January 2026

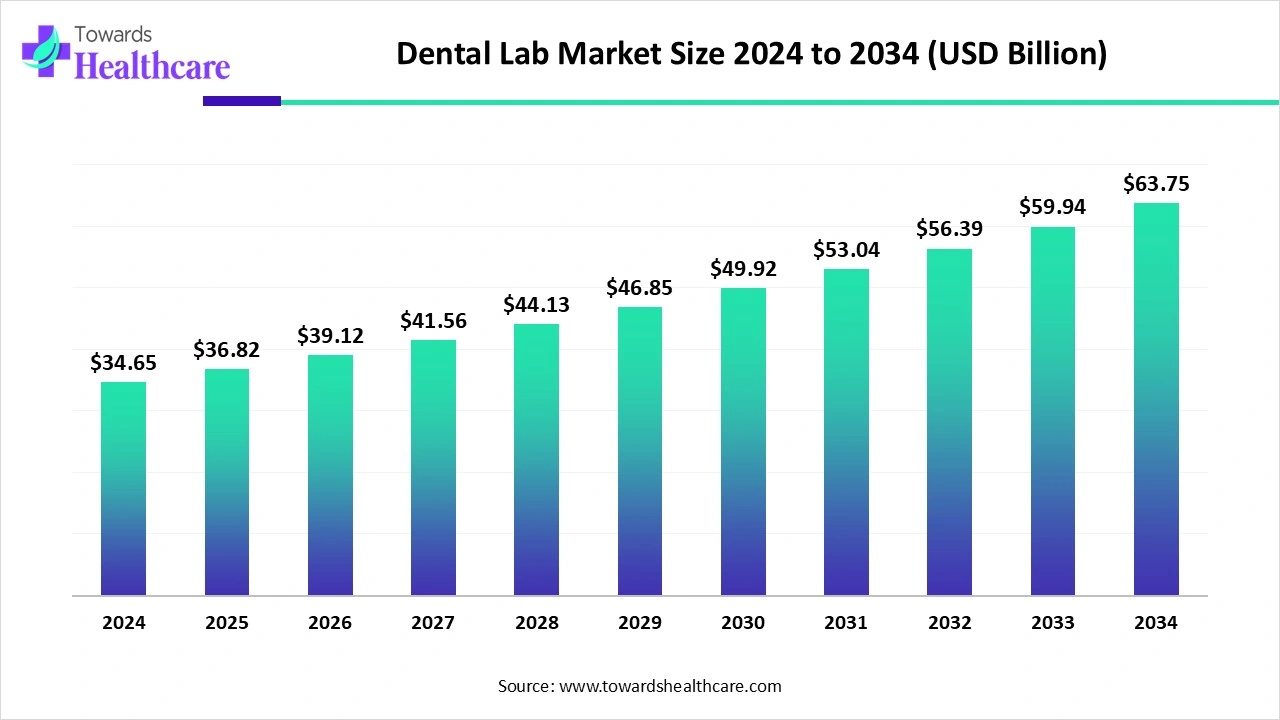

The global dental lab market size is calculated at US$ 34.65 billion in 2024, grew to US$ 36.82 billion in 2025, and is projected to reach around US$ 63.75 billion by 2034. The market is expanding at a CAGR of 6.26% between 2025 and 2034.

Oral treatments have been profoundly changed by the rapid advancements in dental laboratory technology, such as the use of hydroxyapatite coatings in implant materials and bone morphogenic proteins. Patients benefit from shorter chair times, quicker recovery times, and more pleasant experiences because to these developments. Furthermore, the implementation of advanced imaging methods like Computer-aided Design (CAD) and Computer-aided Manufacturing (CAM) has transformed the process of organising and carrying out complex oral surgeries. The exact 3D visualisation of dental implants, crowns, and bridges made possible by the use of these cutting-edge imaging technology improves overall treatment results and patient diagnosis accuracy.

