February 2026

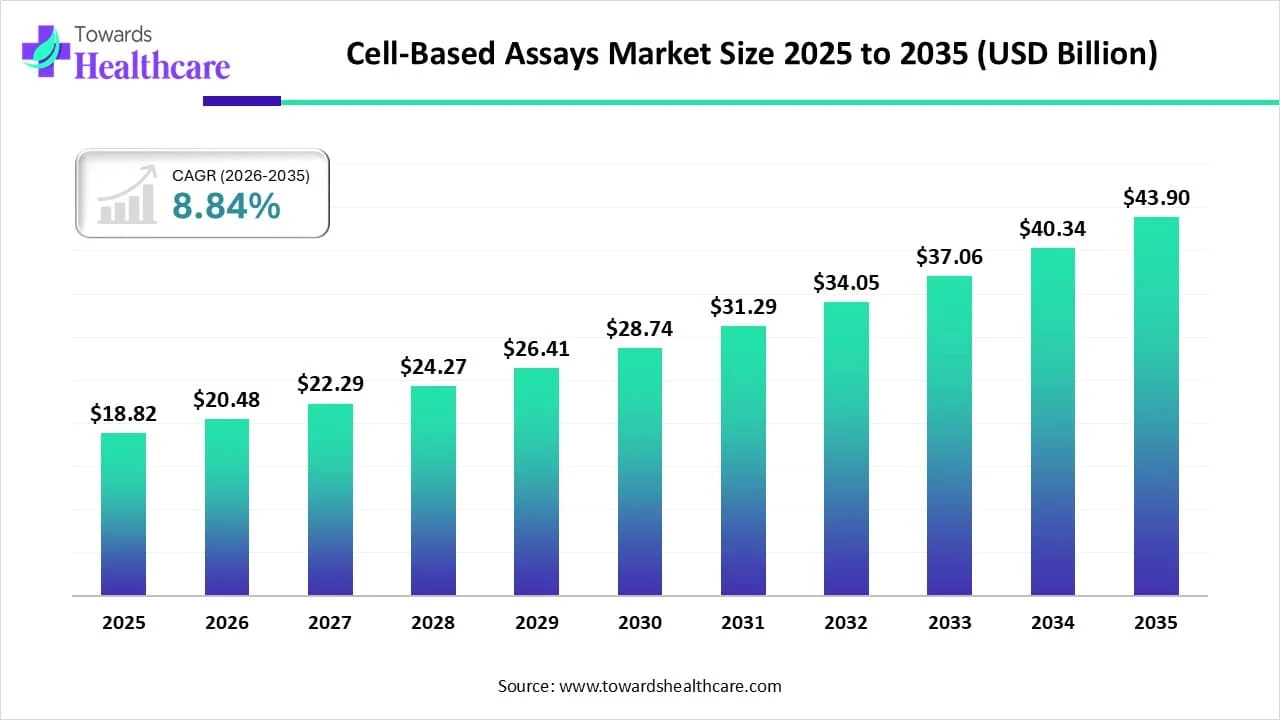

The global cell-based assays market size began at US$ 18.8 billion in 2025 and is forecast to rise to US$ 20.4 billion by 2026. By the end of 2035, it is expected to surpass US$ 43.9 billion, growing steadily at a CAGR of 8.84%.

