January 2026

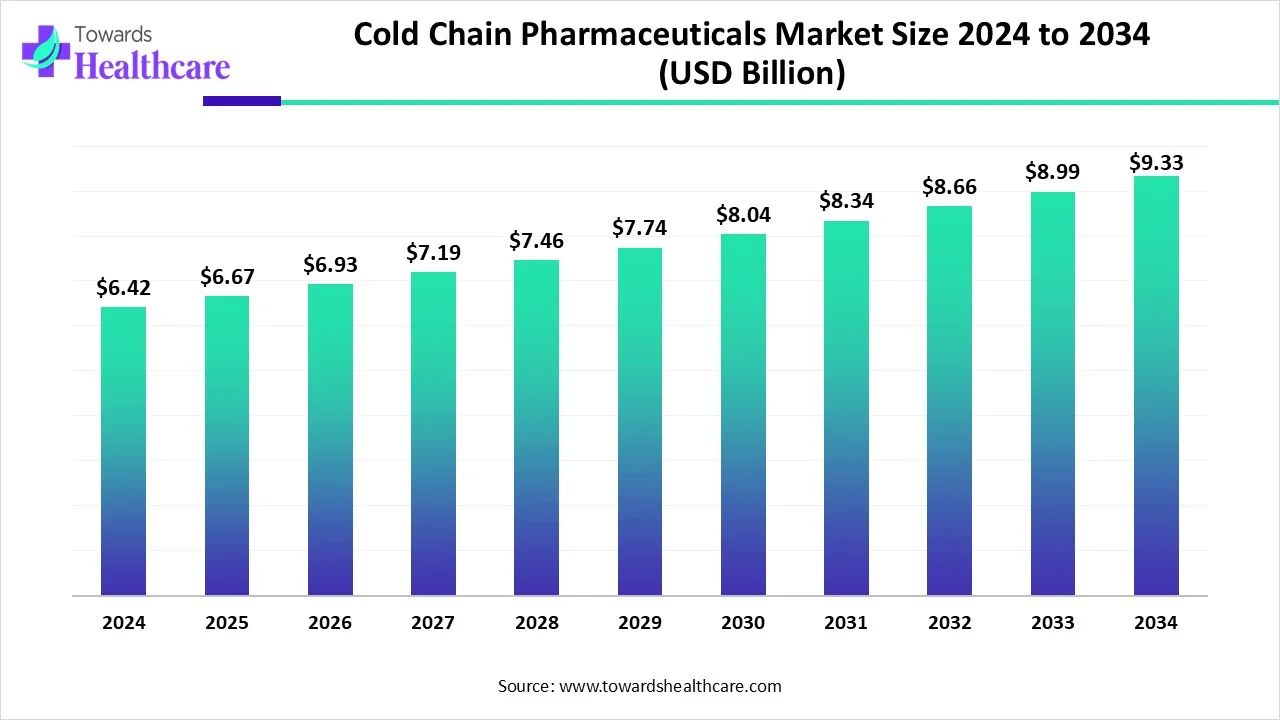

The global cold chain pharmaceuticals market size is calculated at USD 6.67 billion in 2025, grew to USD 6.93 billion in 2026, and is projected to reach around USD 9.71 billion by 2035. The market is expanding at a CAGR of 3.83% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 6.67 Billion |

| Projected Market Size in 2035 | USD 9.71 Billion |

| CAGR (2026 - 2035) | 3.83% |

| Leading Region | North America |

| Market Segmentation | By Type of Primary Packaging, By Type of Secondary Packaging, By Type of Usability, By Region |

| Top Key Players |

CSafe, Cold Chain Technologies, EMBALL’ISO, Cryopak, Peli BioThermal, Temperpack, SOFRIGAM, Intelsius, SEE, Nordic Cold Chain Solutions, Sonoco Thermosafe |

A single-use device used to monitor the temperature inside the vaccine shipping container is known as a cold chain monitor (CCM). They are stored in a compartment separate from the shipping container and are discarded after their use. To optimize the innovation and design of cold chain processes and supporting technologies, pharmacy leaders who are experts in advancing cold chain management and collaborating with all supply chain stakeholders are required. The increased development of vaccines that require a consistent cold chain contributed to the importance of cold chain capacity and expertise during the management of the drug supply chain.

The utilization of technological advances such as the Internet of Things (IoT) has enhanced the growth of the pharmaceutical organizations by resulting in a positive response on the supply chain system. The use of IoT allows pharma companies for value chain end-to-end integration. Furthermore, the inputs of IoT were made available by using cognitive systems and big data analytics, including artificial intelligence and machine learning. This, in turn, enhanced the productivity of the cold chain process as well as the entire supply chain network. Thus, these technological advancements using AI are evolving the pharmaceutical industry.

