February 2026

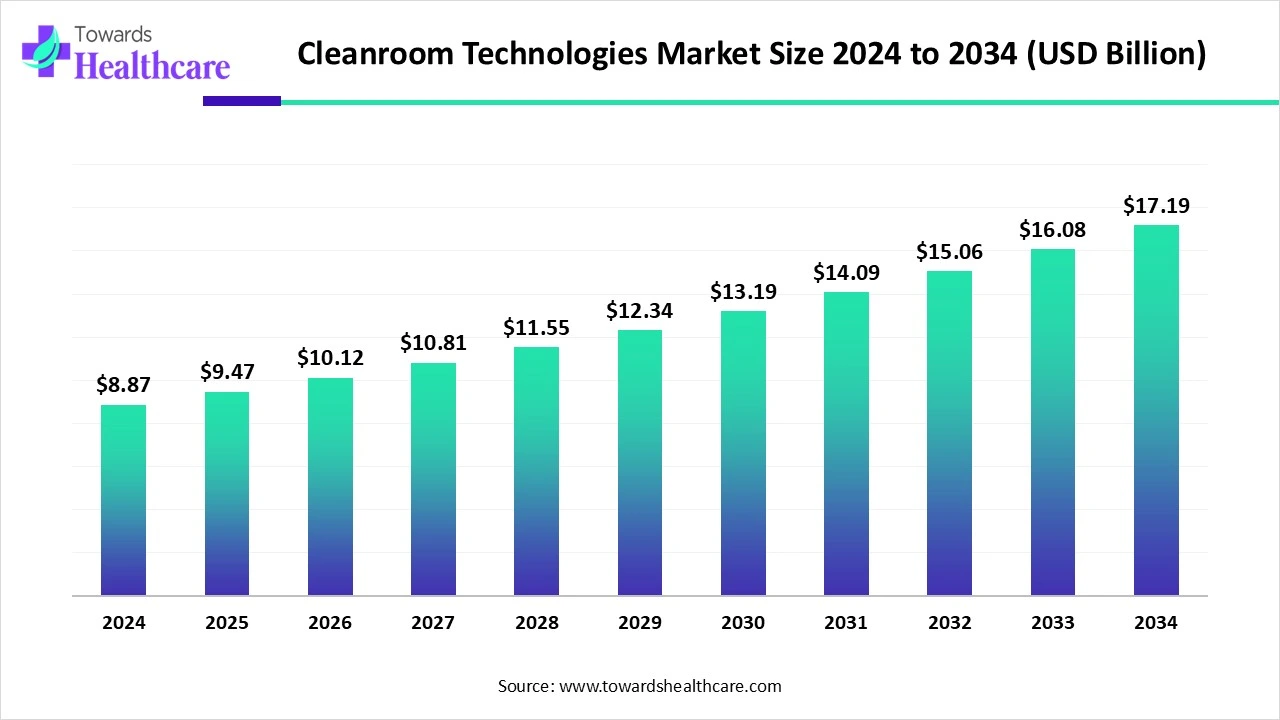

The global cleanroom technologies market size is calculated at US$ 9.47 billion in 2025, grew to US$ 10.12 billion in 2026, and is projected to reach around US$ 18.35 billion by 2035. The market is expanding at a CAGR of 6.84% between 2026 and 2035.

The growing development and production of sensitive biologic drugs, including cell and gene therapies, vaccination, and personalized medicines, necessitate stringent contamination control, driving the cleanroom technologies market. With the healthcare focus towards biopharmaceuticals, the need for aseptic manufacturing conditions in the pharmaceutical and biotechnology industries will continue to rise. The increasing research and development (R&D) activities, such as life science, nanotechnology, and advanced materials, require the establishment of highly controlled environments for experimental integrity and to meet global quality standards. The rising growth in the semiconductor and electronics industries, a focus on healthcare infrastructure, and infection control promote the market growth.

