November 2025

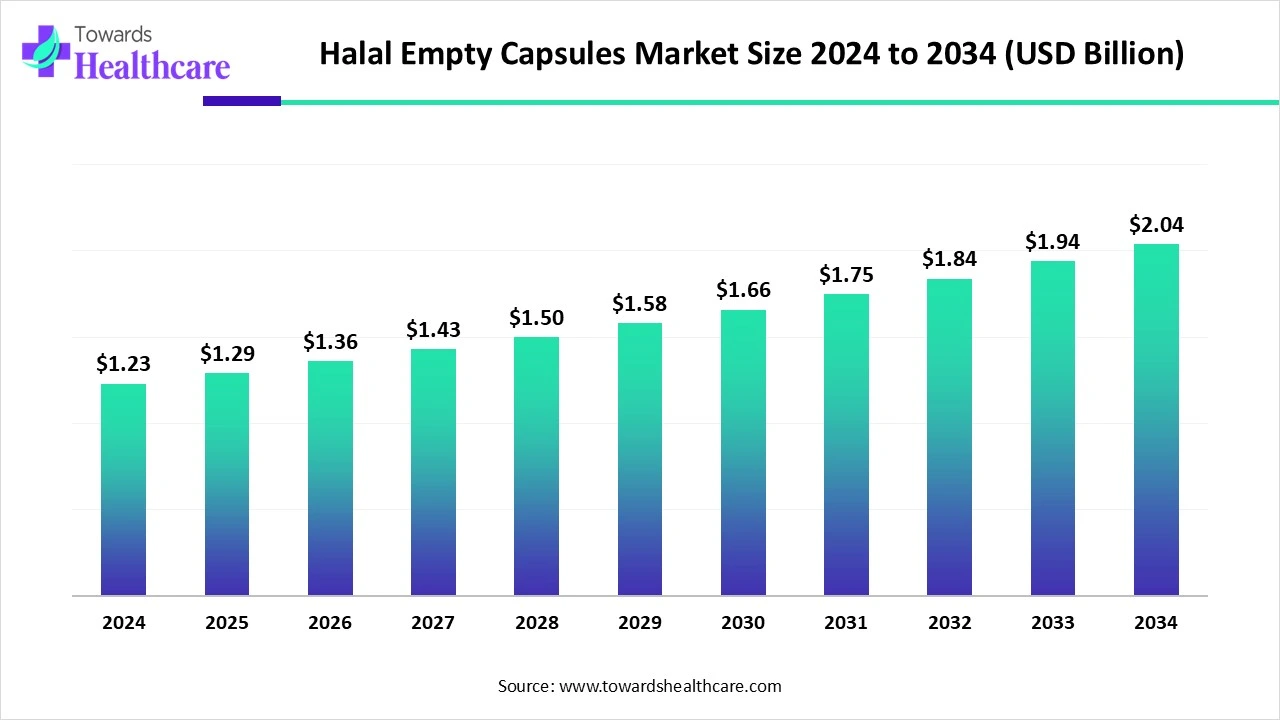

The global empty capsules market size touched US$ 1.23 billion in 2024, with expectations of climbing to US$ 1.29 billion in 2025 and hitting US$ 2.04 billion by 2034, driven by a CAGR of 5.35% over the forecast period.

The halal empty capsules market is witnessing strong growth driven by increasing demand for Sharia-compliant pharmaceutical and nutraceutical products. Rising Muslim populations, particularly in Asia-Pacific and the Middle East, along with growing awareness of halal certification in healthcare, are fueling adoption. Pharmaceutical and supplement manufacturers are increasingly shifting toward gelatin and non-gelatin halal-certified capsules to meet consumer preferences. Additionally, supportive regulatory frameworks and expanding halal certification bodies worldwide are boosting market expansion, positioning halal empty capsules as a rapidly emerging segment.

