March 2026

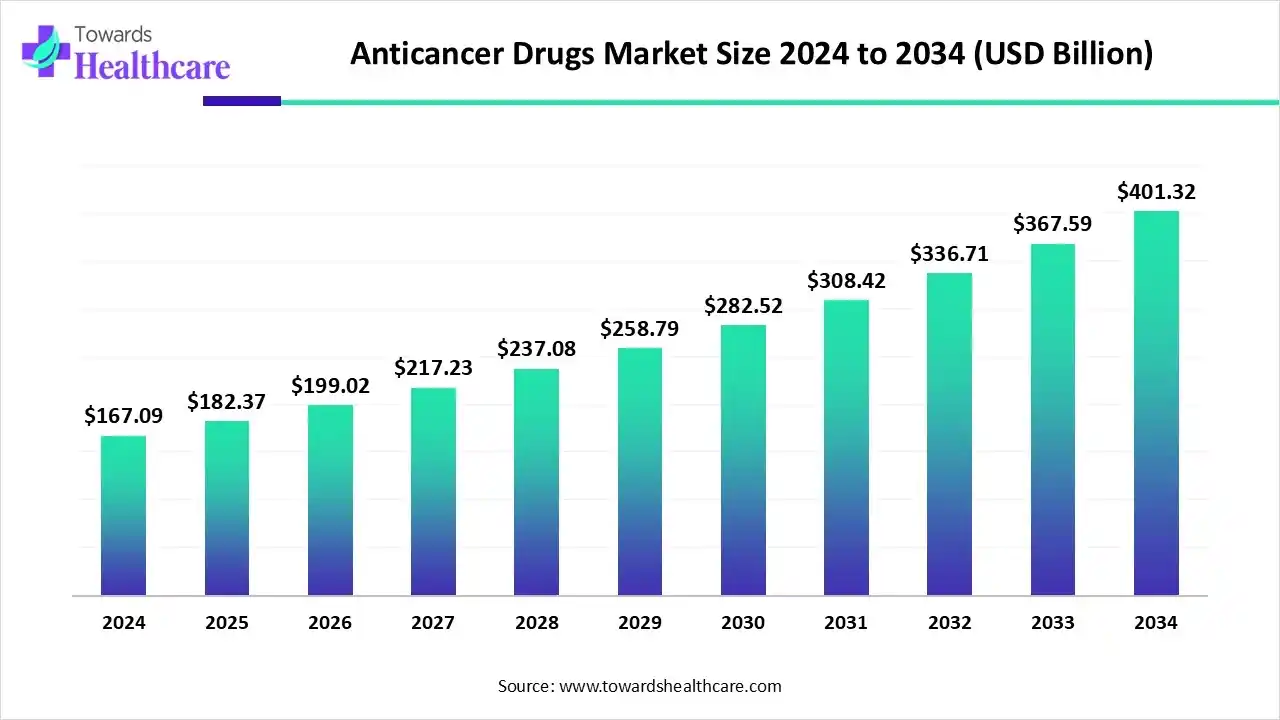

The anticancer drugs market size began at US$ 167.09 billion in 2024 and is forecast to rise to US$ 182.37 billion by 2025. By the end of 2034, it is expected to surpass US$ 401.32 billion, growing steadily at a CAGR of 9.14%.

The anticancer drugs market is witnessing robust growth, driven by rising cancer prevalence, advancements in targeted therapies, immunotherapies, and personalized medicine. North America dominates the market due to its well-established healthcare infrastructure, high R&D investment, and favorable reimbursement policies, which enhance patient access to innovative treatments. The increasing geriatric population, growing awareness about early cancer detection, and adoption of advanced diagnostic technologies further fuel demand. Overall, the market is expanding as pharmaceutical companies focus on developing safer, more effective, and precise anti-cancer therapies worldwide.

