February 2026

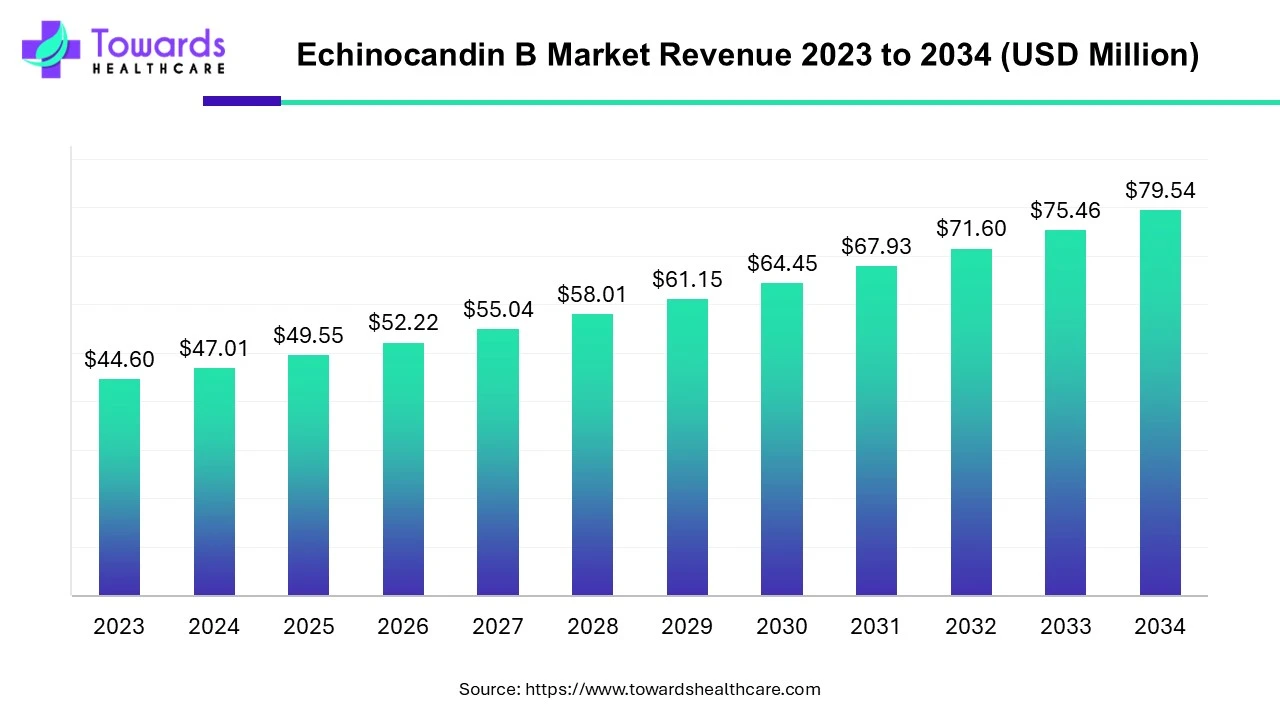

The echinocandin B market size was estimated at US$ 44.60 million in 2023 and is projected to grow to US$ 79.54 million by 2034, rising at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2034.

Echinocandin B is a naturally occurring cyclic lipopeptide with a linoleoyl side chain belonging to the class of antifungal agents. It inhibits the synthesis of β-(1,3)-D-glucan, a major component of the fungal cell wall. Echinocandin B is a fermentation product of Aspergillus nidulans. Caspofungin, Micafungin, and Anidulafungin are antifungal drugs that are synthetically derived from echinocandin B.

The increasing incidences of fungal infections and growing research and development drive the market. More than one billion people in the world are affected by fungal infections annually. The demand for new drugs to treat fungal infections promotes the market. In addition, the increasing number of clinical trials and investments increase the demand for echinocandin B. The rising demand for natural compounds as active drug molecules potentiates the market.