Increasing Use of Biologics

Due to increasing diseases, the demand for the use of biologics has increased. They are used in various diseases such as cancer, diabetes, and autoimmune disorders etc. They are sensitive to temperatures; thus, if it is not maintained, it may degrade. Thus, it becomes crucial to maintain the stability of biologics. Hence, the need for a reliable cold chain system increases. Therefore, by utilizing a consistent cold chain system, the stability of the biologics can be maintained, improving their safety and efficacy, which in turn drives the cold chain pharmaceuticals market growth.

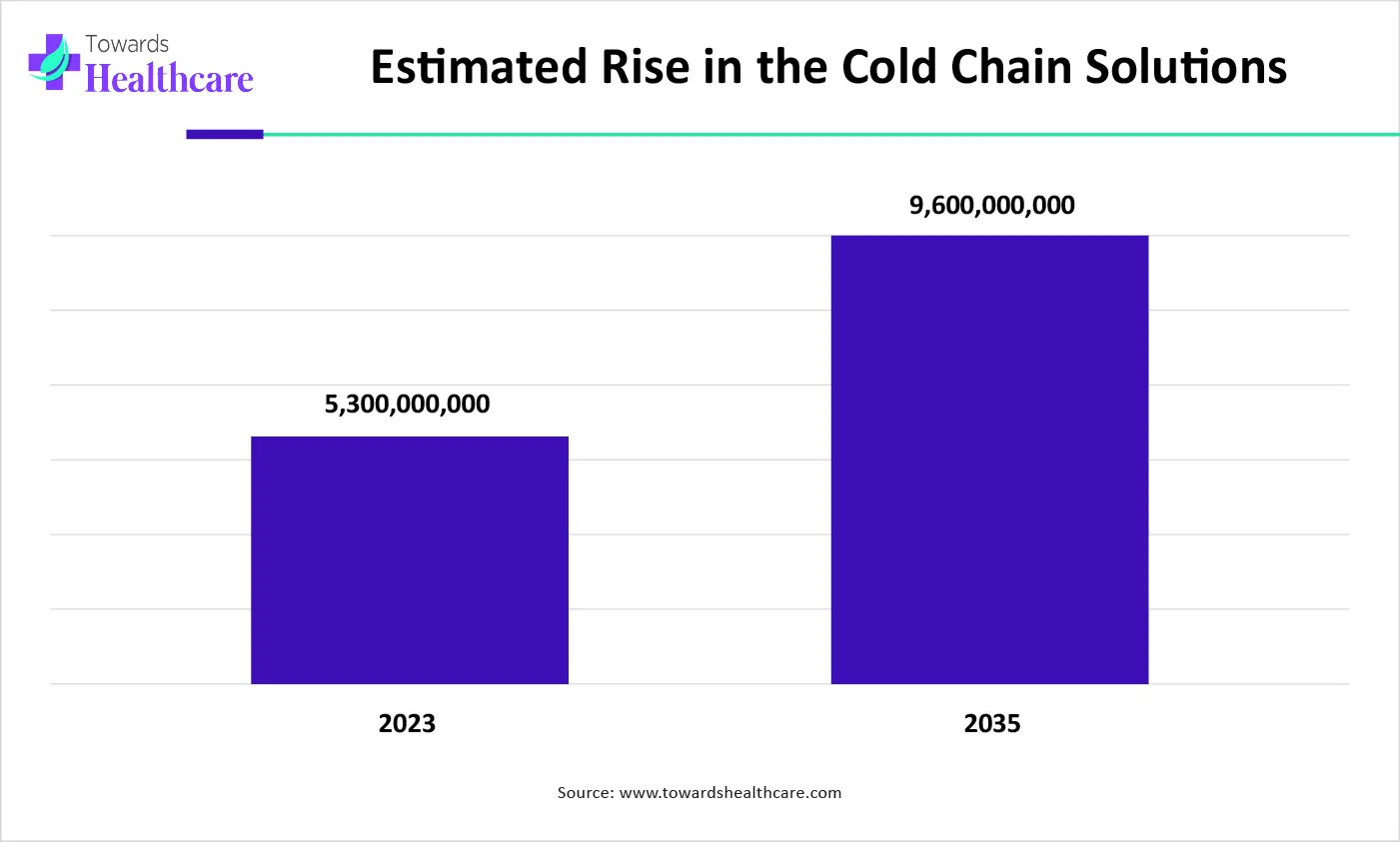

The graph represents the estimated growth in pharmaceutical cold chain solutions. It indicates that there will be a rise in the cold chain solution in 2035, which is expected to be due to increased use of biologics. Thus, this boosts the development of innovations in cold chain facilities, which ultimately promotes market growth.

