February 2026

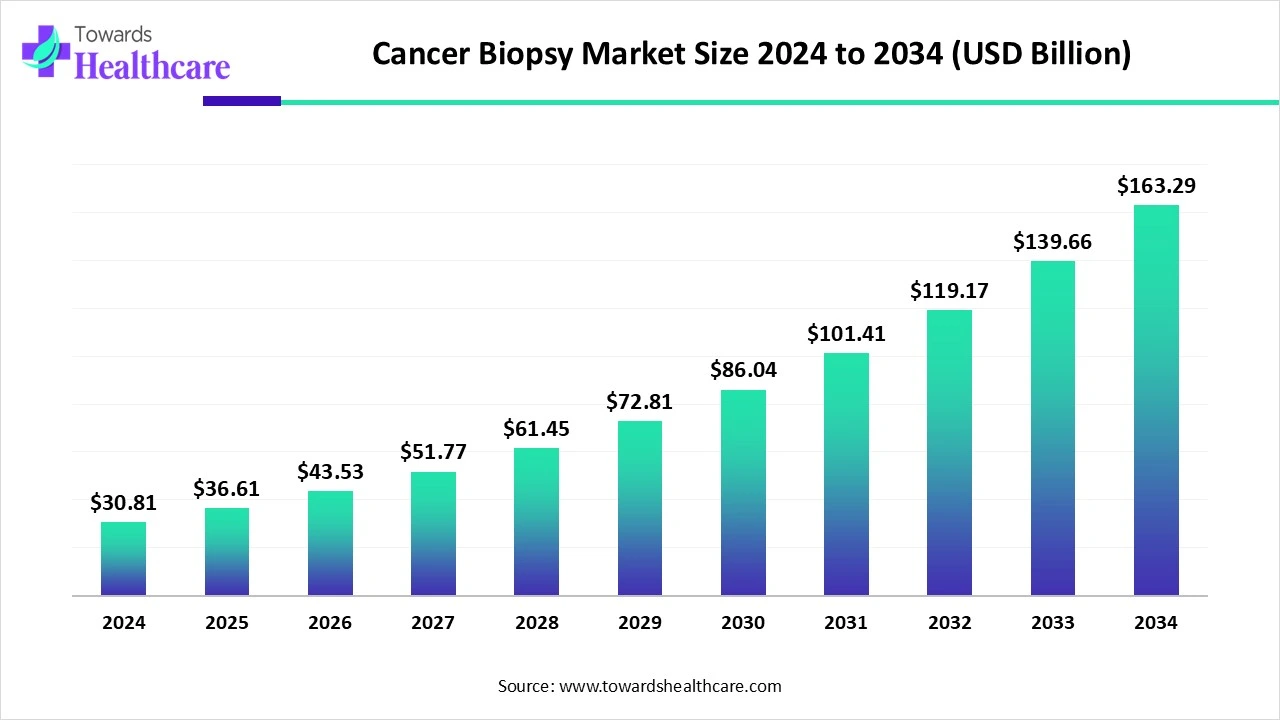

The global cancer biopsy market size is calculated at US$ 30.81 billion in 2024, grew to US$ 36.61 billion in 2025, and is projected to reach around US$ 163.29 billion by 2034. The market is expanding at a CAGR of 18.84% between 2025 and 2034.

In various regions, a huge expansion in cancer instances is boosting demand for biopsy technologies. These biopsies usually include liquid biopsy, tissue biopsy, and other approaches. Primarily, rising advancements in the global cancer biopsy market, like next-generation sequencing (NGS), ctDNA analysis, and AI-assisted pathology. As well as developing methods involved are needle-based biopsy instruments, such as core needle biopsy, fine needle aspiration, image-guided procedures like ultrasound-guided, CT-guided, and robotic-assisted biopsies, which are optimizing accuracy, effectiveness, and patient outcomes.

