January 2026

The global targeted drugs for allergic diseases market size is calculated at US$ 13.96 billion in 2024, grew to US$ 15.08 billion in 2025, and is projected to reach around US$ 30.22 billion by 2034. The market is expanding at a CAGR of 8.06% between 2025 and 2034.

Due to the growing incidence of allergic disorders such as atopic dermatitis, asthma, and chronic sinusitis, as well as the growing need for efficient and focused treatments, the global targeted drugs for allergic diseases market is expanding rapidly. Numerous causes are driving this increase, including improvements in drug discovery that result in more effective and focused treatments, rising healthcare costs worldwide, and patients' greater knowledge of the medicines that are available.

| Table | Scope |

| Market Size in 2025 | USD 15.08 Billion |

| Projected Market Size in 2034 | USD 30.22 Billion |

| CAGR (2025 - 2034) | 8.06% |

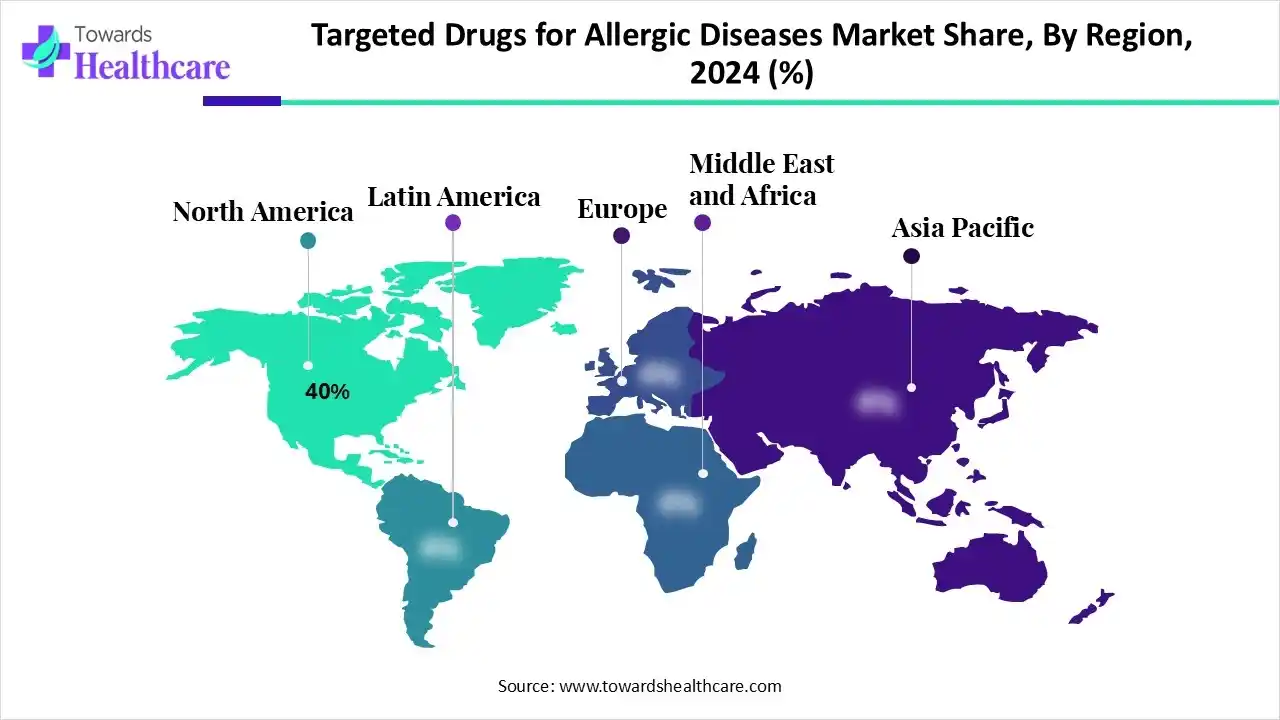

| Leading Region | North America by 40% |

| Market Segmentation | By Drug Class/Type, By Indication, By Mechanism of Action, By Route of Administration, By End User, By Region |

| Top Key Players | Sanofi S.A., Regeneron Pharmaceuticals Inc., AstraZeneca plc, Novartis AG, GlaxoSmithKline plc, Amgen Inc., Eli Lilly and Company, AbbVie Inc., Roche/Genentech, Johnson & Johnson, Kyowa Kirin Co. Ltd., Chugai Pharmaceutical Co. Ltd., ALK-Abelló A/S, Amgen–AstraZeneca Alliance, Takeda Pharmaceutical Co. Ltd., Biogen Inc., Glenmark Pharmaceuticals, Hanmi Pharmaceutical Co. Ltd., Suzhou Connect Biopharma |

The growth of targeted drugs for allergic diseases market is driven by rising allergy prevalence, advances in biologics and precision medicine, expanding indications for monoclonal antibodies, and a shift from symptomatic treatments to long-term immunomodulation and disease control.

