March 2026

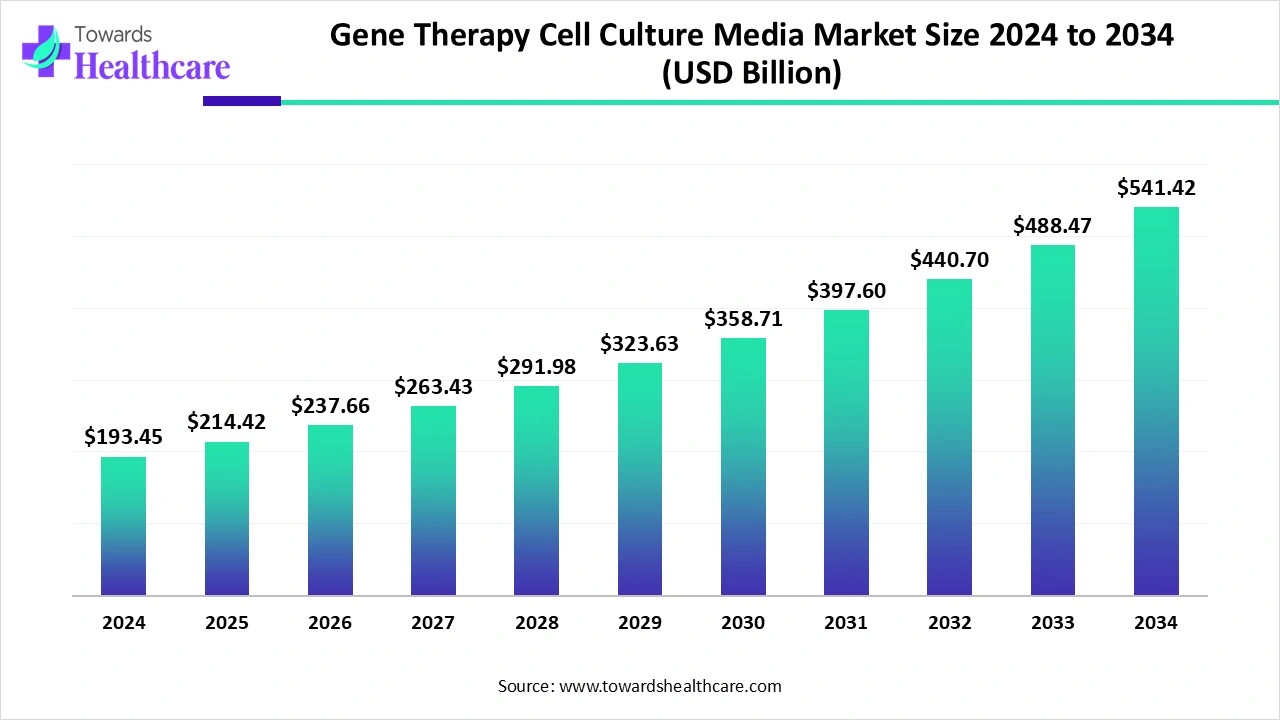

The global gene therapy cell culture media market size began at US$ 214.42 billion in 2025 and is forecast to rise to US$ 237.66 billion by 2026. By the end of 2035, it is expected to surpass US$ 600.11 billion, growing steadily at a CAGR of 10.84%.

The gene therapy cell culture media market is expanding as pharmaceutical and biotech companies focus on scalable manufacturing solutions for advanced therapies. The rising prevalence of genetic disorders and rare diseases is pushing the need for optimised culture systems. Collaborations between research institutes and industry players, along with regulatory support for innovative therapies, are also accelerating adoption. Moreover, technological improvements in media customization are enabling tailored solutions, boosting market growth during the forecast period.

Gene therapy cell culture media are specialized liquid and solid formulations used to grow, expand, and maintain cells used in gene-therapy workflows and to produce viral vectors (AAV, lentivirus, retrovirus, etc.). These media are optimized for cell types commonly used in gene therapy (HEK293, suspension HEK293, CHO, primary T cells, stem cells), and include supporting supplements (transfection enhancers, feed solutions, serum-free / xeno-free formulations, cryo & storage media). They are critical across upstream manufacturing (vector production, transfection), cell engineering (CAR-T, NK, TCR), and process development, where media performance drives productivity, product quality, and regulatory compliance. The gene therapy cell culture media market is evolving as companies emphasize cost-effective and reproducible production processes to meet rising commercial demand. Growing processes to meet rising commercial demand. Growing focus on automation, closed-system bioprocessing, and reducing contamination risks is reshaping development strategies. Additionally, the push for sustainable, animal-free media ingredients is influencing innovation, making them more adaptable to further therapeutic needs.

