March 2026

The global dental consumables market size is estimated at US$ 42.92 billion in 2025, is projected to grow to US$ 45.27 billion in 2026, and is expected to reach around US$ 73.04 billion by 2035. The market is projected to expand at a CAGR of 5.46% between 2026 and 2035.

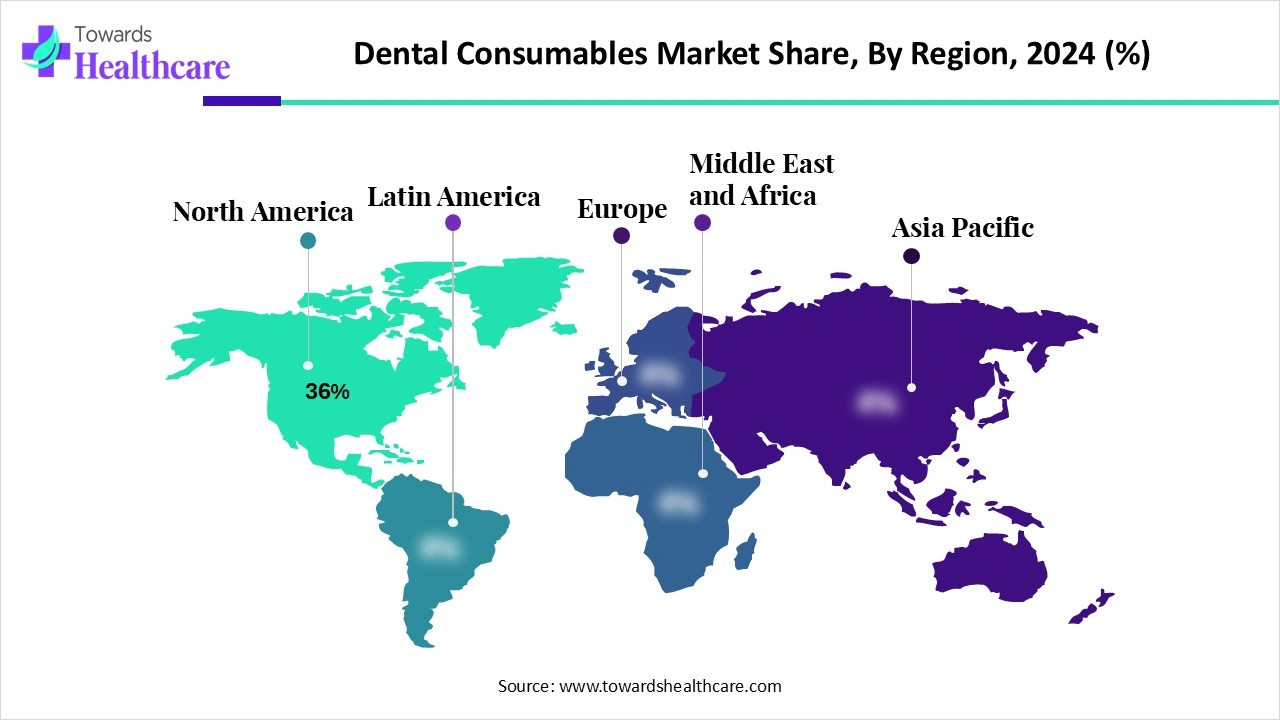

The dental consumables market is expanding rapidly due to increasing awareness of dental health, increasing disposable incomes, and the development of oral technology. North America is dominated in the market by an increasing aging population and more people seeking advanced cosmetic dentistry, while the Asia Pacific is the fastest growing, as increasing demand for whitening kits, electric toothbrushes, and tooth aligners, and also increasing digital platforms.

The dental consumables market covers materials and single-use supplies used for diagnosis, treatment, restoration, and maintenance of oral health. Typical products include restorative and aesthetic materials (composites, adhesives, cements), impression and prosthetic materials, implant and biomaterial supplies, endodontic and orthodontic consumables, infection-control items, and whitening and preventive products. Demand is driven by procedure volumes (restorative, prosthodontic/implant, orthodontic), rising DSO consolidation, aesthetic dentistry adoption, and expanding access to care in emerging markets.

For instance,

For Instance,

Integration of AI in dental consumables drives the growth of the market, as growing digital technology usage in dentistry, rising demand for more precise and effective diagnostic devices, and the requirement to enhance patient treatment outcomes. As the medical care landscape evolves, AI is playing a progressively significant role in enhancing patient care, increasing diagnostic precision, and rationalization administrative processes. AI-driven processes contain a variety of technologies, including natural language processing, machine learning, and computer vision. Its goal is to improve dental practices. AI-driven algorithms analyse dental radiographs and other imaging modalities to detect irregularities, such as cavities, periodontal disease, and other oral health challenges. Rapid FDA approvals for AI-driven dental products inspire early shop entry and broader medical use.

