January 2026

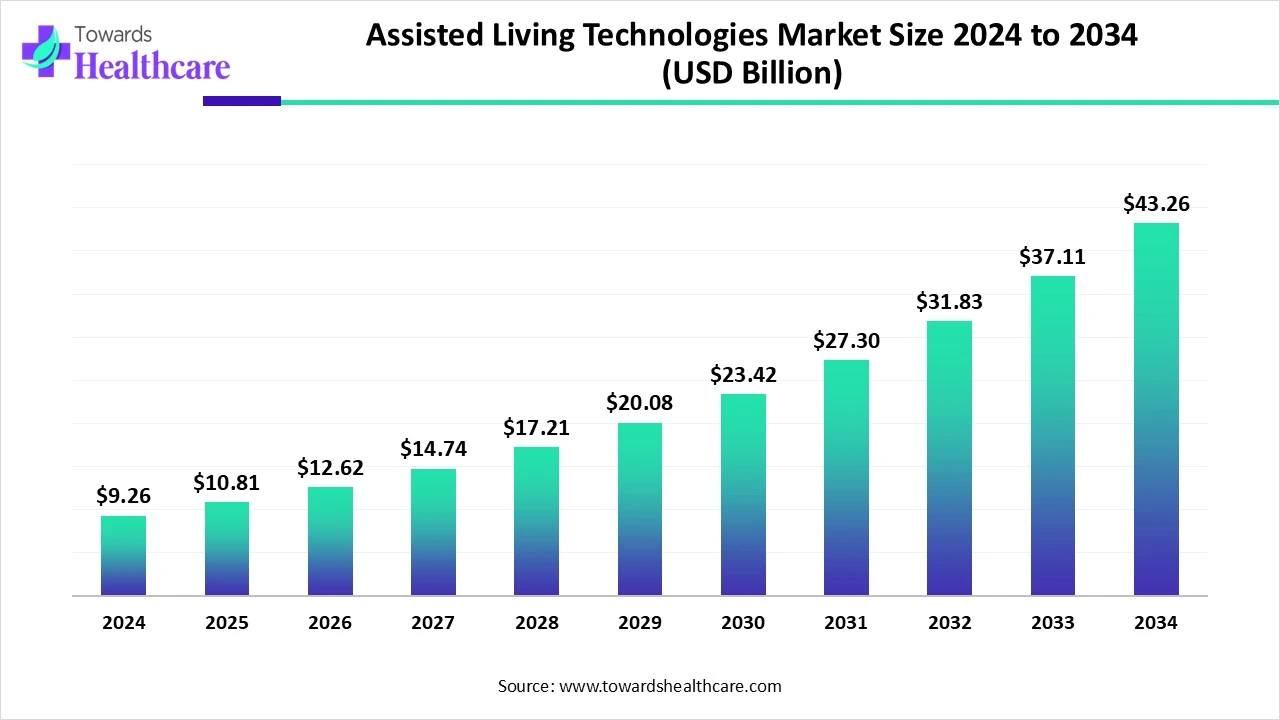

The global assisted living technologies market size is calculated at USD 10.81 billion in 2025, grew to USD 12.62 billion in 2026, and is projected to reach around USD 50.82 billion by 2035. The market is expanding at a CAGR of 16.74% between 2026 and 2035.

The assisted living technologies market is primarily driven by the rising prevalence of chronic disorders and the growing geriatric population. The increasing investments and collaborations among key players facilitate the development of novel assisted living technologies (ALTs). Government and private organizations support patients through reimbursement policies. Artificial intelligence (AI) enables real-time monitoring, predicts potential health risks, and provides customized care to patients. The future looks promising, with the adoption of virtual reality and augmented reality.