For Instance,

AI can impact the market by optimizing media formulations through predictive modeling and data-driven design, reducing reliance on trial-and-error methods. It can analyze large biological datasets to identify ideal nutrient compositions for specific cell types, improving efficiency and consistency in production. AI also enables real-time monitoring and quality control in bioprocessing, minimizing variability and enhancing scalability. These capabilities accelerate innovation, lower costs, and support the development of more effective gene therapy solutions.

Increasing Number of Gene Therapy Clinical Trials

The growing number of gene therapy clinical trials drives the cell culture media market as it creates a need for diverse formulations tailored to different therapeutic approaches. Each trial may involve unique cell types, genetic materials, or delivery systems, pushing companies to develop flexible and adaptive media solutions. This variety fosters continuous innovation and collaboration between manufacturers and researchers, making clinical trial expansion a catalyst for broader application and advancements in the gene therapy cell culture media market.

For Instance,

High Cost of Specialized Media Development and Production

The expensive nature of developing and producing specialized gene therapy cell culture media acts as a market restraint because it limits the ability of smaller companies and emerging markets to adopt these products. High production costs also make scaling up for commercial manufacturing challenging, slowing the availability of therapies.

Development of Customised and Automated Media Solution

The advancement of customized and automated media solutions offers a future opportunity by addressing the growing need for efficient, high-throughput production in gene therapy. These innovations can shorten development timelines, improve consistency across batches, and reduce labor-intensive processes. Additionally, the ability to design media for emerging therapies, including rare genetic disorders and complex cell types, opens new applications, making the market more versatile and attractive for biotech companies and research institutions seeking scalable and reliable gene therapy production.

