January 2026

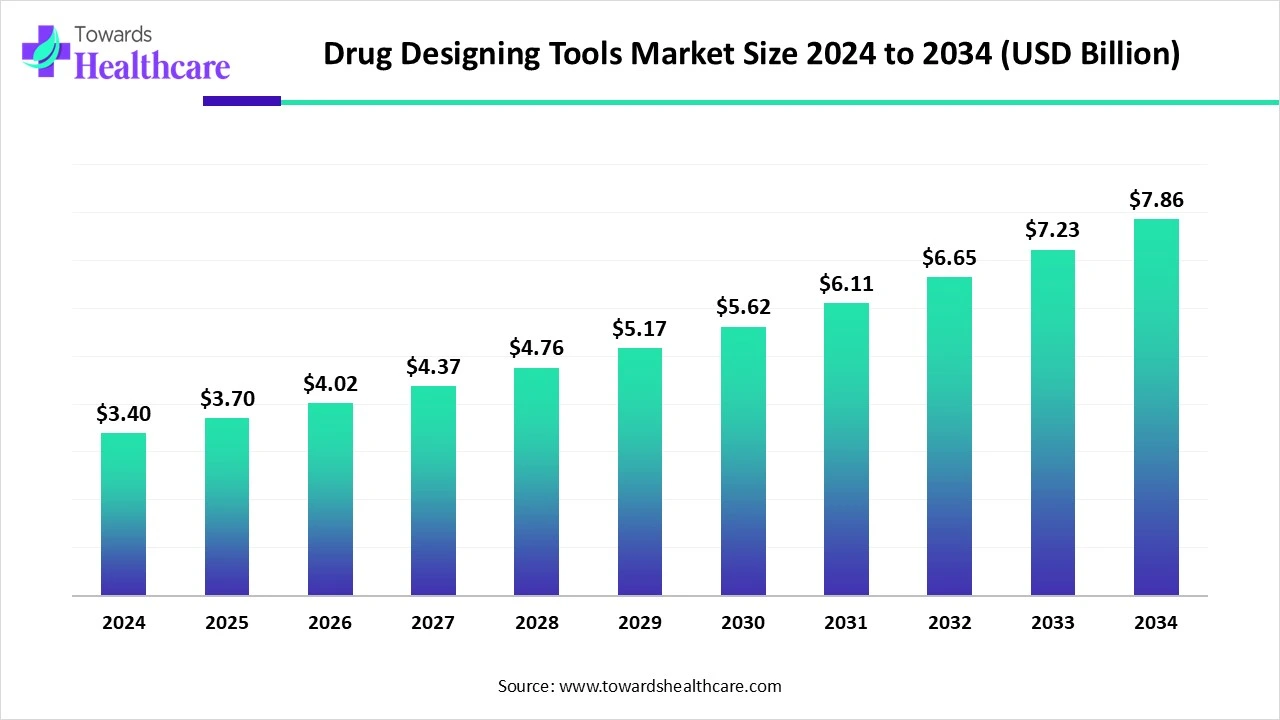

The global drug designing tools market size is calculated at US$ 3.4 in 2024, grew to US$ 3.7 billion in 2025, and is projected to reach around US$ 7.86 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

The drug designing tools market is rapidly expanding because of its increasing demand for rapid and affordable drug development. These tools are used by pharmaceutical companies and major research institutes to identify drug target interactions. North America is dominant in the market due to the presence of advanced healthcare infrastructure and increasing government funding. Asia Pacific is fastest fastest-growing segment due to the presence of major key players and advancement in recent drug development technology.

| Metric | Details |

| Market Size in 2025 | USD 3.7 Billion |

| Projected Market Size in 2034 | USD 7.86 Billion |

| CAGR (2025 - 2034) | 8.73% |

| Leading Region | North America |

| Market Segmentation | By Solution, By Application, By End User, By Region |

| Top Key Players | ChemAxon, Albany Molecular Research Inc., OpenEye Scientific Software Inc., XtalPi Inc., Novo Informatics, PerkinElmer |

The drug designing tools market is rapidly growing because the creative process of developing new drugs is based on an understanding related to biological targets. Designing specific molecules that are complementary in shape and charge to the molecular target with which they interact and bind is a major aspect of drug development. Structure-based drug design and ligand-based drug design it is the main types of drug designing. There are many tools are used to drug designing such as computational tools, which include molecular docking, virtual screening, 3D molecular modelling, ADMET prediction, and homology modelling and experimental tools, such as high-throughput screening (HTS), X-ray crystallography and nuclear magnetic resonance (NMR), bioinformatics databases, and pharmacogenomics.

