February 2026

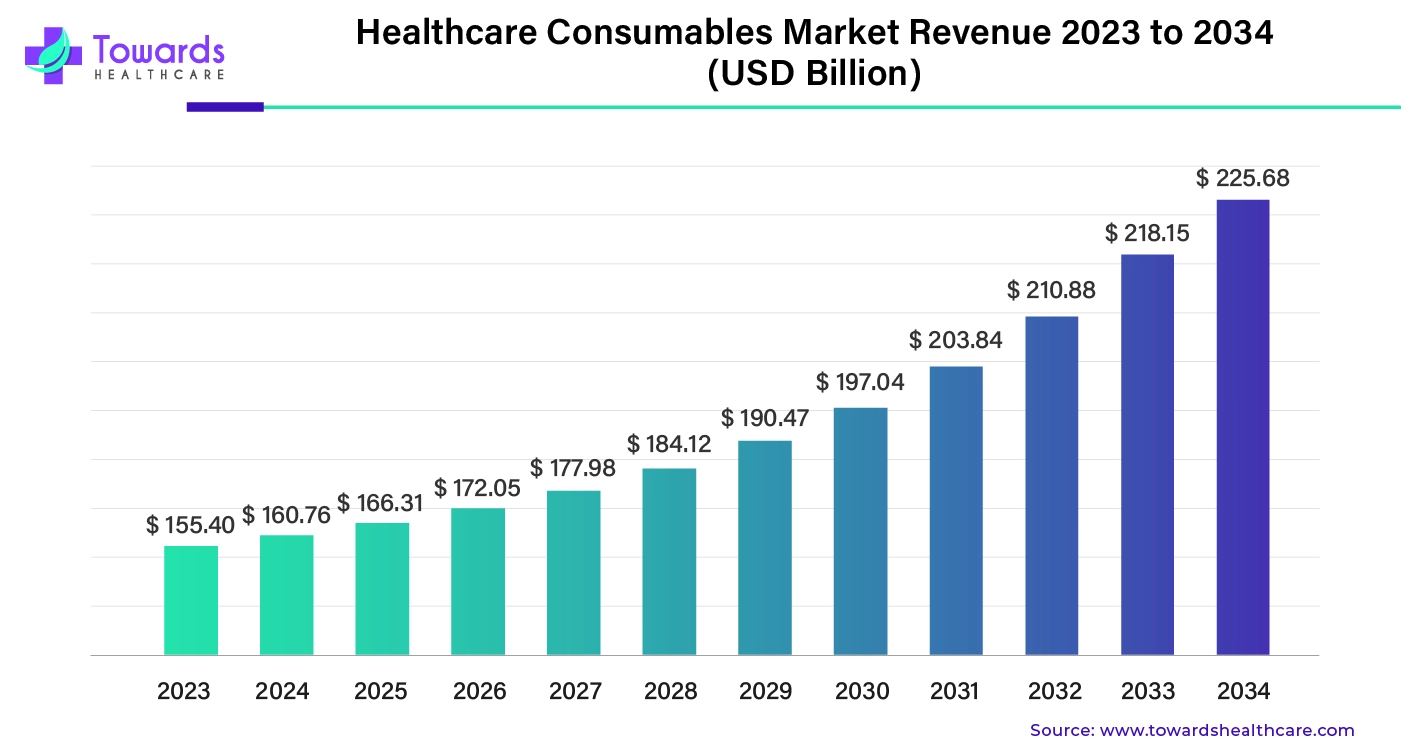

The global healthcare consumables market was estimated at US$ 155.40 billion in 2023 and is projected to grow to US$ 225.68 billion by 2034, rising at a compound annual growth rate (CAGR) of 3.45% from 2024 to 2034.

Healthcare consumables are in constant demand as they are needed in all healthcare facilities, including hospitals, clinical laboratories, ambulatory surgical centers, and others. Other factors that contribute to the market’s growth are the growing prevalence of diseases and the elderly population.

Healthcare consumables are an essential part of diagnosis, treatment, and monitoring of patient health. Healthcare consumables can be found in clinics, wards, operating rooms, and also in homes. Healthcare consumables include bandages, medications, syringes, medical gloves, marks, needles, IV kits, PPE, surgical tools, and many more products. The healthcare consumables market serves the purpose of manufacturing and delivering consumables to all healthcare facilities. Most of the consumables are single-use products, and hence, the supply of such products is continuously needed, which is why the market is in huge demand. Another factor that contributes to the market’s growth is that apart from common consumables, there are specialized consumables needed for the diagnosis and treatment of different diseases.