Limited Cold Chain Facilities

Various startups or industries in rural areas may lack the facilities of cold chain systems. At the same time, inconsistent as well as higher costs of cold chain supplies can affect the distribution of the products. Furthermore, this can also cause degradation of the products, resulting in the risk of toxicity. Thus, all these factors affect the market.

Increasing Trades

There is a growth in the pharmaceutical as well as biotechnological industries. This has increased the development of new therapeutics in both industries for various diseases. Moreover, the demand for vaccines, biologics, gene therapies, etc., is rising, leading to an increase in trade between the industries and hospitals. Therefore, for proper transportation as well as maintenance of such products, the demand for cold chain systems is rising. Thus, the increasing trade is promoting the cold chain pharmaceuticals market growth.

For instance,

By primary packaging type, the vials segment dominated the market in 2024. The vials were the preferred choice as they provided stability, protection as well as were suitable for freeze drying of various vaccines and biologics. This contributed to the cold chain pharmaceuticals market growth.

By primary packaging type, the pre-filled syringes segment is estimated to be the fastest-growing at a notable CAGR during the forecast period. The pre-filled syringes are increasing as they are convenient for self-administration, enhancing their cold transportation.

By secondary packaging type, the cold boxes segment dominated the market in 2024. The cold boxes covered the primary packaging, protecting it from light and physical stress. Furthermore, it also maintained the required temperature for the drug, promoting the market growth.

By secondary packaging type, the vaccine carriers segment is anticipated to grow significantly during the forecast period. The use of vaccine carriers is growing, due to increasing vaccinations. They provide suitable temperatures as well as can be transported to limited cold chain facilities.

By usability type, the reusable segment dominated the global cold chain pharmaceuticals market in 2024 and is expected to be the fastest-growing during the forecast period. It offers multiple uses without reducing the protection provided to the drugs. Thus, this enhances its long-term use.

By usability type, the single-use segment is predicted to grow significantly during the forecast period. Their use is increasing as it reduces the risk of cross-contamination of the drugs. Furthermore, their use is also increasing in vaccination programs, promoting the market growth.

North America dominated the cold chain pharmaceuticals market in 2024. North America consists of a well-developed healthcare infrastructure with technological advancements. This, in turn, increased the development and transportation of medications using cold chain supplies, which contributed to the market growth.

The UK consists of well-established healthcare systems. At the same time, the demand for biologics and gene therapies is increasing the use of cold chain facilities during their transportation for maintaining their stability and efficacy.

Various companies in Canada are collaborating on the development of new biologics and biosimilars. This, in turn, is expanding the transportation of approved drugs to the hospitals using cold chain systems.

Asia Pacific is estimated to host the fastest-growing cold chain pharmaceuticals market during the forecast period. The industries in Asia Pacific are increasing along with the adoption of technological advancements. Furthermore, the adoption as well as use of cold chain systems is increasing due to rising demands for various temperature-sensitive drugs, enhancing the market growth.

For instance,

The industries in China are adopting various technological advancements, which in turn are accelerating the manufacturing process. Moreover, these advancements are also enhancing the cold chain facilities, increasing their use.

The number of industries in India is rising, which in turn is increasing the need for cold chain systems. At the same time, the use of temperature-sensitive drugs has increased, causing enhanced use of the cold chain supply facilities.

Europe is expected to grow significantly in the cold chain pharmaceuticals market during the forecast period. The industries in Europe are advancing due to the increasing production, transportation, as well as advanced technologies, which in turn amplify the use of the cold chain system, promoting the market growth.

The utilization of technological advancements is increasing the production rates, which in turn increases the distribution of drugs using cold chain facilities. Furthermore, the compliance of the cold chain with the rules and regulations imposed by the regulatory agencies enhances its use.

The industries in the UK are advancing as well as collaborating to develop advanced cold chain facilities due to their increasing use. This, in turn, is leading to the adoption of technologies as well as increased investments.

Which Country was the Largest Exporter of Vaccines?

(Source: OEC World)

By Type of Primary Packaging

By Type of Secondary Packaging

By Type of Usability

By Region

January 2026

November 2025

November 2025

October 2025