AI integration in drug-designing tools is driving the growth of the market as AI-based software accelerates the drug-designing method by streamlining the entire drug discovery process. Modern leveraging generative AI and advanced CADD strategies integrates ligand-based and structure-based approaches into a single, simple-to-handle platform. AI-based tools, such as XenoSite, FAME, and SMARTCyp, are involved in identifying the sites of metabolism of the drug. The selection of AI-driven tools based on the particular application significantly impacts the results. Machine learning, deep learning, and AI graph-based tools are generally used for drug repurposing, while generative models and reinforcement learning are appropriate for de novo drug design. AI-driven technology enhances the drug design process by improving the efficacy and accuracy of predicting drug behaviour, properties, and interactions.

For Instance,

Increasing Drug Discovery

Drug discovery design is an innovative process where drug molecules are constructed from the ground up using computational techniques. This approach eliminates the traditional trial-and-error screening method. Instead, drug design concentrates on small molecular fragments that bind to a target site, which are then combined to form an effective drug. This method is commonly employed in developing treatments for cancer and neurodegenerative diseases. In bioinformatics, drug design involves utilizing computational techniques and bioinformatics tools to create new drugs. It combines various fields such as biology, chemistry, and computer science to forecast how potential drug molecules will interact with target proteins. This approach accelerates drug discovery and significantly lowers costs, contributing to the growth of the drug design market.

High Expenses of Drug Designing Tools

A single design project often involves multiple research sites, sophisticated research tools, and comprehensive data management systems. The high costs associated with drug development pose challenges for an industry under pressure to reduce expenses. These costs hinder the progression of innovative ideas and the development of new cures, ultimately constraining market growth.

Recent Advancements in Lead Optimization Technology

Lead compounds are the initial molecules showing potential, which drug designing tools help refine into effective medications. Every step in the process brings us closer to drugs that are not only effective but also precise in targeting. The main aim of hit-to-lead and lead optimization is to find candidate drugs that balance potency, target specificity, pharmacokinetics, and safety. This enhances the chances of success during clinical development and creates opportunities in the drug designing tools market.

By solution, the multi-database segment dominated in the Drug Designing Tools Market in 2024, as by utilizing these databases, scientists access large-scale, high-quality data on drug-like properties, chemical structures, and bioactivity. These databases offer a huge data on bioactive molecules, their properties, and their interactions with different targets, which is leveraged to find potential drug candidates and enhance their development. By utilizing these databases, researchers lower the time and expenses associated with experimental approaches.

The virtual screening tools segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as virtual screening has no limitation of sample like experimental screening and is often used as an alternate complement in high-throughput screening. Through the application of computational programs, virtual screening quickly tests a large number of compounds and natural products at a minimum cost. Virtual screening (VS) has emerged in drug design as a significant computational approach to screen libraries of small molecules for new hits with desired characteristics that can then be tested experimentally.

By application, the chemical screening segment is dominant in the drug designing tools market in 2024, as drug designing for chemical screening includes identifying, designing, and optimizing potential drug candidates by different experimental and computational methods.

The molecular modeling/ homology modeling segment is expected to fastest-growing over the forecast period 2025 to 2035 as molecular modeling is the process to determine the overall structure of an unidentified molecule, be it a small or a macromolecule. This technique encompasses the processes of screening ligand libraries for the development of novel candidate drug molecules.

By end user, the pharmaceutical company’s segment is dominant in the drug designing tools market in 2024, as drug design is the creative process of finding novel medications based on the knowledge of a biological target in the pharmaceutical industry. Drug design involves the design of molecules that are complementary in shape and charge to the molecular target with which they bind and interact, which addresses the major challenges in pharmaceutical companies.