Artificial intelligence (AI) can be used during the supply chain management of healthcare consumables. AI can be used in raw material gathering, manufacturing, post-production, and transportation. AI can use data from production lines and can accurately suggest buying more raw materials. During production, AI can monitor the production, any issues associated with the production line, and the wear and tear of machinery. Based on data analysis, AI can suggest solutions for time management and enhancing production and supply. AI can also be used to transport the products by real-time tracking and monitoring inventories and warehouses. AI can also be useful in demand-driven optimization of distribution and inventory, which can minimize transportation costs and resource wastage.

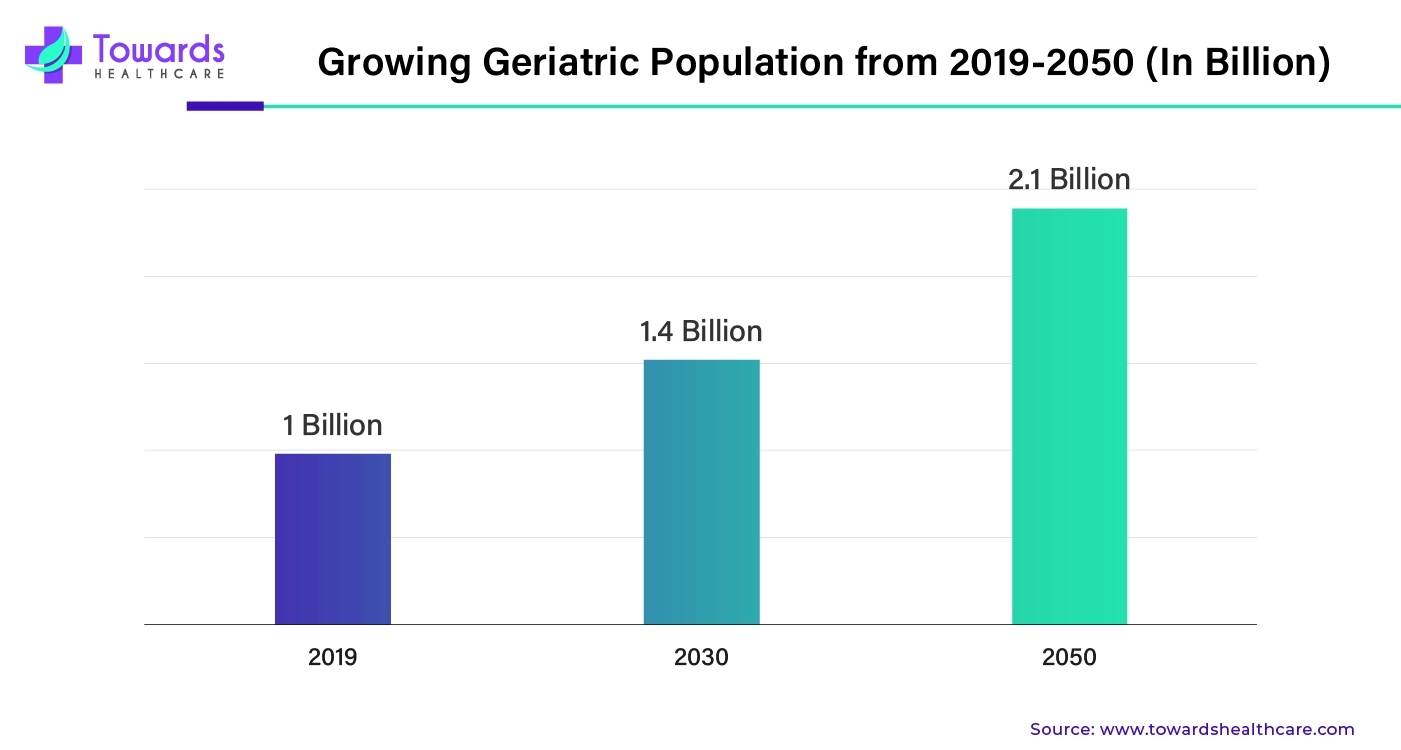

In old age, people are prone to age-related health issues, including hearing loss, neck and back pain, dementia, COPD, and others. Elderly people are prone to various chronic conditions. Many elderly people have more than one chronic condition. Therefore, the elderly population is more prone to hospital visits, hospital admissions, surgeries, home care, and health monitoring, which are subjected to the utilization of healthcare consumables. Another factor that contributes to the demand for healthcare consumables is that old people need continuous health monitoring and treatment because their bodies and immune systems are not strong enough to tackle the health issues naturally.