| Table | Scope |

| Market Size in 2026 | USD 237.66 Billion |

| Projected Market Size in 2035 | USD 600.11 Billion |

| CAGR (2026 - 2035) | 10.84% |

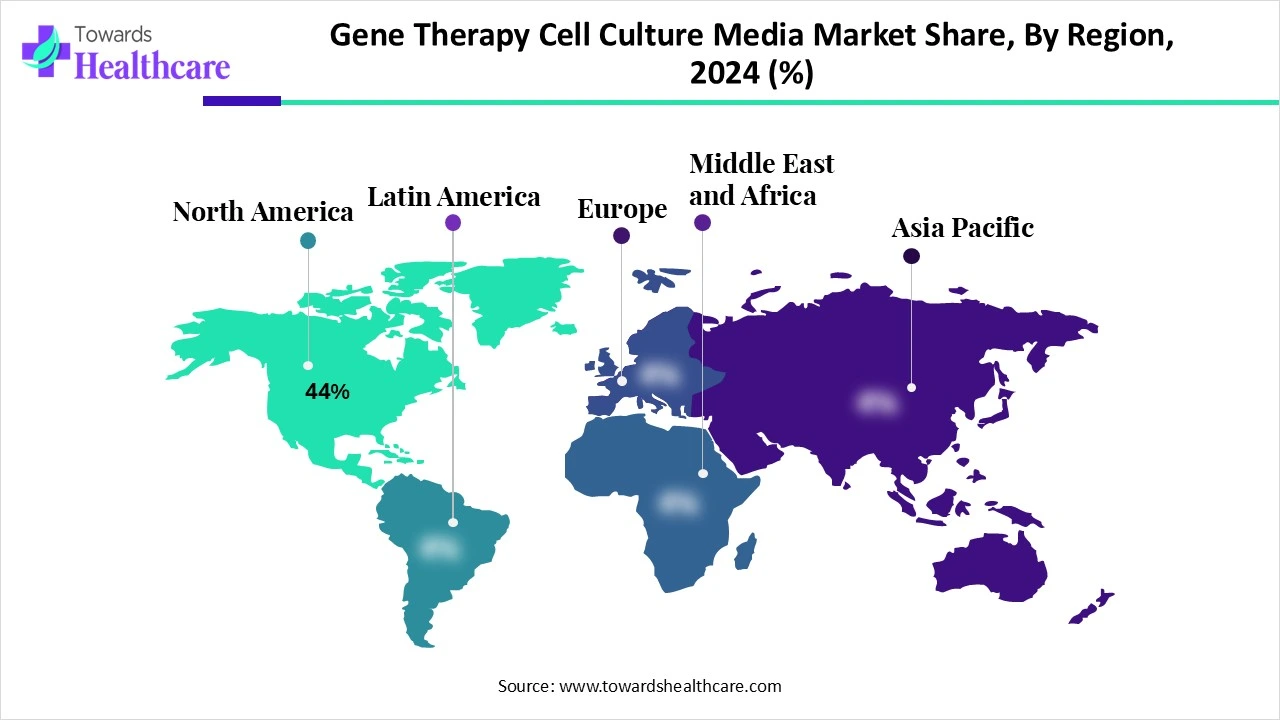

| Leading Region | North America by 44% Share |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Product / Media Type, By Application / Process Stage, By Cell Type / Target Cell Line, By Formulation / Format, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Lonza, Merck / MilliporeSigma, FUJIFILM Irvine Scientific, Cytiva, Takara Bio, BioLife Solutions, Charles River Laboratories, WuXi AppTec, VectorBuilder, Irvine Scientific, Sartorius, Miltenyi Biotec, Biological Industries, PromoCell, CellGenix, Thermo Fisher / Invitrogen, Merck Millipore, Corning Life Sciences, HiMedia / Biological supply regional players |

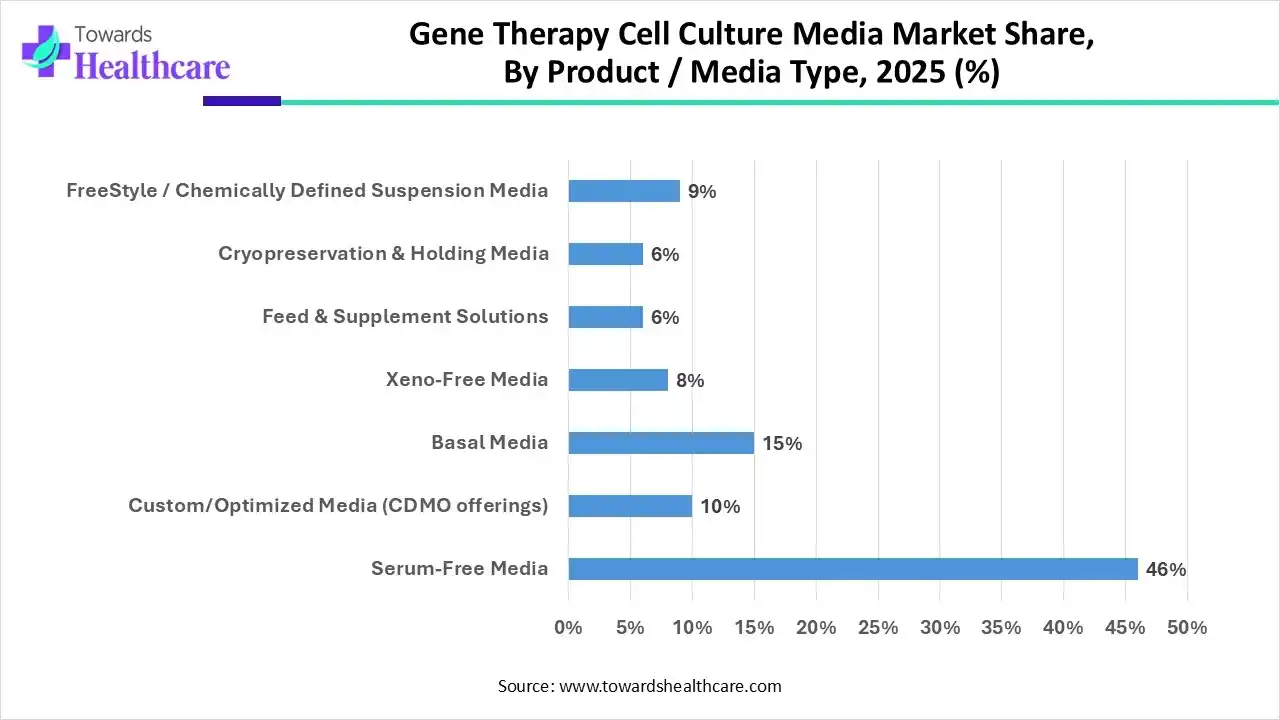

How will the Serum-free Media Segment dominate the Market in 2025?

The serum-free media segment led the gene therapy cell culture media market by 46% in revenue, as it supports more scalable and controlled manufacturing processes for gene therapies. Its compatibility with autonomation and closed-systems bioprocessing makes it ideal for high-volume production while minimizing regulatory hurdles. Additionally, rising demand for ethically sourced animal-derived media and increased use in advanced therapies like CAR-T and viral vector production contributed to its dominance, making serum-free formulation a preferred choice for both research and commercial applications.