| Table | Scope |

| Market Size in 2026 | USD 12.62 Billion |

| Projected Market Size in 2035 | USD 50.82 Billion |

| CAGR (2026 - 2035) | 16.74% |

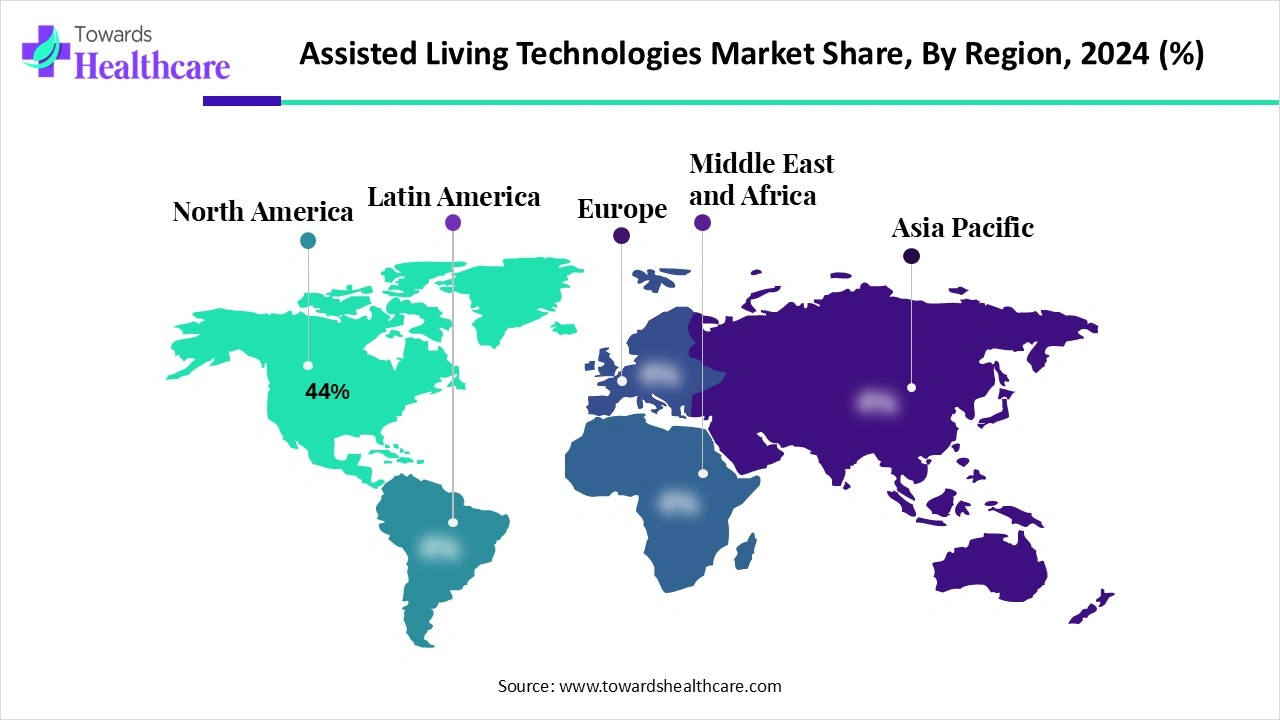

| Leading Region | North America Share 44% |

| Market Segmentation | By Product Type, By Technology, By End-User, By Deployment Mode, By Distribution Channel, By Region |

| Top Key Players | Philips Healthcare, Tunstall Healthcare, Bay Alarm Medical, GreatCall (Lively), ResMed, Omron Healthcare, Teladoc Health, VitalConnect, ADT Health, Care Innovations (Intel & GE JV), Guardian Alarm, MobileHelp, Alarm.com, GrandCare Systems, Essence Group, Huawei Health, BeClose, Mytrex Inc., Independa, LifeStation |

The assisted living technologies market refers to digital health and monitoring solutions designed to support elderly individuals, people with disabilities, or those with chronic conditions in maintaining independence, safety, and quality of life. ALTs include emergency response systems, health monitoring devices, medication management tools, mobility aids, and smart home integration. Their growing adoption is fueled by the aging population, rising prevalence of chronic diseases, caregiver shortages, and the increasing demand for remote care and cost-effective solutions.

Increasing Collaboration: In June 2025, Charter Senior Living announced a collaboration with LifeLoop to deploy LifeLoop’s resident engagement solution for Charter’s Memory Care Program. Organizations focus on redefining the possibilities of personalized care and engagement for older adults living with dementia.

Acquisition Activities: In February 2025, FOXO Technologies, Inc. announced the acquisition of two assisted living facilities in Florida. One facility has 129 units, and the second facility has 137 units. The purchase price of each facility was $30 million.