The majority of healthcare consumables are single-use products, which majorly include syringes, bandages, masks, hand gloves, etc. Apart from being single-use, the products are made of plastic. All these single-use products after use are disposed of in the environment, leading to pollution. According to the UNDP, hospitals generate the largest amount of waste, 60%, followed by pharmaceutical industries (35%) and research labs (5%). Due to the contagious nature of medical waste, specialized disposal and waste management processes are used, which increases the cost of the waste management process. Apart from this, poor handling of medical waste can lead to serious health issues; therefore, special training is provided for disposing and handling healthcare waste, which increases the cost even more.

With the growing healthcare demand and the pollution associated with it also growing, sustainability and eco-friendly practices are the new ways for the healthcare consumables market to grow in the future. Sustainable practices such as recycling, waste-to-energy conversion, and proper sterilization can reduce the negative impact on the environment. Another solution is the use of biodegradable materials for making products and packaging them. To reduce the carbon footprint of healthcare consumables, reusable products can be produced instead of single-use products. They not only require less material and energy but also create less waste.

By product, the sterilization consumables segment captured the dominant share of the market. This segment dominated because sterilization consumables are the most important part of ensuring patient safety. Sterilization consumables include sterilization products, biological indicators, chemical indicators, cleaning indicators, cleaning brushes, accessories, filters, etc. Some consumables are reusable, and some are single-use products. If the sterilization process is ignored or not done properly, the patient can get into life-threatening situations. Apart from hospitals, sterilization consumables are also used in the pharmaceutical & biotechnology industry, research laboratories, test labs, and clinics, which causes the high demand and domination of the segment in the market.

For instance,

By product, the hands sanitizer segment is expected to be the most opportunistic segment in the healthcare consumables market in the predicted years. Poor hand hygiene is responsible for 20% of hospital-acquired infections (HAIs), and the U.S. healthcare system spends US$ 45 billion cost, or US$ 45,00 per bed per year due to HAIs. Therefore, hand sanitizers are continuously used in hospitals and clinical to avoid the spread of infection, cross-contamination, and patient safety. Hand sanitizer is used before attending patients, before and during surgeries, while using different equipment, during the sterilization process, during lab tests, and so on. The major contributor to the growth of hand sanitizer usage is the growing number of surgeries due to the growing number of accidents, chronic conditions, and cancer cases.

For instance,

| List of Plastic Resin Used in Healthcare Consumables | |

| Desired Property of Resin | Name |

| Strength | Polycarbonate (PC) |

| Acrylonitrile Butadiene Styrene (ABS) | |

| Polyethylene Terephthalate (PET) | |

| Flexibility | Polyvinyl Chloride (PVC) |

| Polyethylene (PE) | |

| Thermoplastic Elastomers (TPE) | |

| Rigidity | Polypropylene (PP) |

| Polystyrene (PS) | |

| Polyoxymethylene (POM) | |

| The list contains the names of various plastic resins used in the production of healthcare consumables and devices. Depending on their properties, different resins are used for different products and devices. | |

By raw materials, the plastic resin segment dominated the market. This segment dominated as plastic is a widely used material for the production of various healthcare consumables for single or multiple use. It is important to adhere to various regulatory regulations when choosing the right plastic resin, depending on the product type. Depending on the need, polyethylene is used for medical devices that require transparency & bending, and polycarbonate and ABS are used for strong and durable products.

For instance,

By raw materials, the non-woven segment is estimated to grow at the fastest rate in the healthcare consumables market during the predicted period. Non-woven material is extensively used in the healthcare industry for the protection against biological agents. Non-woven products are used to prevent infections and cross-contamination, which are essential for patient and staff safety. Non-woven material has a lot of advantages, which is why it is used for making various healthcare consumables. Products made using non-woven material include masks, gowns, shoe covers, caps, wipes, sponges, and so on.

