January 2026

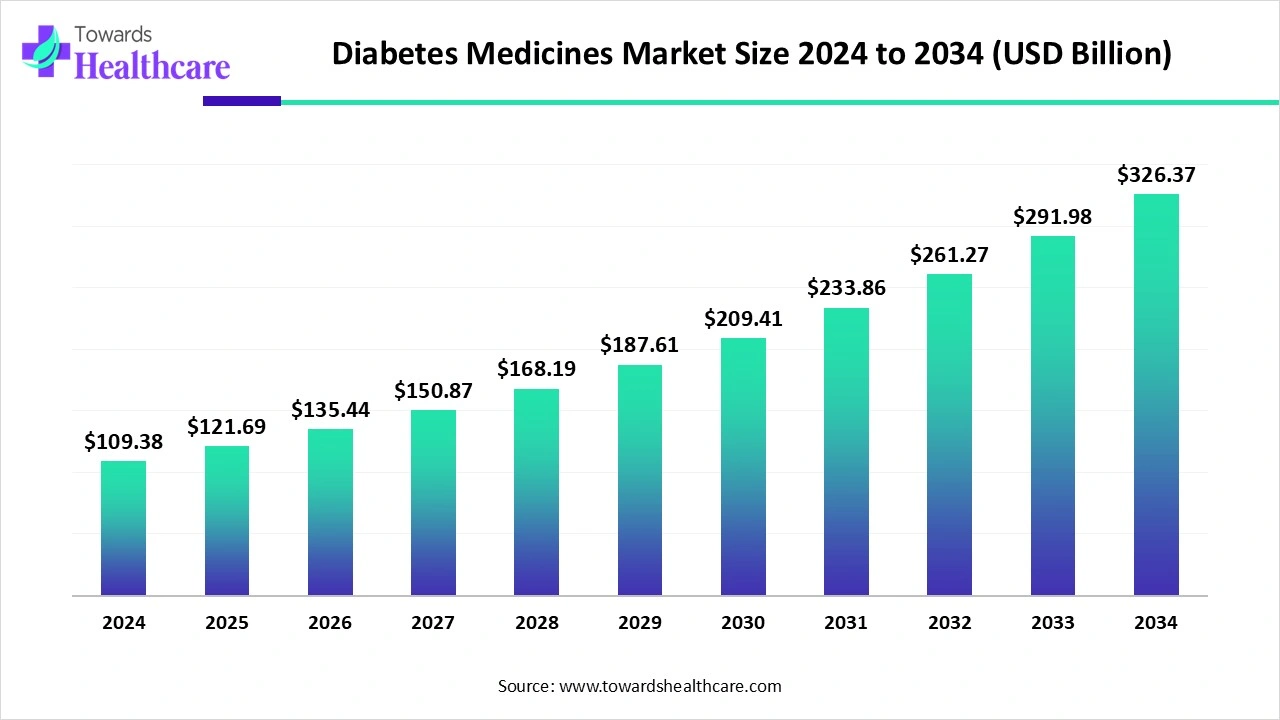

The global diabetes medicines market size is calculated at US$ 109.38 billion in 2024, grew to US$ 121.69 billion in 2025, and is projected to reach around US$ 326.37 billion by 2034. The market is expanding at a CAGR of 11.24% between 2025 and 2034.

As the number of diabetes cases is increasing, the demand for diabetes medicine is also increasing. Moreover, their increasing innovations are enhancing the collaborations among the companies to accelerate their development. AI is also being used for its fast development, optimization, and for discovering new targets. Additionally, their use is increasing in different regions due to the advanced healthcare sector and growing diabetes awareness. At the same time, the companies are developing and launching novel drug candidates. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 121.69 Billion |

| Projected Market Size in 2034 | USD 326.37 Billion |

| CAGR (2025 - 2034) | 11.24% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Diabetes Type, By Route of Administration, By Distribution Channel, By End-User, By Region |

| Top Key Players | Novo Nordisk, Sanofi, Eli Lilly and Company, Merck & Co., AstraZeneca, Boehringer Ingelheim, Novartis, Johnson & Johnson (Janssen), Pfizer, Roche, Takeda Pharmaceutical, Bayer AG, Bristol-Myers Squibb, Amgen, Sun Pharmaceutical, Lupin, Cipla, Teva Pharmaceuticals, MannKind Corporation, Biocon |

