health, Modern Health, Limbix, Happify |

The digital behavioral health market refers to technology-enabled solutions and platforms that deliver prevention, management, and treatment of mental and behavioral health conditions through digital interfaces. It includes mobile applications, telepsychiatry platforms, virtual therapy, cognitive behavioral therapy (CBT)-based programs, AI chatbots, and digital therapeutics tailored for depression, anxiety, stress, substance use disorders, and other behavioral conditions.

Digital health solutions are designed for use by individuals, providers, payers, and employers, offering remote accessibility, real-time engagement, and data-driven personalization. Growth is supported by the rising prevalence of mental health conditions, shortage of in-person providers, expanding insurance coverage for digital behavioral care, and adoption of value-based care models that integrate mental health into overall digital health ecosystems.

Government Investment: Government bodies provide funding to private institutions to promote digital mental health services and increase their accessibility.

Increasing Collaborations: Public-private partnerships among government organizations/regulatory bodies and private organizations provide desired support and accelerate the use of digital health tools in respective nations.

AI plays a vital role in digital behavioral health by providing insights and personalized solutions for cognitive problems. It offers advanced detection approaches, tailored therapies, and virtual therapeutic platforms. The advent of AI-based sensors leads to the development of innovative wearable devices for monitoring vital signs. This enables real-time monitoring of patients, allowing healthcare professionals to make proactive decisions. AI and machine learning (ML) algorithms can detect even minor changes in the behavior of patients that are difficult to detect by humans. They modify treatment regimens based on patient progress.

Rising Prevalence of Neurological Conditions

The major growth factor for the digital behavioral health market is the rising prevalence of neurological disorders. Neurological conditions, such as Alzheimers disease (AD), Parkinsons disease (PD), multiple sclerosis, and stroke, are the most common disorders affecting millions of individuals. AD is the most common disorder in the U.S., affecting around 50% to 60% of cases of dementia. According to a recent study by The BMJ, approximately 25.2 million people are expected to be living with PD globally by 2050. This promotes the use of digital behavioral health.

Lack of Awareness

Numerous patients and healthcare professionals from rural areas or from low- and middle-income countries are unaware of advanced digital health tools for mental health conditions. People from these regions have inadequate resources to study digital tools for mental health. This limits the use of digital behavioral health, restricting market growth.

What is the Future of the Digital Behavioral Health Market?

The market future is promising, driven by the increasing use of generative AI (genAI) and smartphone integration. GenAI-based chatbots are increasingly used to assist patients from diverse geographical locations, reducing linguistic barriers. These chatbots can analyze patient patterns and predict potential disease risks. They can generate human-like responses by handling diverse inputs and exhibiting personality traits. Moreover, the use of smartphone apps potentiates the accessibility of digital health. Advancements in internet technologies encourage users to use smartphone apps. It is reported that the use of mindfulness apps rose by nearly 2,500% compared to the 156% increase of depression-specific apps during the COVID-19 pandemic.

By therapeutic area, the depression & anxiety management segment held a dominant presence in the market in 2024. This is due to the increasing cases of depression & anxiety and the growing awareness among the general public. The rising use of social media has created awareness about the signs of depression & anxiety. Major traumatic events or medical problems may cause depression. The WHO reported that more than 1 billion people live with depression & anxiety. It is estimated that about 1 in 6 adults will develop depression & anxiety in their lifetime.

By therapeutic area, the substance use disorders segment is expected to grow at the fastest CAGR in the market during the forecast period. Teenagers are more attracted to consuming drugs primarily due to peer pressure and a lack of family involvement. More than 50% of people aged 12 years and above have used illicit drugs at least once. The U.S. federal budget for drug control in 2024 was $45 billion in the U.S. Substance use disorder can significantly affect how the brain functions over time, negatively impacting emotional well-being, relationships, and career.

By solution type, the telepsychiatry platforms segment held the largest revenue share of the market in 2024. This segment dominated due to the need for telemedicine and personalized patient care. Telepsychiatric platforms enable secure therapy sessions, remote counselling, and virtual psychiatric assessments. They facilitate seamless collaboration between patients and healthcare professionals, irrespective of geographical locations. They allow patients to attend regular therapy sessions, eliminating the need for a patient to personally visit a clinic. They also enable providers to continuously monitor a patient and prescribe appropriate treatment.

By solution type, the digital therapeutics (DTx) for behavioral health segment is expected to grow with the highest CAGR in the market during the studied years. DTx is an evidence-based and clinically evaluated software tool that enables the diagnosis, treatment, and management of mental health disorders. It can store large amounts of patient data and organize clinical care. DTx offers advanced cognitive-based services to patients in the comfort of their homes. Over the last 5 years, the U.S. Food and Drug Administration (FDA) has approved over 35 DTx products across different therapeutic categories.

By technology, the mobile-based apps segment contributed the biggest revenue share of the market in 2024. The increasing adoption of smartphones and advancements in internet technologies boost the growth of the segment. The availability of user-friendly software enables patients to self-manage their mental health conditions, allowing them to take an active part in clinical decision-making. According to a recent cross-sectional survey conducted in Ethiopia, about 1 in 4 individuals were using mental health apps, and around 94.7% showed interest in using apps.

