February 2026

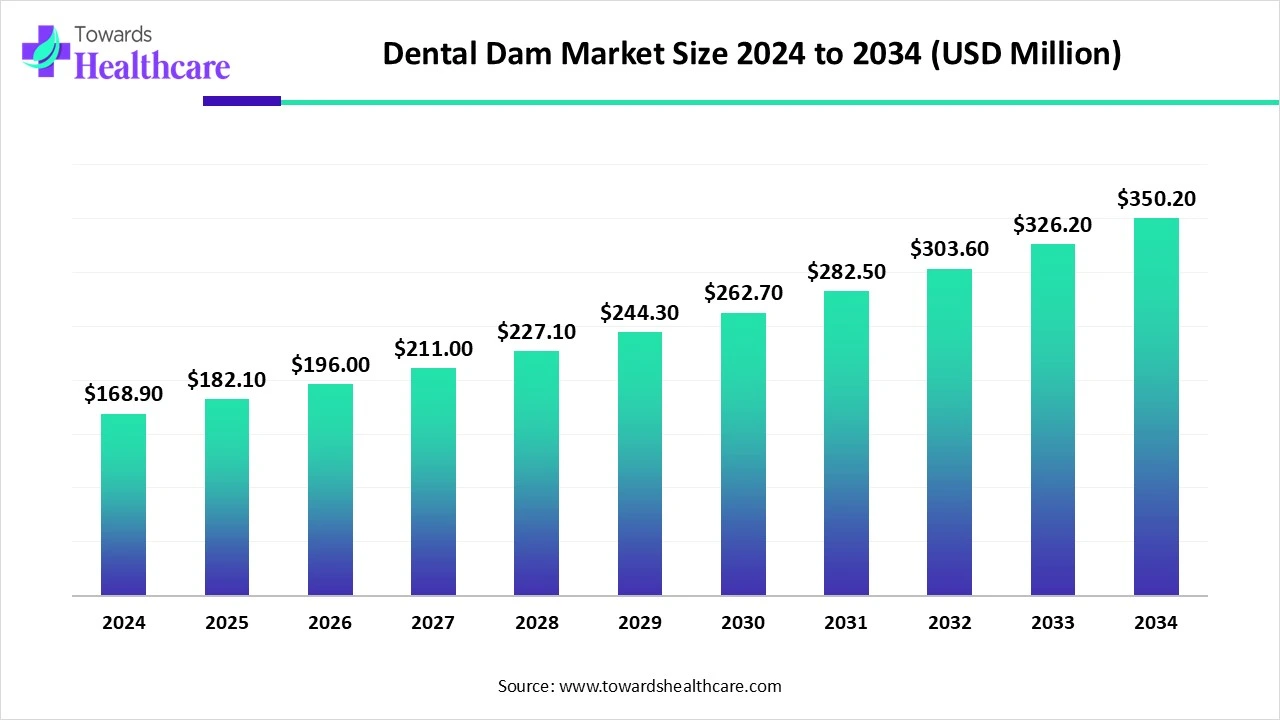

The global dental dam market size is calculated at USD 182.1 million in 2025, grew to USD 196.19 million in 2026, and is projected to reach around USD 383.78 million by 2035. The market is expanding at a CAGR of 7.74% between 2026 and 2035.

The dental dam market is witnessing steady growth, driven by rising demand for infection control, increasing prevalence of dental disorders, and advancements in material innovation, such as non-latex and eco-friendly options. North America remains the dominant region due to its advanced dental infrastructure, strict regulatory standards, and high awareness of oral hygiene practices. Strong insurance support, presence of leading manufacturers, and adoption in both private clinics and group practices further strengthen regional leadership, while global expansion continues through innovation and e-commerce channels.

| Table | Scope |

| Market Size in 2025 | USD 182.1 Million |

| Projected Market Size in 2035 | USD 383.78 Million |

| CAGR (2026 - 2035) | 7.74% |

| Leading Region | North America |

| Market Segmentation | By Product Form, By Material/Composition, By Application/Clinical use-case, By End-user/Buyer segment, By Distribution Channel, By Region |

| Top Key Players | Henry Schein, Patterson Dental, Dentsply Sirona, 3M Oral Care, Coltene, Envista Holdings / Kerr, Ultradent Products, Premier Dental, GC Corporation, VOCO GmbH, Young Innovations, TIDI Products, Medline Industries, Septodont |