For Instance,

Increasing Awareness of Oral Health

Boosting awareness of oral health is vital, as poor oral hygiene can lead to numerous health issues, affecting both physical and mental well-being. Those with better oral hygiene knowledge tend to have healthier teeth compared to those without this knowledge. Promoting oral health plays a key role in maintaining adult teeth. To prevent problems, health education should start early on, with schools taking a leading role in educating children and guiding parents, supported by paediatricians and dentists, which drives the growth dental consumables market.

Major Challenges in Dental Consumables

Many regions face significant challenges in oral health due to low awareness, inadequate infrastructure, and economic barriers. High manufacturing costs, difficulties accessing affordable products, and a lack of awareness about preventative care all limit the growth of the dental consumables market.

Recent Advancements in Modern Dentistry

Modern dentistry has seen remarkable progress in dental materials, completely changing how we approach and treat oral health. Biocompatible materials mark a significant breakthrough in the field, offering a ground-breaking way to restore and preserve oral health. Unlike their predecessors, such as metal amalgam fillings, biocompatible materials like composite resins and ceramics are designed to blend seamlessly with natural tooth structure, providing top-notch aesthetics and functionality. The benefits of biocompatible materials are their ability to mimic the look of natural teeth, ensuring that restorations blend in perfectly with the surrounding teeth. These materials are non-toxic and compatible with oral tissues, greatly reducing the risk of adverse reactions or allergies commonly associated with traditional dental materials, which creates an opportunity for market growth.

| Table | Scope |

| Market Size in 2025 | USD 42.92 Billion |

| Projected Market Size in 2034 | USD 69.23 Billion |

| CAGR (2025 - 2034) | 5.46% |

| Leading Region | North America Share 36% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Product Category, By Material, By Procedure/Indication, By End User, By Distribution Channel, By Region |

| Top Key Players | Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., CEIA S.p.A., Fortress Technology Ltd., Minebea Intec GmbH, Anritsu Infivis Co. Ltd., Sesotec GmbH, Ishida Co. Ltd., Bizerba SE & Co. KG, METTLER-TOLEDO Safeline, DMT GmbH & Co. KG, Nishizaki Co. Ltd., Detectamet Ltd., Globus (Italy), Control Dynamics Ltd., Loma Systems Ltd., Key Technology Inc., Goring Kerr Ltd., Automation Components Inc., A&D Company Ltd. |