| Table | Scope |

| Market Size in 2025 | USD 1.29 Billion |

| Projected Market Size in 2034 | USD 2.04 Billion |

| CAGR (2025 - 2034) | 5.35% |

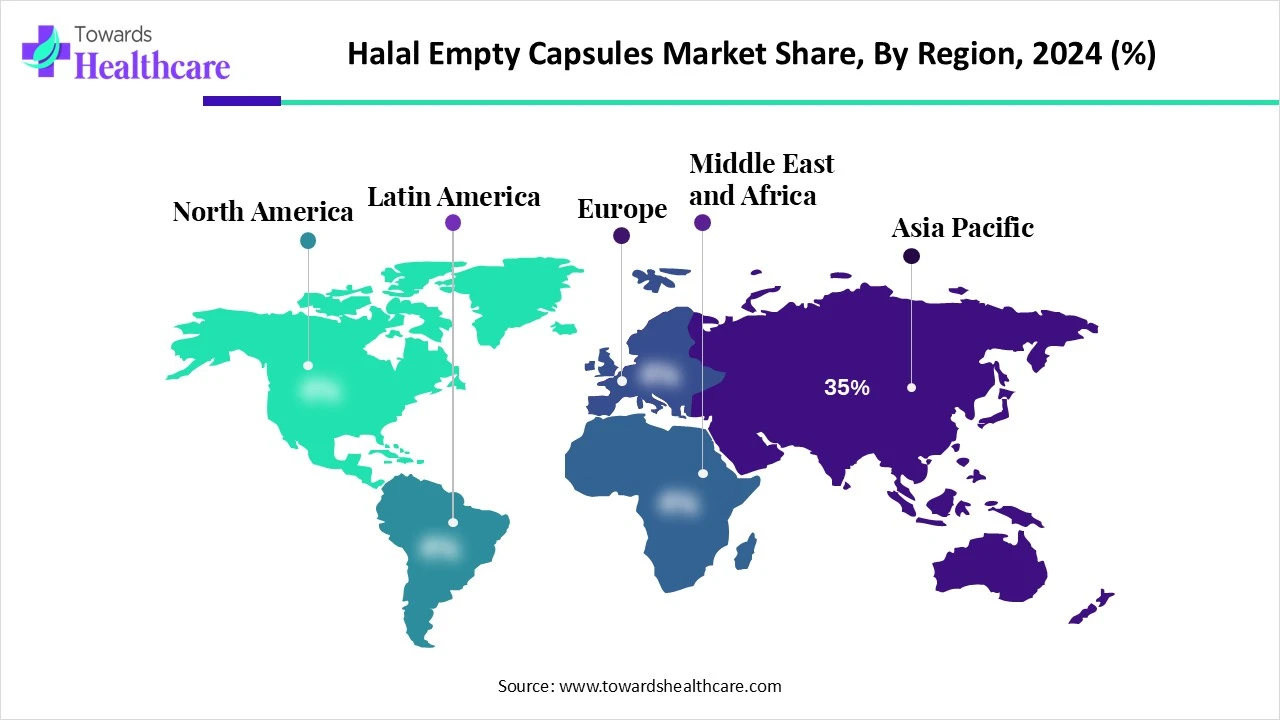

| Leading Region | Asia Pacific Share 35% |

| Market Segmentation | By Product Type, By Formulation, By Application, By End User, By Distribution Channel, By Region |

| Top Key Player | ACG Capsules, Capsugel (Lonza Group), Qualicaps, Suheung Co., Ltd., Parikh Packaging Pvt. Ltd., CapsCanada, Tianjin Zhongxin Pharmaceutical Group, FMT Co., Ltd., Sunil Healthcare, Vegcaps India Pvt. Ltd., Neocaps India Pvt. Ltd., Kerry Group, Rottendorf Pharma GmbH, BioCaps International, Nova Caps, Pharmatrans Sanaq, Capsugel Nutraceuticals, Hanil Capsule Co., Ltd., Lianhua Capsule Co., Ltd., Soft Gel Technologies |

Halal empty capsules are pharmaceutical and nutraceutical capsules manufactured according to Islamic dietary laws, ensuring no use of non-Halal animal-derived ingredients such as pork gelatin. They are widely used in dietary supplements, OTC products, and prescription medications. These capsules can be made from plant-based alternatives like HPMC (hydroxypropyl methylcellulose), pullulan, or other Halal-certified polymers, catering to growing demand from Muslim populations and consumers seeking ethically compliant products globally. The halal capsules market is evolving due to rising demand for halal-certified pharmaceutical and nutraceutical products. Growing health awareness, dietary restrictions, and preferences for ethical clean-label products are driving adoption. Manufacturers are increasingly focusing on plant-based and gelatin-free capsules to meet halal standards. Expanding global trade, supportive regulations, and innovations in capsule technology are further fueling market growth and diversification.

Plant-Based Alternatives: Demand for vegetarian and gelatin-free capsules supports halal compliance and appeals to wider consumers.

Technological Advancements: Innovations in capsule design, filling, and packaging ensure efficiency and quality.

AI can significantly impact the market by streamlining production processes, ensuring compliance with halal certification standards, and enhancing quality control through real-time monitoring. It can optimize supply chain management, reduce waste, and improve efficiency in raw material sourcing. AI-driven analytics also help manufacturers predict market trends, consumer preferences, and regional demand, enabling better decision-making. Additionally, AI supports transparency and traceability, which are crucial for maintaining consumer trust in halal-certified pharmaceutical and nutraceutical products.