A dental dam is a thin, flexible sheet made of latex or non-latex materials that is used in dentistry to isolate the treatment area in a patient’s mouth. It acts as a protective barrier, covering the teeth and gums while exposing only the tooth or section being treated. This prevents saliva and bacteria from contaminating the procedure site and protects patients from swallowing debris or dental materials. Dental dams are commonly used in restorative and endodontic treatments, such as fillings and root canals, to enhance infection control, improve visibility for dentists, and ensure safer, more efficient dental procedures.

In May 2025, Dentsply Sirona leveraged strategic acquisitions to expand its dental dam product line and strengthen intellectual property in barrier materials. High Point University, located in High Point, North Carolina, and Dentsply Sirona, the biggest multifaceted manufacturer of professional dental products and technologies, are pleased to announce a special dental education partnership that will revolutionize educational opportunities. High Point University's innovative educational model and Dentsply Sirona's state-of-the-art products, technologies, and services are combined to provide future dental professionals with cutting-edge skills and practical experience in a modern dental practice curriculum.

Dental service organizations and multi-clinic chains are standardizing procurement, leading to greater bulk usage and inclusion of dental in clinical protocols.

Dental dams are increasingly being adapted for compatibility with digital workflows involving intraoral scanners, imaging systems, and treatment-planning software.

AI integration can significantly improve the market by enhancing efficiency, personalization, and decision-making across the value chain. AI-powered design tools can help manufacturers develop improved dental dam materials, such as stronger, more flexible, and hypoallergenic variants, based on predictive modelling and patient data. In clinical settings, AI-enabled dental imaging and treatment planning systems can guide dentists on when and how to use dental dams most effectively, ensuring optimal infection control and patient outcomes. Additionally, AI-driven supply chain management and e-commerce platforms can streamline distribution, forecast demand, and ensure better product availability, ultimately driving market growth and innovation.

Supportive Regulations & Standards

Supportive regulations and standards play a pivotal role in accelerating the growth of the dental dam market, both by mandating safer clinical practices and by encouraging product innovation. In the United States, the FDA classifies non-latex dental dams as Class II medical devices, requiring manufacturers to submit 510(k) premarket notifications showing that their products are as safe and effective as existing options. This rigorous process raises the quality bar, ensuring widespread confidence in dental dam safety and performance. In the European Union, dental dam producers must comply with the Medical Device Regulation (MDR), which enforces clinical evaluations, robust quality management systems (ISO 13485), and post-market surveillance. This framework boosts consumer trust and opens new regional markets for compliant manufacturers.

In 2025, the ADA launched its Living Guideline Program, which ensures clinical practice recommendations remain current and evidence-based, making it easier for dentists to stay aligned with best practices, including dental dam application.

Patient Discomfort and Resistance & Lack of Awareness, and Training

The key players operating in the dental dam market are facing issues due to a lack of awareness and training & patient discomfort, which is estimated to restrict the growth of the market. Certain patients find dental dams uncomfortable, especially when placed for longer procedures. Issues such as gagging, difficulty breathing, or a sense of confinement can lead to patient resistance, discouraging dentists from using them routinely.

Growing Prevalence of Dental Disorders

The growing prevalence of dental disorders such as caries, periodontitis, and tooth loss serves as a powerful driver for the expansion of the dental dam market, especially by increasing procedural demand, emphasizing infection control, and raising overall awareness of dental safety.

In March 2025, according to the World Health Organization, oral diseases now affect nearly 3.7 billion people worldwide. Specifically, around 2 billion individuals suffer from caries in permanent teeth, and 514 million children are affected by caries in primary teeth. In the United States, the CDC highlights that by age 9, 50% of children have experienced cavities in primary or permanent teeth; additionally, 21% of adults aged 20–64 have at least one untreated cavity.