The biotechnology companies segment is estimated to fastest-growing over the forecast period 2025 to 2035, as biotechnological models are a significant approach to drug designing tools. Researchers have recently been using advanced biotechnology models to discover novel drugs and design solutions for various diseases.

North America is dominant in the drug design tools market with the largest revenue share, as the United States maintains a predominant share of the global pharmaceutical sector. This region is home to major pharmaceutical companies worldwide, and North American consumers have increased access to the most recent pharmaceutical products, which increases the need for drug design tools. The North American healthcare system has invested significant resources in medical research and pharmaceutical development, which has led to progressive discoveries and enhanced treatments in various fields. For Instance, in 2024, the NIH invests more than $48 billion budget in medical research for the North American people, all these factors contribute to the growth of the market.

For Instance,

In the U.S., early adoption of advanced healthcare technology, such as machine learning, AI, and cloud computing, which helps in drug development and allows for real-time health monitoring, improves early diagnosis, and enables healthcare providers to offer more proactive care. Increasing numbers of new drug approvals in the U.S. help the rapid commercialization of drug design output. For Instance, in 2023, 55 new drugs were approved by the U.S. Food and Drug Administration (FDA), and in 2024, a total of 50 new drugs received approval from the FDA.

In Canada, growing government spending on healthcare services and advanced technology helps the adoption of drug-designing tools. For Instance, Total medical care spending in Canada is expected to reach $372 billion in 2024, or $9,054 per Canadian. Increasing cases of chronic diseases, half (45.1%) of all Canadians live with at least one major chronic disease. This is growing the adoption of personalized medicines, advanced drug discovery platforms, and cell and gene therapy, which increases the demand for drug discovery tools.

The Asia Pacific region is projected to experience the fastest growth in the drug designing tools market during the forecast period, due to the APAC biopharmaceutical industry developing rapidly, driven by strong government initiatives, regulatory reforms, and increasing collaboration of pharmaceutical research and institutes, which is driving the growth of the market. The Asia-Pacific (APAC) region is emerging as a leader in AI-based drug design, driven by robust research ecosystems and strong industry partnerships. Increasing cutting-edge technologies are optimising drug development efficiency, which contributes to the growth of the market.

The Chinese government is increasing its support for biotech, spending huge amounts of money to drive major innovation in the medical sector. Also, major factors are increasing growth of the market, including subsidies, healthcare start-ups, science parks, financial incentives, talent recruitment schemes, public-private collaboration, and improvements to expedite drug discovery processes and improve IP protection, which contributes to the growth of the market.

In India, there continues to be progress in infrastructure development, technology-based creation, and a broad range of pharmaceutical products. The advancing pharmaceutical industry made an important contribution to the growth of the market. Increasing burden of disease with rising rates of cancer, diabetes, and infectious diseases, which increases the requirement for novel and effective drugs, and increases the demand for drug design tools.

Europe is expected to grow significantly in the drug designing tools market during the forecast period, as the European pharmaceutical sector is increasing healthcare expenditures on the continent. As major countries of the EU invest in their medical systems, there is an increasing demand for pharmaceutical services and products, which drives the market growth. Also, Europe has the highest proportion of aging citizens, and with age comes an increased requirement for healthcare services. This demographic shift has led to an increase in demand for medical care products that cater to the particular needs of older patients, like medications for chronic diseases and age-related conditions, which increases the demand for drug design tools.

In Germany, the medical care industry has recently increased investment in advanced technology, driven by government support and funding. Germany is a leader in pharmaceutical R&D, with substantial funding and innovation in the field. In 2022, major companies of Germany invested €9.6 billion in R&D. As of 2023, Germany's pharmaceutical industry is valued at €59.8 billion, reflecting a 5.7% growth from the previous year. These factors all contribute to the growth of the market.

In April 2025, Kevin Willoe, president of Revvity Signals Software, “Revvity signals software unveils unified data platform to accelerate drug discovery. With the Signals One platform, we are striving to support scientists across every step of the R&D lifecycle.” (Source - News)

By Solution

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026