For instance,

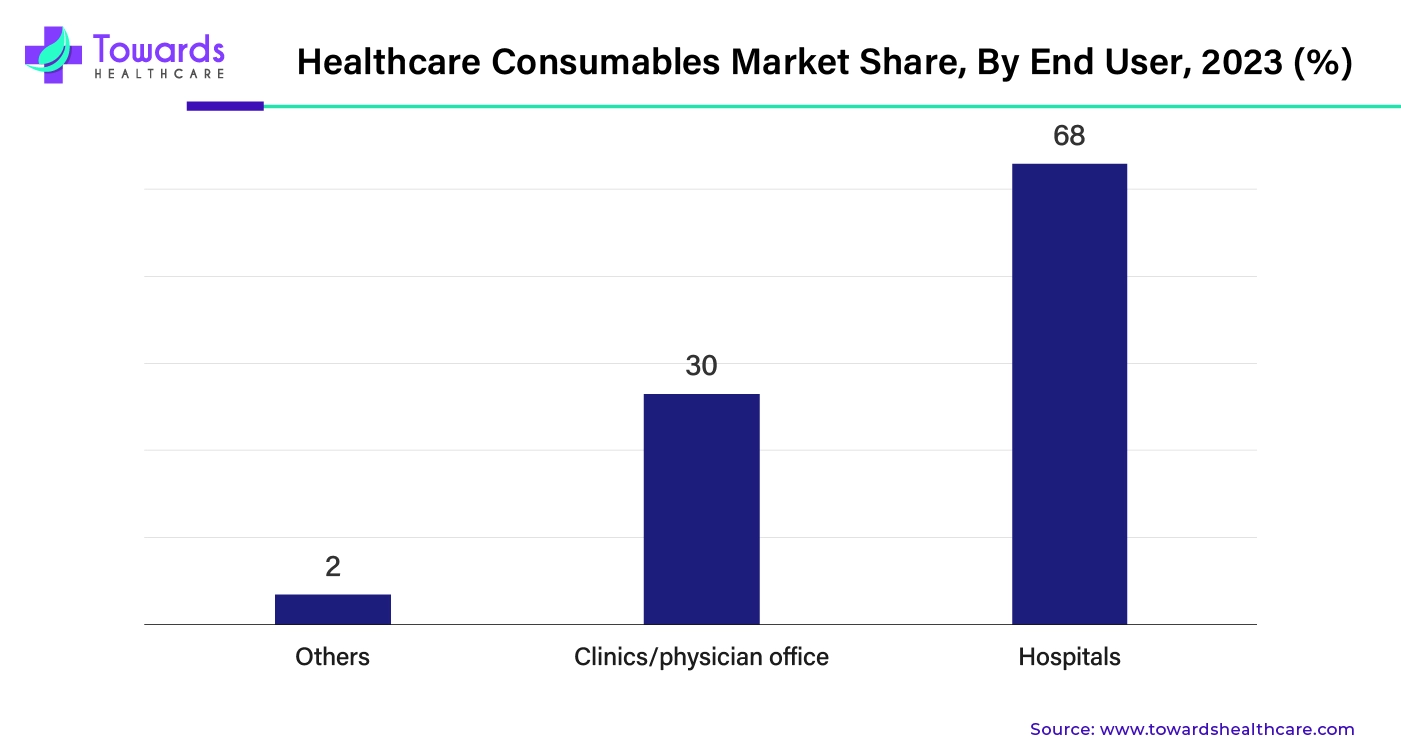

By end-user, the hospitals segment held the largest market share by 68%. This segment dominated because healthcare check-ups, hospital admissions, surgeries, chronic conditions, conducting tests, and patient treatments are all responsible for the growth of the segment. The majority of healthcare consumables are used in hospitals because most of the patients visit hospitals for diagnosis, treatment, monitoring, and post-treatment monitoring. According to the American Hospital Association, there were 31,555,807 community hospital admissions in 2022. With a growing number of communicable and non-communicable diseases, the demand for healthcare consumables in hospitals is growing to grow at a significant rate in the future.

