March 2026

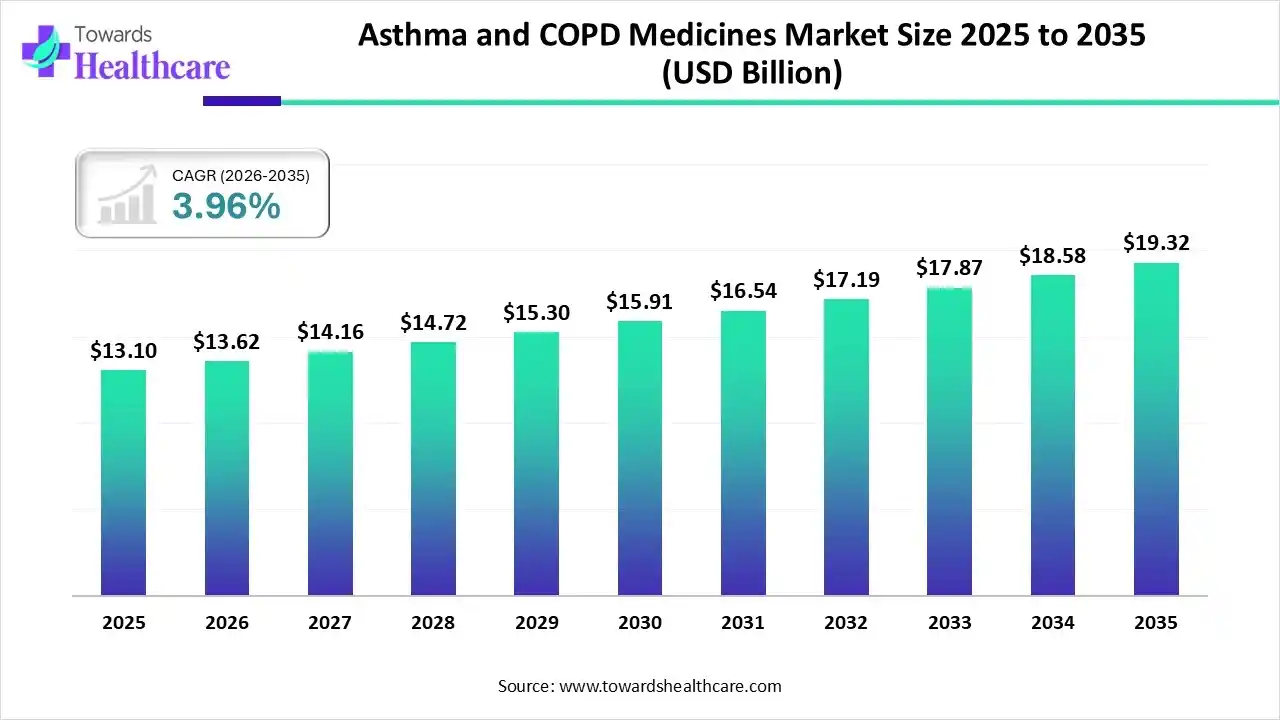

The asthma and COPD medicines market size was valued at US$ 13.10 billion in 2025 and is projected to grow to 13.62 billion in 2026. Forecasts suggest it will reach approximately US$ 19.32 billion by 2035, registering a CAGR of 3.96% during the period.

The asthma and COPD medicines market is growing because of the rising prevalence of respiratory diseases, air pollution, and an aging population. Significant treatments include bronchodilators, corticosteroids, and combination therapies delivered via inhalers and nebulizers. North America is dominated by major pharmaceutical companies that are investing in innovative drug formulations and digital inhaler technologies, Asia Pacific fastest-growing as increasing healthcare access.

