February 2026

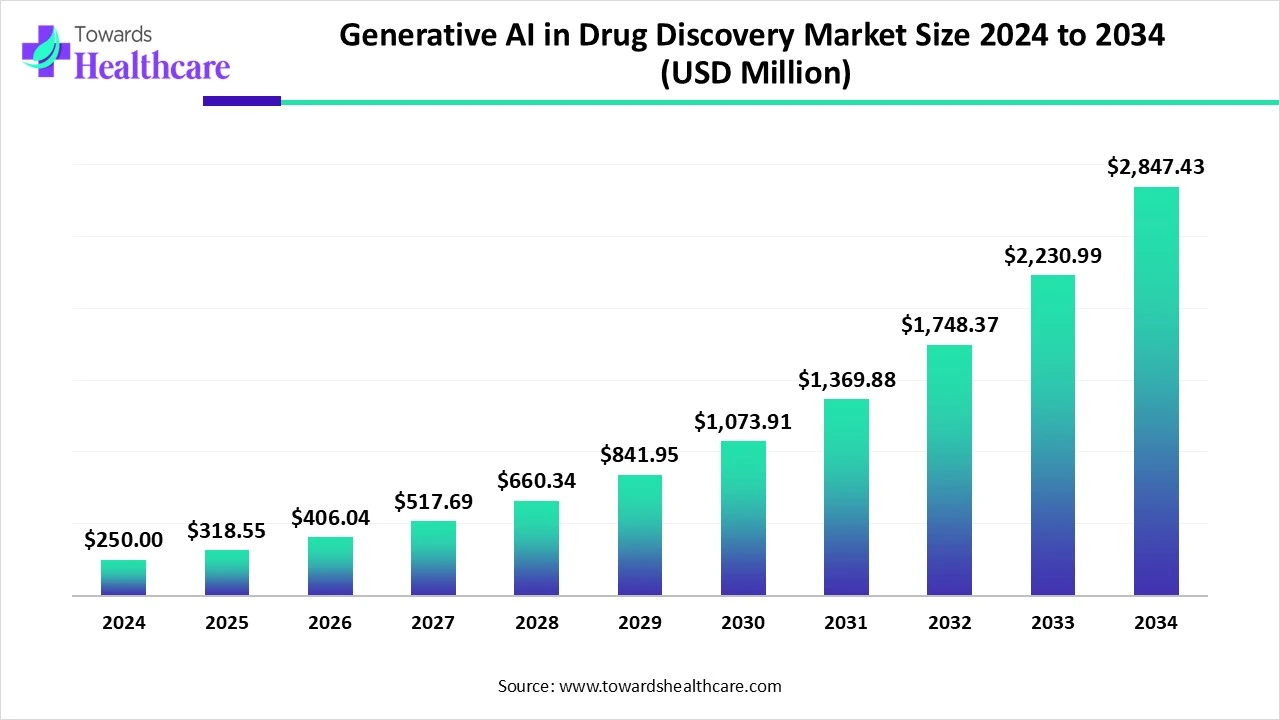

The global generative AI in drug discovery market size is calculated at US$ 250 in 2024, grew to US$ 318.55 million in 2025, and is projected to reach around US$ 2847.43 million by 2034. The market is expanding at a CAGR of 27.42% between 2025 and 2034.

The generative AI in drug discovery market is growing significantly due to several reasons. One of the most prominent reasons is GenAI’s usefulness in drug discovery. It reduces time, cost, and effort in drug discovery. Pharma& biotech companies, along with research institutions, are implementing GenAI in drug discovery in order to fulfill the growing demand for novel drugs. The rising demand is being prevented due to the growing cancer cases, growing chronic conditions, and the need for personalized medicines for better treatment.