Rising Global Demand for Halal-certified and Plant-based Products

The growing preference for halal-certified and plant-based products is boosting the halal empty capsules market as consumers seek safer, ethical, and religious-compliant alternatives. This trend encourages manufacturers to develop vegetarian and non-gelatin capsules, especially for nutraceuticals and pharmaceutical applications. Increasing awareness of product transparency, quality, and adherence to halal standards drives industry investment in production expansion and technological improvements, ultimately supporting wider adoption and sustained market growth globally.

High Production Cost

Elevated manufacturing expenses restrict the growth of the halal empty capsules market because producing halal-compliant capsules requires specialized materials and processes. Ensuring adherence to rigorous certification and quality standards adds operational costs, while advanced production technologies may be necessary to maintain consistency and scalability. These financial burdens can discourage new entrants, limit large-scale expansion, and affect pricing competitiveness, ultimately slowing market penetration despite increasing demand for plant-based and ethically produced capsules.

Advancements in Plant-based and Sustainable Capsule Technologies

The development of plant-based and sustainable capsule technologies offers a promising future for the halal empty capsules market, as consumers increasingly seek products that are both halal-compliant and environmentally responsible. These innovations allow manufacturers to produce biodegradable and vegetarian capsules, reduce reliance on animal-derived ingredients, and expand into health-focused sectors like nutraceuticals and functional foods. Leveraging such technologies can help companies capture new markets, enhance brand reputation, and stay ahead amid rising demand for ethical and sustainable healthcare solutions.

The HPMC capsules segment dominated the market because it offers a reliable, plant-based alternative to gelatin capsules, meeting halal and vegetarian requirements. Its chemical stability, low moisture absorption, and compatibility with a wide range of pharmaceuticals and nutraceuticals make it highly versatile. Manufacturers favor HPMC capsules for their ability to maintain product integrity and deliver consistent performance, driving widespread adoption and resulting in the highest revenue share within the halal empty capsule market.

The pullulan capsules segment is set to grow rapidly in the halal empty capsules market owing to its non-animal, plant-derived nature and strong protective properties for active ingredients. Its resistance to moisture and oxygen, along with biodegradability, makes it ideal for sensitive pharmaceutical and nutraceutical products. Rising awareness of halal, vegan, and sustainable options is encouraging manufacturers to adopt pullulan capsules, driving their increasing use and positioning the market.

The dry powder capsules segment led the market in 2024 due to its versatility and widespread use in pharmaceuticals and nutraceuticals. These capsules efficiently deliver a precise dosage of active ingredients, maintain stability, and have a longer shelf life compared to liquid or semi-solid forms. Their compatibility with plant-based, halal-certified materials like HPMC further boosts adoption. Strong demand for dietary supplements, vitamins, and herbal formulations contributed to their high revenue share, making dry powder capsules the preferred choice for manufacturers and consumers alike.

The liquid fill capsules segment is projected to grow fastest in the halal empty capsules market because it allows efficient delivery of oils, vitamins, and other liquid nutrients with enhanced bioavailability. These capsules offer precise dosing, better absorption, and improved stability for sensitive active ingredients. Increasing consumers' preference for liquid supplements and functional nutraceuticals, along with demand for halal-certified, plant-based formulations, is driving manufacturers to adopt liquid-filled capsules. Their versatility across pharmaceutical and nutraceutical applications supports rapid market expansion.

The nutraceuticals segment dominated the market in 2024 due to growing consumer focus on health, wellness, and preventive care. Rising demand for dietary supplements, vitamins, herbal products, and functional foods has driven manufacturers to use halal-certified capsules to ensure compliance and appeal to Muslim consumers. HPMC and other plant-based capsules offer stability and compatibility with nutraceutical ingredients, supporting product efficacy. This combination of health-conscious trends and halal compliance contributed to the nutraceutical segment capturing the highest market share.

The functional foods segment is poised for rapid growth I the halal empty capsule market because it enables the incorporation of bioactive ingredients, minerals, and supplements into convenient, halal-compliant formats. Increasing consumers' interest in boosting immunity, digestion, and overall wellness through fortified foods is fueling demand. Manufacturers are leveraging plant-based and vegetarian capsules to meet ethical and dietary requirements, making functional foods an attractive application area and contributing to their accelerated adoption in the global halal capsules market.

In 2024, the pharmaceutical companies segment dominated the market because they require reliable, high-quality capsules for a wide range of medications, including sensitive and specialty drugs. Halal-compliant and plant-based options such as HPMC capsules ensure adherence to ethical and regulatory standards while appealing to health-conscious and Muslim consumers. Their ability to maintain drug stability ensures accurate dosing and support large-scale production has driven widespread adoption, securing the pharmaceutical segment the largest revenue share in the market.