| Table | Scope |

| Market Size in 2025 | USD 9.47 Billion |

| Projected Market Size in 2035 | USD 18.35 Billion |

| CAGR (2026 - 2035) | 6.84% |

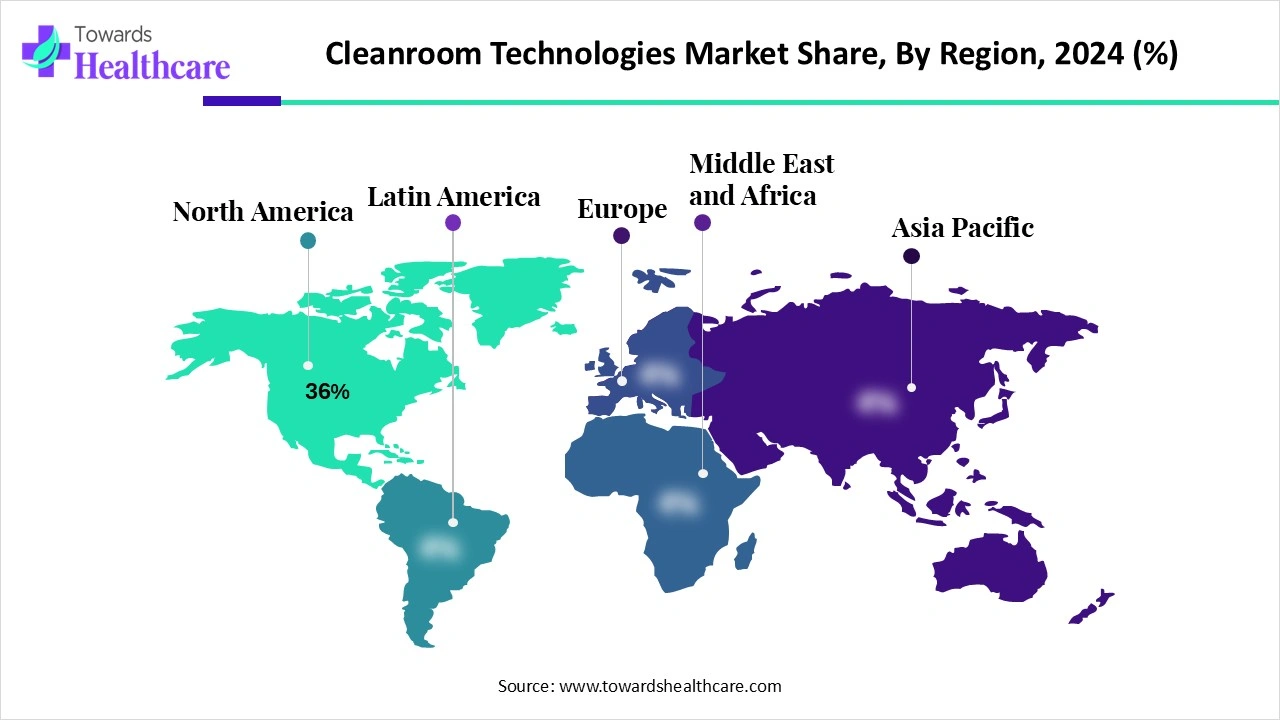

| Leading Region | North America Share 36% |

| Market Segmentation | By Product / Technology, By Cleanroom Class (ISO Standard / Grade), By Deployment Model / Construction Type, By Service Type, By End-Use Industry, By Region |

| Top Key Players | Camfil, Filtration Group / AAF, Donaldson Company, Inc., Parker Hannifin, Honeywell International Inc., Johnson Controls, Carrier (Carrier Global Corporation), Daikin Industries, Ltd., Trane / Ingersoll Rand, TSI Incorporated, Fluke Corporation, Entegris, Inc., Ecolab, STERIS / Cantel, Avantor, Kimberly-Clark Professional, DuPont, G-CON Manufacturing, Terra Universal, Azbil Corporation |

The cleanroom technologies market includes the hardware, consumables, software, and services used to create, operate, and validate controlled-environment spaces (cleanrooms) that control particulate, microbial, and gaseous contamination. Cleanroom technologies span air-handling (AHU/HEPA/ULPA), HVAC/airflow design, laminar flow hoods, pass-throughs, air showers, cleanroom garments, surfaces & furniture, environmental monitoring & particle counters, contamination control consumables, modular cleanroom systems, validation & qualification services, and related automation/building management systems (BMS). These technologies are essential across pharmaceuticals & biotech, semiconductor & electronics, medical device manufacture, healthcare (sterile compounding & OR suites), aerospace, and food & beverage, anywhere product quality, sterility, or extreme cleanliness is required.