| Metric | Details |

| Market Size in 2025 | USD 36.61 Billion |

| Projected Market Size in 2034 | USD 163.29 Billion |

| CAGR (2025 - 2034) | 18.84% |

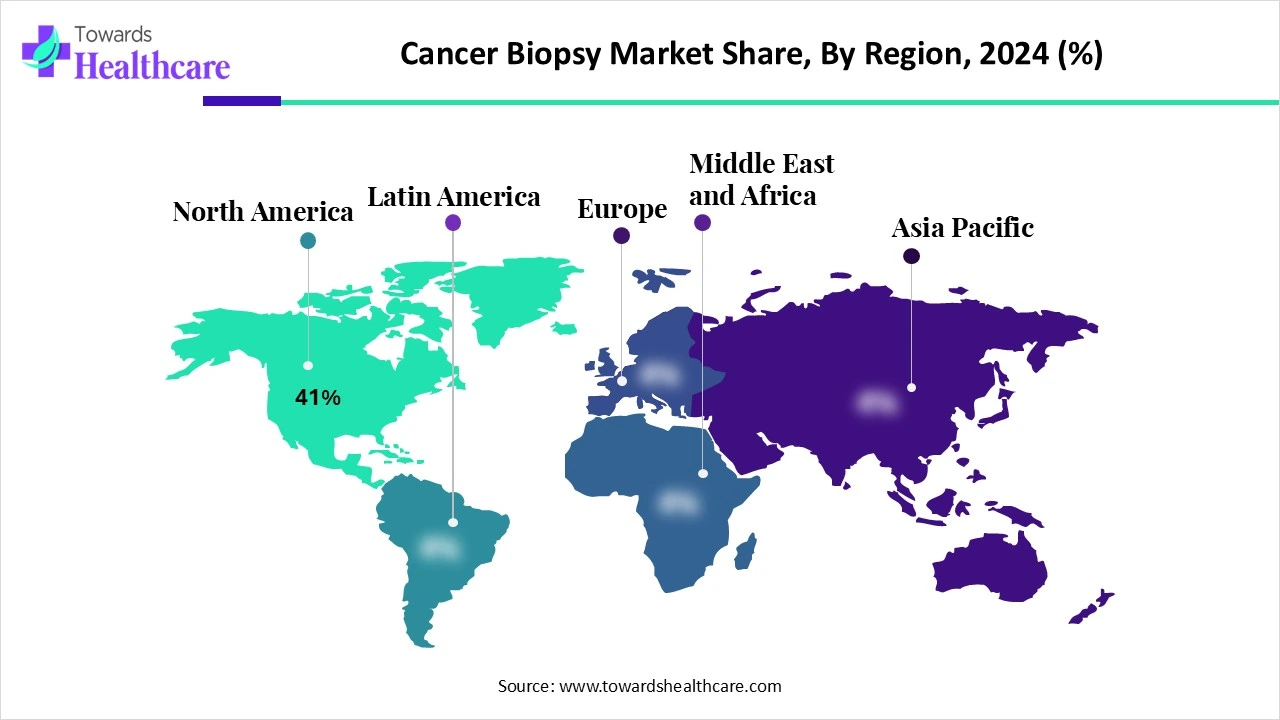

| Leading Region | North America Share by 41% |

| Market Segmentation | By Technique Type, By Cancer Type, By Product Type, By Application, By End User, By Region |

| Top Key Players | QIAGEN N.V., Illumina, Inc., Guardant Health, Inc., Exact Sciences Corporation, Becton, Dickinson and Company (BD), Danaher Corporation, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Hologic, Inc., NeoGenomics Laboratories, Inc., Invitae Corporation, Biocept, Inc., Agilent Technologies, Inc., ANGLE plc, Myriad Genetics, Inc., GRAIL, LLC, Genomic Health, Lucence Diagnostics, Strand Life Sciences |

The cancer biopsy market refers to the industry encompassing technologies, products, and services used to extract and analyze tissue, cell, or liquid samples to detect, diagnose, monitor, and personalize treatment for cancers. Biopsies are critical for identifying tumor type, grade, stage, and genomic mutations, and can be performed through tissue-based (solid) or liquid biopsy (minimally invasive) methods. The market is witnessing strong growth driven by rising global cancer incidence, adoption of precision oncology, demand for non-invasive diagnostics, and innovations in next-generation sequencing (NGS), ctDNA analysis, and AI-assisted pathology.

In 2025, across the globe, in the respective market, AI is playing a vital role with the possession of early detection capabilities by detecting cancerous cells, coupled with AI-driven tools. As well as reducing the major dependence on human analysis of biopsy slides, with helps in minimizing the risk of human error in cancer diagnosis. All these things are happening due to growing breakthroughs in AI and ML algorithms, especially deep learning, which can perform complex tasks efficiently in cancer diagnostics. Alongside, AI-powered diagnostics are important for allowing customized medicines involved in personalized treatments.