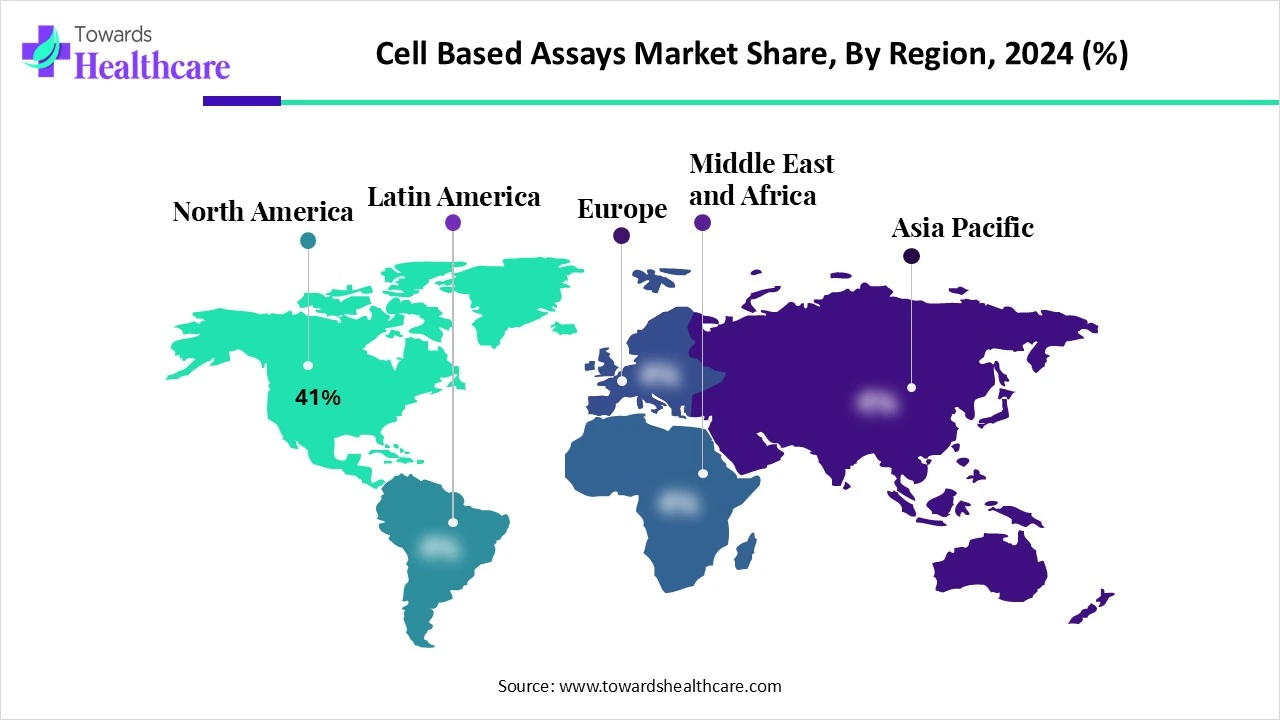

The cell-based assays market is expanding due to the increasing drug discovery and development, increasing demand for targeted therapy, and early adoption of 3D cell culture, high-throughput screening technology, and label-free detection. North America is dominated by the presence of major pharmaceutical and biotech companies that utilize cell-based assays for pharmaceutical manufacturing and production. Asia Pacific is fastest fastest-growing, with increasing government support and growing investment in healthcare.

| Metric | Details |

| Market Size in 2026 | USD 20.4 Billion |

| Projected Market Size in 2035 | USD 43.9 Billion |

| CAGR (2026 - 2035) | 8.84% |

| Leading Region | North America Share 41% |

| Market Segmentation | By Product & Service, By Application, By Technology, By Cell Type, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Danaher Corporation, Becton, Dickinson and Company (BD), PerkinElmer, Merck KGaA, Lonza Group, Charles River Laboratories, Promega Corporation, GE HealthCare, Bio-Rad Laboratories, Corning Incorporated, Agilent Technologies, Eurofins Scientific, Cell Signaling Technology, Miltenyi Biotec, Abcam plc, DiscoverX (Eurofins), Cytek Biosciences, Sartorius AG, Revvity, Inc. |

Cell-based assays refer to experimental protocols used to measure the functional response of live cells to external stimuli such as drugs, chemicals, or biological agents. These assays are vital tools in drug discovery, toxicity testing, and cell biology research as they mimic physiological environments better than biochemical assays. Cell-based assays enable high-throughput screening and are instrumental in evaluating cell viability, proliferation, apoptosis, signal transduction, ion channel activity, and receptor-ligand interactions.

For instance,

For Instance,

Integration of AI in the cell-based assays drives the growth of the market as AI-based technology serves as a significant tool that improves their efficiency and scope. AI-driven technology streamlines the drug discovery procedure by prioritizing compounds for testing, predicting outcomes, and enhancing the design of the assay. This lowers the number of traditional assays required and limits the timeline for discovering promising therapeutics. AI-driven techniques have huge potential to significantly improve drug discovery and reduce the reliance on traditional cell-based assays in some aspects of research and technology. The application of AI-driven technology in fixed sample imaging is a quickly developing field that includes the detailed analysis of stained cells or tissues that have been immobilized or fixated, which causes the growth of the market.

Growing Application of Cell-based Assay in Precision Medicine

The increasing use of cell-based assays in precision medicine involves custom 2D and 3D assays for different cell types, supporting treatments across conditions like diabetes, fibrosis, and cancer. These assays assist in selecting the most effective therapy for each patient, moving away from a one-size-fits-all model. By leveraging genetic and molecular data, this personalized approach aims to improve treatment results and reduce side effects, thereby fueling the growth of the cell assays market.

