February 2026

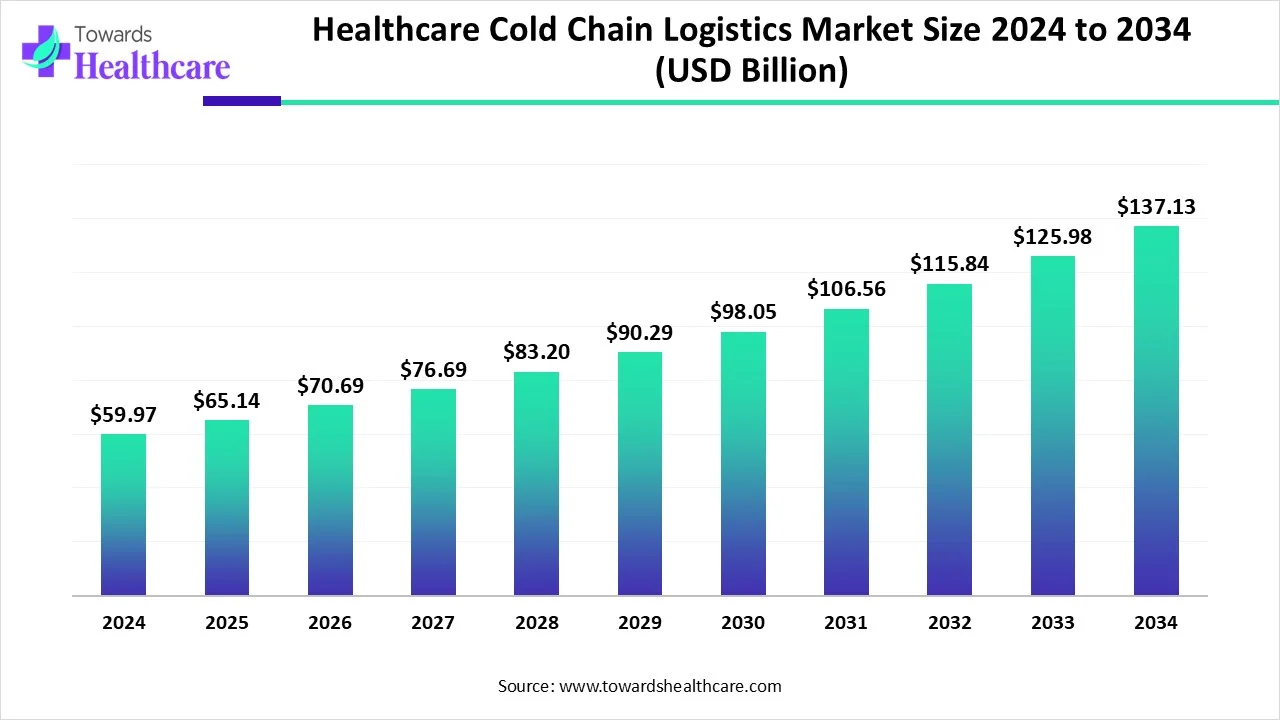

The global healthcare cold chain logistics market size is calculated at USD 59.97 in 2024, grew to USD 65.14 billion in 2025, and is projected to reach around USD 137.13 billion by 2034. The market is expanding at a CAGR of 8.63% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 65.14 Billion |

| Projected Market Size in 2034 | USD 137.13 Billion |

| CAGR (2025 - 2034) | 8.63% |

| Leading Region | North America |

| Market Segmentation | By Type, By Services, By Storage Techniques, By Region |

| Top Key Players | AmerisourceBergen Corporation (U.S.), CAVALIER LOGISITICS (U.S.), Continental Carbon Company (U.S.), DHL International GmbH (Germany), FedEx (U.S.), Kuehne+Nagel (Germany), Deutsche Post AG (Germany), LifeConEx (U.S.), American Airlines Inc. (U.S.), Air Charter Service (India), Agility Public Warehousing Company (U.S.), VersaCold Logistics Services (Canada), Delhivery Limited (India), YUSEN LOGISTICS CO., LTD. (India), V-Xpress (India), FulfillmentHubUSA (U.S.), Prompt Brazil Logistics (Brazil) |

The healthcare cold chain logistics market is growing rapidly because it plays a significant role in the transportation and medical industries. Shipping of these sensitive products is troubled by challenges. Slightest changes of temperature can render medical items ineffective or toxic. Healthcare cold chain logistics ensures that the end user, often a patient, obtains a product that functions as intended. The cold chain refers to the consistent sequence of refrigerated solutions that ensure these goods remain within the range of temperature needed. Which means hospitals and other buyers of medical supplies get the products that are in usable condition. Cold supply chain management providers follow all government and state regulations. By regulating strict temperature controls, improving the distribution of products, and leveraging advanced technology, cold chain management is transforming the logistics supply chain and ensuring the safe delivery of complex medical care products worldwide.