AI plays a vital role in ALTs by automating various functions and providing personalized solutions. It facilitates a more user-centric approach by catering to each individual’s unique needs and preferences. It can predict potential health conditions before they become severe and suggest appropriate disease prevention options. AI and machine learning (ML) can analyze vast amounts of data and suggest potential treatment outcomes. AI-based sensors enable healthcare professionals to monitor patients continuously, allowing them to make proactive decisions.

Growing Geriatric Population

The major growth factor for the assisted living technologies market is the growing geriatric population. The World Health Organization (WHO) estimated that the number of people aged 60 years and above will increase from 1.1 billion in 2023 to 1.4 billion by 2030. Maintaining the good health and lifestyle of older people to remain independent and participate in family life is crucial. Older people are becoming aware of engaging in disease prevention and health promotion strategies, as well as early disease detection and treatment strategies. ALTs are essential for elderly people living alone. According to a recent survey from India conducted on 10,000 individuals, 14.3% of respondents reported living alone.In England, over 2 million people over age 75 live alone.

Lack of Knowledge

Numerous elderly people are unaware of advanced technologies for disease prevention, diagnosis, treatment, and rehabilitation. Access to ALTs is also limited among the geriatric population living in rural areas. This restricts the widespread use of ALTs globally, hindering market growth.

What is the Future of the Assisted Living Technologies Market?

The market future is promising, driven by virtual reality (VR) and augmented reality (AR). VR is a 3D simulation technology that transports a person into an interactive space. VR and AR help improve physical training activities, resulting in more strength, flexibility, and agility. Several research studies have also found that VR improves cognitive thinking and prevents memory loss in the older population with neurological diseases. VR and AR transport older people into a virtual world to enhance community interaction and captivate discourses and kinetic activities. They train the elderly in daily life activities, allowing them to live independently.

By product type, the personal emergency response systems (PERS) segment held a dominant presence in the market in 2024. This is due to geriatric people living alone and an increased risk of medical emergencies. Geriatric people are more prone to developing chronic disorders, enhancing their chances of medical emergencies. PERS sends signals to a response center or family members to help the person in need. It gives confidence and freedom to live independently, as well as gives elders peace of mind.

By product type, the smart home & environmental control segment is expected to grow at the fastest CAGR in the market during the forecast period. Smart home technology includes wireless gadgets and home appliances connected through Wi-Fi. It enables healthcare professionals and family members to observe the activities of elderly people more proactively. It can also help people accomplish their tasks with the use of sensors and voice assistants. Smart home technology offers convenience by making life more accessible and enjoyable.

By technology, the wireless sensors segment held the largest revenue share of the market in 2024. This is due to advancements in sensor technologies and their increasing adoption for health monitoring. Wireless sensors are used in wearable devices, home appliances, and other medical devices to assist patients in performing their daily activities. They can continuously monitor a patient’s conditions and send notifications to the concerned authority. Wearable devices enable people to track their vital signs and incorporate lifestyle changes based on the outcomes.

By technology, the cloud computing & IoT platforms segment is expected to grow with the highest CAGR in the market during the studied years. Cloud computing & IoT platforms are widely preferred as they provide personalized care and proactive interventions for seniors. They help store, process, and analyze large amounts of patient data, enabling healthcare professionals to make proactive decisions. Pill dispensers, mobility aids, and automated lighting systems are some examples of IoT platforms.

By end-user, the elderly population segment contributed the biggest revenue share of the market in 2024. This segment dominated because the elderly population needs constant assistance in performing their daily life activities. Many elderly people live alone, necessitating the use of ALTs. ALTs provide an added layer of safety and security for seniors. They also provide personalized solutions by assessing individual characteristics and health conditions. Thus, ALTs play a critical role in enhancing the quality of care and support for the elderly.

By end-user, the patients with chronic illnesses segment is expected to expand rapidly in the market in the coming years. The rising prevalence of chronic disorders and the increasing number of surgeries boost the segment’s growth. ALTs offer rehabilitation services to patients with chronic disorders, helping them to improve their health and well-being. They enable patients to take part in clinical decision-making and make necessary changes in daily life activities.