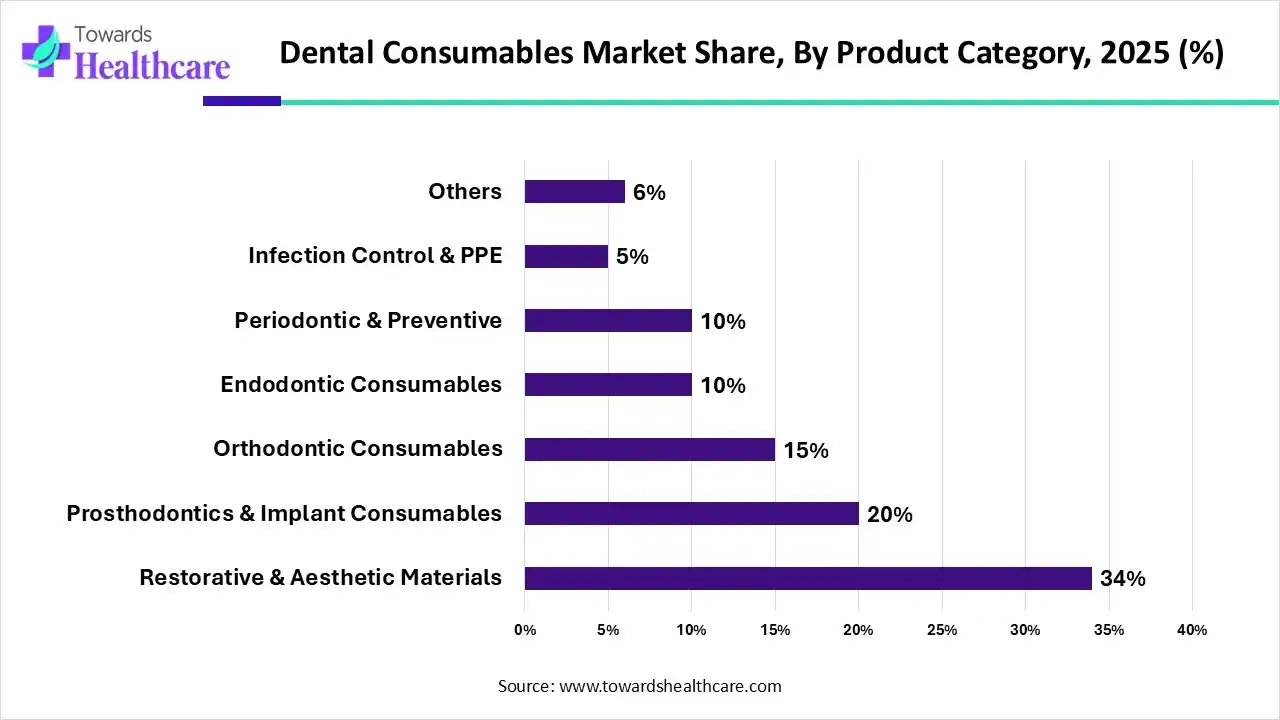

Why the Restorative & Aesthetic Materials Segment Dominated the Market?

By product category, the restorative & aesthetic materials segment led the dental consumables market by 34%, because of the restorative dentistry ais on repairing or replacing damaged teeth. These events help enhance oral health and purpose. Common dental restorations include bridges, crowns, and implants. Cosmetic dentistry focuses on enhancing the appearance of a smile.

On the other hand, the prosthodontics & implant consumables segment is projected to experience the fastest CAGR from 2025 to 2034, as it recovers badly damaged teeth and replaces lost teeth. Dental implants are an outstanding solution for those who have lost a single tooth or multiple teeth, and those who use dentures. A dental implant fitting is a screw-like structure that ends up in the mandible below the gumline. It is usually made of titanium or a titanium alloy. Dental implants can fuse with the bone and form a robust support for restoration.

| Segment | Share 2025 (%) |

| Polymers/Composites/Resins | 42% |

| Ceramics & Glass-Ceramics | 25% |

| Metals & Alloys | 10% |

| Biomaterials | 5% |

| Cements & Adhesives | 8% |

Why the Polymers/Composites/Resins Segment Dominated the Market?

By material, the polymers/composites/resins segment is dominant in the Dental consumables market by 42% in 2025, as it has transformed modern dentistry, providing a versatile and pleasing resolution for different dental requirements. As developments in dental materials continue to progress, composite resin stands out for its extraordinary capacity to restore and improve the natural appearance of teeth. This progressive dental material is applied extensively in modern dentistry for its greater aesthetic and functional characteristics. The resin component gives it the essential flexibility and workability, while the glass or quartz particles offer strength and durability.

The ceramics & glass-ceramics segment is projected to grow at the fastest CAGR from 2025 to 2034, as it is highly attractive for dentists and patients owing to their combination of outstanding physical and chemical properties, such as superiority plus durability, making them an exceptional alternative for lasting restorations. Dental ceramics have become a significant material in advanced dentistry because of their outstanding combination of durability, aesthetics, and biocompatibility.

Why is the Restorative/Operative Segment Dominant in the Market?

By procedure/indication, the restorative/operative segment led the dental consumables market by 38% in 2025, as it provides excellent resistance to wear and withstands the services of chewing, production it suitable for restoring teeth in regions with heavy occlusal loads. Amalgam fillings are comparatively easy to place and need less moisture control compared to various materials. They have a long track record of success and offer a reliable choice for restoring damaged or decayed teeth.

The prosthodontic/implantology segment is projected to experience the fastest CAGR from 2025 to 2034, as these materials provide greater strength, wear resistance, and visual harmony with natural teeth, thus renovating the landscape of restorative dentistry. Furthermore, development in digital dentistry processes, including the use of CAD/CAM technology and 3D printing, has streamlined the design and fabrication techniques of dental prostheses. Technological and material developments in prosthodontics restore function and aesthetics and promise a future where dental restorations are indistinguishable from natural dentition, providing advanced patient outcomes that were once thought impossible.

Why is the Dental Clinics Segment Dominant in the Market?

By end-use, the dental clinics segment led the dental consumables market by 68% in 2025, as it offers treatments to lessen pain from dental challenges, enhancing comfort and quality of life. Regular visits support to prevention of oral diseases, which affect overall health, like heart disease, respiratory infections, and diabetes. These clinics teach patients about correct brushing, overall oral hygiene practices, and flossing techniques to preserve advanced oral health at home. Offering guidance on lifestyle and diet choices that affect oral health, like lowering sugar intake and stopping smoking.