Integration of AI in the healthcare cold chain logistics is driving the growth of the market as AI-driven cold chain incorporates IoT sensors to track real-time temperature data throughout transportation, confirming that pharmaceuticals remain in the needed range of temperature. If the temperature slightly changes, AI alerts logistics teams in real time, enabling proper actions to avoid wastage. AI-driven dynamic routing algorithms improve transportation routes, ensuring on-time delivery and reducing delays of critical biopharmaceutical supplies. This is predominantly significant for temperature-sensitive drugs. AI-driven devices offer continuous monitoring of temperature and humidity during the supply chain. These systems quickly alert logistics teams if conditions change from acceptable ranges, allowing instant corrective actions to protect the integrity of the healthcare products.

Increasing Demand for Pharmaceutical Temperature-Sensitive Products

Cold chain logistics is experiencing rapid growth due to the increasing demand for temperature-sensitive pharmaceuticals and biologics, heightened vaccination initiatives, stricter regulatory standards, and advancements in temperature monitoring and transportation technologies. This indicates a bright outlook for the emerging industry. The rising demand for these sensitive products drives companies to focus on secure storage and transport, leading to a significant shift toward innovative cold chain solutions that guarantee quality and efficacy, thereby fueling growth in the healthcare cold chain logistics market.

Challenges in Healthcare Cold Chain Logistics

Conventional approaches typically lacked full traceability, failing to deliver in-depth insights into each product's journey through the cold chain. This shortcoming complicated the identification of specific causes for temperature fluctuations or instances of spoilage, thereby constraining the healthcare cold chain logistics market.

Recent Technological Advancements

Recent developments in ultracold supply chain logistics have simplified the maintenance of required temperatures for sensitive biopharma products. Technologies like in-transit temperature monitoring and reporting systems facilitate continuous tracking of critical shipments on a unified platform, granting real-time visibility into delays or deviations and backing data-driven decision-making. Smart sensors add an extra layer of security, and early detection of potential temperature fluctuations allows for swift action to avert product damage, thus creating opportunities for the healthcare cold chain logistics market.

By type, the biopharmaceuticals segment dominated in the healthcare cold chain logistics market in 2024, as cold chain logistics plays a significant role in the pharmaceutical and healthcare industry to protect these sensitive products from contamination, spoilage, or loss of potential effect. A properly managed logistics system confirms that medications are delivered in optimum conditions, maintaining their safety and efficacy through the supply chain. This is predominantly important for temperature-sensitive products, where any changes can compromise treatment outcomes and patient safety.

The vaccines segment is expected to be the fastest growing in the healthcare cold chain logistics market because advanced quality cold chain enables health workers to deliver life-saving vaccines to each child. Governments confirm that the cold chain continues to work efficiently and effectively in each country where they deliver vaccines to children. They play an important role in conserving the potency and efficacy of vaccines, ensuring that they are effective and safe from the time they are manufactured until they are administered to individuals.

By services, the storage segment is dominant in the healthcare cold chain logistics market as it supports the protection of delicate pharmaceutical products. Cold chain particularly supports in marketing of those products at a lucrative price in various markets, which is more important for the patients and the manufacturer. Cold chain pharmaceutical products are goods that must be stored at a particular temperature to maintain their safety and quality. These products are biologics, gene therapies, components of cells, or vaccines.

The transportation segment is expected to be the fastest growing due to its developed pharmaceutical transportation, confirming that important vaccines and drugs are delivered efficiently from the manufacturer to the patient. It keeps the efficacy of medications through the supply chain. Minimized challenges of product loss and real-time monitoring systems support companies to detect any temperature changes before they result in product damage. It offers an efficient transport method and reduced freight. Pharmaceutical organizations can save on energy costs associated with refrigeration units.

By storage techniques, the electrical refrigeration segment is dominant in the healthcare cold chain logistics market, as it safeguards sensitive medicinal products from damage, loss of potency, or contamination. It ensures that temperature-sensitive goods are kept at ideal conditions from production through distribution to end-user consumption.

North America dominated the healthcare cold chain logistics market due to the strong presence of major distributor of medical and pharmaceutical supplies in North America, which distributes complex medicines, biotechnology, and specialty pharmaceuticals, medical, and healthcare products. The North American healthcare sector plays a significant role in producing, developing, and distributing medications that enhance and save the lives of patients, which increases the demand for the cold chain logistics market.

