February 2026

The global complex & chronic condition management market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

China, India, and other significant countries are facing a rise in the geriatric population, who are connected with severe or chronic concerns, like diabetes, heart issues, and other neurological diseases. These concerns are further fueling the widespread adoption of highly sophisticated CCM platforms and technologies, like AI, ML, DL, and other predictive analytics for expanded care solutions. Also, the global complex & chronic condition management market is emphasizing the use of telehealth solutions, especially telemedicine, RPM platforms, and wearable sensors.

The complex & chronic condition management market refers to digital health platforms, telehealth solutions, care coordination services, and AI-enabled population health tools that help manage long-term, high-cost, and multi-comorbidity conditions such as diabetes, cardiovascular diseases, cancer, COPD, neurological disorders, and chronic kidney disease. These solutions focus on continuous monitoring, personalized care plans, medication adherence, remote patient engagement, and predictive analytics to reduce hospitalizations and improve quality of life. The market is driven by the rising burden of chronic diseases, an aging global population, growing healthcare expenditure, and value-based care initiatives from payers and providers.

An emphasis on value-based care, government initiatives, enhanced healthcare spending, and a widespread focus on patient-centric, are acting as major growth factors in the respective market expansion.

In 2025, leveraging AI-driven digital health platforms, employing continuous data from wearable devices to offer predictive insights and tailored recommendations for chronic conditions, such as diabetes and heart disease. Moreover, highly developed smart inhalers track medication application and respiratory patterns, assisting in the anticipation of declining lung function in conditions, mainly in COPD and asthma.

For instance,

Escalating Healthcare Awareness

The worldwide growing geriatric population associated with various chronic issues, especially diabetes, cancer, and cardiovascular diseases, is fueling the widespread healthcare expenditure. This further accelerates greater demand for newer and advanced management solutions, with optimized effectiveness and cost-effectiveness is driving the global complex & chronic condition management market growth. Also, the globe is strengthening awareness regarding the significance of early detection and continuous monitoring for long-term disease management, which propels the demand for robust tools and personalized treatment choices.

Shortage of Skilled Professionals and IT Buildings

Broadly developing chronic condition prevalence is boosting the need for highly skilled and trained professionals for their management, which is creating a major barrier in the market. Alongside, restricted connected IT infrastructures and limited coherent data standards impede the feasible flow of information among healthcare stakeholders and providers, which influences structured care program execution.

Emergence of Technology and Further Integration

The global complex & chronic condition management market will have phenomenal and various opportunities in the future, such as technological use. A broader merging of IoT devices is accelerating data collection for remote patient monitoring, allowing better insights and interventions. Also, the rising adoption of telehealth services is facilitating major applications for providers and technology vendors. Furthermore, it is possible to enhance the integration of these emerging technologies with care teams to offer excellent communication and data sharing among them, for a robust management of patients with complex or multiple chronic conditions.

In 2024, the diabetes segment accounted for a major share of the complex & chronic condition management market. A prominent driver of this segment is a rise in the aging population, a widely changing lifestyle, and other hereditary factors that are impacting the demand for management. Currently, the wider adoption of RPM, telemedicine, Continuous Glucose Monitoring (CGM), and dual GIP/GLP-1 receptor agonists is also supporting the comprehensive care in diabetes.

Although the neurological disorders segment is anticipated to witness rapid growth, primarily, the growing geriatric population associated with Alzheimer's and Parkinson's disease is boosting the demand for greater management solutions. Recently, the globe has developed an integrated technology, including brain-machine interfaces, deep brain stimulation, and neuroprosthetics, which are assisting in the neurological issues effectively. Alongside other innovations in diagnostic tools, particularly functional MRI (fMRI) and electrical impedance myography, to better understand and monitor the disease is acting as a significant growth factor in the care system.