By deployment mode, the cloud-based solutions segment led the global market in 2024 and is expected to show the fastest growth over the forecast period. The segmental growth is attributed to the need to store large amounts of patient data. Healthcare professionals and patients can access patient data from anywhere and at any time. Cloud-based solutions operate using the internet and eliminate the need for a specialized infrastructure. They offer scalability and cost-effectiveness, making them a suitable option for numerous people. They also enable remote monitoring of patients’ conditions.

By distribution channel, the retail pharmacies & specialty stores segment accounted for the highest revenue share of the market in 2024. This is due to the increasing number of retail pharmacies and specialty stores. Retail pharmacies have skilled professionals to provide advanced care. They have specialized infrastructure and suitable capital investments to adopt innovative technological products. They also offer special discounts to increase the affordability of ALTs.

By distribution channel, the e-commerce/online platforms segment is expected to witness the fastest growth in the market over the forecast period. Advancements in internet connectivity and the burgeoning e-commerce sector augment the segment’s growth. Online platforms enable patients to purchase ALTs from a wide range of options. Patients can also compare prices on different websites. Online platforms offer free home delivery and special discounts.

North America dominated the market share 44% in 2024. The presence of key players, increasing healthcare expenditure, and favorable reimbursement policies are the major growth factors of the market in North America. The availability of a robust healthcare infrastructure and increasing collaborations among key players propel the market. The growing demand for personalized treatment and the rising adoption of electronic health records (EHRs) contribute to market growth.

Key players, such as Philips Healthcare, GreatCall, Inc., and Guardian Alarm, are the major contributors to the market in the U.S. In June 2025, a survey was conducted on 1,000 U.S. adults aged 60 to 92 years to learn how assistive technologies are used in homes and the way older adults plan to use these devices to help them age in place. About 94% of adults prefer aging in place as of 2025.

It is estimated that approximately 44% of adults in Canada suffer from one or more chronic disorders. The Government of Canada announced an investment of $5.8 million as part of the second phase of the Accessible Technology Program to support the development of new assistive and adaptive digital devices and technologies to make it easier for Canadians with disabilities to participate fully in the digital economy.

Asia-Pacific is expected to host the fastest-growing assisted living technologies market in the coming years. The growing geriatric population in China, Japan, and India potentiates the demand for ALTs. The increasing adoption of smart healthcare products owing to changing lifestyles and rising disposable income boosts the market. Government organizations support the development and deployment of advanced technologies for improving healthcare.

The Ministry of Internal Affairs and Communications announced that Japan’s elderly population aged 65 or older accounts for 36.25 million, representing 29.3% of the total population. Of these, around 20.53 million are women and 15.72 million are men.The Japanese government launches initiatives to support the independence of elderly individuals via caregiving robots and ICT technologies.

In 2023, China’s population aged 60 years and above reached 297 million, accounting for 21.1% of the total population. The number of medical and elderly care institutions increased by 7,881, a 12.8% year-over-year increase. China has launched a pilot programme to enhance the integration of robots into smart elderly care, thereby improving the quality of life of senior citizens and reducing the burden on families.

Europe is expected to grow at a notable CAGR in the assisted living technologies market in the foreseeable future. The increasing investments and the burgeoning medtech sector favor market growth. People are becoming aware of ALTs and their benefits, promoting their use. The rising number of people living with chronic disorders and favorable government support augment market growth. The growing need for telemedicine and the increasing geriatric population foster the market.

The Forth UK Healthcare Statistics reported that about 1 in 4 adults experience a mental health condition in the UK annually. Approximately 1.7 million people are estimated to be using assisted living technologies. In addition, more than 70% of care providers have adopted digital social care record solutions.

Sarah Murphy, Minister for Mental Health and Wellbeing, Government of Wales, commented that the smart home technology will play a crucial role in improving the quality of life and independence for older adults while supporting our dedicated health and social care workforce. She also said that helping people to remain at home for longer, with the right support, will provide a massive benefit in avoiding unnecessary hospital admission and delayed discharge from care.

By Product Type

By Technology

By End-User

By Deployment Mode

By Distribution Channel

By Region

January 2026

December 2025

December 2025

November 2025