February 2026

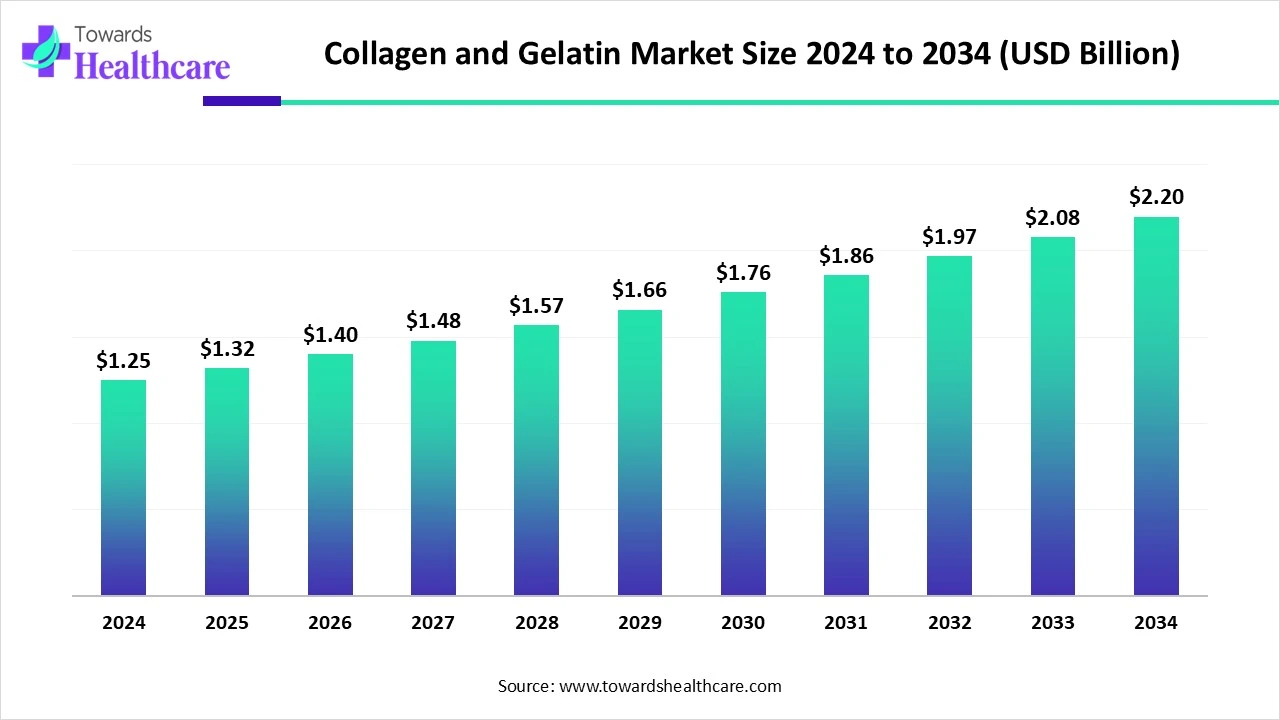

The global collagen and gelatin market size is calculated at USD 1.25 billion in 2024, grow to USD 1.32 billion in 2025, and is projected to reach around USD 2.2 billion by 2034.The market is expanding at a CAGR of 5.84% between 2025 and 2034.

The collagen and gelatin market is experiencing significant growth due to increasing applications in the food, cosmetic, pharmaceutical, and nutraceutical industries. Rising consumer awareness of health, beauty, and wellness, along with growing demand for clean-label and protein-rich products, is driving the market. Additionally, advancements in extraction techniques and product innovation are supporting broader usage across various sectors, further propelling market expansion.

| Metric | Details |

| Market Size in 2025 | USD 1.32 Billion |

| Projected Market Size in 2034 | USD 2.2 Billion |

| CAGR (2025 - 2034) | 5.84% |

| Leading Region | North America |

| Market Segmentation | By Product, By Source, By Application, By Region |

| Top Key Players | Integra LifeSciences Corporation, dsm-firmenich., Collplant Biotechnologies Ltd., NITTA GELATIN INC., Collagen Solutions LLC, Symatese, GELITA AG, PB Leiner, Smith & Nephew Plc, Lonza Group Ltd. |

Collagen is the primary structural protein found in skin, bones, and connective tissues, providing strength and elasticity. When collagen undergoes partial hydrolysis, it produces gelatin, a water-soluble protein used widely as a gelling, stabilizing, and thickening agent in food, pharmaceuticals, and cosmetics. Both play vital roles in health, nutrition, and various industrial applications. Innovation is reshaping the collagen and gelatin market by introducing eco-friendly sourcing methods, such as marine and plant-based alternatives, and enhancing bioavailability through nanoencapsulation technologies. Advancements in processing have improved purity, functionality, and shelf life, making these proteins suitable for high-performance applications in cosmetics, functional foods, and biomedical products. Additionally, tailored formulations and hybrid materials are expanding their use in wound care, tissue engineering, and wellness-focused products, fueling greater market adoption.

