March 2026

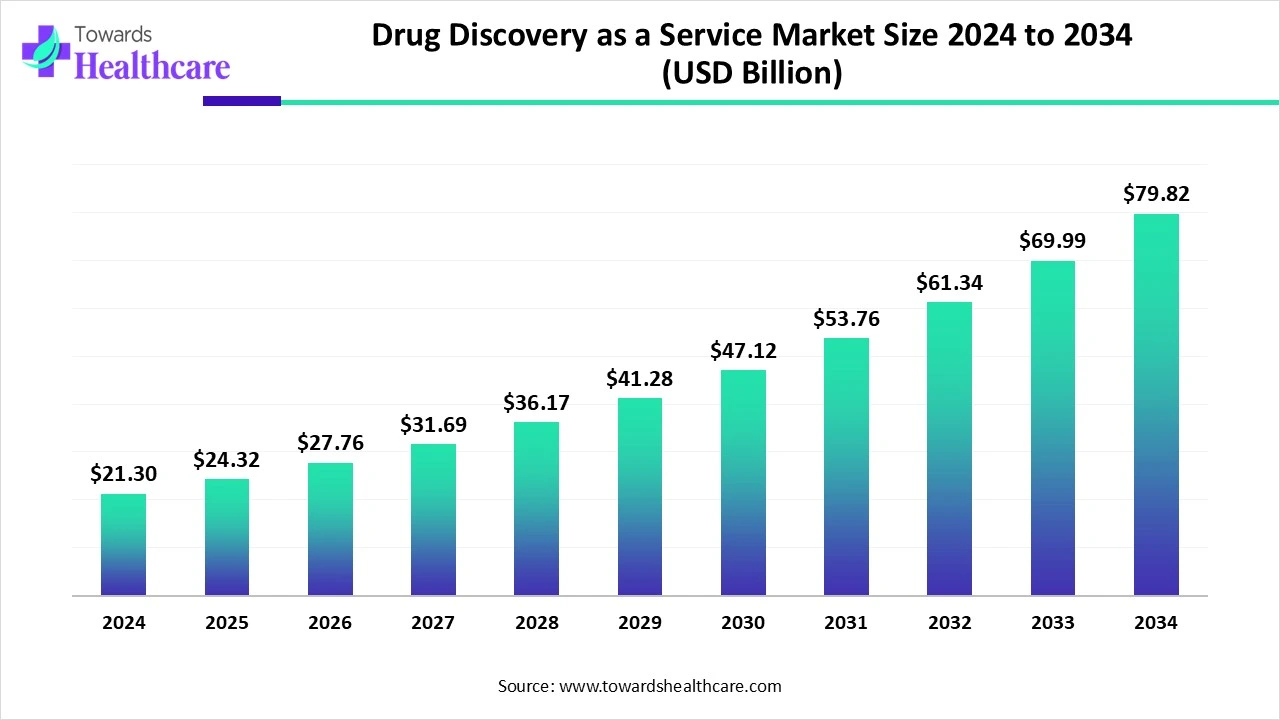

The global drug discovery as a service market size is calculated at US$ 21.3 in 2024, grew to US$ 24.32 billion in 2025, and is projected to reach around US$ 79.82 billion by 2034. The market is expanding at a CAGR of 14.17% between 2025 and 2034.

Due to growing chronic diseases, drug discovery is increasing, which in turn increases the demand for drug discovery as a service. With its help, various advantages as well as challenges of traditional drug discovery can be sorted out. Moreover, with the AI integration, its workflow, performance, and applications are being enhanced. This, in turn, is also developing new collaborations among the companies to launch and enhance their drug discovery platforms. Its demand in various regions is also increasing due to well-developed industries, growing disease, and R&D.