On the other hand, the dental service organizations (DSOs) segment is projected to experience the fastest CAGR from 2025 to 2034, as dentists and dental assistants, joining a DSO, provide many benefits, from economic incentives to enhanced work-life balance. DSO is an entity that offers non-clinical helps to dental practices. This enables dentists to focus more on advanced patient care and less on administrative responsibilities. DSOs handle everything from human resources and marketing to IT procurement and support.

Why is the Indirect Segment Dominant in the Market?

By distribution channel, the Indirect segment led the dental consumables market by 64% in 2025, as this includes distributors and dealers, which allows dentists to buy cost-effective and advanced quality devices such as ultrasonic scaler, micro motor handpiece, and endo motor. These benefits include growing efficiency, increasing access to progressive technology, economic stability, and lowering risk.

On the other hand, the online/e-commerce segment is projected to experience the fastest CAGR from 2025 to 2034, as this distribution channel increases efficiency and gains back control of the business. There are 24 hours and 7-day access to the online supplies, so dentists do not have to spend chair-side time with patients to take care of collation supplies. There has been a rise in the number of dental online stores, which has increased the level of competition. Sellers had to up their game by enhancing their consumer service.

North America is dominant in the market share 36% in 2025, as dental decay is a common chronic disease in children and adults in this region, which increases the demand for dental consumables. 64% of North American adults visited a dentist in each year, and around 46% adults have gum disease. More than 2.3 million Americans get dental implants yearly, which increases the need for advanced quality dental consumables products. North America spends over $124 billion yearly on dental care, which contributes to the growth of the market.

For Instance,

In the U.S., a growing aging population which are more vulnerable to dental diseases, which leads to the demand for dental consumables. More than 1 in 2 women who are pregnant are likely to prioritize dental visits (54%), as they believe it is as significant as scheduling their yearly physical care. Around 6 in 10 adults (64%) schedule regular check-ups to lower future dental challenges, an important rise from the previous year’s 57%. These proactive strategies support identifying potential risks early, avoiding more severe long-term problems.

Increasing anxiety of dental treatment in Canada, so about 24% of Canadians aged 12 and older avoided going to an oral health professional. Around 1 in 4 Canadians experience continuous dental pain because of eating various foods, oral healthcare diseases, and lost teeth, which increases the demand for dental consumables. The rising proportion of senior people, along with their significantly higher rates of dental diseases, contributes to the growth of the market.

Asia Pacific is the fastest-growing region in the dental consumables market in the forecast period, as the increasing prevalence of tooth caries of permanent teeth and periodontal diseases differs significantly in the various portions of Asia-Pacific. Increasing economic growth and growing healthcare spending. Also, rising incidences of dental challenges, maintained by government initiatives endorsing hygiene, development in technology, and the advancement of equipment, contribute to the growth of the market.

For Instance,

Research and development of dental consumables involves various processes, such as developing novel manufacturing techniques and digital technologies. Development of advanced biomaterials for preparing single-use dental consumables. Recent advances in minimally invasive procedures.

Key Players: Dentsply Sirona, Colgate Palmolive, Dr. Reddy's, Cipla, Anand Meproducts, and Prime Dental Products.

Clinical trials for dental consumables contain a various process which includes pre-clinical research, in vitro testing, and clinical trials to evaluate safety and efficacy. This research involves clinical trials associating treatment of tooth diseases; product quality and functioning, like the need for biomaterials in orthodontics, periodontics, endodontics, and pedodontics; oral hygiene materials and processes; and studies focusing on excellence of oral health care.

Key Players: Dentsply Sirona, 3M Company, Zimmer Biomet, Straumann Holding, Ivoclar Vivadent, and Coltene

Dental consumable distribution to hospitals and pharmacies is a multi-step process that includes storage, procurement, and delivery of vital dental supplies.

Key Players: Henry Schein and Patterson Companies, and specialized distributors like Darby Dental and Benco Dental

In June 2025, ZimVie CEO Vafa Jamali stated, “Digital dentistry is at the forefront of this shift, quickly establishing itself as the new standard in implantology. We have seen tremendous traction in other markets with RealGUIDE and Implant Concierge and are excited to expand into yet another growing and increasingly sophisticated market.”

By Product Category

By Material

By Procedure/Indication

By End User

By Distribution Channel

By Region

March 2026

March 2026

March 2026

March 2026