The custom/optimized media (CDMO offerings) segment too projected to grow fastest because it enables biopharmaceutical companies to access ready-to-use, high-performance media without investing in in-house development. The expansion is driven by the increasing requirement for specialized cell culture media tailored to specific bioprocesses, the surge in biologics and cell therapy production, and the focus on improving yield and consistency. Moreover, outsourcing media development to CDMOd allows companies to leverage advanced expertise and reduce time-to-market, fueling the segment's rapid adoption.

Why Did the Upstream Viral Vector Production Segment Dominate the Market in 2025?

In 2025, the upstream viral vector production segment dominated the gene therapy cell culture media market in terms of revenue, driven by the rising use of viral vectors in advanced gene and cell therapies. The need for higher-quality, high-yield vectors to support clinical and commercial-scale production has boosted demand. Additionally, technological advancements in upstream processes, coupled with increased R&D investment by biopharmaceutical companies, have made this segment a critical focus area, contributing significantly to its leading market position.

The process development & optimization segment is projected to witness the fastest growth in the forecast period as manufacturers prioritize streamlining production workflows and ensuring consistent product quality. Rising demand for complex biologics and personalized therapies necessitates precise optimization of each stage, from upstream to downstream processes. Furthermore, increasing outsourcing of process development to specialized service providers allows companies to accelerate timelines, reduce operational costs, and adopt innovative technologies, collectively fueling the segment's rapid expansion.

How does the HEK293/HEK293T Segment Dominate the Gene Therapy Cell Culture Media Market?

The HEK293/HEK293T segment accounted for the largest market by 38% share in 2025 because these cell lines are highly versatile and widely adopted in viral vector and protein production. Their rapid growth, ease of genetic manipulation, and sterility for large-scale biomanufacturing make them a preferred choice for biopharmaceutical companies. Furthermore, the rising development of gene therapies, vaccines, and recombinant proteins has driven increased reliance on HEK293/HEK293T cells, solidifying their leading position in the market.

The primary T cells segment is projected to grow at the fastest rate during the forecast period as demand for personalized immunotherapies continues to rise. These cells are essential for developing CAR-T and other T cell-based treatments, prompting increased research and clinical applications. Innovation in cell isolation, expansion, and genetic modification and effective, while the growing focus on targeted and precision therapies is fueling the boost in adoption and driving rapid market growth.

| Segment | Share 2025 (%) |

| Liquid Ready-to-Use Media | 62% |

| Powder / Concentrate Media | 10% |

| Kits (media + supplements + feeds) | 10% |

| Custom Blends | 18% |

How will the Liquid Ready-to-use Media Segment dominate the Market in 2025?

The liquid ready-to-use media segment led the gene therapy cell culture media market by 62% in 2025 because it offers ease of use and minimizes preparation errors, ensuring consistent performance in cell culture and biomanufacturing. Its pre-formulated nature reduces contamination risks and saves operational time, making it ideal for large-scale and high-throughput applications. Growing adoption in biopharmaceutical production, including vaccines, biologics, and cell therapies, along with the demand for efficient and reliable media solutions, has contributed to its leading revenue position in the market.

The custom blends segment is expected to grow at the fastest CAGR during the forecast period as demand rises for media tailored to specific cell lines and bioprocesses. Companies increasingly prefer personalized formulations to improve yield, reproducibility, and overall process efficiency, especially in gene therapy and biologics production. Additionally, the trend of collaborating with CDMOs for specialized media solutions and the focus on reducing development timelines are accelerating the adoption of custom blends, fueling their rapid market growth.

Why Did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2025?

The pharmaceutical & biotechnology companies segment led the gene therapy cell culture media market by 50% in 2025 with the highest revenue share due to their large-scale production of biologics, vaccines, and cell and gene therapies. Rising investments in innovative drug development, growing demand for personalized medicine, and the need for reliable and high-quality bioprocessing solutions have driven adoption. Their extensive research activities and focus on streamlining manufacturing processes for efficiency and consistency have further strengthened the segment’s dominant position in the market.

The CDMOs/viral vector CMOs segment is projected to register the fastest growth during the forecast period as more biopharmaceutical companies outsource manufacturing to meet rising demand for gene therapies, viral vectors, and biologics. These organizations offer specialized infrastructure, technical expertise, and scalable production capabilities that in-house facilities often lack. The trend toward cost reduction, faster development timelines, and access to advanced bioprocessing technologies is boosting reliance on CDMOs/CMOs, driving rapid expansion of this segment in the market.