| Metric | Details |

| Market Size in 2025 | USD 24.32 Billion |

| Projected Market Size in 2034 | USD 79.82 Billion |

| CAGR (2025 - 2034) | 14.17% |

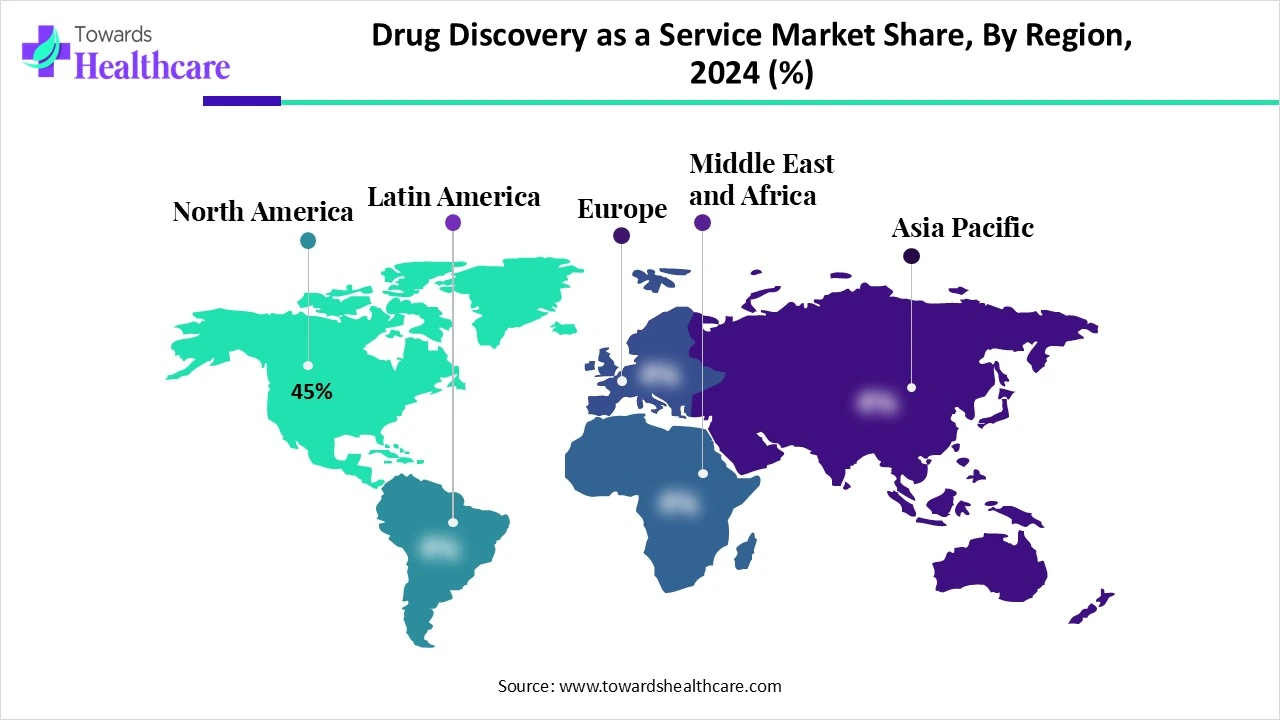

| Leading Region | North America share by 45% |

| Market Segmentation | By Service Type, By Technology,By End User, By Therapeutic Area, By Region |

| Top Key Players | Charles River Laboratories, WuXi AppTec, Evotec AG, Covance (Labcorp), IQVIA, Syneos Health, Pharmaron, PPD (Thermo Fisher Scientific), Medpace, PRA Health Sciences, BioDuro, Frontage Laboratories, ChemPartner, KBI Biopharma, Crown Bioscience, Jubilant Biosys, Recursion Pharmaceuticals, Aragen Life Sciences, Oncodesign, TCG Lifesciences |

Drug discovery as a service (DDaaS) is a business model where pharmaceutical, biotech, and academic organizations outsource various stages of the drug discovery process to specialized external providers. These providers offer integrated services, including target identification, compound screening, lead optimization, and preclinical testing by leveraging advanced technologies such as AI, machine learning, computational modeling, high-throughput screening, and automation. This model helps reduce R&D costs, accelerates timelines, as well as provides access to expert scientific and technological capabilities without heavy capital investments.

AI plays an important role in drug discovery as a service as it provides a powerful platform to discover various new drug targets, overcoming the traditional drug discovery's persistent challenges. It can analyze a large volume of data, screen several molecules, and enhance the identification of new drug candidates. The drug candidates with improved bioavailability and solubility by minimizing the errors can also be easily developed with its help. Moreover, the drug response and disease progression can also be predicted by AI.