Energy Efficiency: The innovations, such as variable air volume systems, demand-controlled ventilation, and heat recovery ventilation, are being adopted to dynamically adjust airflow, reduce energy consumption, and recover wasted heat. Replacing traditional lighting with energy-efficient LED systems, coupled with motion sensors and daylight harvesting, significantly reduces electricity consumption in various aspects of cleanroom operation for holistic energy optimization.

Case Study,

AI impacts cleanroom technologies through AI-powered sensors and monitoring systems that can continuously track parameters such as air quality, particle count, microbial presence, temperature, and humidity. Machine learning algorithms can identify deviations from normal operating conditions. Flagging potential contamination risk that might be missed by the traditional method. Automated disinfection, robots equipped with AI can autonomously disinfect surfaces and potentially even handle and sterilize materials within the cleanroom, reducing human intervention and cross-contamination risk. AI improves efficiency and productivity, reducing human investment. Artificial Intelligence is cost-saving and sustainable, enhancing compliance and data management.

Increasing Demand for Contamination-Free Environments

Pharma/biotech’s sustained investment in aseptic fill, high-value biologics, and ATMP manufacturing drives demand for large, validated cleanrooms and recurrent services (filter replacement, validation). HEPA/ULPA filtration and HVAC remain central CAPEX items. Semiconductor/electronics demand for ultra-clean environments at scale (advanced nodes, EUV processes), and trend to modular cleanrooms and integrated environmental monitoring with Industry 4.0/IoT for real-time compliance. Environmental monitoring/automation grows rapidly as regulators and manufacturers require continuous digital traceability.

High Initial and Ongoing Cost

The requirement of cleanroom building and equipping initial investment, including expenses for design, construction, specialized HVAC systems, filtration units, and other controlled environment technology. These costs are challenging for small and medium-sized enterprises, limiting their adoption of cleanroom technology. The requirement of a cleanroom has high operational and maintenance expenses, specialized equipment needs regular calibration, maintenance, and replacement, contributing to ongoing expenses. The specialized labor cost is hindering the cleanroom technologies market growth.

Energy-Efficient and Green Cleanroom Design

The advanced HVAC systems implement technologies, such as variable air volume systems that adjust airflow based on occupancy and contamination levels, and demand-controlled ventilation, which regulates ventilation rates using real-time data from sensors. Capturing and reducing energy from exhaust air to reduce heating and cooling loads. The energy-efficient filtration and lighting use low-resistance HEPA/ULPA filters and LED lighting to reduce energy consumption.

By product/technology, the HEPA/ULPA filtration & air handling units (AHUs) segment held the dominating share of the market in 2024, because major role in contamination control essential in Air purity. HEPA and ULPA filters are the cornerstone of any cleanroom's ability to achieve and maintain required air cleanliness levels. The high efficiency of HEPA and ULPA in pharmaceuticals, biotechnological, and semiconductor manufacturing, where strict contamination control is paramount. AHUs are responsible for circulating and conditioning the air within a cleanroom.

By product/technology, the environmental monitoring & particle counting systems segment is expected to show the highest growth at a notable CAGR during the forecast period. The pharmaceuticals and medical devices require extremely clean environments to prevent product contamination and ensure safety and efficacy. The rising quality and safety of products, the rising demand for cleanroom facilities, rapid growth in industries, such as semiconductors, electronics, pharmaceuticals, and biotechnology. The innovation in technological advancement in particle counting solutions drives the market growth.

By cleanroom class, the ISO 6–8/Grade C–D segment led the market with approximately a 40% share in 2024, due to broad applicability and cost-effectiveness, importance in diverse manufacturing sectors, like electronic and semiconductor manufacturing. ISO6-8 cleanrooms are used to prevent defects. The healthcare and pharmaceuticals industry is subject to stringent regulatory guidelines that necessitate the use of cleanrooms to ensure product safety and quality.

By cleanroom class, the ISO 4–5/Grade A–B segment is expected to show the fastest growth rate during the forecast period. The miniaturization and complexity of electronic components and chips necessitate the use of ultra-clean environments to ensure process stability and yield optimization. The increasing biologics sector and the need for sterile drug product manufacturing, especially parenteral and injectable formulations, fuel the demand for cleanrooms to prevent contamination and meet stringent regulatory requirements.

