January 2026

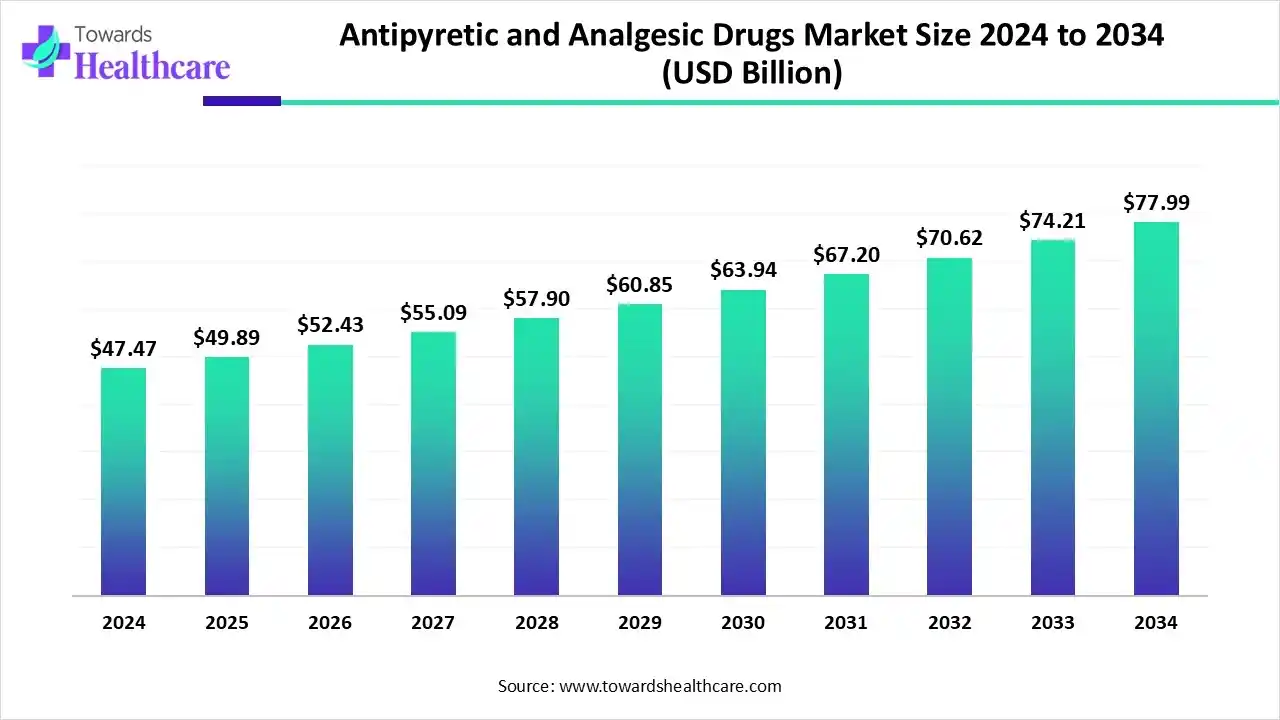

The antipyretic and analgesic drugs market size stood at US$ 47.47 billion in 2024, grew to US$ 49.89 billion in 2025, and is forecast to reach US$ 77.99 billion by 2034, expanding at a CAGR of 5.09% from 2025 to 2034.