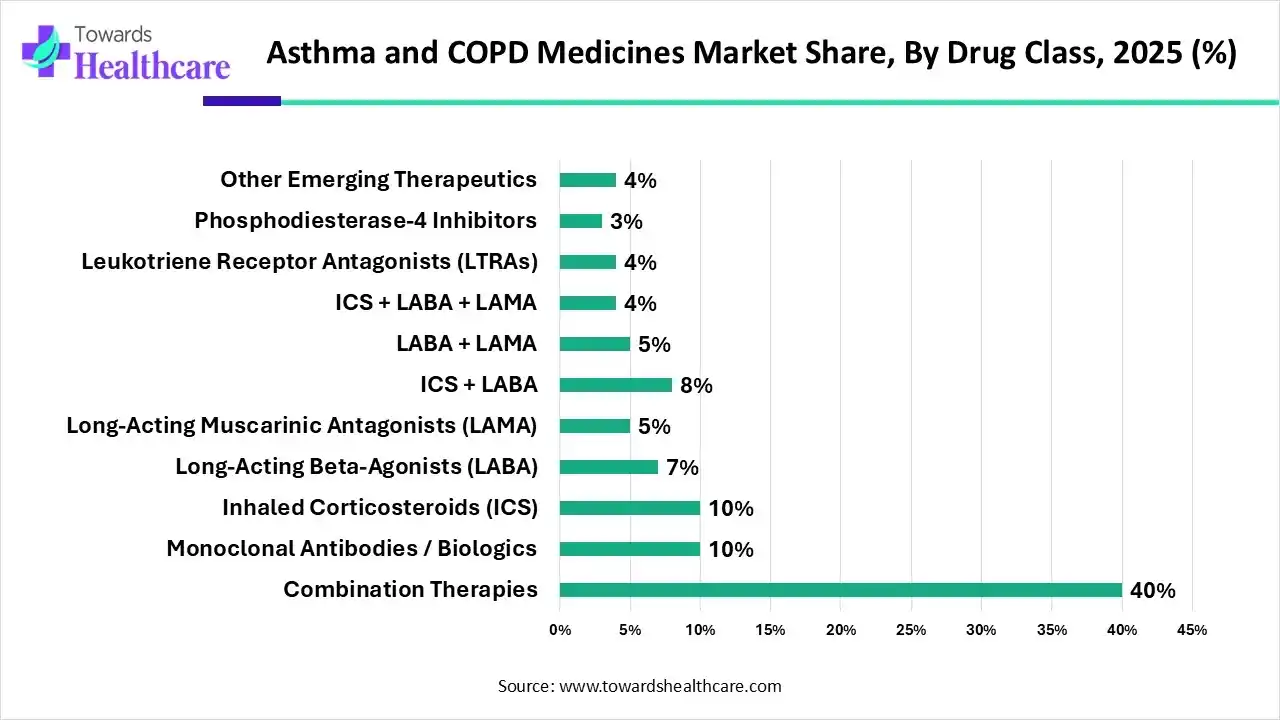

The asthma and COPD medicines market encompasses pharmacological therapies aimed at managing chronic respiratory conditions by reducing airway inflammation, preventing exacerbations, and improving lung function. Key drug classes include inhaled corticosteroids (ICS), long-acting beta-agonists (LABA), long-acting muscarinic antagonists (LAMA), combination therapies, leukotriene receptor antagonists (LTRAs), monoclonal antibodies, and novel biologics.

Market growth is driven by increasing prevalence of asthma and COPD worldwide, rising adoption of combination inhalers, expansion of personalized therapies, and government initiatives promoting chronic respiratory disease management. Technological advancements in inhalation devices, digital monitoring, and formulation improvements, combined with ongoing R&D for next-generation biologics and small molecules, further support the adoption of these medicines across hospitals, specialty clinics, and retail pharmacies globally.

| Company | Investment |

| Lupin | In October 2025, Lupin invested $250 million, including research & development, infrastructure, and capital expenditures over five years. The new site will have the capacity to accommodate the production of more than 25 critical respiratory medicines, including lifesaving albuterol inhalers. |

| Merck | In October 2025, Merck's $10 billion acquisition of Verona Pharma strengthens its respiratory therapy offerings. |

| GSK's | In January 2024, GSK is paying $1.4 billion to acquire Aiolos Bio Inc., aiming to expand its severe asthma treatment capabilities. |

Integration of AI in asthma and COPD medicines drives the growth of the market, as AI-based technology, specifically ML, improves asthma management by analyzing data from wearables and patient records to envisage exacerbations, stratify challenges, and inform targeted treatment. Major research demonstrates AI-driven technology can recommend tailored interventions, monitor adherence by digital applications, and drive real-time treatment adjustments. AI-driven technology offered models with a precision of 68% to distinguish among asthma, COPD, and their overlap (ACO), and predict the overall accuracy of the disease. As these technologies continue to progress, they promise to be a keystone of future respiratory disease treatment, improving healthcare results and converting the inclusive healthcare experience of patients with asthma and COPD.

| Key Elements | Scope |

| Market Size in 2025 | USD 13.10 Billion |

| Projected Market Size in 2035 | USD 19.32 Billion |

| CAGR (2025 - 2035) | 3.96% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Leading Region | North America by 45% |

| Market Segmentation | By Drug Class, By Mechanism of Action, By Dosage Form, By Patient Type, By Region |

| Top Key Players | Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim GmbH, Novartis AG, Sanofi S.A., Johnson & Johnson (Janssen Biotech), Pfizer Inc., Sun Pharmaceutical Industries Ltd., Cipla Ltd., Mylan N.V., Chiesi Farmaceutici S.p.A., Viatris, Inc., Bayer AG, Regeneron Pharmaceuticals, Inc., Amgen Inc., Kyowa Kirin Co., Ltd., Samsung Bioepis Co., Ltd., Boehringer Ingelheim / AstraZeneca Collaboration |

Why the Combination Therapies Segment Dominated the Market?

In drug class, the combination therapies segment led the asthma and COPD medicines market with approximately 40% share, as combination therapies in asthma are convenient to use, confirm that the ICS is not discontinued when a nebulizer is used, and are affordable. Combination therapy devices also support individualized strategies to asthma treatment and lower the complexity of treatment. It serves not only as maintenance but also as a reliever therapy with the same effectiveness as the short-acting beta agonists (SABA).