For Instance,

Major Limitation of Cell-Based Assay

Most biochemical assays, such as radioactivity assays and AlphaLISA, require purified recombinant enzymes and histone substrates. Additionally, these assays cannot reflect the actual interactions occurring within the nucleus of living cells. A potent inhibitor identified through a biochemical assay may not be effective in cellular environments. Therefore, cell-based assays that assess cell permeability, toxicity, on-target activity, and engagement are essential, which limits the growth of the market.

Increasing Advancement in Cell-Based Assays

Current and future trends in cell-based assays show that CRISPR significantly simplifies the development of complex, disease-relevant cell-based assays. The CRISPR/Cas9 technology has transformed gene research by enabling precise and easy genome editing. This advancement makes it easier to develop more sophisticated assays focused on complex questions and heterogeneous diseases. As a result, researchers can explore biologically relevant assays more effectively, creating opportunities for growth in the cell assays market.

For instance,

By product & service, the consumables segment led the cell-based assays market, due to biotech consumables are a significant part of any healthcare practice, as it is used during inpatient hospitalization. It contains masks, cotton, syringes, needles, PPE kits, gowns, gloves, and sanitizers. There are several numbers of various types of consumable products available, each with its quantified use.

The assay kits sub-segment is dominated in the consumables segment as these kits contain the materials, chemicals, and reagents required to perform a precise test. Their significant benefits such as easy operation, limited detection time, suitability for clinical medical institutions, centers for disease control and prevention, inspection and testing institutions, and other units. With the consistent development of science and technology, the precision, suitability, and rapidity of test kits continue to be enhanced, and advanced novel identification technologies and products developed in the future to meet the increasing healthcare and biotech demand.

On the other hand, the services segment is projected to experience the fastest CAGR in the cell-based assays market from 2025 to 2034, as it offers advantages like the development or maintenance of health through the diagnosis, prevention, amelioration, treatment, or cure of disease, injury, illness, and different physical and mental losses in people. These services are offered through a network of different primary, secondary, and tertiary medical care centres.

The screening services sub-segment is dominant in the services segment as screening services using cell-based assays offer various advantages of testing the effects of compounds against molecular targets in the context of living cells, also allowing broad, systems biology strategies to understand cellular mechanisms involved in disease processes. Cell-based screening technologies have enabled drug discovery scientists to develop models of interconnected cellular pathways, extract significant data for precise disease models, and build companion diagnostic programs about relevant cellular biomarkers for therapeutics.

By application, the drug discovery segment is dominant in the cell-based assays market in 2024, as the cell-based assays are used to classify the standard drug moiety, quantify proliferation, toxicity, motility, analyze cell signaling pathways, and variations in morphology. In cell-derived assays, 2D versus 3D culture also contributes to the outcomes. Drug manufacturers use cell-based assays to measure cytotoxicity and cell death due to the tested compounds.

Lead Identification subsegment is dominated in the drug discovery segment as cell-derived assays are used to appreciate protein, gene, or entire cellular functions and the regulatory mechanism controlling these, to screen for possible inhibitors or inducers of biotic processes in drug development, or to restrict a result or event in the cell.

The predictive toxicology segment is projected to grow at the fastest CAGR from 2025 to 2034, as cell-derived toxicology assays present a noteworthy development in predictive safety assessment, providing ethical and economic benefits over traditional animal testing procedures. High-throughput assays that utilize cultured cells and quantify overall phenotypic output that is relevant to predicting acute toxicity, like cell proliferation, cell membrane permeability, or adenosine triphosphate (ATP) content.

By technology, the high-throughput screening (HTS) segment led the cell-based assays market in 2024 as it is a drug discovery technique that enables automated testing of large numbers of chemical and biological compounds for a precise biological target. High-throughput screening processes are widely applied in the healthcare sector, advanced robotics, and automation to rapidly test the biological or biochemical activity of a large number of molecules typically drugs. They speed up the specific analysis, as large-scale compound libraries are rapidly screened affordably.

The high content screening (HCS) segment is projected to experience the fastest CAGR from 2025 to 2034, as it is a process that is used in biotech investigational studies and drug discovery, which combines high-throughput automated microscopy with quantifiable data analysis to explore biological services, allowing the assessment of multiple cellular and subcellular components concurrently for comprehensive cellular analysis.

By cell type, the immortalized cell lines segment led the cell-based assays market in 2024, as these cells, resulting from different sources and the formation of immortal cell lines, are useful in considering the molecular pathways leading cell developmental cascades in eukaryotic, particularly human, cells. Immortalized cells tend to be simple to culture as compared to cells used in primary cultures, in which they grow more rapidly and do not need extraction from a living organism.