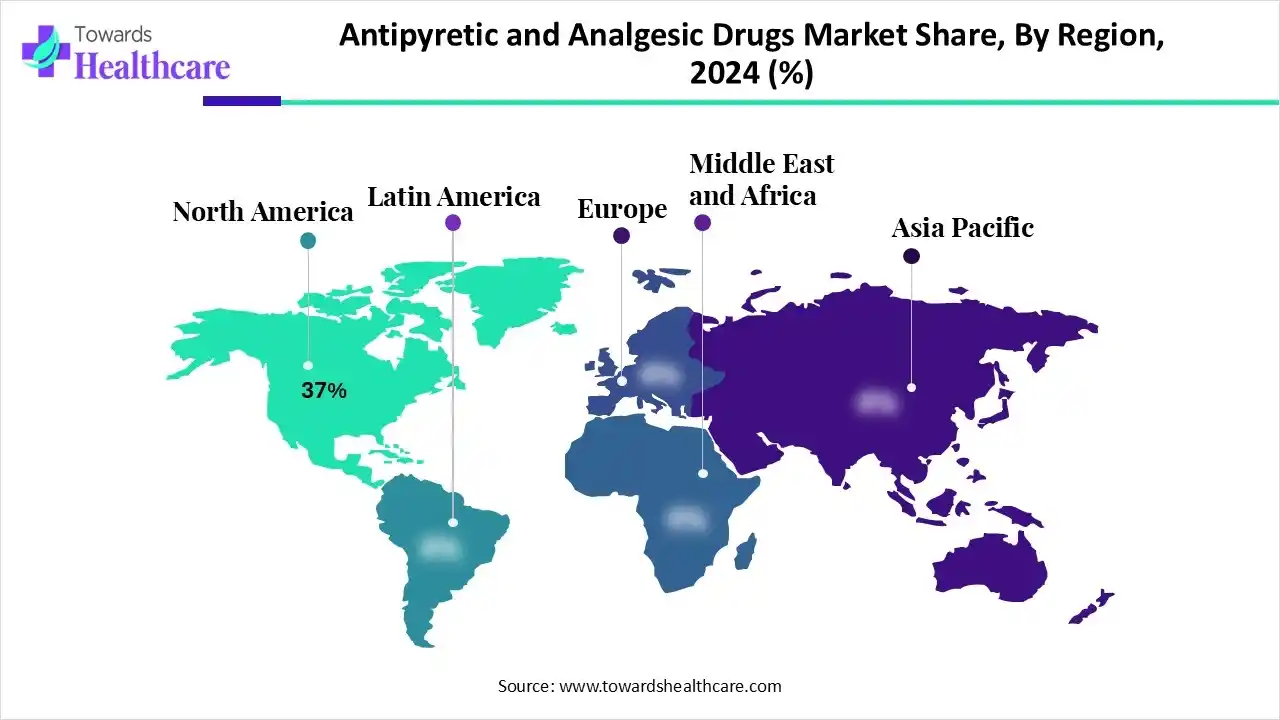

The antipyretic and analgesic drugs market is experiencing steady growth due to the increasing prevalence of fever, pain, and inflammation-related conditions. North America dominated the market, supported by advanced healthcare infrastructure, strong pharmaceutical presence, and high consumer awareness of pain management. The region’s robust R&D activities, extensive availability of OTC medications, and growing geriatric population further contribute to its leadership. Continuous product innovations and increased emphasis on effective, safe, and fast-acting formulations are driving overall market expansion.

| Table | Scope |

| Market Size in 2025 | USD 49.89 Billion |

| Projected Market Size in 2034 | USD 77.99 Billion |

| CAGR (2025 - 2034) | 5.09% |

| Leading Region | North America by 37% |

| Market Segmentation | By Drug Type, By Mechanism of Action, By Route of Administration, By Indication, By End User, By Region |

| Top Key Players | Pfizer Inc., Johnson & Johnson (McNeil Consumer Healthcare), GlaxoSmithKline plc, Novartis AG, Sanofi S.A., Bayer AG, Boehringer Ingelheim GmbH, Reckitt Benckiser Group plc, AbbVie Inc., Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Ltd., Takeda Pharmaceutical Company Ltd., Bristol Myers Squibb Company, Dr. Reddy’s Laboratories Ltd., Lupin Limited, Mylan N.V. (Viatris Inc.), Aurobindo Pharma Ltd., Glenmark Pharmaceuticals Ltd. |

The antipyretic and analgesic drugs market is driven by rising cases of fever, pain, and inflammation-related disorders, coupled with growing demand for fast-acting and over-the-counter medications. Antipyretic and analgesic drugs are pharmaceutical agents used to reduce fever and alleviate pain without causing loss of consciousness. Antipyretics act on the hypothalamus to lower body temperature, while analgesics block pain signals in the nervous system. These drugs are widely used to manage conditions such as headaches, arthritis, muscle pain, and flu symptoms.

Rising Preference for Non-Opioid Pain Relievers:

Increasing concerns over opioid addiction are shifting demand toward non-opioid analgesics such as acetaminophen and NSAIDs, which provide effective pain relief with fewer side effects and lower dependency risks.