Echinocandins are the first molecules approved for the treatment of fungal infections. Echinocandin B is a form of echinocandin. The urge for natural products as drugs increases the demand for echinocandins as anti-fungal agents. Researchers are developing novel derivatives of echinocandins to increase the potency of natural derivatives. Research is also developing novel drug delivery systems for targeted delivery and sustained release of echinocandin B in the body. Additionally, the role of echinocandin B in treating other disorders, such as viral disorders, is being studied. Since echinocandin B is extracted through the fermentation process from the fungus Aspergillus nidulans, novel methods are derived to ease the process of extraction of echinocandin B.

The major challenge of echinocandin B is its resistance to fungal organisms. Fungal species like Cryptococcus, Trichosporon, and zygomycetes are resistant to echinocandins. They also show weak activity against yeast forms of Histoplasma, Blastomyces, and Coccidiodes. This reduces the biological effect of echinocandins on humans, limiting its use. According to the Centers for Disease Control and Prevention report, echinocandin resistance is a concerning clinical and public health threat, particularly when coupled with resistance to azole and amphotericin B.

North America dominated the echinocandin B market in 2023. The state-of-the-art research and development facilities, increasing incidences of fungal infections, and increasing incidences & collaborations drive the market. According to the Centers for Disease Control and Prevention report, ringworm, nail infections, and vaginal yeast are the most common fungal diseases in the US. It has been reported that pharmaceutical companies in the US and Canada invested around 14% to 50% of their revenues in pharmaceutical R&D activities. This promotes novel drug discovery and development, potentiating the echinocandin B market. Rezafungin was the recently approved drug for the treatment of candidemia and invasive candidiasis. Additionally, increasing investments & collaborations and the presence of key players augment the market growth.

Asia-Pacific is anticipated to grow fastest in the echinocandin B market during the forecast period. The rising geriatric population, increasing incidences of fungal infections, and growing research & development activities drive the market. Around 182 Candida auris-associated hospitalizations and outbreaks were reported in China in 2023, compared with 33 in 2022. In India, more than 57 million people are affected by fungal diseases annually. The rising incidences of fungal infections demand the development of novel echinocandin B analogs for their treatment. The market is also driven by favorable infrastructure for manufacturing and increasing investments. The increasing number of clinical trials and patents augment the market.

Europe is expected to grow significantly in the echinocandin B market during the forecast period. The increasing research and development are contributing to the market growth in Europe. At the same time, this is supported by the investments provided by the government as well as the regulation of regulatory agencies.

UK Market Trends

The demand for the use of echinocandin B to treat the increasing fungal infection in the population is increasing in the UK. This, in turn, increases the research carried out within the industries as well as the institutes. These are further funded by the government.

Germany Market Trends

The industries in Germany are focusing on the development of new targeted drug delivery approaches to treat the resistant fungal infections. This is increasing the collaborations between them. Furthermore, the innovations are being developed in compliance with the regulations laid by the regulatory bodies, which further accelerates the approval process.

By type, the powder segment held a dominant presence in the echinocandin B market in 2023. The demand for echinocandin B powder is higher due to its stability and ease of storage and transportation. Powders are comparatively lighter than liquids; hence, they are easily packaged and require less transportation costs. Powders can be dissolved in water and then consumed by the patients. The liquid segment is expected to grow fastest in the echinocandin B market during the forecast period. Liquids increase patient medication adherence as they are easily swallowed by children and the geriatric population. Echinocandin B is obtained in a liquid form through the fermentation process, eliminating the need for further extraction into powder form.

By application, the antifungal drugs segment dominated the echinocandin B market in 2023. The main application of echinocandin B is the treatment of fungal infections. Echinocandin B disrupts the formation of fungal cell walls by inhibiting the synthesis of β-(1,3)-D-glucan, a component of the cell wall. The increasing incidences of fungal infections boost the segment growth. The drug development segment is estimated to expand rapidly in the echinocandin B market over the coming years. The growing research and development activities and increasing investments in R&D activities potentiate the growth of the market. Echinocandin B is modified to develop its synthetic analog with improved pharmacokinetic and pharmacodynamic properties.

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026