| Table | Scope |

| Market Size in 2025 | USD 182.37 Billion |

| Projected Market Size in 2034 | USD 401.32 Billion |

| CAGR (2025 - 2034) | 9.14% |

| Leading Region | North America |

| Market Segmentation | By Drug Class / Modality, By Route of Administration, By Cancer Type / Indication, By Region |

| Top Key Players | Roche/Genentech, Novartis, Pfizer, Merck & Co. (MSD), Bristol Myers Squibb (BMS), AstraZeneca, Johnson & Johnson/Janssen, Sanofi, Amgen, Eli Lilly & Co., Takeda, BeiGene, Regeneron, Bluebird Bio, Seagen, Moderna, Genmab, Incyte, Exelixis, Hutchmed / Chi-Med |

The anticancer drugs market is primarily driven by the increasing prevalence of cancers, the rising geriatric population, and the growing demand for advanced therapies that improve survival rates and quality of life. Anti-cancer drugs, also known as oncology drugs, are medications designed to prevent, inhibit, or treat cancer by targeting rapidly dividing cells or specific molecular pathways involved in tumor growth. These include chemotherapy, targeted therapy, immunotherapy, hormone therapy, and monoclonal antibodies. They work by killing cancer cells, blocking growth signals, or enhancing the immune system’s response. Continuous research, technological advancements, and personalized medicine approaches are expanding the effectiveness and application of these drugs globally.

The anti-cancer drugs industry is experiencing significant growth due to rising cancer prevalence, technological advancements in targeted therapies and immunotherapies, increasing awareness and early detection, and strong investments in research and development, enhancing treatment options and patient outcomes globally.

The global expansion of the anticancer drugs market is driven by rising cancer incidence and healthcare advancements. North America leads due to advanced infrastructure and high R&D investment. Asia-Pacific shows rapid growth from increasing awareness and improving healthcare access. Europe benefits from supportive policies and early detection programs, while emerging markets expand through rising patient demand and the adoption of innovative therapies.

Major investors in the market include pharmaceutical giants like Roche, Novartis, Bristol-Myers Squibb, Pfizer, and Merck. These companies invest heavily in North America for R&D and clinical trials while expanding their presence in the Asia-Pacific to tap emerging patient populations. Investments focus on innovative therapies, immunotherapies, and personalized medicine to strengthen global market growth and treatment accessibility.

The startup ecosystem in the anticancer drugs market is rapidly evolvin, with biotech startups focusing on targeted therapies, immunotherapies, and personalized medicine. Supported by venture capital and government grants, these startups collaborate with research institutions and pharmaceutical companies to accelerate drug development, clinical trials, and innovative delivery systems, fostering competition, technological advancement, and expanded treatment options globally.

Advancements in anti-cancer drug development in 2025 are marked by innovative therapies and technologies aimed at improving treatment efficacy and patient outcomes. Notably, bispecific antibodies, such as Lynozyfic, have been approved for relapsed or refractory multiple myeloma, offering targeted immunotherapy that binds simultaneously to cancer and immune cells.

Additionally, personalized cancer vaccines utilizing mRNA technology are being trialed to prime the immune system against specific tumor antigens, potentially reducing recurrence risks. In the realm of precision oncology, AI-driven drug discovery platforms are enhancing the identification of novel therapeutic targets, expediting the development of effective treatments. Furthermore, advancements in nanotechnology are facilitating the design of intelligent nanorobots capable of targeted drug delivery, optimizing therapeutic outcomes with minimal side effects.

