January 2026

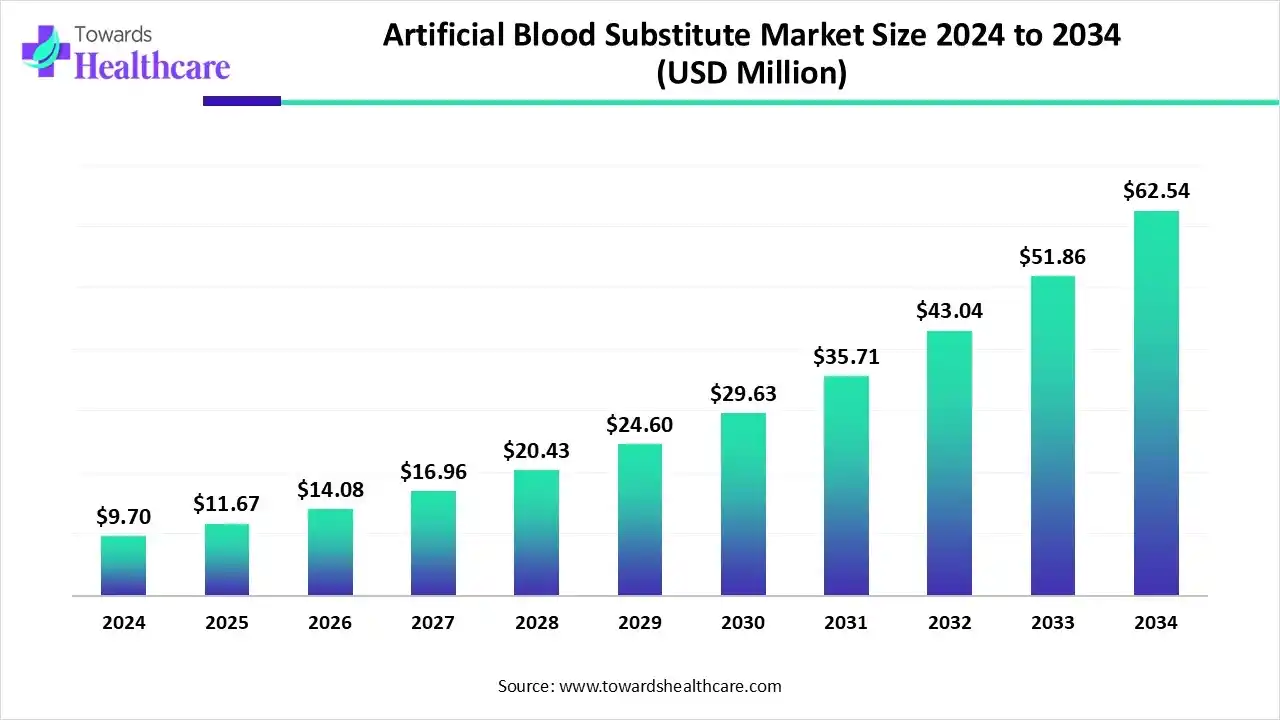

The global artificial blood substitute market size is calculated at US$ 9.7 million in 2024, grew to US$ 11.67 million in 2025, and is projected to reach around US$ 62.54 million by 2034. The market is expanding at a CAGR of 20.45% between 2025 and 2034.

According to the World Health Organization (WHO), millions of people die from severe chronic conditions, due to which the need for safe blood transfusions is of utmost importance. The artificial blood substitute market is accelerated by prime research and development across many areas, such as nanoparticle-based platelets, next-generation oxygen carriers, and freeze-dried substitutes. The clinical trials are conducted to ensure the promising nature of these modern solutions.