AI is impacting the market by optimizing production processes, improving quality control, and accelerating product development. Through data analytics and machine learning, manufacturers can enhance extraction efficiency, predict consumer trends, and tailor formulations for specific applications. AI also supports innovation in sustainable sourcing and bioengineering, helping create plant-based or lab-grown alternatives. These advancements streamline operations, reduce waste, and support the growing demand for high-quality, functional, and ethically produced collagen and gelatin products.

Rising Health and Wellness Awareness

Growing awareness of personal health and wellness is boosting the collagen and gelatin market as consumers look for ingredients that promote vitality and long-term health. These proteins are increasingly included in daily routines due to their roles in improving skin elasticity, strengthening joints, and aiding recovery. With a shift towards proactive self-care and natural, protein-rich products, collagen and gelatin are gaining popularity in dietary supplements, skincare, and functional foods, supporting steady market growth worldwide.

For Instance,

Allergen and Safety Issues

Allergen and safety concerns limit the growth of the collagen and gelatin market, as some individuals may experience adverse reactions due to the animal-derived nature of these proteins. Moreover, risks related to contamination during sourcing or processing raise doubts about product purity and safety, especially in sensitive applications like food and medicine. These issues lead to regulatory scrutiny and consumers' hesitation, particularly among health-conscious and ethically driven buyers, thereby hindering broader market acceptance.

Expansion of Biomedical Applications

Collagen and gelatin hold strong potential in biomedical fields due to their natural origin and ability to support healing processes. Their use is expanding in areas like regenerative medicine, orthopedics, and controlled drug release, where safe and bioactive materials are essential. As the healthcare sector seeks more effective, tissue-friendly solutions, these proteins are gaining traction in advanced therapies, offering significant market opportunities through their versatility, safety profile, and compatibility with human tissues.

For Instance,

In 2024, gelatin emerged as the top revenue-generating segment in the collagen and gelatin market, owing to its widespread integration into everyday consumer goods. Its unique ability to enhance texture and stability in food products, along with its essential role in softgel capsules and medical applications, boosted demand. The segment also benefited from its long-established safety profile and cost-efficiency, making it a preferred choice for manufacturers across the food, healthcare, and cosmetic sectors globally.

The peptide segment is expected to grow at the fastest CAGR in the collagen and gelatin market due to rising demand for easily digestible and quick-absorbing protein supplements. Collagen peptides are gaining popularity in wellness, skincare, and fitness sectors for their effectiveness in improving skin elasticity, joint health, and muscle strength. Their versatility in formulations like powders, beverages, and capsules, along with increased consumer focus on active and healthy lifestyles, is driving strong market growth.

The bovine segment dominated the market in 2024, driven by its extensive use in nutraceuticals, pharmaceuticals, and food products. Bovine sources offer a reliable supply of high-quality collagen types that support skin, bone, and joint health. Manufacturers favor bovine collagen for its lower production cost and favorable processing characteristics. Its widespread acceptance across regions and industries further strengthened its position as the leading product source in the market.

The porcine segment is projected to witness the fastest CAGR in the collagen and gelatin market due to its wide availability, affordability, and ease of processing. Porcine-derived collagen is increasingly used in various sectors like food, biomedical, and personal care because of its excellent gelling and emulsifying properties. Its rising demand is also supported by advancements in healthcare and cosmetics, where it is used for improving skin texture, wound healing, and developing collagen-based therapeutic products.

The cosmetic segment accounted for the largest share of the market in 2024 due to increasing consumer interest in beauty and skincare products that enhance skin texture, reduce wrinkles, and promote elasticity. Collagen and gelatin are key ingredients in anti-aging formulations, serums, and face masks, making them highly popular among both younger and aging populations. Growing awareness of personal grooming and rising spending on premium skincare further fueled demand in the market.

