February 2026

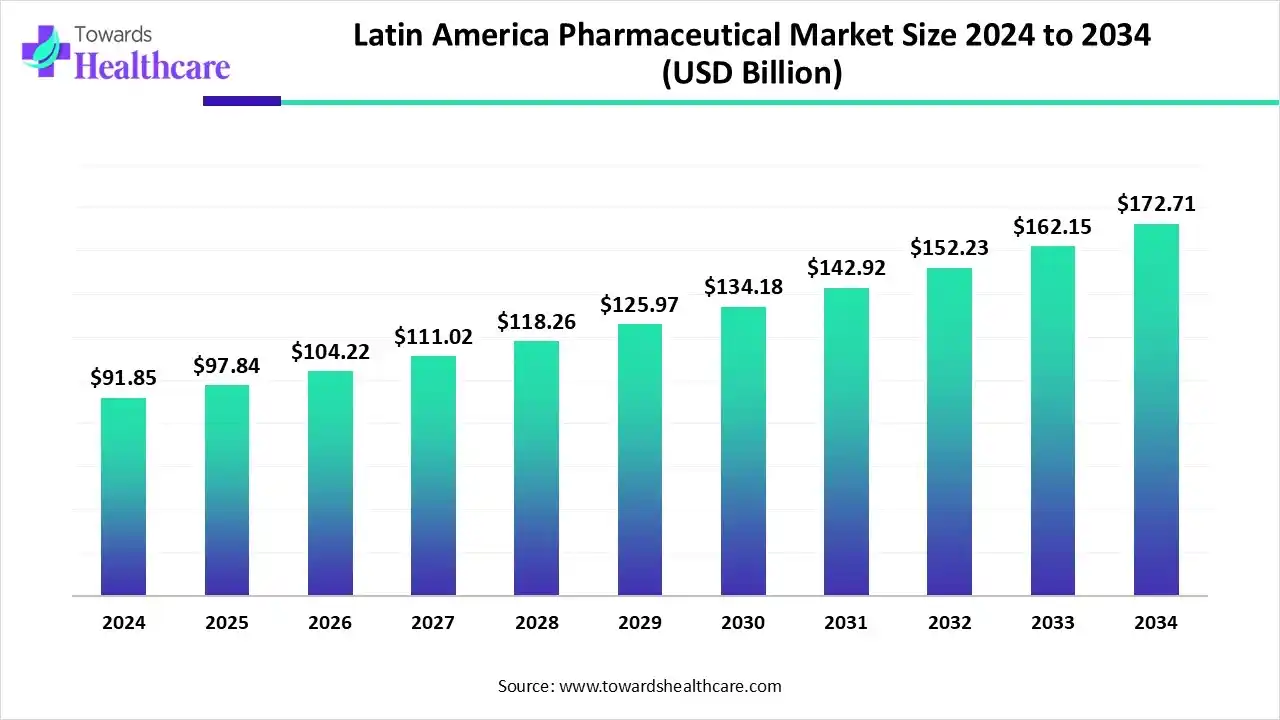

The Latin America pharmaceutical market size was estimated at US$ 91.85 billion in 2024, projected to increase to US$ 97.84 billion in 2025 and reach US$ 172.71 billion by 2034, showing a healthy CAGR of 6.52% across the forecast years.

The Latin America pharmaceutical market is growing due to increasing demand for specialty drugs, expanding health insurance coverage, and rising investments in healthcare infrastructure. Key countries like Brazil, Mexico, and Argentina are driving market expansion through local production and import of innovative therapies. Additionally, government policies supporting affordable medicines, growing clinical research activities, and collaborations between domestic and international pharma companies are contributing to the region’s steady pharmaceutical market growth.

| Table | Scope |

| Market Size in 2025 | USD 97.84 Billion |

| Projected Market Size in 2034 | USD 172.71 Billion |

| CAGR (2025 - 2034) | 6.52% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Channel / Distribution, By Business Model / Revenue Stream, By Buyer / Payer Type, By Region |

| Top Key Players | Roche / Genentech, Johnson & Johnson (Janssen), GlaxoSmithKline (GSK), Merck & Co. (MSD), AstraZeneca, EMS (Brazil), Hypera Pharma (Brazil), Eurofarma (Brazil / regional), Ache (Brazil), Laboratorios Bagó (Argentina / regional), Grupo Biotoscana / mAb producers (regional biologics players), Genomma Lab (Mexico), Laboratorios Richmond / Roemmers (Argentina), Laboratorios Liomont (Mexico, vaccines partner), Major regional distributors & wholesalers (e.g., Farmalink/Distributors, national pharmacy chains) |