The remote patient monitoring platforms segment registered dominance in the complex & chronic condition management market in 2024. The need for long-term management in an accelerating cases of hypertension, diabetes, and other severe issues is expanding the use of highly sophisticated solutions, like RPM platforms. This mainly comprises an evolving trend, such as smart devices for blood pressure, glucose, and activity tracking, and the progress of passive monitoring technologies, such as gait analysis.

Moreover, the AI & predictive analytics segment is predicted to expand rapidly during 2025-2034. The worldwide rising emphasis on preventive care, with other advancements in big data analytics, cloud computing, machine learning, and other AI technologies, is helping to escalate the precision of predictions and the automation of clinical decision-making. Current research activities demonstrate the use of these solutions in real-time monitoring, applying wearables for early risk detection and tailored treatment adjustments. Also, its widespread application in Electronic Health Records (EHRs) is imposing further strategies in the care management of chronic and complex concerns.

In 2024, the cloud-based solutions segment captured the biggest revenue share of the complex & chronic condition management market. Emerging fruitful effects like scalability, affordability over on-premise solutions, and rapid delivery of virtual care are propelling its broader range of use across the market. Furthermore, it has an immense activity in the blockchain by integrating with the same, which develops tamper-proof, decentralized patient records, enhancing data security, belief, and allowing for patient-controlled data sharing.

Besides this, the AI & machine learning models segment will expand rapidly in the coming era. Day by day, the world is phenomenally digitalizing in the healthcare sector, by adopting AI/ML models to detect patterns in huge datasets, resulting in prior and more accurate diagnoses of chronic concerns. Also, the widespread usage of machine learning models assists in the estimation of disease progression, probable difficulties (like heart attacks or strokes), and health risks, ultimately enabling early interventions and preventive care. Ongoing trends encompass the emergence of AI models in integrating several data types, like imaging, electronic health records, and wearables, which are influencing their overall development.

The payers/insurance companies segment led the complex & chronic condition management market in 2024. The increasing emphasis on healthcare expenditure and stepping into value-based care models is focusing on outcomes instead of traditional fee-for-service payments. These companies are highly using patient portals and apps to facilitate information, offer communication, and convey educational resources. Also, they are leveraging diverse digital health tools and AI in the detection of high-risk members and anticipation of prospective expenses, which support proactive interventions and closing care gaps.

And, the employers/corporate wellness programs segment is estimated to register the fastest expansion during 2025-2034. Global corporate areas are expanding the requirement for employee productivity and lowering absenteeism, with a rise in focus on employee mental health and well-being is boosting a surge in the use of advanced and digital care solutions. A prominent benefit of wearable fitness trackers and mobile apps is assisting employees to track critical metrics (blood glucose, heart rate, activity) in real-time and be involved in their health conditions.