| Metric | Details |

| Market Size in 2025 | USD 318.55 Million |

| Projected Market Size in 2034 | USD 2847.43 Million |

| CAGR (2025 - 2034) | 27.42% |

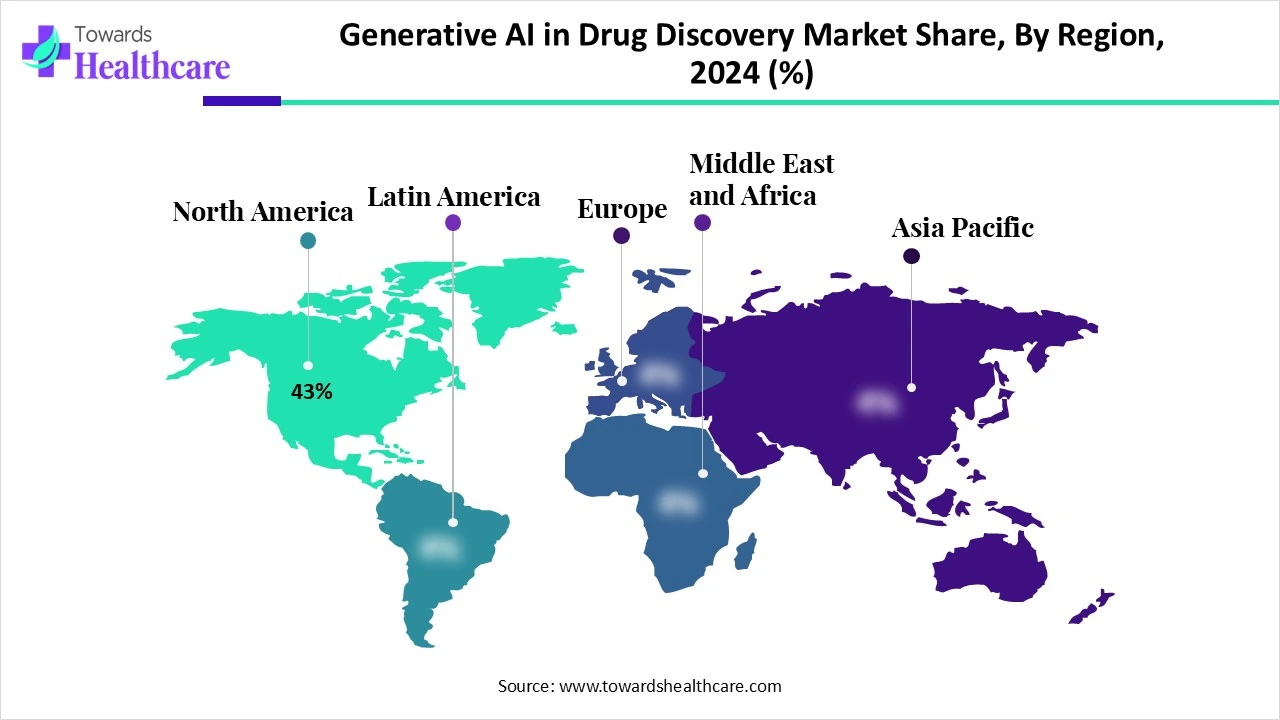

| Leading Region | North America share by 43% |

| Market Segmentation | By Application, By Therapeutic Area, By Deployment Mode, By Region |

| Top Key Players | Insilico Medicine, Exscientia, Atomwise, BenevolentAI, Absci, Cyclica (Recursion), XtalPi, Valo Health, Deep Genomics, Healx |

Generative AI in drug discovery refers to the use of artificial intelligence models-especially generative models like Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and Transformer-based architectures-to design, screen, and optimize novel drug candidates. These AI systems generate molecular structures, predict biological activity, synthesize compound properties, and even suggest formulation pathways with unprecedented speed and accuracy, significantly reducing the drug development cycle and costs.

Rising Funding by Governments

Both the public and private sectors are investing a lot of money in AI for application in healthcare and drug development. These expenditures are boosting innovation, R&D efforts, and the use of AI in drug development, all of which are greatly accelerating market growth.

Data Privacy Concerns

The employment of generative AI in drug discovery market is hampered by the ongoing concerns about data security and privacy, especially when managing sensitive patient data. For the use of GenAI in healthcare, enormous volumes of clinical, genomic, and patient data must be accessed, which raises questions about the confidentiality of private health information.

Rising Collaborations & Partnerships

The growing number of cross-industry partnerships and collaborations has a major impact on the market's growth. These collaborations foster innovation, accelerate research, and boost drug development efforts by pooling resources, technology, and expertise from several sectors. Stakeholders from a variety of industries, including technology, healthcare, academia, and pharmaceuticals, may pool their expertise and perspectives through cross-industry collaborations.