| Table | Scope |

| Market Size in 2025 | USD 36.82 Billion |

| Projected Market Size in 2034 | USD 63.75 Billion |

| CAGR (2025 - 2034) | 6.26% |

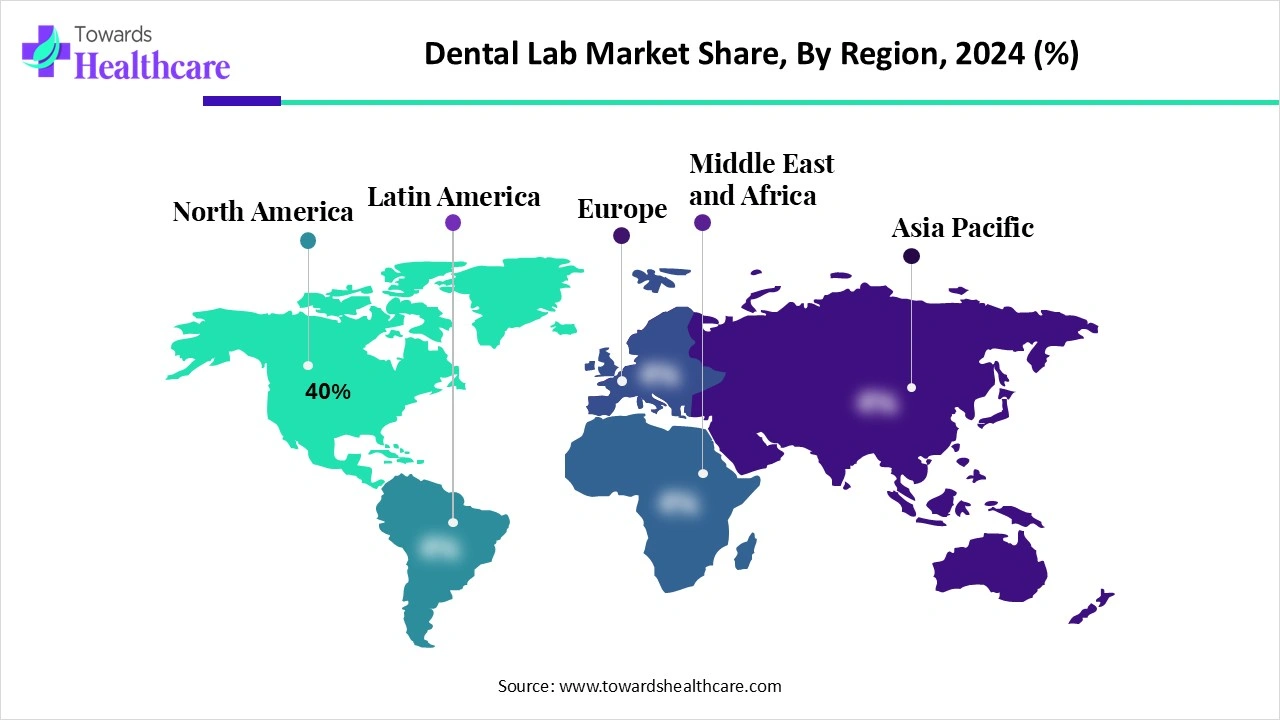

| Leading Region | North America 40% |

| Market Segmentation | By Product Type, By Material, By Technology, By Service Type, By End User, By Region |

| Top Key Players | Glidewell Dental, National Dentex Labs (NDX), Modern Dental Group, Aurum Group, Dental Services Group (DSG), Aspen Dental Labs, Knight Dental Group, MicroDental Laboratories, DTI Dental Technologies Inc., Shofu Dental, Dentsply Sirona (Lab Solutions), Ivoclar Vivadent (Lab Division), Kulzer GmbH, Straumann Group (Dental Lab Products), Argen Corporation, Dental Wings, VITA Zahnfabrik, Panthera Dental, Wieland Dental, Amann Girrbach |

The dental lab market encompasses laboratories that design, manufacture, and customize a wide range of dental prosthetics, restorative devices, and orthodontic appliances used in oral healthcare. These labs serve as the production backbone for dentists and clinics by fabricating crowns, bridges, dentures, veneers, aligners, and implants tailored to individual patient needs. With increasing demand for cosmetic dentistry, digital workflows, and advanced restorative materials, dental labs are adopting CAD/CAM systems, 3D printing, and milling technologies for precision and efficiency. Rising cases of tooth loss due to aging populations, periodontal disease, and accidents continue to drive demand. Furthermore, outsourcing to dental labs helps clinics reduce in-house infrastructure costs, fueling the growth of centralized and specialized dental laboratories worldwide.