The pharmaceutical segment is anticipated to grow rapidly in the collagen and gelatin market due to its expanding role in innovative medical solutions. These biomaterials are being increasingly utilized in tissue scaffolds, hemostatic agents, and encapsulated drug formulations because of their natural origin and compatibility with the human body. Rising investments in healthcare R&D and the demand for safer, more effective drug delivery systems are boosting the use of collagen and gelatin in advanced pharmaceutical applications.

In 2024, North America dominated the market due to strong consumer awareness of health, wellness, and beauty benefits associated with these proteins. The region’s demand was fueled by widespread use in dietary supplements, functional foods, and anti-aging skincare products. Additionally, a well-established pharmaceutical and cosmetic industry, along with high spending on personal care and healthcare products, supported market growth. Ongoing innovation and easy access to advanced products further reinforced the region’s leading position.

The U.S. market is growing due to escalating consumer demand for health-focused and beauty-enhancing products. An increase in awareness about collagen’s benefits, such as improved skin elasticity, joint support, and muscle recovery, is boosting its inclusion in dietary supplements, protein-enhanced snacks, and functional beverages. Meanwhile, innovations in collagen peptides and hydrolyzed forms, along with strong e-commerce and direct-to-consumer channels, have expanded access and appeal across wellness, fitness, and anti-aging markets.

In Canada, the market is expanding due to a strong foundation in meat production, which ensures abundant and cost-effective raw materials for collagen manufacturers, especially from bovine and poultry sources. Consumer demand for clean-label, health-focused, and collagen-enriched products in food, cosmetics, and wellness categories continues to rise. Government and academic partnerships further support R&D in advanced formulations and functional foods, accelerating innovation and supporting future growth.

AsiaPacific is expected to grow at the fastest CAGR in the market during the forecast period because of rapid economic growth in countries like China and India, rising consumer awareness of collagen's health and beauty benefits, and expanding healthcare infrastructure. Increased use in food processing, cosmetics, nutraceuticals, and biomedical applications, along with widespread availability and supportive government investment, drives strong regional demand for collagen- and gelatin-based products.

In China, the market is expanding due to surging middle-class demand for functional foods and wellness-focused beauty products enriched with collagen peptides. Consumers increasingly seek supplements that support skin, joint, and bone health, driven by rising health consciousness and aging demographics. Additionally, abundant low-cost raw materials from domestic slaughterhouses and a growing pharmaceutical sector using gelatin-based capsules further support market growth.

In India, the market is expanding due to increasing consumer interest in functional foods, beauty, and wellness products that support skin, hair, and joint health. Growing urbanization and higher disposable income are fueling demand for collagen-enriched supplements and skincare formulations. Additionally, strong local availability of raw materials, supportive government R&D initiatives, and integration with traditional Ayurveda-inspired wellness products are further accelerating market growth.

In 2024, Europe approached the market with a strong focus on clean-label and sustainably sourced products. Rising consumer demand for anti-aging, joint health, and wellness solutions boosted the use of collagen in supplements and skincare. The region emphasized marine and alternative sources, supported by strict regulatory standards and advanced processing technologies, which encouraged innovation and positioned Europe as a key player in high-quality collagen and gelatin offerings.

In 2024, the UK market expanded due to growing consumer interest in clean-label health and beauty products, particularly collagen-enriched supplements and skincare. Rising demand for anti-aging and joint-support benefits drove product innovation, while collagen-enhanced beverages and functional foods gained traction. Furthermore, the proliferation of e-commerce and direct-to-consumer brands enhanced accessibility. The market also embraced marine- and plant-based collagen sources, supported by strong regulatory standards and transparent sourcing practices.

In Germany, the market expanded in 2024 due to rising consumer focus on preventative health and anti-aging. Increasing use in functional foods, beauty products, and supplements propelled demand, supported by strong domestic production capacity and innovation in hydrolyzed collagen formulations. Germans’ preference for clean-label, scientifically backed ingredients and the influence of fitness trends further fueled product adoption across multiple industries.

In May 2024, Nitta Gelatin India Ltd. (NGIL), a collaboration between Nitta Gelatin, Japan, and KSIDC, announced a ₹200 crore expansion to strengthen its presence in the collagen and gelatin industry. The investment will support the setup of a modern collagen peptide plant, an advanced gelatin facility, and a new headquarters in Kakkanad, Kerala. Managing Director Praveen Venkataramanan stated the upgraded unit will help NGIL meet global demand swiftly, as the company pivots toward clean-label, health-oriented bio-ingredients.

By Product

By Source

By Application

By Region

February 2026

February 2026

January 2026

January 2026