Advancements in Drug Formulation Technologies:

Pharmaceutical companies are developing extended-release, rapid-action, and combination formulations that offer faster onset, prolonged pain relief, and enhanced patient compliance through innovative delivery systems such as gels, patches, and capsules.

Increased Focus on Natural and Herbal Alternatives:

Rising consumer inclination toward natural and plant-based ingredients is boosting demand for herbal pain relief products, promoting cleaner labels and fewer adverse effects compared to synthetic drugs.

Growing R&D Investment in Safer Analgesics:

Companies are investing heavily in research to discover next-generation analgesics that minimize gastrointestinal and cardiovascular risks while maintaining strong efficacy, ensuring long-term patient safety and regulatory compliance.

Advancements in antipyretic and analgesic drug injectables focus on improving drug stability, bioavailability, and rapid onset of action. Pharmaceutical companies are developing novel formulations with targeted delivery, reduced side effects, and enhanced patient safety. Innovations such as prefilled syringes and combination injectables are increasing treatment efficiency, supporting better pain and fever management in clinical settings.

Recent advancements in antipyretic and analgesic drugs include the development of non-opioid formulations, nanotechnology-based delivery systems, and combination therapies for faster and longer-lasting relief. Research focuses on minimizing side effects, enhancing absorption, and improving drug targeting. Innovations such as transdermal patches, dissolvable tablets, and precision pain management solutions are reshaping treatment effectiveness and patient compliance.

The nonsteroidal anti-inflammatory drugs (NSAIDs) segment dominates the market with a share of approximately 41% due to their wide therapeutic applications in treating pain, fever, and inflammation. Their proven efficacy, easy availability as over-the-counter products, cost-effectiveness, and lower risk of dependency compared to opioids further strengthen their dominance across global healthcare markets.

The combination drugs segment is estimated to be the fastest-growing segment in the market due to its enhanced therapeutic effectiveness and convenience. These formulations provide simultaneous relief from multiple symptoms such as pain, fever, and inflammation. Rising patient preference for single-dose, multi-action medications and continuous innovations in fixed-dose combinations further accelerate the segment’s expansion globally.

The cyclooxygenase (COX) inhibitors segment dominates the market with a share of approximately 46% due to its proven efficacy in reducing pain, inflammation, and fever. Wide therapeutic applications, availability as OTC products, and well-established safety profiles contribute to its leading market position.

The serotonin and norepinephrine reuptake modulators (SNRIs) segment is anticipated to be the fastest-growing in the market due to their effectiveness in managing chronic pain, neuropathic conditions, and depression-related pain, supported by increasing clinical adoption and ongoing formulation innovations.

The oral segment dominates the market with a share of approximately 58% due to its convenience, ease of administration, and patient compliance. Wide availability of tablets, capsules, and syrups, coupled with cost-effectiveness and suitability for both prescription and over-the-counter use, makes oral administration the preferred route globally.

The injectable segment is the fastest-growing in the market due to its rapid onset of action, precise dosing, and suitability for hospital and emergency settings. Increasing demand for intravenous and intramuscular formulations for acute pain and fever management drives their accelerated adoption globally.

The musculoskeletal pain segment dominates the market with a share of approximately 32% due to the high prevalence of musculoskeletal disorders, sports injuries, and age-related joint conditions, driving consistent demand for effective pain relief medications worldwide.

The fever management segment is the fastest-growing in the market due to the rising prevalence of infectious diseases, seasonal flu, and pediatric fever cases. Increasing awareness of timely fever treatment, availability of rapid-acting formulations, and preference for over-the-counter medications further drive market growth.

The hospitals & clinics segment dominates the market share of approximately 36% due to the high volume of acute and chronic pain cases treated in these settings. Availability of diverse formulations, professional medical supervision, and preference for injectable and prescription drugs contribute to the segment’s leading position globally.

The online pharmacies segment is estimated to be the fastest-growing in the market due to increasing consumer preference for convenient, home-delivered medications. Ease of access, competitive pricing, digital health platforms, and growing awareness of self-medication drive adoption. Additionally, expanding internet penetration and the rise of e-commerce in healthcare further accelerate growth globally.