| Table | Scope |

| Market Size in 2025 | USD 11.67 Million |

| Projected Market Size in 2034 | USD 62.54 Million |

| CAGR (2025 - 2034) | 20.45% |

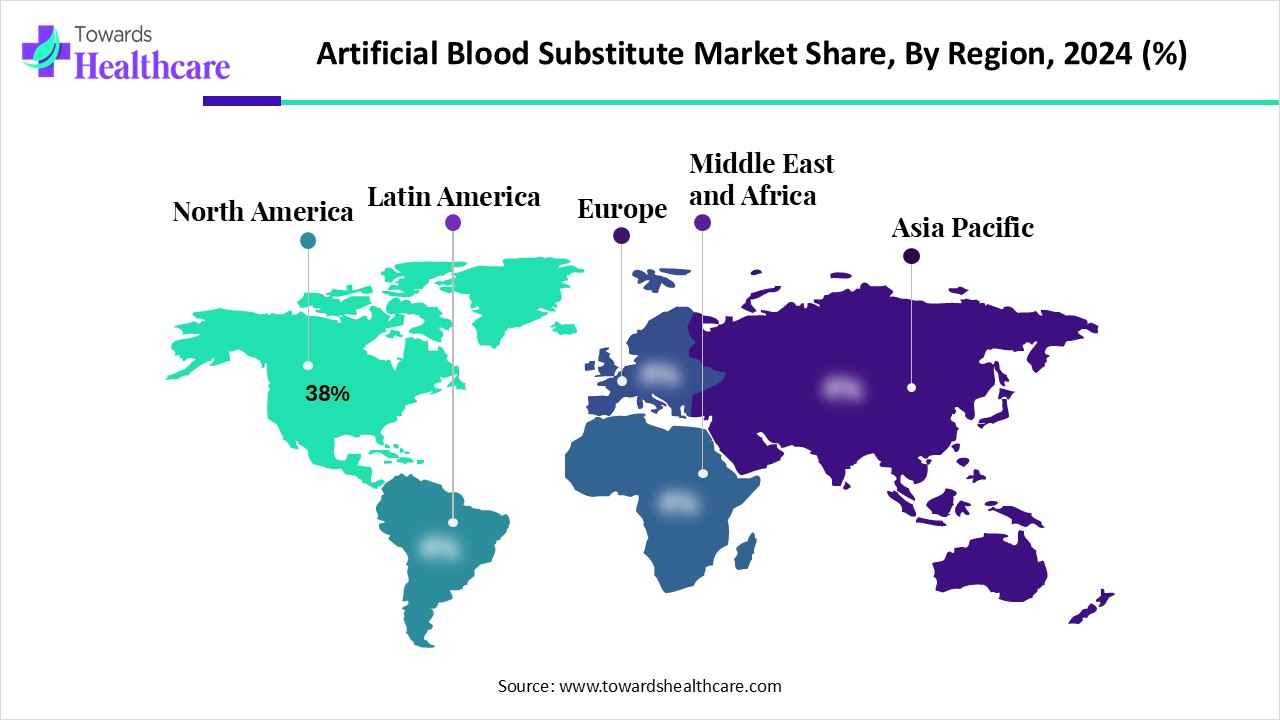

| Leading Region | North America 38% |

| Market Segmentation | By Product Type, By Clinical Application/Use Case, By End User, By Technology/Formulation Subsegment, By Region |

| Top Key Players | Hemarina, OxyVita, Inc., Hemoglobin Oxygen Therapeutics/Hemopure, Aurum Biosciences, KaloCyte/KaloCyte, Inc., OPK Biotech/related oxygen therapeutic developers, NuvOx Pharma/Oxygen Biotherapeutics, Spheritech/SpheriTech Ltd., Boston Therapeutics/small specialty developers, NanoBlood/nanomedicine developers, Prolong Pharmaceuticals, Academic & research centers, Commercial plasma expander manufacturers, CDMOs & contract manufacturers, Defense/government research agencies, Small biotech startups developing synthetic platelets/hemostatic nanoparticles, Companies developing inhalable or organ perfusion oxygen therapeutics, Diagnostic & biomarker firms, Veterinary oxygen carrier suppliers, Emerging cell-manufacturing startups |

AI contributes to research and development and advanced molecular modeling, including the prediction of molecular interactions and optimization of protein structure. It enhances quality control and monitoring, and streamlines the supply chain and logistics. AI can forecast consumer demands and optimize inventory. It accelerates the discovery process, improves diagnostic accuracy, and optimizes production methods.

| Sr. No. | Name of the Company | Location | Role | Product Offerings |

| 1 | Hbo2 Therapeutics | Souderton, Pennsylvania | A leading developer and manufacturer of oxygen-carrying solutions |

|

| 2 | Hemarina | Morlaix, France | To conduct R&D of oxygen carriers for medical purposes | HbAm is designed to deliver oxygen safely to the tissues that are at risk |

| 3 | Kalocyte | Baltimore, Maryland | A pre-clinical stage biotech startup company that is dedicated to developing artificial red blood cell substitutes for trauma care | ErythroMer is a nanoparticle-encapsulated human hemoglobin that mimics the oxygen-carrying abilities of red blood cells |

| 4 | NuvOx Pharma | Tucson, Arizona | To develop a therapeutic to treat diseases relating to hypoxia |

|

| 5 | Membio | Mississauga, Canada | Membio utilizes biomanufacturing to produce blood without a donor | artificially created blood |

The plasma/volume expanders segment dominated the market in 2024, with a revenue of approximately 35% owing to their offerings in oxygen delivery, restoration of blood volume, maintenance of blood pressure, and enhanced microcirculation. The volume expanders are critical for the function of oxygen carriers, and they provide the essential circulatory volume. Research focuses on the development of oxygen-carrying plasma expanders that have combined features.

The other/cell-derived RBCs & experimental biomimetic substitutes segment is expected to grow at the fastest CAGR in the market during the forecast period due to reduced infection risk, optimal functionality, extended storage, and broad applications. The advantages, such as oxygen delivery, long shelf-life, and universal compatibility, drive segmental growth. This approach focuses on growing mature and functional RBCs in a laboratory setting.

The trauma/emergency resuscitation segment dominated the market in 2024, with a revenue of approximately 40% owing to immediate availability, ease of use, rapid oxygen delivery, and universal compatibility. It helps to overcome challenges associated with incomplete blood function, short half-life, toxicity, and adverse effects. The launch of bioengineered solutions and freeze-dried options drives segmental growth.