On the other hand, the monoclonal antibodies/biologics segment is projected to experience the fastest CAGR from 2026 to 2035, as people with moderate-to-serious asthma are treated using a different type of monoclonal antibodies that target key inflammatory cytokines elaborate in disease pathogenesis. Management with anti-IgE better asthma control and lowers the serious exacerbations in patients with severe asthma and raised serum IgE levels. mAbs are the medications that target exact proteins to help lower inflammation in patients with severe asthma.

Why the Anti-Inflammatory Segment Dominated the Market?

By mechanism of action, the anti-inflammatory segment led the asthma and COPD medicines market in 2025 with approximately 45% share, as anti-inflammatory medications are the significant treatment choice for patients with asthma; they help stop the process that causes asthma attacks. Anti-inflammatory drugs include corticosteroids that are inhaled directly into the lungs or that are systemic. Mast cell stabilizers and leukotriene transformers are medicines that work inversely and help enhance the anti-inflammatory action of corticosteroids.

On the other hand, the targeted biologic therapy segment is projected to experience the fastest CAGR from 2026 to 2035, as this type of therapy reduces asthma exacerbations, enhances lung function, lowers oral corticosteroid use, and improves quality of life in appropriate COPD patients. It targets particular cells in the body’s immune system, which cause inflammation in the lungs.

| Segments | Shares 2025 % |

| Inhalers (MDI / DPI) | 50% |

| Soft Mist Inhalers | 10% |

| Nebulizers | 7% |

| Oral Tablets / Capsules | 10% |

| Injectable / Infusion (Monoclonal Antibodies / Biologics) | 23% |

Why the Inhalers (MDI / DPI) Segment Dominated the Market?

By dosage form, the inhalers (MDI / DPI) segment led the asthma and COPD medicines market in 2025 with approximately 50% share, as inhalers are an efficient way of carrying drugs to small airways. This lowers systemic or entire-body effects. A minor dose is needed using an inhaler rather than an oral steroid. Inhalers are both safe and affordable. Types include dry powder, metered-dose, and soft mist inhalers. They are generally used to treat asthma and COPD.

On the other hand, the injectable/infusion segment is projected to experience the fastest CAGR from 2026 to 2035, as applications of biologic therapy delivered through IV infusion support patients in lessening airway inflammation, preventing attacks of asthma, and enhancing lung function; often, traditional therapies are no longer sufficient. Infusion therapy for asthma management shows a targeted, biologic treatment choice that tackles the original causes of inflammation, not just the symptoms. Use of intravenous therapy with many nutrients, containing magnesium, for acute and chronic asthma provides considerable advantages.

Why the Adult Segment Dominated the Market?

By patient type, the adult segment led the asthma and COPD medicines market in 2025 with approximately 60% share, as treating asthma in adults provides significant advantages for both short-term symptom relief and chronic asthma and COPD, mainly by controlling the chronic airway inflammation that is the main cause of the disease.

On the other hand, the pediatric/adolescent segment is projected to experience the fastest CAGR from 2026 to 2035, as managing asthma and COPD in pediatric and adolescent patients in early stages provides a better quality of life, enabling normal physical activity and school attendance, and lowering the challenges of serious asthma attacks and hospitalizations.

North America is dominant in the asthma and COPD medicines market in 2025, with approximately 45% share, due to the increase in research and development efforts aimed at creating new treatment choices. Growing prevalence of respiratory diseases and increasing demand for advanced therapies. North America possesses a well-organized healthcare system and significant insurance coverage, which enables earlier diagnosis and greater patient adoption of advanced treatments.

In the U.S., increasing rates of tobacco smoking, as well as rising air pollution in urban areas, contribute to the high incidence of respiratory diseases in this region. In 2023, in the US, 19.2 million adults were diagnosed with asthma, and 12.8 million adults were diagnosed with COPD, which increases the demand for asthma and COPD medicine.

In Canada, the strong presence of a robust, government-driven medical care system ensures extensive access to respiratory treatments. While the system moderates pricing, it simplifies public access to both novel therapies and generic substitutes.

Asia Pacific is the fastest-growing region in the asthma and COPD medicines market in the forecast period, due to rising disposable incomes and economic growth in the region, which has led to higher medical care investment. This includes spending on medications and novel treatments for long-term healthcare conditions. Major countries, such as China and India, are creating policies to inspire domestic manufacturing of progressive healthcare devices and therapies, which drives the growth of the market.

The research and development (R&D) technology for asthma and COPD medicines mainly contains preclinical modeling, advanced clinical trial design, and sophisticated drug delivery methods.

Key Players: AstraZeneca and GSK

Clinical trials of asthma and COPD medicines involve pre-clinical and early-phase studies, exploratory trials, confirmatory trials, regulatory submission, and approval

Key Players: Boehringer Ingelheim and Novartis

Asthma and COPD medicines are mainly focused on comprehensive support, education, and disease management strategies to improve patient outcomes.

Key Players: Merck KGaA and Roche

By Drug Class

By Mechanism of Action

By Dosage Form

By Patient Type

By Region

March 2026

February 2026

February 2026

February 2026