On the other hand, the induced pluripotent stem cells (iPSCs) segment is projected to experience the fastest CAGR from 2025 to 2034, as iPSC technology has revolutionized in vitro research and holds huge potential for progressive regenerative medicine. iPSCs have the potential for almost unlimited expansion, are amenable to genetic engineering, and are distinguished from most somatic cell types. iPSCs are broadly used to model human development and diseases, perform drug screening, and develop cell therapies.

By end user, the pharmaceutical & biotechnology companies segment led the cell-based assays market in 2024 due to cell-based assays (CBAs) are valuable for measuring cellular responsiveness to drug complexes or external stimuli on inclusive cell function in the pharmaceutical & biotechnology companies. The outcome of drugs is based upon the concentration, site of binding, and mechanism of action in the different cell organelles.

On the other hand, the contract research organizations (CROs) segment is projected to experience the fastest CAGR from 2025 to 2034, as cell-based assays allow CRO to characterize the activity and safety of a potential drug early in development. Producing this data early in the process enables key decisions, which raises the chance of attainment in later stages of drug development by supervising the design of in vivo studies and informing aspects of later preclinical stage studies as well.

North America is dominant in the market share 41% in the 2024, as the biotech and pharma fields in the North America consistently growing as increasing aging population pursues prevention and management for an extensive variety of health challenges, advance diseases transform the researchers focus, and increasing governments and private investment in research and development of novel solutions, it rises the cell based assay for drug discovery, target validation and toxicity testing. Also, strong presence of CMOs and CROs such as Thermo Fisher, Charles River, and other provide a broad range of cell-based services to worldwide pharma clients, which contributes to the growth of the market.

For Instance,

Increasing R&D investment in the U.S. for novel drug launches and increasing government support for advanced therapy, which increases the demand for cell-based assays. Increasing collaboration between public and private healthcare institutes fuels the adoption and development, which drives the growth of the market.

The Canadian biotechnology sector is growing rapidly and is dominated by small and medium-sized healthcare organizations, which increases the demand for cell-based assays due to advanced drug discovery. The increasing prevalence of chronic diseases such as high blood pressure, heart disease, and obesity is accelerating the application of cell-based assays for personalized therapy and precision diagnostics.

Asia Pacific is the fastest-growing region in the cell-based assays market in the forecast period, as the strong presence of well-established research institutions and academic centres actively creates and validates advanced cell-based therapy. Rapid increase of pharmaceutical and biotech industries due to the presence of large populations and increasing healthcare demand, therefore increasing the adoption of cell-based assays for drug discovery and toxicity testing, which contributes to the growth of the market.

In China, increasing government support to the healthcare sector, such as China’s government has introduced medical care system reforms in broad-ranging areas with government funding for research and development, renovation of healthcare authorization requirements, product authorizations, procurement assessments, and management of the supply channel, which drives the growth of the market.

In India, governments are accelerating the biotech and life science sectors by subsidies, grants and biotech parks, such as India’s DBT which improving government supply system by re-engineering the presenting process in welfare schemes for easy and faster flow of healthcare funds and to ensure precise targeting of the beneficiaries, de-duplication and lessening of fraud, it supports the biopharma growth and alternative animal testing.

Europe is expected to be notably growing in the cell-based assays market during the forecast period, as the improving research centres for generating solutions to health problems and advancing the life science processes, which increases the need for cell-based assay services. European government has a strong focus on non-animal testing alternatives such as cell-based assays, which contributes to the growth of the market.

For Instance,

The life sciences industries in Germany are increasing due to a strong and stable healthcare advancement, increasing government support for research and development, and a wealth of companies and institutes. Germany provides the standard investment for health innovation, which drives the growth of the market.

The UK has a world-leading science base, genomics research capabilities, and industrial heritage, which is accelerating the adoption of cell-based assays. Recent advancements in regenerative therapy, such as stem cell therapy and 3D culture systems driving the demand for in-vitro testing platforms like cell-based assays.

In June 2025, Jacob Thaysen, chief executive officer of Illumina, stated, “Illumina and SomaLogic have partnered closely for more than three years, and this combination increases our ability to serve our customers and accelerate our technology roadmap towards advanced biomarker discovery and disease profiling.”

By Product & Service

By Application

By Technology

By Cell Type

By End User

By Region

February 2026

February 2026

February 2026

February 2026