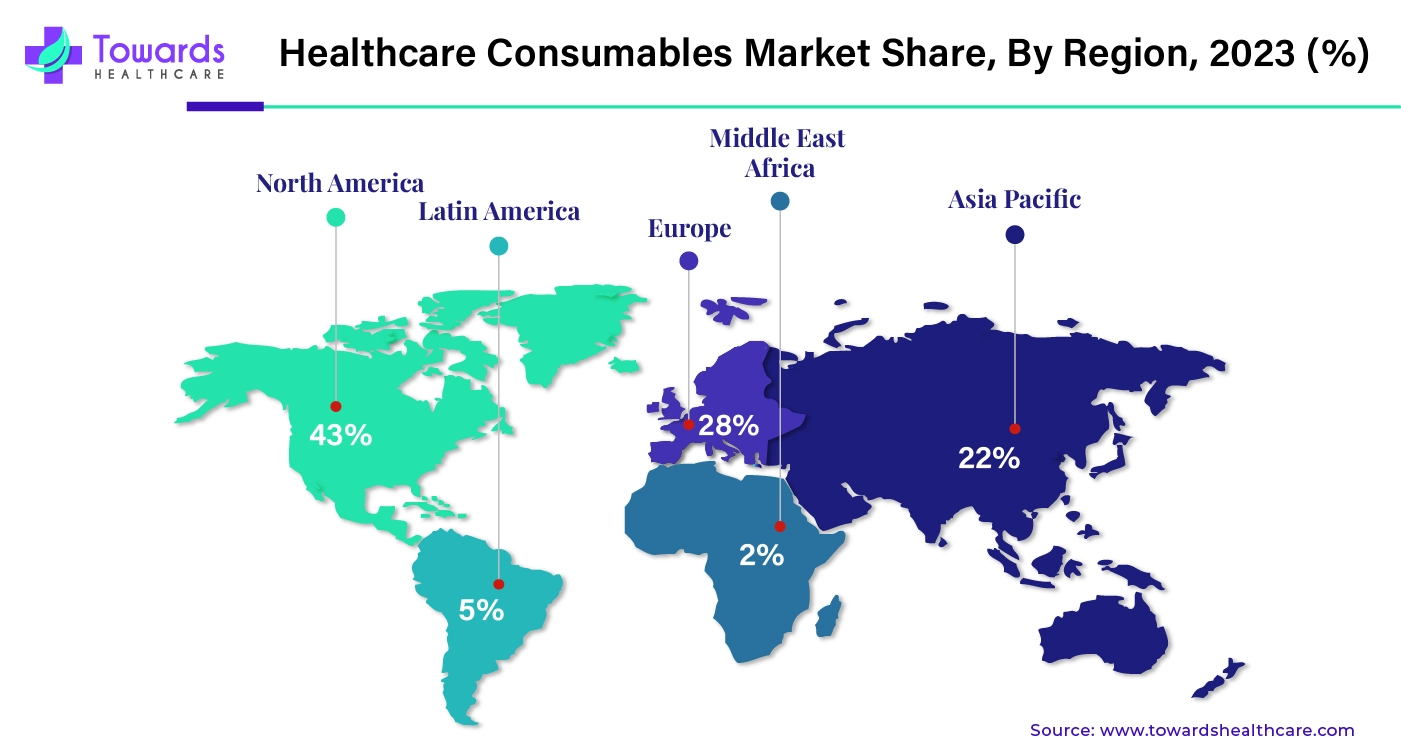

By region, North America dominated the healthcare consumables market share by 43% in 2023. North America has an advanced healthcare system that is responsible for providing high-quality care. High-quality care needs high-quality healthcare consumables, which are supplied in North America by the key market players. Government initiatives and strict regulatory compliance ensure that the consumables are of high quality and supplied with utmost safety. Continuous innovation and the need for better products drive the key player to conduct research and development.

The two major countries that contribute to the growth of the healthcare consumables market in North America are the U.S. and Canada. The U.S. held the largest share of the market due to the presence of a large healthcare network. There were 6,120 hospitals in the U.S. and 31,555,807 hospital admissions in 2022. There are regulatory bodies like the FDA and the American Hospital Association that provide guidelines for the production, transportation, and usage of healthcare consumables.

By region, Asia Pacific is expected to grow at the fastest rate during the forecast period. The healthcare consumables market is growing significantly in Asia Pacific, and India, China, Japan, and South Korea are the major contributors to the growth. There is a growing prevalence of chronic conditions and infections, due to which hospital admissions are increasing. Due to the largest population and growing geriatric population, the number of patients is increasing. Some of the major diseases include diabetes, cancer, and respiratory infections.

India is significantly contributing to the growth of the healthcare consumables market. India has the largest population, due to which the prevalence of diseases is increasing. Apart from this, government bodies and various companies are contributing to the market’s growth.

For instance,

Nnaemeka Ugwoke, General Manager of Uni-medical, commented on collaborating with Sysmex Corporation that the partnership is poised to redefine diagnostic healthcare in Nigeria. He further stated that both companies are ready to take on challenges ahead and deliver world-class solutions with innovations, commitment, and collaboration, benefiting healthcare professionals and patients. (Source: Business Day)

| Company Name | Surgical Holdings |

| Headquarters | Southend-On-Sea, Europe |

| Recent Development | In March 2024, Surgical Holdings, the award-winning British producer and repairer of surgical equipment, established a new consumables segment to enhance supply chain resilience for surgical solutions intended for single use. |

| Company Name | Inspira Technologies OXY B.H.N Ltd. |

| Headquarters | Israel, Middle East |

| Recent Development | In January 2024, for its INSPIRA ART medical device line, Inspira Technologies OXY B.H.N Ltd. stated that it would introduce a single-use disposable blood oxygenation kit (the "Kit") presently under development. Additionally, to capitalize on the market for disposable perfusion systems, the Kit is designed to work with various additional life support systems. |

By Product

By Raw Materials

By End User

By Region

February 2026

February 2026

February 2026

February 2026