Accelerating Advances in Liquid Biopsy Technologies

The global cancer biopsy market is widely driven by the expanding burden of cancer cases, with crucial and broad advancements in liquid biopsy technologies. These non-invasive techniques support the analysis of biomarkers, including circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) in bodily fluids, with the provision of a less invasive alternative to tissue biopsies. Moreover, the market has advanced molecular techniques that enable deep genetic and molecular analysis of tumor samples, coupled with personalized treatment plans. Although in the case of virtual biopsy, non-invasive imaging approaches are also emerging that interpret medical scans to offer probability-based significances for cancer assessment, diagnosis, and treatment planning.

Restricted Insurance Coverage and Shortage of Specialized Professionals

Primarily, in various insurance companies of developing countries, a lack of comprehensive insurance facilities for diagnostic procedures may create a critical barrier to access to timely diagnosis. Apart from this, inadequate healthcare resources and infrastructure, mainly in rural areas, and a shortage of well-trained oncologists and radiologists, and other healthcare professionals are evolving another hurdle for the market expansion.

Widespread Developments in Tissue Biopsy and other Innovations

The global cancer biopsy market will have several opportunities in the coming era, such as immense expansion in liquid biopsy techniques, as well as advancements in tissue biopsy techniques. In this tissue biopsy technique, there will be numerous updates in imaging, such as ultrasound-guided and MRI-guided biopsies, which are boosting the accuracy and efficiency of tissue biopsies. Besides this, AI and machine learning are being integrated into imaging platforms to optimize lesion detection and diagnostic accuracy. However, other emerging approaches are included as needle-based biopsy instruments, such as core needle biopsy, fine needle aspiration, image-guided procedures like ultrasound-guided, CT-guided, and robotic-assisted biopsies, which are enhancing accuracy, effectiveness, and patient outcomes.

In 2024, the tissue biopsy segment held the biggest revenue share of the market. There are many factors are contribute to the segment growth, such as its ability to give detailed data about the tumor. As well as it is also increasingly adopted in different cancer diagnosis applications as it offers comprehensive analysis, including tumor type, nature, and genetic information. Continuous advancements in tissue biopsy techniques, mainly minimally invasive procedures, are assisting with an escalated patient experience.

On the other hand, the liquid biopsy segment is estimated to grow fastest in the projected period. Due to the increasing emergence of CancerSEEK, ctDNA methylation analysis, and Tumor-educated platelets (TEPs) development in the market are fueling the overall segment expansion. It has advantages in real-time monitoring by providing real-time insights into a patient's cancer update. Additionally, multi-cancer early detection (MCED) tests, are represent robustness in detecting cancers at prior stages when treatment is more likely to be successful.

Mainly, the breast cancer segment was dominant in the global cancer biopsy market in 2024. Due to the application of liquid biopsy techniques, which support the interpretation of tumor components in bodily fluids, and improvements to conventional tissue biopsies, like vacuum-assisted biopsy (VAB), are acting as a major driver. Also, with the rising prevalence, many techniques are employed to meet the required efficiency, including Fine Needle Aspiration (FNA), Core Needle Biopsy (CNB), and other surgical biopsies.