Dental Initiatives by Government: Dental health is ignored by people, and hence, a lot of people face dental health issues in the long run. This is more prominent in developing and underdeveloped countries. To overcome these issues, various governments are taking initiatives to improve dental health among netizens.

For instance,

Artificial intelligence (AI) is becoming a potent tool for dental labs and clinics, and the field of dentistry is changing quickly. AI can improve diagnosis in dental offices by studying intraoral, CT, and X-ray data. By assessing patient data, it enhances therapy planning and produces individualised treatment plans. Additionally, it may use AI-powered chatbots to respond to patient enquiries on treatments, medications, and dental hygiene. AI can improve 3D printing procedures for dental restorations and design dental restorations including crowns, bridges, and dentures in dental labs.

Rise in Dental Insurance Coverage

Dental care is still mostly disregarded, despite the fact that oral health is an essential part of total wellbeing. The need for accessible and reasonably priced dental care is growing as dental conditions including cavities, gum disease, and oral cancer become more common. Insurers are being urged by the Insurance Regulatory and Development Authorities to increase coverage for outpatient dental operations, even in cases when hospitalisation is not necessary. Insurers are anticipated to launch more extensive dental insurance policies in the future due to rising customer demand and knowledge.

High Cost of Products & Services Restrains the Dental Lab Market

Zirconia and ceramic materials used in dentistry are becoming more and more expensive. Additionally, lab revenues are being severely impacted by increased energy, equipment, and rent expenses. Labs may experience financial issues as a result of rising pricing and costs, particularly small and startup businesses.

Cosmetic Dentistry will Drive the Dental Lab Market

There are many interesting developments in cosmetic dentistry that might improve the effectiveness, naturalness, and patient experience of treatments in the future. These developments are changing the way that dental aesthetics are thought of, from bioactive materials and regenerative dentistry to AI-driven smile designs and 3D-printed restorations. A new age of customised and durable cosmetic treatments is being ushered in by less invasive procedures, more intelligent whitening methods, and self-repairing dental materials.

By product type, the crowns segment accounted for the major revenue of the market in 2024. For many years, dental crowns have been a crucial component of restorative dentistry, providing answers for a variety of tooth problems. These multipurpose tools have seen tremendous advancements throughout time, altering smiles and restoring dental health with unmatched accuracy.

By product type, the dental implants segment is estimated to grow at the highest rate during the forecast period. For those who lose teeth as a result of illness or accidents, dental implants enhance their quality of life. In addition to expanding the spectrum of dental care, the ability to replace missing teeth with permanent implants has become essential to dental care worldwide.

By material, the zirconia segment captured the largest share of the dental lab market in 2024. In recent years, zirconia crowns have grown in popularity in the dental field. They are now regarded as a superior choice for dental restorations and aesthetic procedures by both patients and dental professionals. This is mostly because they offer a metal-free substitute with superior aesthetics, durability, biocompatibility, and tooth preservation.

By material, the all-ceramic segment is estimated to be the fastest-growing during the upcoming period. The usage of all-ceramic restoration has grown in the last several years. Patients' desire for good aesthetics, advancements in the mechanical and cosmetic qualities of the materials, the need for less invasive tooth preparation, and manufacturing techniques have all been cited as reasons for this rise.

By technology, the CAD/CAM segment was dominant in the dental lab market in 2024. Dental lab operations have evolved as a result of the Computer-Aided Design and Computer-Aided Manufacturing (CAD-CAM) revolution. From crowns and bridges to implant-supported restorations, this potent technology has made it possible to produce dental prosthesis more precisely and effectively.

By technology, the 3D printing/additive manufacturing segment is anticipated to grow at a rapid rate during the predicted period. Dental labs are being revolutionised by 3D printing because it provides previously unheard-of levels of integration, efficiency, and customisation. With advancements in biocompatible materials, enhanced accuracy, optimised processes, and the possibility of point-of-care manufacture, 3D printing in dental laboratories appears to have a bright future.

By service type, the full-service dental labs segment dominated the dental lab market in 2024. By using state-of-the-art techniques and technology, the dental lab offers restoration treatments and products to patients and dentists. Computer-aided design and manufacturing (CAD/CAM) laboratories, fixed departments, removable departments, implant divisions, and orthodontic treatments are all offered by full-service dental labs.