The surgical blood replacement segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to its major role in critical surgical procedures and specialized surgical applications. It enables organ transplantation and neurovascular and ischemic tissue perfusion. Patients with rare blood types and patients who refuse blood transfusions get numerous benefits from surgical blood replacement.

The hospitals & acute care centers segment dominated the market in 2024, with a revenue of approximately 60% owing to the primary functions of artificial blood in acute care. It allows the management of blood shortages and improves care for specific patient populations. It enables targeted oxygen delivery and helps in organ preservation.

The research institutes & CROs segment is anticipated to grow at a notable rate in the market during the upcoming period due to the major importance of R&D efforts, testing of medical devices, drug delivery systems, etc. The preclinical development, clinical trial execution, formulation, manufacturing support, and regulatory compliance drive the expansion of CROs and research institutes. They allow the study of complex biological processes and the development and evaluation of new therapies.

The polymerized/cross-linked hemoglobins segment dominated the market in 2024, with a revenue of approximately 28% owing to the essential oxygen-carrying capacity in the absence of RBCs. The scientific efforts focus on overcoming the severe toxicity of free hemoglobin. Research improvements allow it to function outside of RBCs for a longer time.

The cell-derived/engineered RBCs segment is predicted to grow at a rapid rate in the market during the studied period due to the use of Artificial blood substitutes, such as perfluorocarbons (PFCs) and hemoglobin-based oxygen carriers (HBOCs) for a large-scale manufacturing of engineered red blood cells (RBCs). These solutions expand the emergency medicine field through extensive R&D. They overcome the limitations of acellular and earlier substitutes.

North America dominated artificial blood substitute market share by 38% in 2024, owing to the expansion of clinical applications, a favorable regulatory environment, and military and defense applications. These advanced solutions are used in several clinical applications such as organ transplantation, oncology treatments, neonatal conditions, and support for patients with rare blood disorders. The government-supported research, investments, and innovations in bioengineering accelerated the North American market. Scientists are focusing on the development of artificial blood that could save lives in emergencies. Research has shifted towards more efficient storage of developed artificial blood that could be provided to ambulances, military medics, and medical helicopters.

The U.S. government and the Defense Advanced Research Projects Agency (DARPA) invested millions of dollars in programs that aim to develop artificial blood substitutes. Some other government initiatives include DARPA FSHARP Program, DARPA Smart-RBC Initiative, and Department of Defense funding. These programs aim to address and resolve critical challenges associated with medical and logistics.

Statistics from 2024 and 2023 indicate that approximately 11 million units of blood were collected annually in the United States, supported by about 6.5 million donors. Key organizations involved in the U.S. blood supply include the American Red Cross and America's Blood Centers

The Canadian researchers and regulatory bodies, like Health Canada, are involved in general research and development and funding. The federal agencies such as the Public Health Agency of Canada (PHAC), Canadian Food Inspection Agency (CFIA), Canadian Institutes of Health Research (CIHR), and Patented Medicine Prices Review Board (PMPRB) play a crucial role in health and help Canadians maintain and improve their health. These efforts are enabling access to safe and effective health products, managing risks to health, and responding to public health emergencies.

In 2023–2024, Canada performed over 2.3 million surgeries, a 5% increase over pre-pandemic levels. However, a Fraser Institute report found the average wait time for specialist treatment in 2024 was 30 weeks, with orthopedic surgery delays reaching 57.5 weeks.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to government-supported programs for research and development and numerous clinical trials. The Asian Pacific countries, like Japan, launched a major government-led program to research artificial blood substitutes. These programs focus on addressing blood shortages and saving the lives of people during emergencies. The advanced technologies are contributing to the development of universal artificial blood. The other countries, like China, are also making efforts to develop universal synthetic blood through clinical trials that will be long-lasting.

The modern R&D process for artificial blood substitutes includes pre-clinical research, clinical trials, regulatory approval, and manufacturing.

Key Players: Hemoglobin Oxygen Therapeutics LLC, HEMARINA SA, KaloCyte Inc., Prolong Pharmaceuticals LLC, Membio.

In March 2025, Nara Medical University announced the initiation of Phase I clinical trials for a universal artificial blood composed of hemoglobin vesicles. Researchers in the UK and Germany also conducted clinical trials on artificial blood products. Hemopure is approved for clinical use in countries like Russia and South Africa.

Key Players: KaloCyte, Inc., Hemarina SA, NuvOx Pharma, HbO2 Therapeutics LLC.

The ongoing clinical research for patient support and services is conducted on Hemoglobin-based oxygen carriers (HBOCs), Perfluorocarbon-based oxygen carriers (PFCs), Japanese universal blood, ErythroMer, and rebranded products, among others.

Key Players: KaloCyte, Inc., Hemarina SA, NuvOx Pharma, HbO2 Therapeutics LLC, Prolong Pharmaceuticals.

By Product Type

By Clinical Application/Use Case

By End User

By Technology/Formulation Subsegment

By Region

January 2026

December 2025

December 2025

February 2026