The market encompasses the development, production, and commercialization of biologics, monoclonal antibodies, small molecules, and novel immunomodulators designed to specifically target pathways involved in allergic diseases such as asthma, atopic dermatitis, allergic rhinitis, chronic rhinosinusitis with nasal polyps (CRSwNP), and food allergies. These therapies primarily act on cytokines, immunoglobulin E (IgE), and interleukin pathways (e.g., IL-4, IL-5, IL-13, IL-31) to modulate immune response and inflammation.

In recent years, allergic diseases have become much more common. It affects 40% of the population. About 400 million people worldwide suffer from allergic rhinitis, 300 million from asthma, 10–20% of children have atopic dermatitis, and 4–10% have food allergies. These conditions put a tremendous strain on humankind's mental and financial well-being.

Artificial intelligence (AI) is likely to promote the growth of the targeted drugs for allergic diseases market, which is altering clinical allergy practice by enhancing diagnostic accuracy, personalizing therapy, and speeding healthcare delivery. AI-powered technologies, comprising clinical decision support systems (CDSS), natural language processing (NLP), and conversational agents, are being introduced into allergy services, promising gains in documentation, risk assessment, and remote patient engagement.

By drug class/type, the monoclonal antibodies segment was dominant in the targeted drugs for allergic diseases market with a revenue of approximately 48% in 2024. Monoclonal antibody therapy has advanced significantly during the past 20 years in treating a wide range of illnesses, including allergic disorders. This progress has been made possible by the ongoing expansion of knowledge on the cellular and molecular mechanisms behind the allergic cascade, which has made it possible to pinpoint precise targets for treatment.

By drug class/type, the anti-IgE and anti-IL biologics segment is estimated to grow at the fastest CAGR during 2025-2034. Because biological treatments target certain immunological components implicated in the pathophysiology of these chronic disorders, they constitute a paradigm change in the treatment of allergic diseases. The most promising biologics for CIU at the moment are anti-IgE, anti-IL-4/13, and anti-IL-1 treatments.

By indication, the asthma segment was dominant in the targeted drugs for allergic diseases market with a revenue of approximately 40% in 2024. According to estimates, asthma affects 358 million people globally, making it the most prevalent respiratory condition. Children aged 5 to 9 years had the highest frequency of asthma (21.231 million males and 16.057 million females).

By indication, the atopic dermatitis segment is estimated to grow at the fastest CAGR during 2025-2034. In terms of disability-adjusted life years (DALYs), atopic dermatitis ranks first among all skin diseases worldwide and 15th among non-fatal diseases. An estimated 204 million individuals worldwide suffer from atopic dermatitis (AD), a very common noncommunicable disease.

By mechanism of action, the anti-IgE pathway inhibitors segment was dominant in the targeted drugs for allergic diseases market with a revenue of approximately 24% in 2024. Monoclonal antibodies that target IgE, like omalizumab, have been shown to be highly effective in lowering the need for systemic corticosteroids in cases of severe allergic asthma, reducing asthma exacerbations, and improving respiratory symptoms and quality of life.

By mechanism of action, the IL-4/IL-13 pathway blockers segment is estimated to grow at the fastest CAGR during 2025-2034. Immunotherapeutics that employ big, monoclonal antibody molecules that target the IL-4 or IL-13 cytokines or their corresponding receptors make up the vast majority of inhibitory therapeutics being researched for IL-4 pathway inhibition.

By route of administration, the subcutaneous injection segment was dominant in the targeted drugs for allergic diseases market with a revenue of approximately 55% in 2024. The most popular and successful type of allergy immunotherapy is allergy injections. In addition to reducing sensitivity to allergens, allergy shots frequently provide long-lasting relief from symptoms, even after treatment is discontinued. For many people, this makes it a beneficial and affordable treatment option.