In the United States, the presence of cutting-edge technologies and leveraging smart management of the pharmaceutical sector, while increasing adoption of forward-leaning infrastructure policies that drive the growth of the healthcare cold chain logistics market. Also, secure and safe transportation for medical products makes it easy to shift temperature-sensitive goods quickly within the country. Biopharmaceutical manufacturers in the United States have access to innovative solutions and cutting-edge technologies. This involves the adoption of robotics, automation, and artificial intelligence in different manufacturing processes, improving productivity and efficiency, which contributes to the growth of the market.

In Canada growing collaborative environment where industry, academia, and government agencies work together to increase innovation and advancements in biopharmaceutical manufacturing. Because of this, there is a huge demand for cold chain logistics in this country. Health Canada supports making sure companies and products meet Canada's high-quality and safety standards by improving and enforcing compliance with regulations and laws. To meet these regulations, companies invest in advanced cold chain technology.

The Asia Pacific region is projected to experience the fastest growth in the healthcare cold chain logistics market during the forecast period, because the rising income middle class in Asia Pacific has created a great propensity to spend on novel technology, and this is supporting the region's innovation economy. In the region, investments in research and development consistently encourage technological advancements, which make the cold chain system smarter, faster, and more reliable. The Asia-Pacific healthcare sector has emerged as a hub for pharmaceutical investment and development, drawing attention from both global and local players, which drives the growth of the market.

For Instance,

With an increasing aging population exceeding 1.4 billion in China, experiencing a rising demand for medical care services, medical devices, and pharmaceuticals, as more people require healthcare, the demand for biologics, vaccines, and temperature-sensitive drugs is rapidly increasing. This drives the need for cold chain logistics for safely delivering those medicines. Economic advancement closely influences healthcare expenditure, with the Chinese government’s investments potentially growing, which creates a strong push to expand and build a cold chain system.

Growing Indian government support and attention for health incentives and smart infrastructure projects, as well as the government's investment in cold chain storage, transportation, and digital monitoring systems, which causes the growth of the market. Indian healthcare companies are progressively investing in research and development for the manufacturing of innovative drugs and therapies. There is also a notable increase in clinical trials performed in India, which increases the demand for healthcare cold chain logistics in India.

Europe is expected to grow significantly in the healthcare cold chain logistics market during the forecast period, as increasing demand for biosimilars is expected to experience noteworthy growth, driven by the growing demand for cost-effective biologics and the focus is shifting towards personalized medicine, with a growing emphasis on targeted therapies and diagnostics. This trend pushes pharma organizations and logistics providers to advance cold chain potential, which contributes to the growth of the market.

Germany is the major European pharmaceutical sector and the fourth major worldwide, after the US, China, and Japan. Advanced innovation, a long tradition as the world´s pharmacy, and incessantly rising demand for medical care products make Germany the best location for pharmaceutical research and development, production, and sales of medicines. This supports the development of efficient cold chain logistics, which contributes the market growth.

The Middle East & Africa are expected to be a significantly growing area in the healthcare cold chain logistics market, due to the burgeoning healthcare sector and the rising adoption of advanced technologies. Regulatory agencies are drafting favorable regulations to strengthen cold chain supply in the Middle East & Africa. Countries have a favorable manufacturing infrastructure, supporting the manufacturing of vaccines and other biologics. The increasing number of clinical trials of temperature-sensitive products facilitates market growth.

Companies like Total Freight International, TLM Logistics, and DP World are major players that provide cold chain logistics in the UAE. In July 2025, the Department of Health (DOH) announced the launch of the region’s vaccine distribution hub in Abu Dhabi. The hub leverages Abu Dhabi’s cold chain logistics infrastructure and a regulatory environment.

Concox, Maersk, and DHL are some of the companies that provide cold chain logistics in South Africa. As of September 19, 2025, a total of 208 clinical trials were registered in South Africa related to vaccines. In June 2024, the Africa Vaccine Manufacturing Accelerator (AVMA) was launched to catalyze investment in Africa’s vaccine manufacturing ecosystem.

In March 2025, Oscar de Bok, CEO of DHL Supply Chain, stated, “The acquisition of CRYOPDP is a significant shift for our supply chain business as to expand our Pharma Specialized Network to meet the developing requirements of clinical trials, cell and gene therapies and biopharma, in addition to further growing our footprint in the conventional life science and pharma healthcare segment. The acquisition of CRYOPDP and the extended partnership with Cryoport Inc. allow us to deliver integrated end-to-end solutions, improving our capabilities of service.” (Source - DHL group)

By Type

By Services

By Storage Techniques

By Region

February 2026

February 2026

January 2026

December 2025