The diabetes medicines market includes pharmaceutical therapies developed to manage blood glucose levels, improve insulin sensitivity, and address complications associated with Type 1, Type 2, and other forms of diabetes. The insulin therapy is the most commonly used, where the use of metformin and non-insulin agents is also significantly increasing. Moreover, a reduction in the glycated hemoglobin is also being observed with the use of GLP-1/ glucose-dependent insulinotropic polypeptide (GIP) agonist. The market covers both traditional drugs and advanced biologics, reflecting the increasing prevalence of diabetes globally and the demand for innovative treatments.

Growing Demands: Due to the growing diabetes burden, there is a rise in the demand for advanced or personalized medications. This is increasing the collaborations among the companies to enhance their R&D. Moreover, these collaborations are also contributing to the joint use of advanced technologies to accelerate their development.

For instance,

The use of AI in the development of diabetes medicines is increasing. It helps in predicting drug responses. Additionally, with the use of machine learning (ML), new drug targets can be identified. Moreover, it can also predict the safety and efficacy of the drug, which in turn can enhance their optimization process. With the use of AI models, the genetic data of the patient can be gathered, and the development of personalized medications can be promoted. They are also being used for developing automated insulin delivery systems.

Growing Innovations in Diabetes Medicines

To tackle the growing diabetes cases, different types of advanced diabetes medicines are being developed. These medications not only target blood glucose levels but also help in the management of weight, heart, and kidney health. New controlled-release formulations are also being developed, which minimize the dosing frequency. Similarly, oral biologics and novel insulin formulations that act only during high blood glucose levels are also being developed. Furthermore, personalized medications are also increasing patient outcomes. Thus, this enhances the diabetes medicines market growth.

High Cost and Safety Concerns

The cost associated with the diabetes medications is often high. This decreases the adoption rates as well as their adherence to the treatment. At the same time, the medications also possess side effects such as hypoglycemia. This, in turn, can also minimize the use of diabetes medications. Thus, the high cost and safety concerns can limit the use of diabetes medicines.

Increasing Use of Combination Therapies

The use of combination therapies is increasing as they help in targeting diabetes as well as its comorbidities. At the same time, the number of medicines is also minimized with their use, as they are developed in the form of fixed-dose combinations. Additionally, depending on the patient information, these therapies are also being customized, which in turn helps in reducing the risk of side effects. Therefore, these advantages are increasing their early adoption for the treatment of diabetes with comorbidities. Innovations are also being conducted for developing their injectable combinations. Thus, this promotes the diabetes medicines market.

For instance,

By drug class type, the insulin segment held the dominating share of the diabetes medicines market in 2024, as it was widely used by type 1 diabetes patients. It was used for a chronic time. Moreover, it was also used by type 2 diabetes patients in their advanced stages. Thus, this contributed to the market growth.

By drug class type, the injectable non-insulin drugs segment is expected to show the highest growth during the predicted time. They show enhanced effectiveness. At the same time, significant weight loss was also observed with its use. Additionally, it also minimized the risk of hypoglycemia.

In the injectable non-insulin drugs segment, the GLP-1 receptor agonists sub-segment is expected to be the fastest growing during the forecast period. Along with lowering blood sugar levels, it also provided benefits such as weight loss and cardiovascular protection. Moreover, it also provides long-term effects, which reduce their dosing frequency to once a week. This enhances patient adherence.

By diabetes type, the type 2 diabetes segment led the diabetes medicines market in 2024, due to its growing incidence. This increased the use of diabetes medicine, mostly in adults. Additionally, the growing lifestyle changes also contributed to their increased use. Furthermore, the production of a variety of medications was also enhanced.

By diabetes type, the gestational diabetes segment is expected to show the fastest growth rate during the predicted time. Due to growing early diagnosis and awareness, the use of diabetes medicines is increasing in this condition. Additionally, the growing rates of obesity are increasing the risk of gestational diabetes. This is increasing the demand for fast-acting diabetes medications.