The Latin America Pharmaceutical systems market is growing due to increasing demand for efficient drug manufacturing, advanced laboratory technologies, and rising investments in healthcare infrastructure and R&D. The Latin America pharmaceutical market covers prescription medicines (innovator and generics), biologics and biosimilars, vaccines, over-the-counter (OTC) products, and associated services (distribution, manufacturing, clinical trials).

Growth is supported by expanding healthcare access, government procurement programs, growing middle-class demand, local manufacturing expansion, and increasing investments in vaccines and generics. The region is heterogeneous large markets like Brazil and Mexico dominating revenue, while smaller markets (Colombia, Chile, Argentina, Peru) grow rapidly and are important strategic targets. The market is expanding due to rising adoption of advanced manufacturing technologies, increasing pharmaceutical R&D activities, government support, and growing demand for efficient, high-quality drug production solutions.

AI is transforming the Latin America pharmaceutical market by enabling automated drug formulation, real-time patient monitoring, and digital diagnostics. It supports predictive modeling for disease trends, improves manufacturing efficiency, and enhances regulatory reporting, helping companies reduce operational costs, optimize production, and deliver targeted therapies more effectively across the region.

The generics & off-patent small molecules segment led the market with the revenue shares of 38% in 2024 as healthcare systems prioritized accessible and affordable medications. Expanding local production capacities, increasing government support for generic adoption, and growing patient demand for essential therapies boosted this segment. Moreover, strong supply chains, widespread physician acceptance, and the ability to rapidly replace branded drugs following patent expirations contributed to its market dominance, ensuring high revenue generation and continued preference among healthcare providers in Latin America.

The specialty & advanced therapies segment is projected to grow rapidly as healthcare providers increasingly adopt cutting-edge treatments for unmet medical needs. Innovations in cell and gene therapies, regenerative medicine, and targeted biologics are expanding therapeutic options. Rising collaborations between biotech firms, hospitals, and research institutions, along with improved reimbursement policies and growing patient demand for personalized care, are accelerating adoption, making this segment the fastest-growing in the Latin America life sciences market during the forecast period.

The infectious diseases & vaccines segment held the largest revenue share of 22% in 2024 as governments and healthcare providers prioritized preventive care and outbreak management. Rising demand for immunizations, including seasonal and emerging infectious disease vaccines, drove growth. Expanded production capabilities, partnerships with global pharmaceutical companies, and enhanced cold-chain logistics enabled wider distribution. Additionally, public health campaigns, increasing awareness of vaccine-preventable diseases, and ongoing investment in innovative vaccine technologies contributed to the segment’s market leadership in Latin America.

The rare/specialty & biologic therapies segment is projected to experience rapid growth as demand rises for precision treatments and personalized healthcare solutions. Technological advances in monoclonal antibodies, recombinant proteins, and advanced biologics enhance treatment efficacy. Expanding clinical trials, increasing partnerships between biotech companies and healthcare providers, and greater availability of specialized care centers support adoption. Additionally, government incentives, improved reimbursement frameworks, and heightened patient awareness for complex and rare diseases contribute to the segment’s accelerated CAGR in the Latin America life sciences market.

The retail community pharmacies segment led the Latin America pharmaceutical market with a revenue share of 50% as they serve as primary access points for medications, especially in urban and semi-urban areas. Their extensive networks, reliable stock availability, and personalized customer service make them a preferred choice for patients. Additionally, partnerships with pharmaceutical companies, integration of digital ordering systems, and the ability to cater to both prescription and OTC demand contribute to strong sales, securing the segment’s largest market share in the Latin America life sciences distribution channel.