By technology, the virtual reality (VR) & gamified therapy segment is expected to expand rapidly in the market in the coming years. VR & gamification are the future therapeutic options for mental health. They leverage psychosocial principles to encourage individuals to adopt desired behaviors, sustain engagement, and achieve positive outcomes. VR creates a virtual world for patients, offering them an immersive and interactive experience for users. These features help patients address and cope with mental health disorders.

By end-user, the individuals/patients segment accounted for the highest revenue share of the market in 2024. Patients prefer using digital behavioral health tools due to increased awareness about mental health and the growing demand for tailored care. They can get access to world-class treatment from various geographical locations in the comfort of their homes through remote monitoring. This saves a lot of time and cost for patients as they do not need to visit a clinic in person.

By end-user, the employers & corporate wellness programs segment is expected to witness the fastest growth in the market over the forecast period. The corporate sector and employers focus on the mental health conditions of employees. They conduct wellness programs to monitor and track their physical and mental health. This reduces absenteeism, increases productivity, and decreases healthcare costs. The Survey on Health and Benefit Strategies 2025 by Mercer reported that more than half of large employers (500 employees or more) either provide digital or in-person resources or will add them to help manage stress.

By distribution channel, the direct-to-consumer (D2C) apps segment led the market in 2024. The segmental growth is attributed to the development of novel and innovative mental health apps. Developers design apps for patients and providers, allowing them to collaborate. Patients get direct access to guided meditation, sleep stories, and mood tracking. These apps offer subscription-based services, benefiting patients, providers, and developers. They offer 24x7 support facilities at affordable rates.

By distribution channel, the insurance-integrated platforms segment is expected to show the fastest growth over the forecast period. Several government and private companies provide reimbursement for digital behavioral health tools. This encourages people to use digital tools and increase their affordability. Insurance-integrated platforms improve mental health services and ensure that individuals receive the necessary care without financial burden.

North America dominated the market in 2024. The availability of a robust healthcare infrastructure, favorable reimbursement policies, and the rising prevalence of neurological disorders are the major growth factors of the market in North America. Government organizations support the development and deployment of digital tools for mental health. North America is home to major players that provide advanced digital tools to Americans and globally.

The National Institute of Mental Health (NIMH) estimates that more than 1 in 5 adults live with a mental illness in the U.S. In FY 2023, NIMH awarded approximately 579 new and competing research project grants, with an estimated application success rate of 22%.The Centers for Medicare & Medicaid Services (CMS) provides reimbursement to patients.

The Canadian Mental Health Association (CMHA) suggests that 1 in 5 Canadians suffer from mental illness and projects that 14% of people in Canada will experience major depressive disorder in their lifetime. The Government of Canada recently launched the Youth Mental Health Fund to provide funding for increasing access to community-based mental healthcare for young Canadians.

Asia-Pacific is expected to grow at the fastest CAGR in the digital behavioral health market during the forecast period. The increasing geriatric population and the rising adoption of advanced technologies augment the market. People are becoming aware of early diagnosis of mental health disorders in the Asia-Pacific countries. The increasing investments and collaborations among key players contribute to market growth. There is a sufficient shortage of trained professionals to provide personalized care to patients, owing to the growing population, necessitating the demand for digital behavioral health.

The National Health Commission and the Chinese government announced a sweeping action plan to eradicate dementia by 2030, encompassing all aspects of the disease, from prevention and early diagnosis, treatment, rehabilitation, and care. The “Healthy China 2030” initiative also aims to enhance patient well-being and reduce their health risk.

The National Tele Mental Health Programme (NTMHP) by the Indian government led to the development of the Tele MANAS Mobile Application. As of April 2025, more than 20 lakh calls have been handled on the helpline number. The government allocated Rs 230 crore in NTMHP over the past three years.

Europe is expected to grow at a considerable CAGR in the digital behavioral health market in the upcoming period. Government organizations play a crucial role in creating awareness about digitization in the healthcare sector through initiatives. The rapidly expanding healthcare sector and the increasing mental health disorders foster market growth. Favorable regulatory policies lead to the launch of novel digital tools. The WHO released a digital health report: “Exploring the digital health landscape in the WHO European Region: digital health country profiles”.

The geriatric population aged 60 years and above accounts for 30.5% of the total population. The International Trade Administration reported that the penetration for digital treatment in Germany was 18.1% in 2024 and is projected to reach 28.08% in 2029. The government initiatives, like the Digital Healthcare Act (DVG) and Digital Health Applications Ordinance (DiGAV).

The Center for Ageing Better organization estimated that 26% of the total population will be aged 65 years and above, while 46% will be over 50 years by 2065. The UK government funds £2.3 billion in extra mental health funding annually in England, as well as £2.5 billion to support over a billion people, including those with mental health conditions.

Michael Jablonski, Vice President of Clinical Development & Medical Affairs at Boehringer Ingelheim, commented on collaborating with the Center for Technology and Behavioral Health (CTBH) that the collaboration aims to elevate the promise of prescription digital therapeutics to positively impact the health and quality of life of individuals living with serious mental illness and provide easier access to care. He also stated that the company aims to deliver more integrated and tailored solutions, enabling better outcomes.

By Therapeutic Area

By Solution Type

By Technology

By End-User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026