| Trial ID | Therapy | Cancer Type | Objective | Status |

| NCT05257408 | Relacorilant | Ovarian Cancer | Evaluate efficacy in platinum-resistant cases | NDA submitted |

| NCT05257408 | Decitabine + Venetoclax | Acute Myeloid Leukemia | Assess safety and efficacy in newly diagnosed patients ineligible for intensive chemotherapy. | NDA accepted |

| NCT05257408 | Pembrolizumab | Head and Neck Cancer | Evaluate as perioperative therapy | FDA approved |

| NCT05257408 | Encora + Cetuximab | Colorectal Cancer | Assess efficacy in BRAF-mutated metastatic cases | FDA approved |

| NCT05257408 | Niraparib | Prostate Cancer | Evaluate in combination with hormone therapy | Phase 3 completed |

| NCT05257408 | Zepzelca + Tecentriq | Small Cell Lung Cancer | Assess as first-line maintenance therapy | FDA approved |

| NCT05257408 | Sonrotoclax | Blood Cancer | Evaluate as an alternative to Venclexta | Regulatory review ongoing |

| NCT05257408 | BGB-43395 | Breast Cancer | Evaluate as CDK4-specific therapy | Early-phase trial |

| NCT05257408 | GLSI-100 | HER2-Positive Breast Cancer | Evaluate patients with the HLA-A*02 genotype | Fast track designation |

| NCT05257408 | Tabelecleucel | EBV+ PTLD | Assess efficacy in Phase 3 trial | FDA resubmission |

| NCT05257408 | Avmapki Fakzynja Co-Pack | Ovarian Cancer | Evaluate in KRAS-mutated recurrent cases | Approved |

| NCT05257408 | Imaavynipocalimab-aahu | Myasthenia Gravis | Assess efficacy | Approved |

| NCT05257408 | Relacorilant | Ovarian Cancer | Evaluate in platinum-resistant cases | NDA submitted |

| NCT05257408 | Decitabine + Venetoclax | Acute Myeloid Leukemia | Assess safety and efficacy in newly diagnosed patients ineligible for intensive chemotherapy. | NDA accepted |

| NCT05257408 | Pembrolizumab | Head and Neck Cancer | Evaluate as perioperative therapy | FDA approved |

| NCT05257408 | Encora + Cetuximab | Colorectal Cancer | Assess efficacy in BRAF-mutated metastatic cases | FDA approved |

| NCT05257408 | Niraparib | Prostate Cancer | Evaluate in combination with hormone therapy | Phase 3 completed |

| NCT05257408 | Zepzelca + Tecentriq | Small Cell Lung Cancer | Assess as first-line maintenance therapy | FDA approved |

| NCT05257408 | Sonrotoclax | Blood Cancer | Evaluate as an alternative to Venclexta | Regulatory review ongoing |

| NCT05257408 | BGB-43395 | Breast Cancer | Evaluate as CDK4-specific therapy | Early-phase trial |

| NCT05257408 | GLSI-100 | HER2-Positive Breast Cancer | Evaluate patients with the HLA-A*02 genotype | Fast track designation |

| NCT05257408 | Tabelecleucel | EBV+ PTLD | Assess efficacy in Phase 3 trial | FDA resubmission |

| NCT05257408 | Avmapki Fakzynja Co-Pack | Ovarian Cancer | Evaluate in KRAS-mutated recurrent cases | Approved |

| NCT05257408 | Imaavynipocalimab-aahu | Myasthenia Gravis | Assess efficacy | Approved |

The chemotherapy segment dominates the market with a share of approximately 35% due to its long-standing efficacy in treating a wide range of cancers, including breast, lung, and colorectal cancers. Its broad clinical adoption, well-established treatment protocols, and availability of generic drugs make it highly accessible to patients worldwide. Additionally, chemotherapy is often combined with other therapies, such as immunotherapy or targeted therapy, enhancing its effectiveness. The ongoing research into novel chemotherapy agents and improved delivery methods further strengthens its dominant position in the market.

The targeted therapy segment is estimated to be the fastest-growing in the anticancer drugs market, with a share of approximately 25% due to its ability to precisely attack cancer cells while minimizing damage to healthy tissue, resulting in improved patient outcomes and reduced side effects. Advances in molecular biology and genomics have enabled the identification of specific biomarkers, allowing therapies to be tailored to individual patients. Additionally, the increasing approval of novel monoclonal antibodies, small molecule inhibitors, and combination regimens is driving adoption. Rising awareness, favorable reimbursement policies, and integration with personalized medicine approaches further contribute to the rapid growth of targeted therapies in oncology.