By route of administration type, the oral segment held the largest share of the market in 2024, because of its enhanced convenience. Its non-invasive and easy use increased the patient compliance. Orally administered drugs were also used as first-line treatment in type 2 diabetes. Additionally, they were widely available and affordable.

By route of administration type, the injectable segment is expected to show the highest growth during the forthcoming years. This route offers a rapid onset of action, which is increasing its use in type 1 diabetes and type 2 diabetes in advanced cases. Moreover, they also offer a controlled release mechanism providing a long duration of action.

By distribution channel type, the retail pharmacies segment led the market in 2024, driven by their wide availability of OTC drugs. Guidance or medication counselling was also offered by these pharmacies. Moreover, different types of diabetes medications, depending on the demand done by patients, were also provided by them.

By distribution channel type, the online pharmacies segment is expected to show the fastest growth rate during the upcoming years. A wide range of diabetes medicines is provided by them. They also provide fast home deliveries, which enhances patient convenience. Additionally, the presence of discounts is attracting patients.

By end user, the hospitals segment held the largest share of the global market in 2024, due to the large volume of diabetes patients. Different types of diabetes medicines, mostly insulin, were used for their treatment. Moreover, continuous monitoring along with insurance polices was also provided. This enhanced the market growth.

By end user, the specialty diabetes clinics segment is expected to show the highest growth during the upcoming years. These clinics provide expertise that increases trust and adherence to the treatment among patients. Additionally, personalized diabetes medications are also provided to the patient. Moreover, advanced therapies are also being used, which is attracting the patients.

North America dominated the diabetes medicines market in 2024. Due to a growth in the diabetes cases, there was a rise in the demand for diabetes medicines in North America. The presence of well-developed healthcare systems enhanced their development and accessibility, increasing their use. Thus, this contributed to the market growth.

The U.S. consists of an advanced healthcare sector that is increasing access to diabetes medications to deal with the growing diabetes. Moreover, growing awareness is increasing their early adoption. At the same time, the industries are also developing new drugs and therapies. These developments are further supported by the investments to enhance their accessibility.

Due to growing lifestyle changes and a geriatric population, the diabetes prevalence in Canada is increasing. Thus, to tackle their growing rates, the healthcare systems are providing advanced diagnostics, medicines, and monitoring devices. This, in turn, is increasing their development. Moreover, the growing research and development are also providing new treatment approaches.

Asia Pacific is expected to host the fastest-growing diabetes medicines market during the forecast period. The healthcare sector in the Asia Pacific is expanding, which is increasing the innovations and launches of diabetes medicines. The growing diabetes burden is amplifying their use. Moreover, the government is supporting their development by providing investments. Additionally, they are also increasing awareness through campaigns, which is increasing their adoption rates. Thus, this is promoting the market growth.

The R&D of diabetes medicine focuses on discovering new drug targets, developing novel treatment options, and enhancing their action.

Key Players: Eli Lilly and Company, Novo Nordisk, Boehringer Ingelheim, AstraZeneca, and Sanofi.

The product integrity, patient safety, packaging with a unique serial number, trace and track systems, and temperature-controlled packing are provided in the packaging and serialization of the diabetes medicines.

Key Players: Gerresheimer AG, Becton, Dickinson and Company (BD), West Pharmaceutical Services, SCOTT Pharma.

Educational programs focusing on patient progress, self-management, financial assistance, and the use of telehealth, along with other tools for remote monitoring, are provided in the patient support and services of diabetes medicine.

Key Players: Eli Lilly and Company, Novo Nordisk, Sanofi, Novartis, and Lupin.

In August 2025, after announcing the collaboration with Novo Nordisk, the CEO of BioMed X, Dr. Christian Tidona, stated that a notable impact would be observed in the lives of the patients by developing orally available peptide drugs, such as GLP-1 receptor agonists, using new formulation technologies. Moreover, they are confident that they can propel innovation in oral formulation technologies with Novo Nordisk and their unique global crowdsourcing approach.

By Drug Class

By Diabetes Type

By Route of Administration

By Distribution Channel

By End-User

By Region

January 2026

January 2026

January 2026

January 2026