By service type, the orthodontic labs segment is anticipated to witness the fastest growth during 2025-2034. One important segment of the dental lab business, Orthodontic Dental Labs, creates orthodontic products for bite correction and tooth alignment, such as braces, retainers, and clear aligners. In these labs, dental technicians work alongside orthodontists to create specialised appliances for patients utilising advanced techniques and materials.

By end-user, the dental clinics segment led the dental lab market in 2024. Dental clinics provide a host of advantages that greatly enhance people's general health and wellbeing. With the use of cutting-edge technology and skilled personnel, they offer complete treatment via restorative, cosmetic, and preventative therapies. Frequent dental clinic visits can result in long-term financial savings, better aesthetics, and improved general health.

By end-user, the group dental practices segment is anticipated to grow at the highest rate during the forecast period. The financial risk of launching a new, independently owned dental office might be decreased by collaborating with other dentists. Additionally, because they have more resources, group dental offices are able to buy and run more than one practice.

North America dominated the market share 40% in 2024. In 2021, North America accounted for 35% of the whole market, the biggest share. A comprehensive and top-notch healthcare infrastructure is one of the reasons for this segment's growth. On the other hand, the rise in the each continent is driven by countless flows of wealth in research and development, strong public awareness about oral health, and comfortable per capita income.

In the US, tooth decay is the most prevalent chronic illness affecting both adults and children. The goals of Healthy individuals 2030 are to assist individuals access oral health care services and to reduce tooth decay and other oral health issues. More than 1,600 dental labs and dental technicians are represented by the National Association of Dental labs, a trade association comprising state and regional commercial dental laboratory associations. Dental laboratory sales in the U.S. are $6 billion, according to data from the Food and Drug Administration (FDA).

When it comes to the general oral health of its people, Canada ranks among the top countries in the world. One of the biggest social programmes in the nation, the Canadian Dental Care Plan (CDCP), is anticipated to lower dental care costs for up to 9 million Canadians.

Asia Pacific is estimated to host the fastest-growing dental lab market during the forecast period. greater knowledge of oral health and an increase in dental visits. The market in this category is also driven by a number of variables, including a growing economy, an ageing population, rising disposable income, rising oral health awareness among the populace, enormous unrealised potential, and fast expanding trends in the health care system.

The 28th International Exhibition on Dental Equipment, Technology, and Products, or DenTech China 2025, will be held in the Shanghai World Expo Exhibition and Convention Centre from October 23 to October 26, 2025. For dental professionals, manufacturers, and distributors, this premier event provides an essential forum for examining the newest advancements in dental technology and equipment. DenTech China, China's first dental trade show, has been a mainstay of the dentistry sector since its launch in 1994. A wide range of people attend the show, including foreign distributors, traders, and purchasers looking for affordable, high-quality dental equipment and goods made in China and the Asia-Pacific area.

In October 2024, the Prime Minister officially opened the National Level Research and Referral Institute for Dental Sciences (NaRRIDS), a state-of-the-art institute for basic and translational research at AIIMS, New Delhi. In order to provide advanced training, NaRRIDS aims to become one of India's leading institutions for dental research and teaching.

Europe is estimated to grow at a significant CAGR in the dental lab market during the forecast period. More oral health programmes are being run in different areas. The goals of these community-based oral health initiatives are to raise awareness, assist in providing preventative care, and improve patient education on dental hygiene.

Despite being nearly completely avoidable, poor oral health is the leading cause of hospitalisation for children between the ages of 5 and 9, with the NHS spending £40 million a year on the 31,000 tooth extraction episodes caused by tooth decay in young people.

In March 2025, according to Ahn Young-hyun, Senior Analyst at Murex Partners, one of the new investors in this round, there haven't been many chances to introduce Korea's superior dental laboratory goods to the international market, even if digital dentistry is expanding quickly. By developing a cutting-edge prosthetics request and supply solution for dental professionals globally, Innovaid has swiftly acquired a sizable number of international clients. We identified a tempting investment opportunity because of its great growth potential.

By Product Type

By Material

By Technology

By Service Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026