The intravenous (IV) segment dominates the market with a share of approximately 55% due to its ability to deliver precise and controlled doses of chemotherapy, immunotherapy, and targeted therapies directly into the bloodstream, ensuring rapid systemic distribution. IV administration allows for combination regimens, higher bioavailability, and close monitoring by healthcare professionals, enhancing treatment efficacy and safety. Its widespread adoption in hospitals, oncology centers, and infusion clinics, along with well-established clinical protocols, makes it the preferred route of administration for many anti-cancer drugs, maintaining its dominant position in the market.

The oral segment is anticipated to be the fastest-growing segment in the anticancer drugs market, with a share of approximately 30% due to its convenience, ease of administration, and ability to enable at-home treatment, reducing hospital visits and healthcare costs. Advances in drug formulation have improved bioavailability, stability, and targeted delivery of oral anti-cancer medications. Additionally, patient preference for non-invasive therapies, coupled with the increasing development of oral targeted therapies and combination regimens, is driving rapid adoption. Enhanced adherence and improved quality of life further contribute to the growth of the oral segment in oncology treatment.

The breast cancer segment indication leads the market with a share of approximately 22%, driven by its high prevalence and significant impact on public health. According to the data published by Breastcancer.org, it has been estimated that in the United States, breast cancer is the most common cancer to be diagnosed in women.

Breast cancer accounts for around 32% of all newly diagnosed cancers in women each year. About 316,950 women will receive a diagnosis of invasive breast cancer in 2025, while 59,080 new cases of non-invasive ductal carcinoma in situ (DCIS) will also be reported. Approximately 16% of breast cancer patients are under 50. Approximately 66% of cases of breast cancer are discovered when the disease is localized, before it has spread outside the breast, when cures are more effective. The lifetime risk for women is about 1 in 8, underscoring the widespread nature of the disease.

These statistics highlight the urgent need for effective treatments, propelling the development and market dominance of breast cancer therapies. While these figures provide the latest available data, it's important to note that the WHO projects that by 2050, the number of new breast cancer cases could rise to 3.2 million annually if current trends continue.

The hematological cancers segment is estimated to grow at the fastest rate in the anticancer drugs market, with a share of approximately 15% due to the increasing prevalence of blood cancers such as leukemia, lymphoma, and multiple myeloma. Advances in targeted therapies, immunotherapies, and CAR-T cell treatments have improved survival rates. Early diagnosis, rising awareness, and favorable reimbursement policies further drive the adoption of innovative treatments, fueling rapid market growth.

The North America region dominates the market with a share of approximately 40% due to its advanced healthcare infrastructure, strong pharmaceutical industry, and high adoption of innovative therapies. The presence of well-established research centers, significant R&D investment, and supportive regulatory frameworks accelerates the development and commercialization of novel drugs. Additionally, the region has a high cancer prevalence, rising awareness, and favorable reimbursement policies, which facilitate patient access to treatment. These factors collectively strengthen North America’s leadership in the global anti-cancer drugs market.

The U.S. dominates the anticancer drugs market due to its robust healthcare infrastructure, advanced research capabilities, and high pharmaceutical R&D investment. In 2025, an estimated 1,850,000 new cancer cases are projected in the U.S., reflecting a substantial patient population requiring treatment.

The country benefits from early diagnosis programs, cutting-edge clinical trials, and rapid adoption of targeted therapies, immunotherapies, and personalized medicine. Strong regulatory support from the FDA, coupled with favorable reimbursement policies, ensures patient access to innovative treatments. This combination of factors solidifies the U.S. as the largest and most influential market for anti-cancer drugs globally.

Canada’s market is growing steadily, driven by increasing cancer prevalence and government-backed healthcare initiatives. In 2025, approximately 220,000 new cancer cases are projected in Canada among a population of 39 million, highlighting a significant demand for effective therapies.