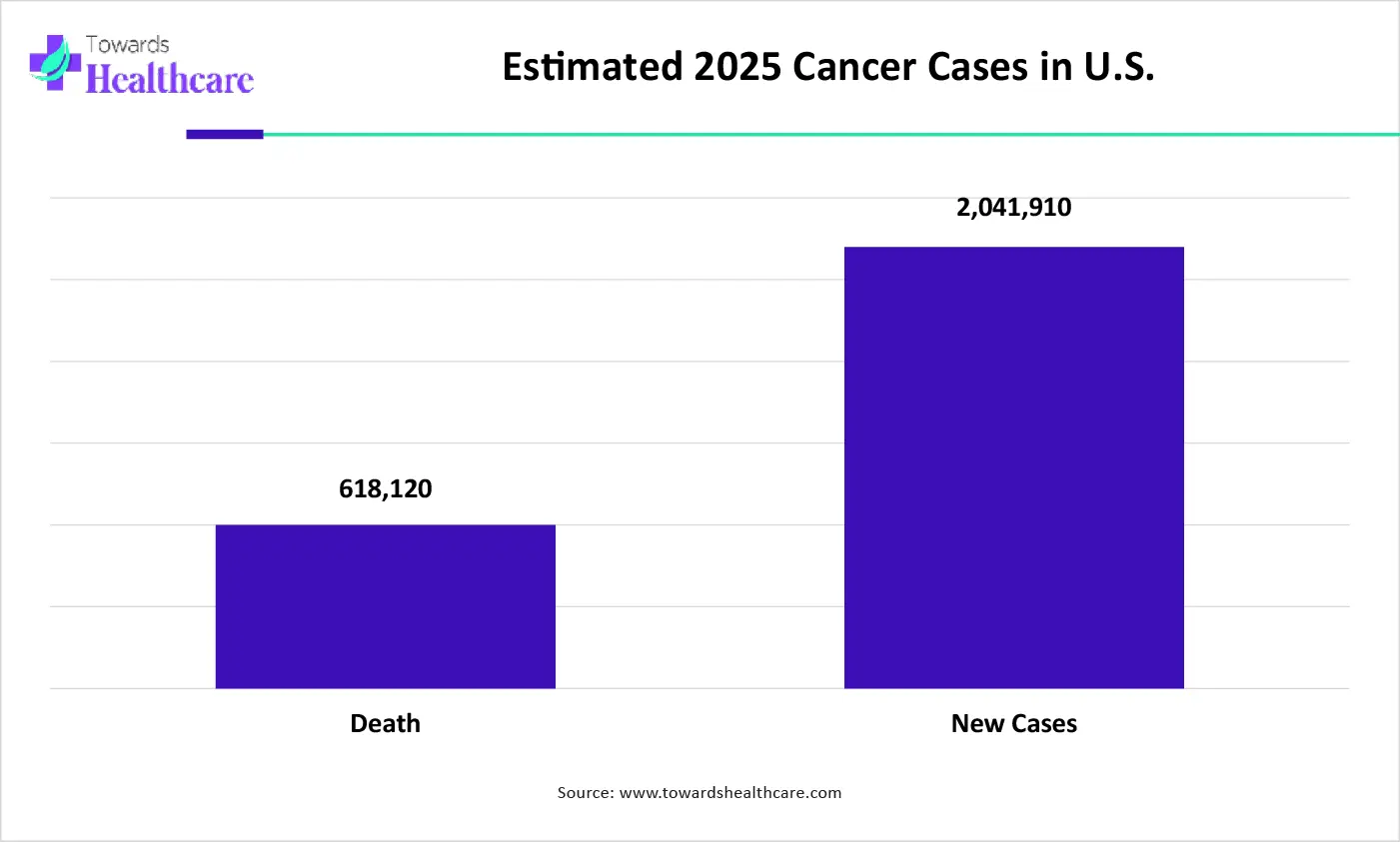

Growing Incidences of Cancer

There is a rise in the incidence of cancer, which in turn increases the demand for new treatment approaches. Thus, the process of drug discovery is also increasing, and to amplify this process, various platforms are provided by drug discovery as a service. Moreover, its screening and validation are also enhanced. At the same time, the testing of newly discovered and developing technologies with advanced technology is also offered by it. Thus, this drives the drug discovery as a service market growth.

The graph represents the estimated number of cancer cases for the U.S. in year of 2025. It indicates that there will be a rise in cases of cancer. Hence, it increases the demand for drug discovery as a service for the discovery and development of new treatment options for its effective management. Thus, this in turn will ultimately promote the market growth.

Security Concerns

The data about the drug discovery is stored by the drug discovery as a service, which can be leaked or stolen, resulting in loss or misuse of the researched data. At the same time, the risk of hacking can also lead to the same issues. Thus, the partnership with the companies outsourcing drug discovery data can be affected, limiting its use.