By route of administration, the oral segment is estimated to grow at the fastest CAGR during 2025-2034. Oral medication administration is the most common, practical, and cost-effective approach. The majority of drug absorption usually occurs in the small intestine, and the bioavailability of a medication is influenced by the amount of drug absorbed through the intestinal epithelium.

By end-user, the hospitals & specialty clinics segment was dominant in the targeted drugs for allergic diseases market with a revenue of approximately 45% in 2024. When an allergy's symptoms are severe, persistent, or uncontrollable with over-the-counter (OTC) remedies, people seek treatment in hospitals and specialty clinics. Specialist diagnosis, cutting-edge therapies like immunotherapy, and prescription-strength drugs that are unavailable elsewhere are all made available in hospitals and clinics.

By end-user, the homecare/self-administration patients segment is estimated to grow at the fastest CAGR during 2025-2034. In addition to being safe, home therapy gives patients more control over how their treatment is delivered. The cost-effectiveness of home treatment in comparison to hospital treatment has shown a lot of promise.

North America dominated the targeted drugs for allergic diseases market with an approximate share of 40% in 2024, caused by a high prevalence of allergic diseases. The area's well-established pharmaceutical sector, state-of-the-art medical facilities, widespread screening procedures, and advantageous reimbursement policies have encouraged widespread use of both cutting-edge immunotherapies and conventional anti-allergy medications and increased treatment rates. Market penetration is aided by top pharmaceutical companies with FDA approvals and a robust clinical channel.

According to recent reports, over 100 million Americans experience allergies annually, including seasonal, skin, and food allergies. Food allergies affect up to 11% of adults and 8% of children, with peanuts, milk, and shellfish being common triggers. Respiratory issues like hay fever impact about 60 million people yearly. Eczema affects approximately 18.9 million adults and 8 million children.

Asia Pacific is estimated to host the fastest-growing targeted drugs for allergic diseases market during the forecast period. The Asia-Pacific market is expanding quickly due to the rise in allergic conditions, especially in nations like China and Japan, which is driving up demand for anti-allergic medications. The development of new anti-allergic medications is continuously progressing in the Asia Pacific market. Biologics, which are being used more and more to treat severe allergic conditions like asthma, are one important area of focus.

Food allergy patterns are changing significantly in China, a country with a large population and landmass. In contrast to Western nations, where tree nuts are frequently triggered, Chinese people are increasingly experiencing allergic reactions to wheat, seafood, and fruits. The prevalence of food allergies varied from 3.13% to 11.9% in northern China, where wheat and other coarse and mixed grains are staples. On the other hand, food allergies were more common in southern China, where they ranged from 3.5% to 21.13%.

Europe is expected to grow at a significant CAGR in the targeted drugs for allergic diseases market during the forecast period. The market for allergy diagnostics and treatments in Europe is anticipated to expand quickly due to stricter regulations like the EU In Vitro Diagnostic Regulation (IVDR), rising public health awareness, and the prevalence of allergic diseases. The need for early allergy detection and customized treatments is rising as a result of European governments' promotion of preventive healthcare.

Allergies have become a modern plague in the UK, affecting more and more adults and children each year. Twenty million people, or one-third of the UK population, suffer from an allergy. The allergies of 5 million people are so bad that they need specialized care. Allergies affect 150 million people in Europe. It is predicted that 50% of people in Europe will have allergies by 2025. The NHS spends around £900 million a year on allergies.

Identifying disease targets, conducting drug discovery, performing preclinical laboratory and animal testing, conducting human clinical trials, and obtaining regulatory approval are all steps in the research and development (R&D) process. Additionally, post-market surveillance is carried out.

Clinical trials go through stages to evaluate the safety and effectiveness of targeted medications in humans. After reviewing this data, regulatory agencies such as the FDA authorize the new medication or biologic to be sold. After that, post-market surveillance monitors long-term security.

Regulatory approval with manufacturing quality control, stability testing, clinical trials, API characterization, excipient compatibility, and dosage form optimization (e.g., tablet, injectable) are among the steps.

By Drug Class/Type

By Indication

By Mechanism of Action

By Route of Administration

By End User

By Region

January 2026

January 2026

January 2026

January 2026