Advanced healthcare infrastructure, centralized cancer care programs, and strong research collaborations support the adoption of targeted therapies, immunotherapies, and combination treatments. Public funding, universal healthcare coverage, and favorable reimbursement mechanisms further enable patient access to innovative drugs. These factors position Canada as a key regional player, contributing to North America’s overall dominance in the global anti-cancer drugs market.

The Asia-Pacific region is the fastest-growing in the anticancer drugs market, with a share of approximately 20% due to rising cancer prevalence, increasing healthcare spending, and expanding access to advanced therapies. Rapid urbanization, changing lifestyles, and an aging population contribute to higher incidence rates. Countries like China, India, and Japan are investing heavily in oncology research, infrastructure, and clinical trials. Growing awareness, government initiatives, and improving reimbursement policies further drive the adoption of innovative treatments, including targeted therapies, immunotherapies, and combination regimens, fueling rapid market growth across the region.

China is a key driver of the Asia-Pacific anticancer drugs market due to its large population, rising cancer prevalence, and expanding healthcare infrastructure. In 2025, according to the data published by the World Health Organization, approximately 4.3 million new cancer cases are projected in China, with lung, breast, and colorectal cancers being the most common. The government is heavily investing in oncology research, clinical trials, and hospital networks. Increased awareness, access to innovative therapies such as targeted treatments and immunotherapies, and supportive reimbursement policies are accelerating the adoption of advanced anti-cancer drugs, making China a dominant and rapidly growing market within the region.

India’s market is expanding rapidly, fueled by the rising prevalence of cancers, particularly breast, lung, and cardiac-related cancers. In 2025, according to the data published by the World Health Organization, around 1.5 million new cancer cases are projected in India, including a significant burden of cardiac-related malignancies, driving demand for effective therapies.

Increasing awareness, expanding healthcare infrastructure, government initiatives, and improving access to advanced therapies such as targeted drugs, immunotherapies, and biosimilars are boosting market growth. Additionally, rising private healthcare investments, clinical trial activity, and pharmaceutical R&D contribute to India’s position as one of the fastest-growing anti-cancer drug markets in Asia-Pacific.

Japan is a major contributor to the Asia-Pacific market due to its advanced healthcare system, aging population, and high cancer incidence. In 2025, according to the data published by WHO, approximately 1.0 million new cancer cases are projected, with stomach, colorectal, and breast cancers being the most prevalent. Strong government support, well-established oncology research, and adoption of innovative therapies such as targeted treatments and immunotherapies drive market growth. Additionally, high healthcare expenditure, early diagnosis programs, and reimbursement policies ensure patient access to novel drugs. These factors make Japan a key, rapidly growing market within the Asia-Pacific anti-cancer drugs landscape.

R&D in anti-cancer drugs begins with target identification and compound screening, followed by preclinical testing to evaluate safety and efficacy. Formulation development and optimization prepare promising compounds for clinical trials. Key organizations involved include Roche, Novartis, Pfizer, AstraZeneca, and Bristol-Myers Squibb.

Clinical trials start with Phase I to assess safety, Phase II to determine efficacy, and Phase III for large-scale validation. Successful trials lead to regulatory submission and approval. Major organizations include the National Cancer Institute (NCI), the American Cancer Society (ACS), Roche, Novartis, and Pfizer.

Patient support involves awareness programs, counseling, and financial assistance, followed by adherence monitoring and post-treatment care to improve outcomes. Key organizations providing these services include CancerCare, American Cancer Society, local hospital networks, and oncology clinics.

Key Offerings:

Key Offerings:

Key Offerings:

Key Offerings:

Key Offerings:

Key Offerings:

Key Offerings:

By Drug Class / Modality

By Route of Administration

By Cancer Type / Indication

By Region

March 2026

March 2026

March 2026

March 2026