By application, the hit generation & lead discovery segment dominated the generative AI in drug discovery market in 2024. AI is changing the drug discovery process from hits to leads. While traditional screening methods can be slow, costly, and ineffective, AI-driven virtual screening and advanced analytics can help pharmaceutical companies spot promising compounds quickly, optimize leads, and speed up life-saving treatments.

By application, the clinical trial design & optimization segment is anticipated to be the fastest-growing during the predicted timeframe. Clinical development comprises several interrelated, overlapping processes, each of which contributes to trial success to varying degrees and is prepared for transformation by genAI. Trial sponsors may utilize genAI to evaluate real-time empirical evidence, operational data, and disease prevalence in order to estimate recruitment potential, improve site selection, and ensure that sites have the necessary resources and tools to conduct trials successfully.

By therapeutic area, the oncology segment held the largest share of the generative AI in drug discovery market in 2024. The intersection of generative AI and oncology is an intriguing new field for ground-breaking advancements in cancer research and patient care. By making it possible to analyze vast volumes of biological data, anticipate molecular interactions, and optimize medication development with unprecedented precision, artificial intelligence (AI) dramatically saves time and money.

By therapeutic area, the neurological disorders segment is anticipated to grow at the fastest CAGR during 2025-2034. More than 1000 conditions are classified as neurological illnesses, which makes it very challenging to create new medications. There would be 4.9 billion cases of mental disorders by 2050, a 22% increase above 2021 projections. Additionally, it is anticipated that the global all-age DALY rate of brain disorders would rise by 10% between 2021 and 2050, from 5,139 DALYs per 100,000 to 5,666 DALYs per 100,000. Generative AI will thus be essential to drug research in order to handle the growing number of cases.

By technology, the deep learning (DL) segment led the generative AI in drug discovery market revenue in 2024. As deep learning (DL) technology advances and drug-related data grows, DL-based approaches are gaining popularity across all stages of drug research. To identify drug targets and drug–target interactions, DL technologies such as DeepCPI, DeepDTA, WideDTA, PADME DeepAffinity, and DeepPocket are employed in drug discovery.

By technology, the reinforcement learning (RL) segment is estimated to grow at the fastest CAGR during the upcoming period. In recent years, the approach of reinforcement learning (RL) has gained popularity in drug design due to its ability to recommend and optimize molecules with desirable properties. The decision-making process of a molecule may be altered by RL algorithms to achieve certain chemical features, resulting in novel molecules with desired properties.

By deployment, the cloud-based segment dominated the generative AI in drug discovery market in 2024 and is expected to grow at the highest rate during the forecast period. The size and complexity of potential drug-target interactions, the amount of calculations and models that must be done, the benefits of having software-based discovery engines that are always available and accessible to all stakeholders, and the capacity to integrate discovery results with a range of software-based statistical, modeling, and documentation tools are the primary factors that make cloud computing appealing for drug discovery.

By end-user, the pharmaceutical companies segment led the generative AI in drug discovery market in 2024. Pharmaceutical companies, of course, have long been at the forefront of artificial intelligence. It is the responsibility of pharmaceutical companies to develop new drugs as soon as possible. This might be accomplished with GenAI. GenAI can help pharmaceutical companies address "asset lifecycle compression," which refers to the reduction in the time it takes to realize the value of a new medicine.

By end-user, the biotechnology companies segment is expected to grow at the fastest CAGR during the forecast period. Biotech AI firms are using AI to find new biomarkers, enhance clinical trial results, and optimize protein design. AI adoption is not only an improvement but a fundamental change in the way biotechnology functions, increasing the accuracy, scalability, and efficiency of procedures.

North America dominated the generative AI in drug discovery market share by 43% in 2024. Fueled by large expenditures in medical technology and solid partnerships between tech behemoths and pharmaceutical corporations. Innovation is also encouraged by the region's esteemed research institutes and an encouraging regulatory framework. AI is being used by businesses more and more to speed up the release of novel treatments onto the market, save expenses, and simplify drug research procedures.

The U.S. pharmaceutical industry develops a substantial number of new drugs with significant health benefits each year. To ensure the long-term supply of antimicrobial medicines, the U.S. Government funds research, product development, and appropriate use through various programs. Opportunities still exist to support the long-term sustainable development of antimicrobial drugs and provide adequate access to them both domestically and globally, notwithstanding the emergence of antimicrobial resistance.