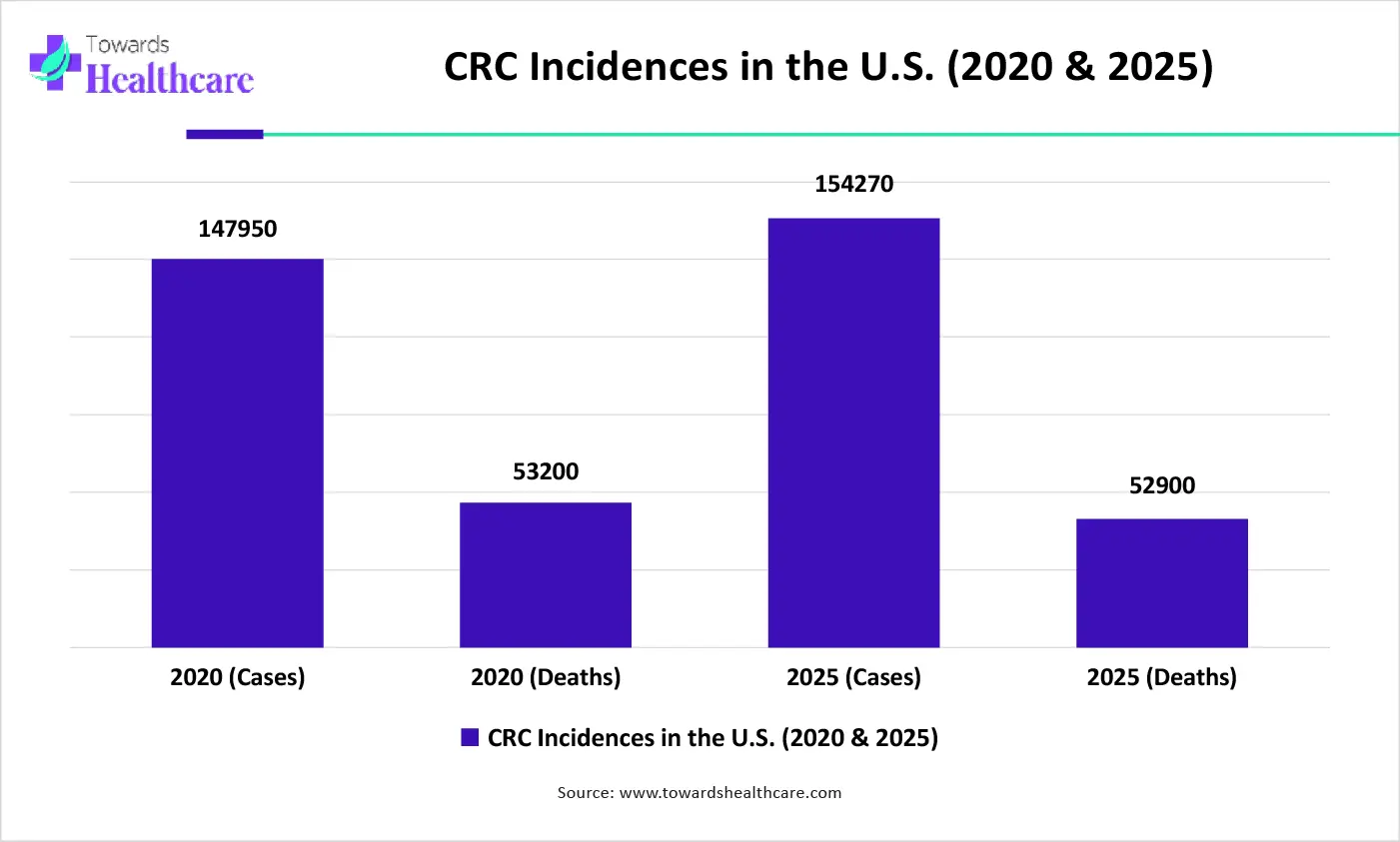

Moreover, the colorectal cancer segment will expand rapidly, due to the accelerating intake of unhealthy food and a rise in the shift towards a sedentary lifestyle. Along with this, the segment is driven by wider adoption of early detection methods, like blood-based tests, particularly the Shield test, which is being created to identify CRC in average-risk individuals, probably boosting early detection rates. In addition, enhancements in imaging modalities like CT scans and MRI improve the ability to determine and characterize tumors. Also, fostering public awareness about the importance of colorectal cancer screening results in early detection and diagnosis.

In the global cancer biopsy market, the instruments & biopsy devices segment led with a major share in 2024. The segment is experiencing this expansion because of the rising movement towards minimally invasive procedures. Primarily, it comprises recent developments, like Robotic-Assisted Biopsy, such as Medtronic's Hugo platform, are integrates sophisticated imaging and AI to optimize the precision level with decreased procedure time during biopsies. Also, nowadays, the adoption of 3D biopsy is a novel device for prostate biopsies, which can handle more comprehensive tissue samples.

The liquid biopsy kits & assays segment is predicted to expand at the fastest CAGR as this product type encompasses numerous benefits for others, such as providing a minimally invasive choice to tissue biopsies, with less patient risk and discomfort. It also enables serial monitoring of cancer progression and treatment response. Moreover, the segment is fueled by its incorporation in holistic tumor assessment in various sites, which gives rise to a greater comprehensive picture of the disease compared to a single tissue biopsy. As well as it is also helping in accelerating the sensitivity and specificity of liquid biopsy assays for finding tumor-driven material in body fluids like blood and urine.

In 2024, the cancer diagnosis & staging segment registered dominance with a major share of the market. The adoption of innovative and robust biopsies in cancer cases is allowing definitive diagnosis, accurate staging by combining with imaging and other tests. Furthermore, these biopsies are a key component in getting molecular information about the tumor, such as genetic mutations and biomarkers. Alongside, the information acquired from biopsies, like tumor type, stage, and molecular characteristics, assists in guiding treatment decisions.