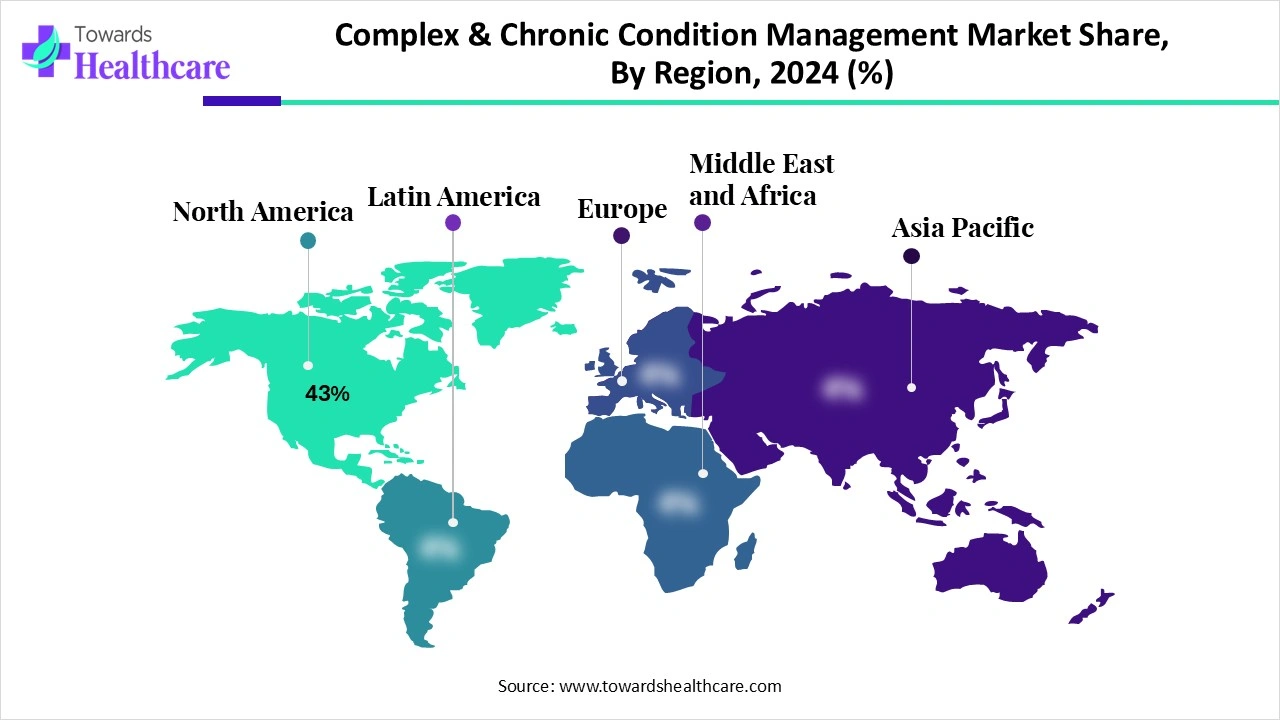

In the global complex & chronic condition management market share 43%, North America was dominant in 2024. Due to a strong presence of value-based care models, high chronic disease prevalence, and digital health adoption, this region has greatly advanced care management. Additionally, ongoing various programs, especially the Medicare Chronic Care Management program and the Affordable Care Act (ACA), deliver financial incentives for coordinated care, encouraging the use of management tools and services in North America.

The US’s complex & chronic condition management market is aiming at telehealth, mobile health (mHealth), and wearable technologies to power patients with remote monitoring, personalized care, and expanded engagement.

For instance,

Canada’s market is greatly adopting an integrated technology for information sharing and decision support, and the growth of non-physician healthcare roles is impacting its complete market expansion.

For this market,

In the future, the Asia Pacific is predicted to witness rapid growth in the complex & chronic condition management market. As ASAP is facing the rising healthcare burden, urbanization, and adoption of mobile-first digital health tools in China and India is supporting the novel developments in care management. Apart from this, the possession of strong primary healthcare systems that deliver comprehensive, coordinated, and continuous care to accelerate outcomes and manage chronic conditions in the ASAP’s diverse areas is also fuelling the technological breakthroughs.

In July 2025, Fangzhou signed a memorandum of understanding (MoU) with Novo Nordisk to partner on the management of serious chronic diseases, including obesity and diabetes.

In September 2025, Garmin India and Apollo HealthAxis, a subsidiary of Apollo Hospitals, entered into the next phase of their strategic partnership to strengthen health monitoring, chronic disease management, and overall wellness throughout India.

Europe is experiencing a significant growth in the complex & chronic condition management market. Primarily, ongoing various projects, such as the ICARE4EU project, are putting efforts to evolve care for individuals with multiple chronic issues by disseminating knowledge of efficiency, united models. This focuses further on the shift from a fragmented to a coordinated system of health and social care.

For instance,

In July 2025, Amigo, a platform that offers AI agents for patient care needs, partnered with the telehealth platform Eucalyptus to integrate AI health agents into Eucalyptus' portfolio of specialized healthcare brands.

By Disease Type

By Solution Type

By Technology

By End User

By Region

February 2026

January 2026

January 2026

December 2025