The sheet/flat dental dams segment dominated the market because they offer flexibility, cost-effectiveness, and broad applicability across a wide range of dental procedures, including endodontics, restorative, and cosmetic treatments. Their customizable size allows dentists to cut and adapt them according to patient needs, making them highly versatile. Additionally, flat sheets are easy to store, widely available in both latex and non-latex variants, and preferred in training and educational institutions, reinforcing their strong adoption and dominance in the market.

The pre-framed/pre-mounted dams segment is estimated to be the fastest-growing segment in the dental dam market due to their ease of use, time-saving application, and enhanced convenience for dental practitioners. Unlike traditional sheets, these dams come pre-stretched on frames, eliminating the need for additional setup and reducing chairside preparation time. This makes them particularly attractive in high-volume practices where efficiency is critical. Their growing adoption in pediatric and general dentistry, where quick application improves patient comfort and compliance, further accelerates their demand and drives rapid segment growth.

The natural rubber latex segment dominates the market because of its superior elasticity, strength, and ability to provide an effective seal during dental procedures. They are widely preferred for their durability, flexibility, and ease of manipulation, which allows dentists to isolate treatment areas efficiently. Additionally, latex dams are more cost-effective compared to non-latex alternatives, making them a practical choice for clinics in both developed and emerging regions. Their broad availability and long-standing clinical acceptance further reinforce their dominance in the market.

The nitrile segment is anticipated to be the fastest-growing segment in the dental dam market due to rising awareness of latex allergies, driving demand for safer, hypoallergenic alternatives. Nitrile dental dams provide excellent elasticity, tear resistance, and durability, making them suitable for complex procedures. Their chemical resistance and patient comfort further enhance adoption. Growing preference for eco-friendly, non-latex materials in developed markets, along with increasing availability in flavoured and pre-punched options, supports rapid uptake, positioning nitrile dental dams as the preferred modern alternative to latex.

The endodontics segment is the dominant segment in the market. This is because dental dams are considered the standard of care in root canal treatments, ensuring a sterile operating field, preventing contamination from saliva and bacteria, and enhancing patient safety. Professional associations like the American Association of Endodontists (AAE) mandate their use during endodontic procedures, making adoption nearly universal. While restorative dentistry also uses dental dams, their consistent and compulsory application in endodontics secures this segment’s dominance in the market.

The pediatric dentistry/behavior management segment is anticipated to be the fastest-growing segment in the dental dam market due to increasing focus on early oral care, rising prevalence of childhood caries, and growing awareness among parents about infection control. The availability of flavoured, colorful, and more flexible dental dams enhances comfort and compliance among children, making treatments less intimidating. Additionally, pediatric dental specialists are increasingly adopting dental dams to ensure safety and efficiency during restorative and preventive procedures, driving rapid growth in this segment within the market.

The dental clinics & solo practitioners segment is the dominant segment in the market. This dominance is due to the large number of independent dental practices globally, which make up the majority of dental service providers. These clinics routinely use dental dams in restorative and endodontic procedures to ensure infection control and patient safety. While dental chains and group practices are growing rapidly and adopting standardized protocols, the sheer volume and prevalence of solo and small clinics sustain their position as the dominant segment.

The retail/consumer segment is estimated to be the fastest-growing in the dental dam market due to increasing awareness of sexually transmitted infection (STI) prevention and rising demand for at-home sexual wellness products. Growing e-commerce penetration and discreet online purchasing options make dental dams more accessible to consumers. Educational campaigns promoting safe sexual practices, combined with product innovations like flavoured, pre-punched, and non-latex variants, further encourage adoption. Convenience, privacy, and increasing acceptance of sexual wellness products drive rapid growth in this segment.

The dental distributors/wholesalers segment is the dominant segment in the market because it serves as the primary channel connecting manufacturers with clinics, hospitals, and dental chains. Their established distribution networks ensure widespread availability of both latex and non-latex dental dams across regions. Bulk supply capabilities, strong relationships with dental practitioners, and the ability to offer a variety of product types, including flavoured, pre-punched, and eco-friendly options, enhance accessibility and convenience, reinforcing their dominant position in the market.