Rising Drug Discoveries for Chronic Disease

The number of patients suffering from different types of chronic diseases is increasing, which is enhancing the drug discovery and development of novel therapeutic approaches. Hence, with the help of drug discovery as a service, the screening, along with the identification of new drug candidates or targets, can be achieved. Similarly, the development of personalized medications is enhanced by using bioinformatics and other advanced technologies. Furthermore, advanced infrastructure is also provided for growing research. Thus, this promotes the drug discovery as a service market growth.

For instance,

By service type, the lead optimization segment held the largest share in the market with ~30% in 2024. There was a rise in the use of lead optimization to enhance the safety and potency of the drug candidate. At the same time, it also helped in reducing the cost and time involved in research. This contributed to the market growth.

By service type, the computational drug discovery segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. The use of computational drug discovery is increasing to amplify drug discovery. It is also improving the screening of a large volume of data, optimizing the drug development.

By technology type, the high throughput screening (HTS) segment led the market with ~35% in 2024. The HTS helped in the early identification of the drug candidates. Moreover, numerous compounds were quickly screened, reducing the time for the screening and also enhancing its accuracy and quality. This enhanced the market growth.

By technology type, the AI and machine learning segment is expected to show the highest growth during the predicted time. The use of AI and machine learning in drug discovery as a service is increasing as it is enhancing drug discovery, target identification, and screening. It is also predicting the toxicity, efficacy, and reducing the chances of failures of the compound discovered.

By end user, the pharmaceutical companies segment held the dominating share in the global market with ~55% in 2024. The growing research and development in pharmaceutical companies has increased the use of drug discovery as a service to enhance early-stage discoveries. This, in turn, promoted the market growth.

By end user, the biotechnology companies segment is expected to show the fastest growth rate during the upcoming years. The use of drug discovery as a service in biotechnology companies is being preferred due to increasing therapeutic innovations. Moreover, its use in the discovery of new therapeutic approaches for rare diseases and gene editing is also increasing.

By therapeutic area type, the oncology segment led the market with ~40% in 2024. The growing incidence of cancer has increased the use of drug discovery as a service to develop new treatment options. It also helped in optimizing the development of targeted therapies, as well as screening and validation of the targets.

By therapeutic area type, the neurological disorders segment is expected to show the highest growth during the upcoming years. With the help of specialized tools provided by drug discovery as a service in neurological disorders, the discovery and development of various treatment options are being enhanced. Similarly, their advanced platform helps in identifying the drug responses, optimizing their action.

North America dominated the drug discovery as a service market share by 45% in 2024. The industries in North America are well-developed, along with the presence of advanced technologies. This increased the discovery, development, and outsourcing of the new drug candidates through drug discovery as a service, contributing to market growth.

The U.S. consists of various drug discovery as a service companies that have enhanced collaborations with other pharmaceutical or biotechnological industries to provide various advantages for their drug discovery. This was also supported by funding provided by various companies or agencies.

The industries in Canada are well-developed, and they are using advanced technologies to enhance and develop new drug discovery platforms. Moreover, they are also outsourcing the data by establishing new collaborations with drug discovery as a service. Furthermore, new preclinical drug development platforms are also being developed.

Asia Pacific is expected to host the fastest-growing drug discovery as a service market during the forecast period. Asia Pacific is experiencing a rise in the occurrences of various chronic diseases, which in turn is increasing the demand for drug discovery platforms, provided by drug discovery as a service, enhancing the market growth.

The industries as well as institutes in China are focusing on research, accelerating the drug discovery and development. This, in turn, increases the need for drug discovery as a service. Thus, they are providing new platforms integrated with AI that help in enhancing drug discovery by minimizing possible errors.

The growing diseases in India and the expanding healthcare sector are leading to the adoption of drug discovery as a service for promoting drug discovery. At the same time, the presence of skilled professionals is enhancing the process. Furthermore, they are also supported by the government initiatives.

Europe is expected to grow significantly in the drug discovery as a service market during the forecast period. The research and development conducted in Europe is increasing, driving the demand for the use of drug discovery as a service. The growing startups are also contributing to the same. This promotes the market growth.

The German industries, as well as startups, are contributing to the rising drug discoveries and developments, where collaborations with drug discovery as a service are offering advanced technologies, infrastructure, and platforms, amplifying the process. Moreover, the screening, target validation, and optimization are also enhanced by them.

The growing demand for personalized medications in the UK is enabling new partnerships with drug discovery as a service. They are providing novel models for drug testing, reducing the reliance on animal models. Moreover, they are in compliance with the regulations laid by regulatory agencies, which is attracting companies.

By Service Type

By Technology

By End User

By Therapeutic Area

By Region

March 2026

March 2026

March 2026

March 2026