The e-commerce/online pharmacies & direct-to-patient segment is projected to grow rapidly as consumers increasingly seek convenience, privacy, and time-saving solutions for medication access. Expansion of digital health platforms, rising adoption of subscription-based medicine delivery, and improved last-mile logistics enhance service reach. Furthermore, growing trust in online healthcare services, integration with telehealth consultations, and rising demand for specialty and chronic care medications contribute to the segment’s accelerated CAGR in the Latin America life sciences market during the forecast period.

The local & global branded + generic sales segment led the Latin America pharmaceutical market with the revenue shares of 64% as it combines the reliability of established brands with the affordability of generics, meeting diverse patient needs. Expanding access to healthcare, increasing pharmacy networks, and rising demand for essential medications supported strong sales. Additionally, companies’ strategic pricing, promotional activities, and collaborations with public and private healthcare providers enhanced market reach, making this business model the primary revenue driver in the Latin America life sciences market.

The specialty distribution & patient-supportive services segment is projected to grow rapidly as healthcare providers increasingly rely on tailored delivery solutions for high-value and temperature-sensitive therapies. Enhanced patient engagement programs, personalized follow-ups, and home delivery services improve treatment adherence and satisfaction. Furthermore, partnerships between biotech firms, specialty distributors, and clinics, along with expanding access to advanced therapies for rare and chronic conditions, are accelerating adoption, making this segment the fastest-growing revenue stream in the Latin America life sciences market during the forecast period.

The out-of-pocket/private consumers segment led the market with the revenue shares of 38% in 2024, as many patients preferred immediate access to medications and treatments without insurance delays. Growing urbanization, expanding retail pharmacy networks, and increased availability of over-the-counter and specialty products encouraged direct purchases. Additionally, cultural tendencies toward self-care, rising awareness of preventive health, and demand for convenience and personalized therapies contributed to strong adoption, making out-of-pocket spending the largest revenue contributor in the Latin America life sciences market.

The pharmacy chains/retail group purchasing/specialty hubs segment is projected to grow rapidly as centralized purchasing and distribution models improve medicine availability and reduce costs. Expansion of large retail networks, adoption of digital inventory systems, and partnerships with manufacturers enhance operational efficiency. Additionally, these channels provide convenient access to specialty therapies, adherence programs, and patient-support services, attracting more consumers and healthcare providers. Combined, these factors drive the fastest CAGR in the Latin America life sciences market during the forecast period.

Brazil dominated the market with a revenue share of 38% in 2024 due to its well-established healthcare infrastructure, large patient population, and strong domestic pharmaceutical manufacturing capabilities. Significant government support for research, development, and public health initiatives, combined with favorable regulatory policies, encouraged investment and market expansion. Additionally, rising demand for both generics and specialty medicines, extensive clinical trial activities, and strategic partnerships between local and international pharmaceutical companies reinforced Brazil’s leading position, securing the highest revenue share in the regional pharmaceutical market.

Mexico is leading the Latin America pharmaceutical market as rising consumer awareness and demand for preventive and specialized healthcare increase. Expansion of retail pharmacy chains, improved cold-chain logistics, and adoption of digital health solutions enhance medicine accessibility. Additionally, government efforts to modernize healthcare infrastructure, coupled with increasing private sector participation and foreign investments, are driving innovation and product availability. These factors collectively support rapid market growth, making Mexico one of the fastest-expanding pharmaceutical markets in Latin America.

Argentina is growing the Latin America pharmaceutical market as rising middle-class populations and increasing health awareness boost demand for both essential and specialty medicines. Enhanced distribution networks, growth of private healthcare services, and digital health adoption improve access and efficiency. Additionally, foreign investments, local manufacturing initiatives, and collaborations with global pharmaceutical companies accelerate the introduction of innovative therapies, driving overall market growth. Supportive government policies and initiatives targeting disease prevention and vaccination further strengthen Argentina’s position within the Latin America pharmaceutical sector.

The global pharmaceutical market was valued at approximately US$ 1,573.20 billion in 2023 and is expected to reach US$ 3,033.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% between 2024 and 2034.

By Product Type

By Therapeutic Area

By Channel / Distribution

By Business Model / Revenue Stream

By Buyer / Payer Type

By Region

February 2026

February 2026

February 2026

February 2026