The hospitals & clinics segment is projected to grow fastest in the halal empty capsules market as healthcare providers increasingly adopt capsules for patient-specific treatments, including vitamins, supplements, and prescription medications. Halal-compliant, plant-based capsules ensure adherence to dietary and ethical standards, particularly in regions with significant Muslim populations. Their ease of administration, precise dosing, and compatibility with various active ingredients make them ideal for clinical use, driving higher adoption rates and contributing to rapid market growth in this segment.

In 2024, the direct sales segment led the market because it allows manufacturers to engage directly with pharmaceutical, nutraceutical, and functional food companies, ensuring product quality and compliance with halal standards. This approach minimizes intermediaries, reduces distribution costs, and enables faster delivery and bulk supply. Direct interaction also allows manufacturers to offer customized solutions, maintain strong client relationships, and respond quickly to market demand, making direct sales the most revenue-generating and preferred distribution channel in the market.

The online sales segment is projected to expand rapidly in the halal empty capsules market due to the increasing reliance on digital platforms for purchasing and sourcing products. Consumers and businesses can easily access a wide range of halal-certified capsules, verify certifications, and place bulk or customized orders online. The convenience, wider reach, and time-saving nature of e-commerce, combined with growing awareness of plant-based and ethical capsules, are driving faster adoption and making online channels a key growth area in the market.

Asia-Pacific dominated the market share by 35% in 2024 due to its large Muslim population, rising health awareness, and growing demand for dietary supplements and nutraceuticals. The region’s pharmaceutical and nutraceutical industries are rapidly expanding, with manufacturers increasingly adopting halal-certified, plant-based capsules like HPMC to meet consumer preferences. Strong regulatory support for halal products, coupled with increasing investments in manufacturing facilities and technological advancements, has strengthened production capabilities, enabling the region to capture the highest revenue share in the global halal empty capsule market.

The Chinese market is growing due to rising consumer awareness of health, wellness, and dietary compliance, particularly among the Muslim population. Increasing demand for plant-based, halal-certified nutraceuticals and pharmaceuticals drives manufacturers to adopt HPMC and other vegetarian capsules. Additionally, government support for halal certification, expanding production facilities, and advancements in capsule technology contribute to market growth, enabling China to become a key player in the global halal empty capsules industry.

The Indian market is expanding due to rising health consciousness and increasing demand for halal-certified, plant-based nutraceuticals and pharmaceuticals. A growing population of Muslim consumers, coupled with awareness of ethical and dietary compliance, is driving adoption. Manufacturers are investing in HPMC and other vegetarian capsule production, while supportive regulations and advancements in capsule technology further boost the market, positioning India as a significant contributor to the global halal empty capsules industry.

North America is expected to register the fastest growth in the market due to increasing consumer demand for halal-certified and plant-based dietary supplements, nutraceuticals, and pharmaceuticals. Rising health awareness, ethical consumption trends, and a growing Muslim population drive adoption. Additionally, advanced manufacturing infrastructure, strong regulatory support for halal compliance, and investment in research and development of vegetarian and non-gelatin capsules enable manufacturers to expand production, meet market demand, and capitalize on emerging opportunities in the region.

Halal empty capsules are neutral shells, usually made from gelatin or plant-based HPMC, used to enclose pharmaceutical, nutraceutical, or dietary supplement ingredients. Research and development in this field aim to ensure halal compliance, maintain product quality and stability, and explore new materials and manufacturing methods for improved performance and innovation.

Key Players: Natural Capsules Limited, CapsCanada, Roxlor Group

Halal empty capsules are mainly made from gelatin sourced from halal-certified materials, combined with water, plasticizers, and occasionally colorants or opacifiers, ensuring compliance with dietary and religious standards.

Key Players: Sunil Healthcare, HealthCaps India

Halal empty capsules are medication shells that comply with Islamic dietary laws, avoiding any haram ingredients such as certain animal byproducts or forbidden processing agents. They are specifically preferred by Muslim patients who want to ensure their medications align with religious dietary requirements.

Key Players: Lonza, ACG, Qualicaps

In May 2024, Roquette, a global leader in plant-based ingredients and pharmaceutical excipients, launched LYCAGEL® Flex, a hydroxypropyl pea starch premix for nutraceutical and pharmaceutical softgel capsules. Built on their pioneering LYCAGEL® technology, this plasticizer-free excipient allows manufacturers to customize plasticizer combinations and formulations while ensuring high quality, stability, and performance. Steve Amoussou-Guenou, Technical Developer Manager Europe at Roquette, stated that LYCAGEL® Flex provides softgel producers the flexibility to tailor vegan capsules without compromising stability, offering a versatile alternative to gelatin-based products.

By Product Type

By Formulation

By Application

By End User

By Distribution Channel

By Region

November 2025

November 2025

November 2025

November 2025