North America dominates the antipyretic and analgesic drugs market with a revenue of approximately 37% in 2024 due to advanced healthcare infrastructure, strong presence of leading pharmaceutical companies, and high consumer awareness regarding pain and fever management. The region also benefits from widespread availability of over-the-counter and prescription medications, robust R&D activities, and favorable reimbursement policies. The increasing prevalence of migraine, affecting a significant portion of the population, has particularly driven demand for effective analgesics, supporting the rapid adoption of novel formulations and combination therapies to manage chronic and acute pain conditions efficiently.

For instance,

The U.S. antipyretic and analgesic drugs market is experiencing notable growth, driven by several key trends. The increasing prevalence of chronic pain conditions, such as musculoskeletal disorders and neuropathic pain, is contributing to a higher demand for effective pain management solutions. Additionally, the rising adoption of over-the-counter (OTC) medications reflects a shift towards self-medication, offering consumers convenient access to pain relief options.

Advancements in drug formulations, including the development of non-opioid analgesics, are addressing concerns related to opioid use and expanding treatment alternatives. Furthermore, the integration of digital health technologies is enhancing pain management strategies, allowing for more personalized and efficient care. These factors collectively indicate a dynamic and evolving landscape in the U.S. antipyretic and analgesic drugs market.

The Asia-Pacific region is the fastest-growing in the antipyretic and analgesic drugs market due to rising healthcare awareness, expanding medical infrastructure, and increasing prevalence of pain and fever-related disorders. Growing urbanization, rising disposable incomes, and improved access to both prescription and over-the-counter medications further accelerate market adoption across the region.

In China, increasing awareness and education on post-operative and cancer pain, expanding healthcare infrastructure, and improving access to advanced analgesics are driving market growth. Supportive regulatory policies, insurance coverage, and digital health platforms enhance treatment accessibility and adherence, while public health campaigns encourage timely pain management, collectively boosting the market.

India's antipyretic and analgesic drugs market is experiencing significant growth, driven by increasing consumer demand for over-the-counter (OTC) pain relief solutions. The market is projected to reach ₹16,000 crore, with approximately five new brands launching every week, indicating a competitive and expanding landscape. This surge is fueled by rising awareness of self-medication, the prevalence of chronic pain conditions, and the growing preference for convenient, accessible treatment options. Additionally, the wellness segment is gaining traction, with companies leveraging sports partnerships to enhance brand visibility and consumer trust.

Europe presents significant growth opportunities in the antipyretic and analgesic drugs market due to the rising prevalence of chronic pain, musculoskeletal disorders, and migraine. Well-established healthcare infrastructure, high consumer awareness, and strong regulatory support encourage the adoption of both prescription and over-the-counter medications. Additionally, increasing R&D investments and innovations in non-opioid and combination therapies further drive market expansion across the region.

The U. K. market is driven by the rising prevalence of chronic pain, musculoskeletal disorders, and fever-related conditions. High consumer awareness, widespread availability of over-the-counter and prescription medications, strong healthcare infrastructure, and ongoing advancements in non-opioid and combination therapies further support market growth across the country.

R&D begins with target identification, molecule screening, and preclinical testing to evaluate efficacy and safety.

Organizations: Pharmaceutical organizations such as Pfizer, Johnson & Johnson, and Novartis conduct extensive laboratory research, formulation development, and optimization to create innovative analgesic and antipyretic therapies.

Promising compounds advance to phased clinical trials (Phase I–III) conducted in collaboration with hospitals, research institutions, and CROs like ICON and IQVIA.

Organizations: Regulatory authorities such as the FDA (U.S.), EMA (Europe), and CDSCO (India) review trial data for safety, efficacy, and quality before granting approval for commercial use.

Post-approval, organizations implement patient education, adherence programs, and digital health solutions to enhance drug utilization.

Organizations: Companies such as GlaxoSmithKline and Bayer provide helplines, mobile applications, and counseling services, ensuring proper administration, monitoring adverse effects, and promoting effective pain and fever management.

Johnson & Johnson

Bayer AG

GlaxoSmithKline (GSK)

Pfizer Inc.

Novartis AG

Teva Pharmaceutical Industries Ltd.

Reckitt Benckiser Group plc

By Drug Type

By Mechanism of Action

By Route of Administration

By Indication

By End User

By Region

January 2026

January 2026

January 2026

January 2026