North America led the market share 44% in 2024, due to its advanced healthcare infrastructure and concentration of major biopharmaceutical and biotechnology companies. The region’s significant investment in research and clinical trials, combined with early adoption of innovative cell and gene therapies, fueled demand for specialized culture media. Supportive government initiatives, strong funding for life sciences, and the presence of state-of-the-art manufacturing facilities further strengthened North America’s dominant share in the market.

U.S. Gene Therapy Cell Culture Media Market Trends

The U.S. market is witnessing strong growth due to the rising focus on advanced therapies such as CAR-T and other personalized treatments. High adoption of innovative bioprocessing technologies, extensive clinical research, and robust investment in life sciences have fueled demand for specialized culture media. Moreover, the country’s well-established biopharmaceutical ecosystem, coupled with access to a skilled workforce and state-of-the-art manufacturing facilities, supports efficient production and accelerates market expansion.

Canada Gene Therapy Cell Culture Media Market Trends

The market in Canada is expanding due to the country’s growing emphasis on biotechnology and precision medicine. Increasing R&D activities, strategic partnerships between biotech firms and research institutes, and supportive regulatory frameworks are driving the adoption of specialized culture media. Moreover, rising clinical trial activity and investments in advanced manufacturing infrastructure for cell and gene therapies are fueling market growth, making Canada an increasingly important region in the global gene therapy cell culture media landscape.

Asia-Pacific is projected to grow at the fastest CAGR in the gene therapy cell culture media market during the forecast period, driven by the region’s expanding biotech and pharmaceutical sectors. Increasing investments in research and development, rising demand for advanced therapies, and improving healthcare infrastructure are key growth factors. Additionally, supportive government policies, growing collaborations with global biopharma companies, and the rapid establishment of state-of-the-art manufacturing and clinical trial facilities in countries like China, India, and Japan are accelerating market adoption.

China Market Trends

The growing government initiative in China and the expanding gene therapy pipeline are increasing the demand for their cell culture media. Growing investments, the biotech sector expansion, and increasing R&D activities are also increasing the adoption of high-quality and tailored media solutions.

Europe is expected to grow significantly in the gene therapy cell culture media market during the forecast period, due to the presence of stringent regulations. The growing investments, R&D activates and expanding biotech ecosystem are also increasing the adoption of the gene therapy cell culture media. Moreover, growing advancements in cell and gene therapies are also increasing their use, enhancing the market growth.

UK Market Trends

The growing gene and cell therapy awareness is increasing their adoption rates, encouraging their R&D in the UK. This, in turn, is driving the demand for their cell culture media, leading to new collaborations among the industries and institutions. Moreover, growing funding and investments are also driving their innovations, increasing the use of the media.

South America is expected to show lucrative growth in the gene therapy cell culture media market during the forecast period, due to growing gene therapy R&D and adoption rates. Growth in the development of biologics, regenerative medicine, and advanced therapies is also increasing the use of gene therapy cell culture medicine, which is further supported by government initiatives, promoting the market growth.

Brazil Market Trends

Brazil is experiencing an expansion in the biotech hub, which is increasing the use of gene therapy cell culture media for the development of gene therapies for various applications. Growing clinical trials, government funding, and advancements in the development of new media are also driving the demand.

Research and development in gene therapy cell culture media is centered on creating tailored, well-defined, and xeno-free formulations that enhance the growth, survival, and functional performance of genetically engineered cells. These efforts are especially focused on supporting cells used for producing viral vectors, ensuring optimal gene expression and consistent performance in therapeutic applications.

A clinical trial for gene therapy cell culture media involves testing specific media formulations to assess their effectiveness in supporting cell growth, viability, and scalability during the development of gene therapy products, while ensuring safety and consistent performance.

Regulatory approval for cell culture media in gene therapies requires proving safety, quality, and consistency. Agencies such as the FDA evaluate comprehensive CMC (Chemistry, Manufacturing, and Controls) data to ensure the media meets standards and poses minimal risk in therapeutic applications.

iotaSciences introduced the Single-Cell Cloning Platform XT, an enhanced version of its original system with proprietary fluid-shaping technology. The platform automates single-cell isolation, culture, and transfer to 96-well plates, offering higher throughput and documented monoclonality via the new SCAI technology. Expanding its use from stem cell and gene editing research, it now supports cell line and reporter line development. Dr. Feuerborn noted it delivers reliable, high-quality monoclonal cultures, while CEO Dr. Lutz highlighted its role in advancing single-cell biology and cell and gene therapy R&D.

By Product / Media Type

By Application / Process Stage

By Cell Type / Target Cell Line

By Formulation / Format

By End User

By Region

March 2026

February 2026

February 2026

February 2026