Although the minimal residual disease (MRD) detection segment is anticipated to grow rapidly. Mainly, the emergence of crucial and highly developed techniques, such as deep sequencing, flow cytometry, NGS, and PCR, is being refined to expand the sensitivity and specificity of MRD detection. Besides this, other tumor-informed assays, including Signatera, RaDaR, and ArcherDX PCM, are developed to monitor specific mutations found in a patient's tumor, while tumor-naive assays like CAPP-Seq can identify a widespread of mutations without the incorporation of tumor tissue genotyping.

The hospitals & surgical centers segment was dominant in the global cancer biopsy market in 2024. The inclusion of digital mammography, MRI, and ultrasound is driving its significance of the segment is being propelled by providing precise biopsy approaches. Also, they consist of strong facilities with advanced specialized departments like radiology and oncology, and a workforce of multidisciplinary expertise. Moreover, hospitals are often indicated as the initial point of contact for cancer patients, due to encompassing a convenient and comprehensive approach to diagnosis, treatment, and follow-up care.

On the other hand, the liquid biopsy startups & CROs segment is estimated to show rapid growth. Mursla, Lucence, Predicine, Guardant Health, and Natera, etc. are emerging startups in the respective markets. They are offering different liquid biopsy tests, non-invasive prenatal tests, and other advantages in cancer diagnosis. Whereas, SRI International encompasses expertise in diverse aspects of liquid biopsy, such as assay development, biomarker discovery, and clinical trial support. Covance, ICON, and WuXi AppTec are also well-known CROs to provide services regarding liquid biopsy research.

Due to holding a major share of the market, North America dominated market share by 41% in 2024. The market emphasized novel developments in precision therapeutics, which need well-described biopsy data for diagnosis and molecular interpretation. Also, the increasing awareness in this region about inherited cancer predispositions and the role of genetic testing in cancer risk assessment propels the demand for biopsy methods. And, other crucial innovations in biopsy techniques, such as liquid biopsies and molecular profiling technologies, are accelerating the precision, pace, and completeness of biopsy results.

In the US, widespread modifications to lifestyles are contributing to the highest adoption of novel and advanced liquid biopsy procedures. Also, this region comprises major market players that have immense participation in the development and research activities in cancer diagnosis and innovative technologies.

For instance,

Canada is also experiencing major expansion by adopting liquid biopsies widely, which helps in analyzing biomarkers in bodily fluids like blood. Also, Canada’s supportive government policies and reimbursement landscapes for cancer screening and diagnosis are playing a major role in fueling market growth, especially for early detection programs.

For this market,

Across the cancer biopsy market, the ASAP is anticipated to show the fastest expansion during 2025-2034. In ASAP, greatly putting efforts towards awareness relevant to cancer and expanding healthcare infrastructure are mainly incorporated to raise the demand for biopsy methods. Also, the escalating healthcare expenses in ASAP assist the adoption of advanced diagnostic technologies. Various regions’ governments of ASAP are actively executing programs for cancer screening and early detection, like free screening for breast, cervical, and lung cancers, with enhanced alliances among governments, research institutes, and companies.

Due to growing investments in diagnostics and genomic testing, along with wider access to novel technologies the India’s respective market.

For instance,

China’s expanding burden of diverse cancer cases is boosting the research and development activities in the oncology area and biopsy technologies. China’s many healthcare centers are adopting early detection approaches in cancer incidences to achieve timely treatment with reduced risk of damage.

For instance,

In the worldwide market, Europe’s market is facing significant expansion, due to there is a complete plan of action highlighting the cancer burden in the entire disease pathway, including early detection, diagnosis, and treatment. Also, they are focusing on early diagnosis and screening initiatives, resulting in increased survival rates. Besides this, ongoing investment in cancer research and development is developing novel diagnostic tools and therapies, such as breakthroughs in liquid biopsy techniques.

The UK’s market is fueled by an increasing number of advanced diagnostic centers, as they are providing highly sophisticated imaging approaches and catering to the rising need for cancer diagnostics.

For instance,

Germany's robust healthcare system, which comprises specialized cancer centers, assists in the market's growth by offering access to advanced diagnostic and treatment options.

For instance,

By Technique Type

By Cancer Type

By Product Type

By Application

By End User

By Region

February 2026

January 2026

January 2026

December 2025