By deployment model, the traditional stick-built cleanrooms segment held the largest share of the market in 2024, due to established practices and familiarity, cost structural advantages the convenience of spreading out the building costs throughout the construction process, rather than incurring them all at once, is advantageous for traditional cleanrooms. The traditional cleanrooms are well-suited for industries where long-term, permanent clean environments are crucial, such as large-scale pharmaceutical manufacturing or semiconductor fabrication plants.

By deployment model, the modular/prefabricated cleanrooms segment is expected to show the highest growth during the forecast period. The modular cleanroom can be easily customized, expanded, expanded, or reconfigured to adapt to changing production needs without costly renovations or evolving technological requirements. Modular cleanrooms are designed and engineered to meet or exceed stringent industry standards and regulations, such as ISO and cGMP requirements. This method generates less material waste compared to traditional construction.

By service type, the installation & commissioning segment led the market in 2024, as the cleanrooms in pharmaceuticals and biotechnology are subjected to strict regulations such as GMP and ISO 14644. Proper installation and commissioning are crucial to ensuring that these facilities meet the required cleanliness classifications and operational parameters to achieve and maintain compliance face significant risk, including product recalls, legal liabilities, and certification. The requirement of validation and testing, complexity of cleanroom technology.

By service type, the validation, qualification & certification segment is expected to show the fastest growth rate during the forecast period. With the stringent regulatory standards in the industry, rising demand for product quality and safety, growing consumers, and regulatory scrutiny, companies are placing higher emphasis on delivering high-quality, contamination-free products. The increase in biopharmaceuticals and personalized medicine, rising technological advancements, drive the market growth.

By end-use industry, the pharmaceuticals & biotechnology segment led the market in 2024, due to the increase in demand for biologics and advanced therapies. The expansion of the biologics sector, including gene therapies and vaccine development, necessitates highly controlled and sterile environments. The rising R&D and manufacturing activities, protecting product integrity and patient safety.

By end-use industry, the semiconductor & electronics manufacturing segment is expected to show the fastest growth rate during the forecast period. The increasing demand for high-performance microchips, sensors, and integrated circuits across various sectors fuels the need for specialized cleanrooms in semiconductor manufacturing. Rising investment in semiconductor manufacturing and the rise of modular and flexible cleanroom solutions.

North America dominated the cleanroom technologies market share 36% in 2024. The North America region biopharma and medtech sector heavily relies on cleanrooms for manufacturing medications, vaccines, medical devices, biologics, and conducting research and development. Cleanrooms are critical for semiconductor manufacturing to prevent contamination during chip fabrication and assembly, where even microscopic particles can cause defects and affect product performance. There is high retrofit spend and facility upgrades.

The U.S. region's increase in the biologics and personalized medicine sector, heavily focused on the pharmaceutical biotechnology industry, on biologics and personalized medicine expanding growth. The increasing demand for high-performance microchips, sensors, and other electronic components growing semiconductor and electronics manufacturing, and innovation in cleanroom design and technology is making them more efficient and cost-effective.

Asia Pacific is expected to host the fastest-growing cleanroom technologies market during the forecast period. The advanced electronic devices, from consumer gadgets to industrial applications, fuel the need for semiconductor manufacturing expansion. The increasing demand for biologics, vaccines, and advanced therapies necessitates expansion in biopharmaceutical manufacturing. This region spends the R&D in the biopharmaceutical sector, and drives the cleanroom facilities for research and development activities.

R&D in cleanroom technologies follows a standard product development cycle, encompassing idea generation, feasibility analysis, prototype development, and testing to create solutions for industries like pharmaceuticals, electronics, and biotech.

The formulation and final dosage preparation in cleanroom technologies prevent contamination, ensure product quality and consistency, meet regulatory requirements, and prevent cross-contamination.

The prevention of healthcare-associated infections, ensuring the safety and efficacy of medication, facilitating medical research and development, and protecting immunosuppressed patients.

In July 2025, the Cleanroom Centre partnered with Bio North Texas and established its global headquarters in Dallas, Texas, US. Kathleen Otto, CEO of BioNTX, emphasized the timely nature of the partnership, stating that it strengthens the region's infrastructure for innovation, manufacturing, and workforce development. This, in turn, positions North Texas as a prominent leader in bioscience advancement nationally.

By Product / Technology

By Cleanroom Class (ISO Standard / Grade)

By Deployment Model / Construction Type

By Service Type

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026