The e-commerce/online marketplaces segment is anticipated to be the fastest-growing in the dental dam market due to the increasing adoption of digital purchasing channels by both consumers and dental professionals. Online platforms offer convenience, bulk-ordering options, and discreet access, particularly for at-home sexual health use and professional clinics. Rapid growth in internet penetration, rising smartphone usage, and the expansion of reliable delivery services further support this trend. Additionally, online marketplaces provide easy access to a wider variety of products, including flavoured, pre-punched, and non-latex dental dams, accelerating adoption.

North America dominates the market due to its advanced dental infrastructure, strict regulatory standards, and high awareness of infection control practices. The region has a large base of skilled dental professionals and strong adoption of safety protocols in restorative and endodontic procedures. Supportive insurance coverage, continuous product innovations such as non-latex and eco-friendly variants, and the presence of leading manufacturers further strengthen the market. Additionally, professional guidelines, such as those from the ADA and AAE, mandate dental dam use, reinforcing regional leadership.

The U.S. stands as the principal driver of North America’s market, propelled by a robust healthcare infrastructure, high oral health awareness, and supportive reimbursement policies. Dental colleges and continuing education programs in the U.S. emphasize the use of dental dams, particularly in restorative and endodontic procedures, as a standard of care. Additionally, the region’s strong focus on patient safety and infection control has fostered widespread adoption among professionals, while favourable insurance coverage further encourages dentists to use higher-quality barrier tools like dental dams.

In Canada, while dental education is well-established with prominent institutions like the University of Toronto and UBC offering comprehensive programs, dental care is not generally included in publicly funded healthcare. According to a Statistics Canada survey, over one-third of Canadians reported not visiting a dentist in the past year, often due to cost or lack of insurance, highlighting access challenges. Though infection-control standards and clinical training likely encourage dental dam usage among professionals, reduced utilization is possible in underinsured or cost-sensitive populations.

Asia-Pacific is emerging as the fastest-growing region in the dental dam market, due to expanding dental infrastructure, rising oral health awareness, and increasing disposable incomes. Rapid growth in dental clinics, a surge in dental tourism, and higher demand for cosmetic and restorative procedures are fueling market expansion. Strong government initiatives, particularly in populous countries like China and India, further support adoption. This dynamic mix of improving healthcare access, evolving consumer preferences, and economic upliftment positions the region for accelerated dental dam usage.

For instance, in 2025, China’s Oral Health Action Plan (2019-2025) continued its rollout by funding widespread public workshops, dramatically enhancing oral hygiene awareness across urban and rural areas, boosting demand for infection-control tools like dental dams. Simultaneously, India’s National Oral Health Program advanced integration of oral care in primary services, prompting a sharp increase in preventive dental procedures that routinely require dental dam use.

R&D involves defining use cases (dental isolation or sexual health), selecting materials such as latex or polyurethane, prototyping, and performing bench tests for strength, leakage, and biocompatibility (ISO 10993).

Key Players: include manufacturers like Top Glove, dental suppliers such as Hu-Friedy, and accredited testing labs.

Clinical trial and approval steps begin with regulatory classification; in the U.S., the FDA requires a 510(k) pathway, supported by bench and biocompatibility data, usability studies, and clear instructions for use. In Europe, CE marking requires technical documentation reviewed by notified bodies. Organisations involved include the FDA, EU notified bodies, CROs, and regulatory consultants.

Patient support and service emphasize awareness, education, and safe usage through multilingual IFUs, demos, and outreach via NGOs like Planned Parenthood and CDC programs. Clinics, pharmacies, and e-commerce ensure accessibility, while customer service manages complaints and post-market surveillance.

In February 2025, Simon Campion, President and Chief Executive Officer of Dentsply Sirona, stated that the company had started the process of assessing strategic options for its Wellspect Healthcare division. As part of their recent transformation strategy, years, the Dentsply Sirona company made investments to fortify Wellspect’s base and set up the company for success in the future by giving top priority to product innovation and lucrative revenue growth, and capacity extension to satisfy projected increases in demand.

By Product Form

By Material/Composition

By Application/Clinical use-case

By End-user/Buyer segment

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026