Health Canada's 2025–2026 Departmental Plan, which details the Department's main objectives for the upcoming year, was just released by the Canadian government. A three-year commitment of up to $1.5 billion was also made by the Canadian government in March 2023 to finance the first-ever National Strategy for Drugs for Rare Diseases.

Asia Pacific is estimated to host the fastest-growing generative AI in drug discovery market during the forecast period. Both the expanding pharmaceutical sector and the rising incidence of cancer are to blame for the regional development. A big patient population, rising healthcare costs, and a growing need for novel treatments are some of the drivers driving the region's fast-growing pharmaceutical business. In order to solve unmet medical needs in the area and speed up the creation of new medications, generative AI is being used in drug research.

China's pharmaceutical policies are constantly being changed, although the country's drug laws quickly caught up to international standards. The 204 recommendations published by the Center for Drug Evaluation since 2020 provide comprehensive guidance for the development of novel drugs, especially for priority diseases and drugs. Because Chinese companies are more focused on developing innovative drugs, 30 Chinese-made medicines were approved in 2023, accounting for 37% of all new pharmaceuticals approved in China.

The government's ingenious initiatives are the cornerstone of this achievement. The Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) operates 15,479 Jan Aushadhi Kendras and offers generic drugs at up to 80% less than the cost of name-brand ones. A heart medicine that used to cost ₹500 can now cost as little as ₹100. The Production Linked Incentive (PLI) Scheme for Pharmaceuticals provides ₹15,000 crore to 55 projects developing luxury drugs, such as therapies for cancer and diabetes, in India.

Europe is expected to grow significantly in the generative AI in drug discovery market during the forecast period. As precision medicine becomes increasingly important, the biotechnology industry is booming, and more AI-enabled technologies are being utilized to expedite the drug development process. Europe is a market leader in this field due to its robust research infrastructure and laws that support the use of AI in drug development. The most well-known large companies, such as Insilico Medicine, Owkin, Iktos, Deep Genomics Inc., and Atomwise, are setting the benchmark for the advancement and application of AI in drug discovery by focusing on specific therapeutic areas.

The German government published its National Pharma Strategy in an attempt to counteract this trend. In an effort to revitalize the country's pharmaceutical industry, it signaled a shift in how lawmakers viewed clinical research and drug development challenges. Under the new rules, Germany is likely to be given greater consideration when designing trials. Biopharma may entrust CROs with the task of "ring-fencing" a section of the patient recruitment for Germany so that the sponsor may benefit from the relaxed pricing rules.

By cutting drug research and discovery expenses by up to £100 billion, the new OpenBind partnership will establish the UK as a pioneer in AI-driven drug discovery. Researchers will be able to open up new avenues in the fight against disease thanks to the training of new AI models that can recognize promising new drugs. Along with igniting the innovation and economic growth that form the foundation of the government's Plan for Change, it will also assist in cutting development costs by up to £100 billion.

The Middle East & Africa are expected to grow at a notable CAGR in the generative AI in drug discovery market in the foreseeable future. The rising adoption of advanced technologies and the growing demand for personalized medicines boost the market. Government organizations launch initiatives to promote the use of AI and digital tools for drug discovery. The increasing investments and collaborations among key players contribute to market growth. The region has a suitable infrastructure for startups, providing advanced solutions to pharma & biotech companies.

In May 2024, Insilico Medicine developed the world’s first fully AI-generated drug to treat a deadly lung disease, idiopathic pulmonary fibrosis. The company has over 30 AI-designed drugs in its pipeline. As of mid-2024, there were more than 400 AI-based companies registered in Abu Dhabi alone, marking a 41.3% year-on-year growth in the sector.

The Saudi Arabian government’s GenAI strategy fosters innovation, economic growth, and transforms industries as part of Vision 2030. The government makes constant efforts to integrate genAI capabilities into various fields, strengthening companies’ capitalization on its transformative potential.

In March 2024, according to David M. Reese, executive vice president and chief technology officer of Amgen, generative AI is revolutionizing drug discovery by enabling us to create complex models and seamlessly integrate AI into the antibody design process. To develop the next generation of medications that will benefit patients the most, our team is utilizing this technology. (Source - Nvidia news)

By Application

By Therapeutic Area

By Technology

By Deployment Mode

By End User

By Region

February 2026

February 2026

February 2026

February 2026